Your Early Access launch? It (kinda!) is your launch...

Also: market share stats for subscription platforms, and lots more...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s a holiday Monday here in the U.S. - but we’re just sending this newsletter out quickly before we return to our DICE prep and general ‘we’re not working today’ shenanigans. (Aided by this Four Tet x Fred Again x Skrillex (!) Times Square DJ set.)

Re-reminding, also: GameDiscoverCo Plus (paid) has a 25% off all Plus subs deal until the end of Feb. (It’s got good stuff: Discord access, an extra weekly game analysis newsletter, ‘live’ Steam Hype dataset, 2x eBooks, and more - details here.)

Your (Steam) Early Access launch? A ‘real’ launch..

We’ve strayed away from this topic for a while, because of how complex it is. But we feel like it’s time to finally tackle it. What does an ‘Early Access’ release signify, particularly on Steam, and how does it relate to the 1.0 release of that same game?

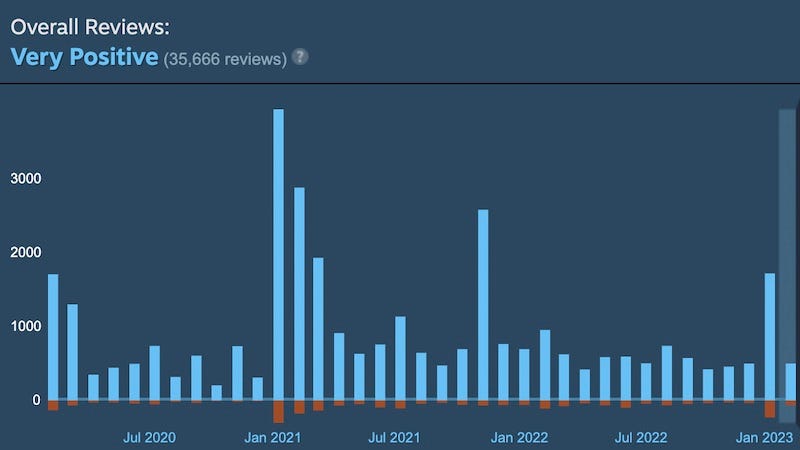

Obviously, if you did launch in Early Access - pretty much an arbitrary ‘this game is still in early development’ flag you can use on Steam, you’ll be hoping for a ‘EA → 1.0’ result like 2D roguelike Skul: The Hero Slayer.

Skul did well - thousands of reviews - during its 10 months of Early Access during 2020. But you can clearly see an interest spike that has sustained it to >1.1 million units sold on Steam (our estimate), kicking off with its 1.0 version in January 2021:

This is pretty much the dream for a lot of devs - especially those whose EA launch is slow. But, unfortunately, we’re here to tell you that this type of behavior is an outlier. A deliciously tempting outlier, but one nonetheless. Why? Let’s see:

Your ‘Early Access’ release has to be pretty complete: the Steam audience is voracious - it doesn’t cut you slack for EA titles. Notable streamer Splattercat even said recently: “I’ve begun developing this instinct that since you’re using other people’s money to make your game [by launching in Early Access], it should really be on point compared to even 1.0 self funded releases.” Debatable, but he says it needs to be ‘tight’ and replayable to work on EA, and we 100% agree.

Your essential discoverability may not change between EA and 1.0: streamers like playing your game, or not, right? And most games out there won’t get a mass of streamers playing them - for concept, genre, or execution reasons. So if you can’t interest influencers at Early Access launch with a 75% ‘complete’ game, are they going to be interested again when it’s 100% done? (Possibly, but possibly not!)

A lot of your audience are already ‘in the bag’, even by Early Access launch: you should have done a lot of marketing and demos of your game even by Early Access launch, and have many wishlists. Don’t go into EA without having done a lot of publicity or outreach. But it’s possible you can pick up new audience with a 1.0 push, yes!

Your existing audience will be persuaded by discounts/updates during Early Access: you’re going to be - and should be - launching updates and doing lots of discounts during Early Access. If you have a popular game, you could juice your 1.0 launch massively by never discounting during EA. But that’s just delaying - and likely decreasing - revenue. Aim for your hardest-core audience to convert during EA - why wouldn’t you?

The actual Steam algorithm discovery advantages of a 1.0 release are marginal: it’s not like you suddenly get 50x the discoverability - in most cases - when your game moves to 1.0 on Steam. If you’re big enough, you may appear in the ‘New & Trending’ slot on the Steam front page at 1.0 (something that isn’t allowed during EA launch). And you may get extra Discovery Queue traffic. But there’s no ‘magic 1.0 algorithm bullet’ on Steam - EA and non-EA titles are treated pretty similarly.

The main issue here is that some people seem to think 1.0 is a ‘whole new world’ from a discovery/metrics perspective. We’ve also talked to people who were looking at putting a lot of resources and money into a 1.0 launch for games, even when the initial Early Access launch didn’t get a lot of interest. Again, we worry that people are allotting too much significance to the flag.

Which is to say - Early Access on Steam is more of an arbitrary ‘state of mind’ than something concrete, in our view. You can really blow up big at 1.0 release - but you need to have streamer interest and a great GaaS-y game in the first place.

And if Skul is an example of a 1.0 launch that went 100% right (we believe because the team successfully got lots more streamers to play the game at 1.0 than EA launch?), what are some other examples of EA → 1.0 transitions?

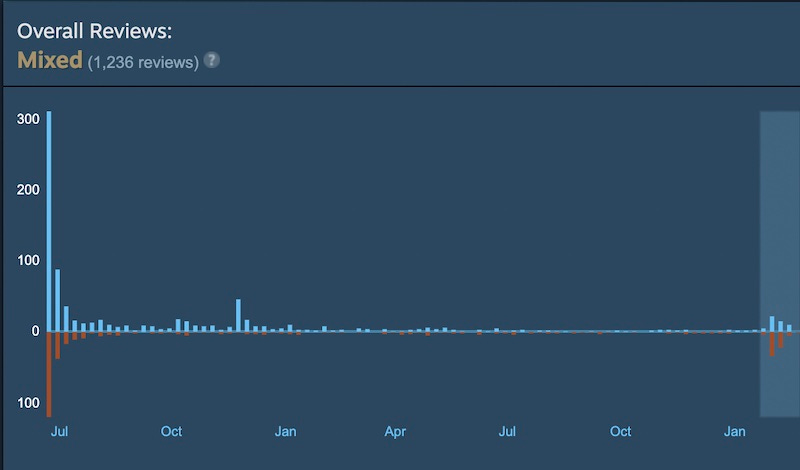

On the not-so-good side (and not to pick on them), Brace Yourself Games’ Industries Of Titan is a super-interesting, ambitious game that never quite got its execution right. As it happens, it just went 1.0, and you can see the review/interest arc clearly:

Absolutely, more people were willing to pick it up at 1.0. But it’s more like Jake said - a glorified discount sale, plus marginally more organic interest from those ‘on the fence until 1.0’. But not a game-changer. And this is what it’ll be like for 95% of games.

We’ve seen examples of publishers who have wielded the 1.0 launch adeptly, of course. The Paradox Arc label debuted alongside the 1.0 release of Across The Obelisk, an existing Early Access card-based strategy game, and its sales blew up (in a good way!) majorly. (The Paradox ‘reach’, which hadn’t existed before for this game, helped a lot.)

And in the newsletter about strategy game publisher Goblinz we ran in October, they listed several games that outgrossed Early Access Week 1 in the first Week of 1.0. (Some were definitely pre-2020, when the market was waaay less busy, though.)

But in general, our advice is - sure, launch your Steam game in Early Access if you want. But for the purposes of marketing and planning, basically pretend that the ‘EA tag’ isn’t a soft launch for your game. Because that’s what most players do! And be very realistic about the possible size of a 1.0 sales bump, if streamers & wishlists aren’t scaling.

[NOTE: We edited this article a little in August 2023, because we felt we were overly harsh on people hoping to improve their fortunes with 1.0 releases of games!]

Worldwide game console marketshare? New hints!

We have to admit that after a while, the sheer amount of government paperwork in the Microsoft x Activision lawsuits got to us (how many hundreds of pages?), and we stopped checking them for interesting tidbits of information.

But luckily, others have been keeping on, such as Idas from the ResetEra forums. And in this thread, they point out some interesting data from the UK’s Competition & Markets Authority released on February 8th.

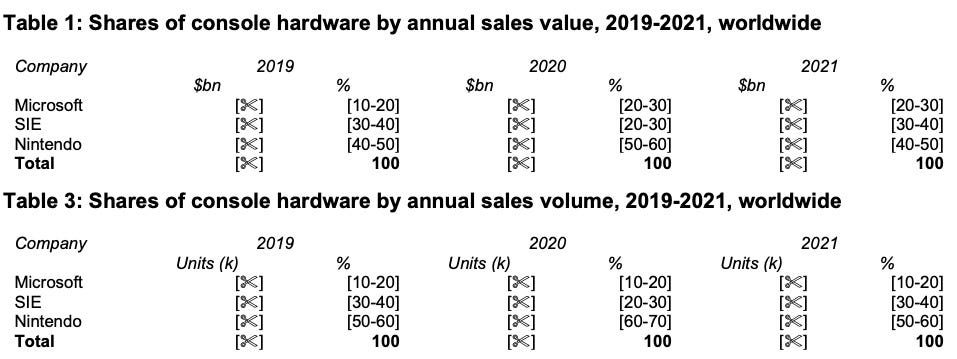

Above is - with the exact figures redacted, boo - the worldwide console hardware $ and unit shares across Microsoft, Sony (SIE) and Nintendo for 2019 to 2021. It’s a period when the COVID-19 pandemic disrupted supply, but still intriguing to see.

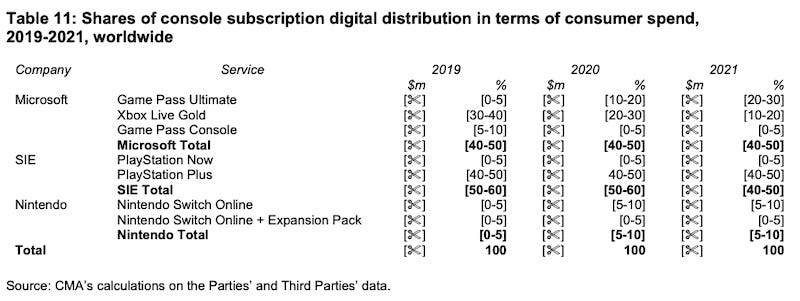

Also available in the data, and perhaps even more interesting, is the relative consumer spend percentage of ‘console subscription digital distribution’ from 2019 to 2021:

Since this only goes to 2021, it doesn’t include the PlayStation Plus enhanced tiers intro-ed in 2022. But it confirms that Xbox is successfully shifting its legacy Xbox Live Gold $ - largely to Game Pass Ultimate, which is doing better than we thought.

In addition, the CMA posted a summary of third-party calls about the deal [.PDF] late last week, and it has a few interesting tidbits, such as: “Some third parties described multi-game subscription services as increasingly popular within console gaming, while one expressed concern regarding the financial sustainability of the model.”

These competitors in console gaming services or cloud gaming services were also obviously nervous about MS’ heft: “Two third parties commented on Microsoft’s combined portfolio of Windows OS, the Azure cloud platform, its console strength, and its multi-game subscription business and expressed concerns about the impacts on competition of adding Activision’s content and studio development capacity to this portfolio.”

None of this changes the fundamental question, though - is this enough of a ‘roll-up’ that it becomes a dangerous monopoly that governments should restrict? Honestly: Microsoft and Activision says no, Sony says ‘absolutely’, and everyone else is just hanging back, concentrating on their own portfolios & biting their nails distractedly...

The game discovery news round-up..

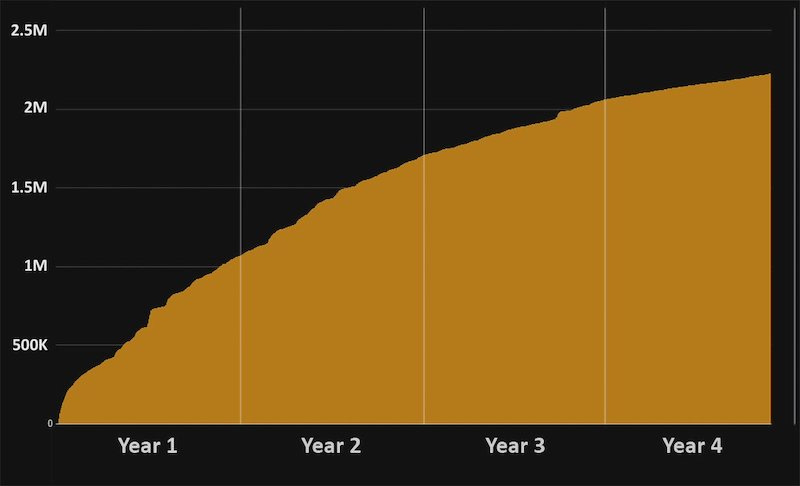

Let’s finish off today’s newsletter with style, starting with the above graph, which is, according to Danny Weinbaum: “Eastshade's cumulative net Steam revenue (USD) over the first 4 years. Pretty much textbook exponential decay so far.” (He does note that Steam’s export made this graph smoother than he would expect.) Anyhow, onward:

There’s a gigantic ‘Steam year in review 2022’ post from Valve up, much of which you might have spotted already. But new stats? Steam was “averaging a staggering 83,000 new first-time purchasers every day of the year” in 2022, and: “Our total content delivery increased 36% from 2021, for a total of 44.7 exabytes downloaded to players.”

PlayStation VR 2 has started to get press reviews ahead of its Wed, Feb 22nd release date. Axios says: “Sony’s PlayStation VR 2 headset is a big improvement over its previous version, but it is unlikely to convert VR skeptics… [it’s] very good, if you don’t mind the price, the wire and understand the trade-offs inherent to immersive VR gaming.”

The third-party organized Steam strategy event TactiCon is back again from May 11th-15th: “Whether your game is grand strategy, 4X, SRPG, turn-based deckbuilding, RTS, or anything in-between… developers can submit a project via this form.”

Per 9to5Mac: “Apple has once again delayed its announcement event for the Apple AR/VR headset. Originally expected to debut in the spring, Bloomberg reports that Apple is now targeting its WWDC conference in June as the new date for the product’s unveiling.”

We liked this quote from TiMi Studio Group’s Bob Holtzman on LinkedIn: “If you want to build a strong community and help boost retention for a Games-as-a-Service title, it’s important to communicate with three C’s: 1. Consistency; 2. Context; 3. Compassion.” It true!

Ampere’s latest report on the 2022 UK game market has it falling 1.6% to £5.38bn ($6.48bn), and adds that it’s: “the first decline in the UK games market since 2012, yet spending remains 23% ahead of pre-pandemic levels in 2019 - illustrating the significant long-tail impact the crisis has had on gaming consumption.”

We’ve heard from a couple of sources - one on Discord, and another on Twitter - that: “The network situation of the Steam platform in China has recently improved… more Chinese players can now directly connect to and access the Steam store page.” Wonder why? The block was never total, and maybe Chinese companies not releasing big games on Steam Global made the authorities calm down…

That ‘big first-party influencer platform event’ TwitchCon has confirmed its two iterations this year, with “TwitchCon Paris, which will be hosted… on July 8-9… and TwitchCon Vegas, taking place at the Las Vegas Convention Center from Oct. 20-22.”

With E3 coming up soon, Ubisoft’s Yves Guillemot was a little bit vague about how big the show is going to be - “if E3 happens, we will be there and we will have a lot of things to show” - and current organizer ReedPop was quick to clarify: “E3 is full speed ahead and we are pleased with the progress and engagement from the community.” And hey, people started getting press passes, so there…

As some VR platforms go forward, others… don’t: “Tencent Holdings is abandoning plans to venture into virtual reality hardware, as a sobering economic outlook prompts the Chinese tech giant to cut costs and headcount at its metaverse unit.”

Finally, we’ve talked before about Poppy Playtime’s ubiquitous mascot Huggy Wuggy - currently to be seen as a featured character in like a billion YouTube Minecraft & Roblox videos. So we were stoked to see the NYT (gift link) take her/him/it on:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]