In-depth: Yacht Club gets transparent with sales numbers

The developer, not the place for mooring your vessels.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Happy Monday! We have returned, back from the discovery van down by the river, where we have been extensively consulting with motivational speaker Matt Foley. He says we’re “not going to amount to jack squat”, but we’re choosing to ignore this.

Our lead story today is one of those we always appreciate seeing. We’re always preaching transparency so people can understand the state of the market, and sometimes prominent companies just… do that! So let’s do it…

[Would you like to support us & get lots of extra PC and console analysis and data? Our GameDiscoverCo Plus paid sub has a data-rich weekly game trends analysis, interactive Steam ‘Hype’ charts, two eBooks, a member-only Discord & more. Sign up today!]

Yacht Club: Shovel Knight spinoffs & series stats!

The folks at Shovel Knight devs Yacht Club Games have always been extremely open about their sales numbers. But their last major update on this was a while back, when they broke down 2 million sales of Shovel Knight back in 2018.

Well, they’re back in a big way in 2022, with a breakdown of sales numbers for Shovel Knight’s Pocket Dungeon spinoff - as part of a mammoth blog which also showcases sales numbers and unit splits for the Yacht Club-published Ninja Gaiden-esque 2D platformer Cyber Shadow, and franchise total revenues for Shovel Knight itself!

It’s super rare to get this level of transparency - and you can read the full blog for the complete rundown. But here’s some of the takeaways we spotted:

Full-time indie game dev in the U.S. is (no surprise!) expensive:

The entire dev cost of the multi-part Shovel Knight ‘Treasure Trove’ game series, which spanned 110 months, 16 team members, and four expansions (!), has been $9 million. That’s quite a lot for a retro-looking 2D title, to say the least. But Yacht Club has netted around $40 million to date after platform cut/taxes, almost entirely on the core Shovel Knight products. (So, what, $70-$80 million gross, including retail deals?)

And the Yacht Club crew explains, for its future planning: “What ends up in Yacht Club’s accounts is about $24M due to taxes. We spent around $9M making Shovel Knight and more than $2M on external games. Which gives us around $13M for the next two games” - which include Mina the Hollower.

They continue: “But we’ve already spent two years working on them, and our current man month is around $12,000, which means we’ve spent more than $7M.” And the company’s overall burn rate is $5 million per year. This explains why a lot of indie devs are popping up in lower-GDP countries - there aren’t many 2D indie franchises that can deal with this level of expenditure.

(As a side note, there’s some minor second-guessing of ‘give out so much content as free Shovel Knight DLC’, which was a pretty interesting approach to take: “As our previous articles showed, adding new campaigns for free didn’t really boost our sales to an enormous degree.” Around 150,000 players finished the King Of Cards DLC, compared to about a million players for the original game, btw.)

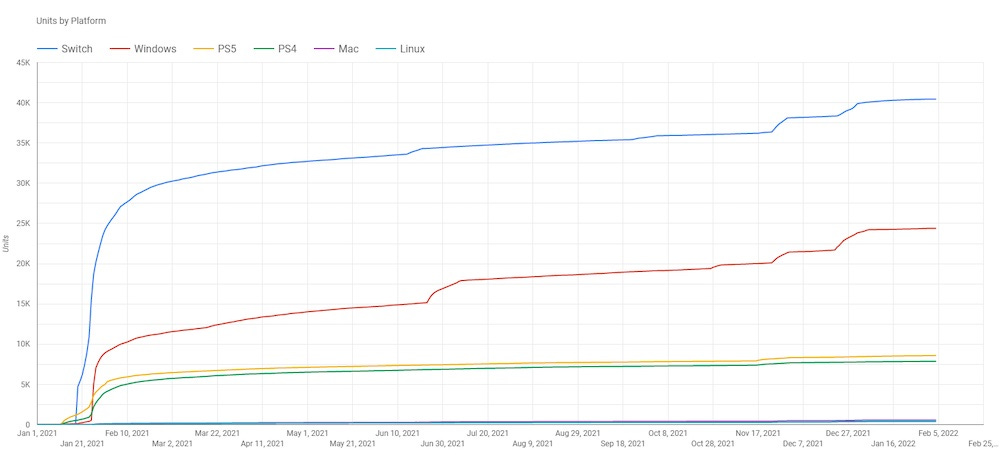

Shovel Knight Pocket Dungeon sold 35k units in the first 2 months:

That’s.. not bad? But perhaps a bit disappointing, given the main franchise. The team notes: “Our first week sales were just under 20,000 units, and our first month sales were just over 30,000… Where Shovel Knight had about 40% units sold on Nintendo platforms after a month, Pocket Dungeon had a staggering 70%!”

One thing that looks very different to many other games we look at nowadays is the Switch sales percentage. Many ‘Nintendo-friendly’ titles sell as well or better on Steam compared to Switch in 2022, as the Switch market gets very saturated. So it’s a testament to Yacht Club’s Switch fan-base that Nintendo’s still dominating, SKU-wise.

Anyhow, Yacht Club reveals: “For Pocket Dungeon’s development, we essentially were split with a budget of 500k for [third-party dev] Vine and 500k for YCG… The revenue from those sales [so far] covers our expenses with Vine, but don’t cover our internal costs.” But might over time?

They also shared the Steam playtime stats (average is a decent 5 hours 38 minutes, but median is a slightly disappointing 1 hour 48 minutes, suggesting that “people who play it fall deeply in love, but some players are bouncing off it pretty quickly.”) And they’re planning “online multiplayer, mod support on Steam, and more more more”, so we’ll see how that juices things…

The Yacht Club-published Cyber Shadow has sold 85k units in Year 1:

In addition to the 85k figure, Cyber Shadow was a Day 1 Xbox Game Pass title, which, says Yacht Club, “according to our estimates means more than 300,000 players got the game for free on Game Pass”. So somewhere towards 400k units played, all in - very creditable for this type of game.

Of the 85k units sold, 50% were Switch, 20% PlayStation (a bit more than normal - boosted by being available on PlayStation 5, perhaps), and the remaining 30% on Steam. And then basically no extra unit sales on Xbox because of the Game Pass inclusion - but that would be expected for most small games.

One super interesting part of this: “55,000 units were sold in the first month, and 44,000 units were in the first week! This is fascinating compared to Shovel Knight’s 180,000 first month and 75,000 first week.” The Yacht Club team notes that Pocket Dungeon also had a similar fall-off after Week 1, and wonders how they can maintain interest.

Perhaps we might say that it was Shovel Knight that was the outlier. It debuted at a time where there were so many less games, and benefited from above average viral word of mouth. The market has changed a LOT in the past few years. (But also having post-release content and GaaS-style updates help with long tail.)

Overall, Cyber Shadow did $1.2 million in revenue, separate of the Game Pass deal. And since the advance payments to the solo dev on the game was $600,000 (out of pocket), it worked out well and profitably for Yacht Club and their dev. Hurray.

Oh, and ending with one particularly intriguing thing - Yacht Club mentions that “Cyber Shadow was named by Nintendo as one of the best selling indie games of 2021”, and we now know that’s with somewhere around 40,000 Switch units sold. (Looking forward, it seems Yacht Club is relatively sparse with discounts for Cyber Shadow, and more/bigger discounts could further juice units sold over time.)

[Thanks to Yacht Club for sharing all of this. You didn’t have to do it, and you did. Many hearts in your direction. And let’s continue with the newsletter…]

The two major Steam algorithm inflection points..

We see a lot of conversation - obviously - at GameDiscoverCo about how you can improve game sales in context of ‘the Steam algorithm’. This phrase generally intended to mean ‘how people discover your game on the Steam platform itself’.

And it’s our view that - although perhaps optimizing your Steam page and icon can make marginal differences - there’s really only a couple of major things that make the platform take you more seriously. And those are:

A minimum threshold of interest (10 Steam reviews)

We’ve referenced this before, but many people are still surprised about the jump they see in referrals and interest when their game reaches 10 reviews.

We recently got some neat data (above) from Konstantinos 'Tall Guy' Vasileiadis showcasing this: “The moment I got my 10th Positive review (getting me a "Positive" score) Steam decided Apotheorasis: Lab of the Blind Gods was a... worthy title, and gave it a 30x jump in inbound traffic (90% of which came from the Discovery queue).”

This 30x inbound traffic translated to Wishlists in a pretty notable way as well (below). Obviously, we know the 10 review threshold is just a few hundred units sold. But if you didn’t make it yet, it’s worth noting that Steam has deliberately set this low bar. And you do need to get over it to take advantage of some discovery mechanisms.

Beyond this, btw, although getting to Very Positive reviews (50 at 80% Positive) vs. Positive feels great, there is no obvious algorithmic change there, nor at any other milestones like Overwhelmingly Positive (500 at 90% Positive). They may help players get more excited to buy, but they don’t trigger anything in Steam’s visibility rules…

Significant external traffic to load up ‘Discovery Queue’ & other metrics…

As you would expect, external traffic to your Steam page - like a big streamer playing your game after release - really helps you pick up new wishlists and sales.

But what I think people don’t always understand is that Steam takes note of that traffic and then ups your profile on the platform as a whole - often for weeks after the initial ‘hit’. There’s reference of this in this write-up of a 2020 Q&A with the Steam team:

“Steam is essentially a positive feedback loop. It looks at sales and decides - okay - customers are giving us good data, they’re buying a game because people are interested in it, [let’s] show it to more customers if that keeps working.”

So for example, if your ‘hit’ is big enough and sustained enough and you start going high up the top seller charts, you can make it all the way to the top ‘Featured & Recommended’ showcase on the front page of Steam, without a human at Valve ever lifting a finger.

(As indeed Ready Or Not is currently doing, see above. This would happen even if a game had been out for months with no sales until a big spike hit. Ready Or Not has been a smash since launch, so that’s not the case. But ‘sudden burn’ sleeper hits like Vampire Survivors have likely had that happen.)

As for smaller but notable wins, the below graph - from an anonymous unreleased game on Steam late last year - shows the effect of a Steam page traffic spike (from a demo & streamer) on Discovery Queue traffic:

The top line is total page visits, and the purple line is Discovery Queue-related visits. It’s much more gradual - both up and down - but you can see how it sustains even after the external visits calm down. It’s an interesting dynamic.

And those are the main Steam algorithm things that we care about. There’s lots more that are worth poking at - the ‘More Like This’ box, best use of tags, etc - but these are the ones we think you should care about the most. Hope that helps.

The game discovery news round-up..

Finishing out for today’s newsletter, we have a lot to get through, including a couple of follow-ups. And of course, there’s the continued Russia boycott from game companies & payment companies alike, due to to the shameful invasion of Ukraine. But here’s what else we have for you today:

On ‘how Steam can get Deck Verified running full speed’, The Verge’s Sean Hollister has Valve’s Greg Coomer on the record re: a user-led method: “Crowdsourcing would be awesome, but right now we're just focused on getting it right… We think that it's unfortunately a high touch, slow process and that having Valve people involved in that, in figuring out how to have the highest confidence that the categorization that we're putting out there is reliable, is the most important thing.”

Yes, there’s backseat op-eds verbally redesigning the Steam Deck cert program - here’s a loud, messy one from a GamingOnLinux contrib. In the meantime, 1,000 Deck games are now Verified, with slightly harsh-sounding bonus Valve commentary on standards: “Our existing standards for titles to get a Verified or a Playable rating are very high. If a game shows controller glyphs 99% of the time but tells you to 'press F' sometimes during gameplay, that's Playable, not Verified. If 99% of a game's functionality is accessible, but accessing one optional in-game minigame crashes, or one tutorial video doesn't render, that's Unsupported. For now!”

Continuing its slightly odd path, Nintendo Switch Online (the subscription service) just added new Game Pass-style ‘missions and rewards’ (above). Here’s a guide if you’re wondering what’s in it, but it’s mainly ‘do basic tasks to get points you can change your avatar with’ right now. Even Switch aficionados seem a little underwhelmed, but hey, it’s a step forward.

Following up our ‘Steam Next Fest trends’ piece, the idea of doing pre-Fest publicity to get you trending for Fest start keeps coming up. Firstly, Sean from Fireshine noted: “We announced the release date for Core Keeper on [Feb.] 10th and also set the demo live on the 10th, so the existing community were already playing it and pushing up the numbers.” And secondly, the same idea was pushed in this Chris Zukowski piece on lessons from the latest Next Fest.

We’ve been wondering whether PlayStation VR 2 can really launch for holiday 2022, as rumored, and now there’s a new report: “Citing what the channel calls “credible sources,” PSVR Without Parole now maintains Sony may launch PSVR 2 sometime in Q1 2023, which is owed to the fact that PS5 is still (and will continue to be) very hard to come by.” Not a Tier 1 source, but wouldn’t be surprised if it happens.

Steam Deck Microlinks: for players, the Deckerati are allocating Q3 orders and pushing for Japanese release this year; for Steam devs, Valve put up a post about “a simple tracker to show Pending and Published ratings”, and the fact “you can post a Steam Event for your product about your product on Steam Deck, and link that post to the Deck Compatibility display.”

In the UK, trade organization ERA released its annual report for 2022, including a bunch of data about the physical/digital market. Notable in there: a quarterly player survey on where people buy digital games in the UK had the following results: 40.1% Steam, 36.8% PlayStation Store, 24.3% Microsoft Store, 12.5% Nintendo eShop, and 12.5% Amazon (digital codes?)

Here’s a useful shout-out from Whisker Squadron’s Aaron San Filippo on controller support for PC: “Game developers: Make sure you support Xbox controllers in your [PC/Steam] games! Data for our recent demo shows that controller makes up 90% of sessions with controllers. PlayStation is a distant second.”

Microlinks: Facebook Gaming appears to have a lot of odd spam cluttering its highest viewcount videos; love these GameRefinery monthly round-ups of announcements & events in F2P mobile games; advocacy groups are asking the FTC to scrutinize the Microsoft/Activision deal closely.

Seems like Apple has settled into the ‘4-ish releases per month, most of them ported from App Store classics’ groove for Apple Arcade. And here’s March’s line-up, with a remaster of Alto’s Adventure, the excellent Monument Valley 2+, the F2P-converted ‘sandbox adventure’ Pocket Build+, and the iOS oldskool (2014 release!) Shadow Blade+. Slow and steady wins the race, here?

Microsales milestones: Sloclap announced its martial arts brawler Sifu sold 1 million units in its first three weeks; Live Wire/Adglobe & Binary Haze announced its 2D Souls-like Ender Lilies sold 600k units since June 2021; Elden Ring is now the sixth most played all-time Steam game in terms of concurrent players.

And that’s all we got for this newsletter. Oh, except in the ‘video games x other media’ news front, where I was delighted to find out about this real, actual book our kid brought home from the school library:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

The way I read Valve's reference above (and others made in the past) is that the metric that affects the visibility is STRICTLY sales. Not external traffic and not Wishlists. If the bump in sales is "big enough" (a vague term in and of itself), then Steam will bump the game's visibility. They've been very clear about it so I'm not sure where is the data coming from about traffic numbers and Wishlists being a factor.