Miss, miss, hit: why three Steam launches had different trajectories

Also: a great deal of interesting discovery and platform news, we promise.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Returning to your inboxes after a weekend of debauchery* (*fine, Animal Crossing), it’s the GameDiscoverCo newsletter, this time taking a look at three recent Steam game releases with varying fortunes to ask - why?

Oh, and very late-breaking news, Netflix is now beta testing its game streaming tech across TVs now (with its smartphone game controller app), and via PCs & Macs soon. More on this later in the week, but it’s definitely ‘a big deal’…

[REMINDER: the ‘new user’ pricing of our GameDiscoverCo Plus subscription is going up at the end of August, so grab it now to get Steam pre/post-release data, weekly sales research, an exclusive Discord, detailed game discovery eBooks - with more coming soon - & lots more.]

A ‘miss’: Arcadian Atlas converts disappointingly..

We’d been keeping an eye on long-in-dev Steam pixel art tactical RPG Arcadian Atlas, ahead of its release on July 27th. And indeed, it was ranking decently, with our proprietary ‘Hype’ charts showing it #6 for its week of release, and within the Top 350 on Steam’s official ‘unreleased game’ wishlist rankings.

But it just didn’t pick up launch momentum, with an all-time Steam peak of 190 CCU, and a frustrated (since-deleted) Tweet from co-creator Becca Bair: “‘Don’t launch your game unless you have at least 7-12k wishlists’. We launched with 90,000 wishlists. We have only 73 reviews. There is no set rule to releasing a game, it is honestly kind of just a crapshoot.”

Unfortunately, this brought on all manner of Twitter replies (some mansplaining adjacent?) about what went ‘wrong’. We don’t want to pile on - and, heck people are still digging the game - but this is a learning opportunity, too. Here’s some data:

We expected Arcadian Atlas to have 500+ Steam reviews in Week 1: there is measurable underperformance here, unfortunately. The game converted at 0.02 in GameDiscoverCo’s ‘Hype to reviews’ ratio, about 1/8th of the median of around 0.15. The question, of course, is why.

Excessive age of Steam wishlists may play a role in inflated expectations: we’ve often commented that older (1-2 years) Steam wishlists can convert just as well as new ones. But for Arcadian Atlas, which Kickstarted back in 2016, it had >50% of its launch Steam followers by August 2019, and ‘only’ added about 1,500 followers in the 12 months up to release week. So this was a slower burn…

Overall expectations need to adjust for recent wishlist velocity: our charts don’t do this at all (bad doggie!), but Steam’s official wishlist ranking does shift around somewhat based on good/bad wishlist velocity. (Generally by just a few positions, occasionally by much more!) Anyhow, ‘what have you done for me lately?’ needs to be more of a wishlist mantra than overall balance.

There’s been some success in Arcadian Atlas’ general genre area on Steam. Fell Seal: Arbiter’s Mark and Symphony Of War have each sold at least ‘6 figure’ units on Steam - although the latter is closer to a Fire Emblem model than a Final Fantasy Tactics one.

But it looks like the extended dev cycle built up more ‘sluggish’ wishlists than normal - perhaps with Fell Seal taking some of the ‘Hype’ for an indie FF Tactics-like. And Day 1 CCUs - which followed a mixed-reception Next Fest demo in February, btw - were predictive of interest way before the Mixed reviews kicked in.

Anyhow, the game looks visually great. And the fact it could get almost 100k wishlists with such a tiny team shows interest in this space. But we wonder if this submarket is filled with gamers with (irritatingly?) specific wants, given the top Steam review for Fae Tactics also makes direct FF Tactics comparisons. Perhaps that’s a lesson, too.

A ‘miss’: Space Mechanic Simulator debuts slow…

The other title we wanted to highlight as a slow start recently is Space Mechanic Simulator from Atomic Jelly & PlayWay, which unfortunately only has 52 Mixed reviews since its August 11th debut, and topped out at 82 CCU, despite over 9k Steam followers at launch. (Its ‘Hype → reviews’ conversion rate is also 1/8th of the median.)

And oh boy, please refer to our 2021 article on PlayWay’s ‘unique’ modus operandi for more on this. But here’s what we think is going on with this extreme outlier:

It arrived on Steam all the way back in 2015 with a ‘target gameplay’ trailer: if you look at an earlier trailer for the game, it’s clearly a classic PlayWay ‘let’s render a version of what this game could look like, to gauge interest’ setup. (The final game UI, seen above, is completely different to this.)

The current dev only started working on the game later: the dev, Atomic Jelly, is one of a myriad of tiny PlayWay-related companies trading on the Warsaw Stock Exchange, had the majority of its shares acquired by PlayWay in 2019, and has been regularly working on the game since.

‘Mechanic games’ are a staple hit for PlayWay, but its devs don’t share tech: you can see from PlayWay’s own Car Mechanic Simulator 2021 (19,000 Steam reviews, around 1 million Steam owners!) how big a hit these can be. But the publicly traded nature of many PlayWay subsidiaries means these small devs have to independently ‘reinvent the wheel’ for each game. In this case, not so adeptly…

So after you get two-thirds of your game’s wishlists/followers from a ‘target gameplay’ trailer, and some of those wishlists are 8 years old? You may get subpar conversion, especially if the devs don’t nail the gameplay. (Which they didn’t, unfortunately.)

But before you rubbish PlayWay’s methods, they just had Contraband Police take the same basic concepts - small team, sim gameplay, PlayWay-originated idea - and ride it to a decent-sized hit. But in Space Mechanic Sim’s case? Ancient wishlists, plus trouble finding gameplay hook in the overarching concept, led to non-optimal results…

The ‘hit’: Tinybuild’s Punch Club 2 does good…

Despite TinyBuild being a publisher that - like Devolver - probably shouldn’t have gone public at the height of the ‘growth stock market’ frenzy (its share price is down 96% since an April 2021 peak), it’s had a couple of mid-level hits on Steam recently.

One of those is Lazy Bear’s pixel art fighting management sim sequel Punch Club 2: Fast Forward, which was the highest-CCU launch (5,500) on Steam for the week of July 17th, albeit helped by pre-orders. And GameDiscoverCo Plus data has the game converting by 2x median on an already-decent ‘Hype’ score.

So the TinyBuild folks wrote a blog post about what went right, and we’d love to highlight the following things, per CEO Alex Nichiporchik:

TinyBuild thinks PC/console simul-launch really helps profile nowadays: “Less games launch on consoles, and by announcing and launching across several platforms you leverage a halo effect.” Getting trailers on official console channels helps - though we reckon Xbox, PS and Switch combined have sold maybe 10% of Steam so far.

The game did well despite not ‘breaking out’ during Next Fest: Alex claims: “While we had a solid 40-60 minutes of [Next Fest demo] gameplay, and most people beat it, demos that end up trending and get algorithm favorability have a higher time spent.” It’s true that PC2 peaked just outside the Top 50, per our numbers - but maybe people were left wanting more, helping pre-orders and launch excitement?

The sequel managed to sell to the Asian market far better than the OG: understanding international markets is key on Steam, and this time around: “24% of copies sold and 18% of revenue came from Asia for Punch Club 2, compared to low single digits for the original.”

And indeed, Punch Club 2 has performed well for an ‘indie-adjacent’ pixel art singleplayer game. Alex says it did $1.4 million gross in the first 18 days, and has median playtime of 10 hours (double the original).

There’s lots more interesting opining in the full blog. But we’d like to add - the original Punch Club, which we believe has around 1 million Steam players, had a super-tight, ‘grind’-heavy gameplay loop that drew people in. Looks like the sequel keeps that - but also refines it, leading to some good results in a tough market.

The game discovery news round-up..

Finishing off for this fine Monday, let’s trawl through the not inconsiderable amount of game platform and discovery news that piled up:

There’s some more possible intel on the PlayStation 5 ‘Slim’, via a leaked video of its possible case. TL;DR? It’s not that much smaller, but “the molded area around the optical drive… appears detachable”, meaning it’s easier to sell the same model with or without Blu-Ray capability. (Maybe even ‘add a drive’ upgrades? We’ll see.)

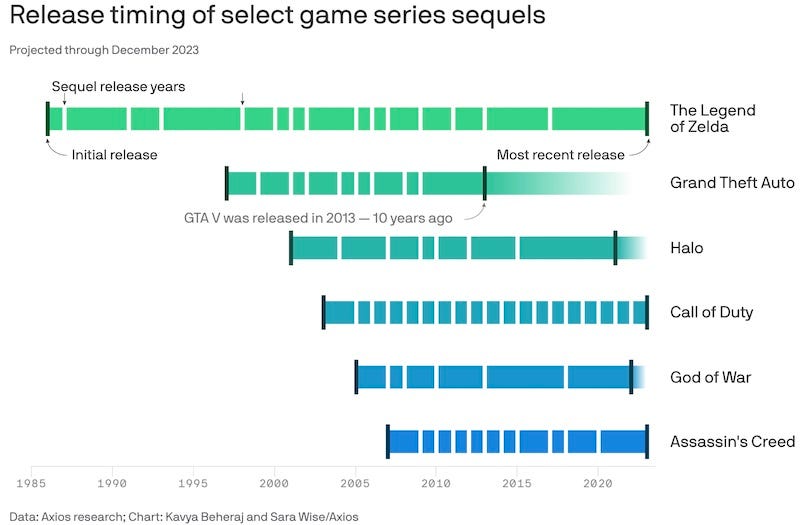

An Axios infographic (above) on game sequels taking longer to get to market underscores comments in the piece: “Fans expect bigger, more graphically detailed games each time out, several developers mentioned to Axios, which requires bigger teams and richer budgets.” (Plus the shift to “recurring live-service game revenue”, of course.)

More evidence of low quality/scam-adjacent ‘keyword bingo’ games swarming Nintendo’s Switch eShop, and Luke Wild from YouTube channel SwitchStars tells NintendoLife: “There is some kind of centralised submission and certification process involved… currently, it appears [Nintendo] are relying on the honesty and integrity of the publishers themselves, which clearly doesn’t work.”

The latest StreamElements/Rainmaker.GG ‘state of the stream’ report reveals that Twitch’s hours watched daily (averaged out over a month) increased continuously from March 2023 (55 million hours) to July 2023 (57.3 million hours). Oh, and new Teamfight Tactics patches brought Riot’s PC/mobile game back into July’s Top 10 games (41 million hours watched!)

Super interesting to see Grand Theft Auto makers Rockstar acquire GTA RP (roleplaying) FiveM community team Tfx.re. As UGC consultant Josh Ling says: “There were 200,000+ players online (across all tracked FiveM servers) when I checked this weekend. A chunky UGC blind spot for many, continuing the legacy of RP servers from Gmod, MUDs, MC and others.” (But there’s some complex questions around future monetization, since these servers run independently of GTA Online.)

It went a bit unreported (except a thread from Derek Strickland), but Sony has stopped publicly listing PlayStation Plus sub numbers quarterly. Seems like they’ll shift to yearly, as they move to more of an ‘upsell’ yield model? Last public totals? That’d be 33.3 mil PS+ Essential, 6.1m PS+ Extra, 8m PS+ Premium.

We talked about Overwatch 2’s huge but negatively player-reviewed Steam debut in Friday’s Plus-exclusive research, and Niko’s Daniel Ahmad points out that Chinese-language reviews are particularly negative for the game, because “gamers in China have been upset over losing their accounts [on the NetEase-licensed domestic version of OW2] and ability to play on the national server.”

Minor note: we minorly updated our ‘is your Early Access launch really your ‘main’ launch?’ article last week, because, to quote: “we felt we were overly harsh on people hoping to improve their fortunes with 1.0 releases of games.” Still - getting 5x your EA launch at 1.0 is rare, and we’re working on some real, nuanced data ‘soon’.

Dipping into mobile briefly, the folks at Liquid & Grit did an ‘explainer’ of Scopely’s Monopoly Go!, which is doing serious numbers (over $2m/day recently?), and how it builds on perennial mobile mega-hit Coin Master. (Notable game mechanics: asynchronous multiplayer lets you attack/steal from other players.)

Microlinks: a retrospective of Nintendo’s iOS/Android mobile games, which seem to be in decline as it concentrates games on Switch & ‘next Switch’; Xbox switched up its ‘1 month for $1’ Game Pass Ultimate offer to ‘14 days for $1’; as Sony cuts PS5 prices in the UK, sales of the Standard PS5 SKU are “now up 511% compared with the week before the promotions began.”

Finally, we’ve been looking at ‘game IPs in the toy aisle’ at big U.S. retailers like Target. And while there’s plenty of trade (Mario & Sonic) merch, and the ‘big guns’ like Fortnite and Minecraft, there’s ‘game influencer’ and Roblox-related merch too. A prime example of ‘Roblox conquers all’ for U.S. kids, from Jazwares’ Devseries:

We think it’s fascinating that, for many kids, ‘only the top games!’ means specifically and only… Roblox games. How many of these have you heard of? (We do at least know Brookhaven, which is running at a ridiculous 780k CCU right now, per RoMonitor.)

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

I guess it can be complicated, though this statement says a lot: "But for Arcadian Atlas, which Kickstarted back in 2016, it had >50% of its launch Steam followers by August 2019, and ‘only’ added about 1,500 followers in the 12 months up to release week."

I have a huge Steam wishlist of well over 500 games. I get regular notices of game launches and game sales. These compete against each other, and just because I wishlisted a game doesn't mean I will jump to buy it at launch. Developers should realise they are competing for our time. A wishlist is not a confirmation, just a show of interest. And we are interested in many games, old and new.

I think the poor ratio between wishlists and reviews for Arcadian Atlas shows that there is much more to keeping interested than a wishlist.