Why your Steam 'follower to wishlist' multiplier matters!

Also: an interesting mobile indie story; and lots more goodness.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back again, with some Steam survey results which possibly verge into the arcane. But we think they have some really interesting ramifications for pre-release metrics on Valve’s ‘kinda important’ PC platform.

Also: 7 days left on our 25% off deal for our GameDiscoverCo Plus paid sub, which includes a Friday ‘exclusive’ newsletter, Discord access, our Steam ‘Hype’ & post-release back-end, multiple eBooks & more. Support us & make this all possible..

Steam ‘follower to wishlist’ multiplier - changes!

We find the public ‘Steam follower’ count for unreleased PC games to be a very useful stat. Why? As Steamworks explains: “Players can choose to follow your game by selecting the option from your store page. This action allows your news and events to appear in the player's Friends Activity Feed and also within their Steam News Hub.”

So, while you can get a basic idea of the popularity of an unreleased Steam game from its ‘Top wishlists’ Steam ranking, you can see exact follower counts for every Steam game, and sites like SteamDB have nice historical charts of followers. Not all games convert the same. But we still think followers are very ‘indicative’ of overall interest.

Of course, only individual devs can see their own wishlist count. So we surveyed 125+ Steam games anonymously, to see if the ‘follower to wishlist’ ratio had changed - and some more granular data - since the last time we surveyed it in February 2021.

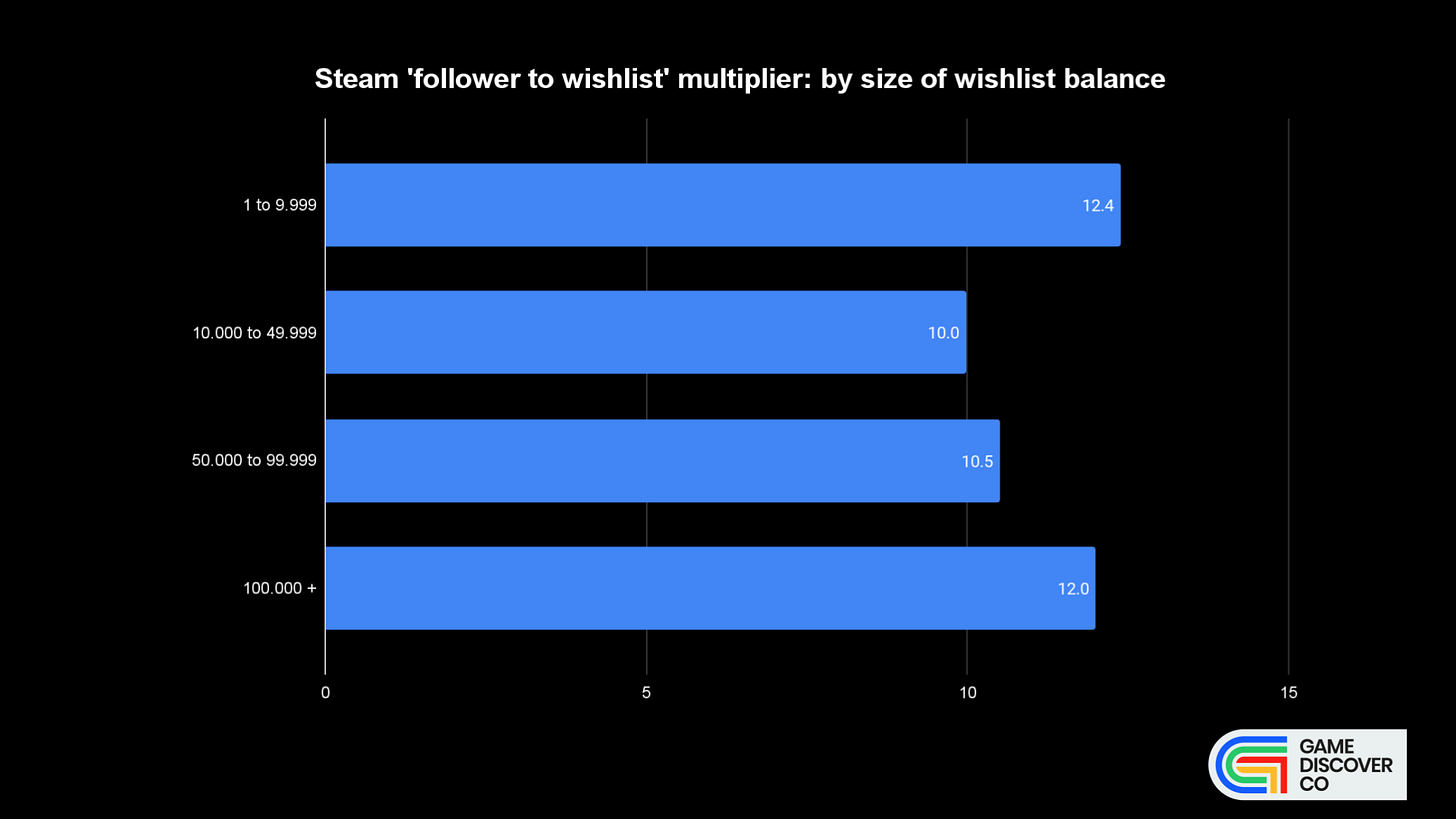

Back in 2021, “the vast majority of wishlists for unreleased Steam games are between 5x and 14x the followers, with an average of 9.64x and a median of 9.6x.” But let’s forward to today, June 2023. What changed?

Well, as you can see in the above diagram, the vast majority of wishlists for unreleased Steam games in June 2023 are between 7x and 20x the followers, with an average of 12.37x and a median of 12x.

So the median multiplier has gone up by 25% in the last two years! Huh. Why is this, and what does it mean? Well:

We now understand what is ‘expected’: if you know that 12x is ‘normal’, that’s useful when looking at a game’s follower count and estimating its wishlists. (We know wishlists can convert to sales radically differently, but we know they still matter.)

We can speculate on why this multiplier has increased: it could just be that marketers are concentrating on adding wishlists, not followers. It could also be that today’s Steam gamers follow games less often. It could just be Goodhart’s law acting on wishlists: “When a measure becomes a target, it ceases to be a good measure.”

We can start to discuss whether certain multipliers are ‘good’ or ‘bad’: we’ve sometimes wondered if high follower to wishlist ratios mean that your wishlist quality is ‘poorer’, or conversion might be more difficult. Can we prove this?

Firstly, is there any major trend in the number of wishlists you have, and the multiplier? Not really - in this particular sample set, it starts out higher, dips, and goes back up again. (This is the opposite of the 2021 survey, btw.)

Our only thought here: we’d speculate that games with a lot of wishlists are sometimes more ‘mainstream’, so might attract a mass of slightly more casual players, who are less likely to follow titles. But.. no big takeaways, we reckon. But:

We asked those we surveyed to list the Top 5 tags of their games. We managed to get enough data (5 or more results) for select genre tags to show average multipliers. We think the results are pretty notable.

So yes, the multipliers are much lower for deep, complex strategic PC games (4X - 7.5x; turn-based strategy - 9.0x, survival - 9.5x) than they are for other more chill or narrative-led genres (story-rich - 13.2x; relaxing - 15.7x; puzzle - 15.9x).

What gives? I chatted to HowToMarketAGame’s Chris Zukowski, and he pointed out that when he did his Steam gamer buying observation study a while back, when he asked why some people follow games. And it’s generally for deep, games as a service-y (GaaS) titles which have a lot of detailed Steam news updates.

So is this data meaningful? Is having a lower ratio ‘good’ for your game? Well our GameDiscoverCo Plus data-set has a ‘median game genre by Hype’ chart, which ranks overall interest across all 15,000+ unreleased Steam games.

And we mapped the ranking of all Steam tags (red graph points and ‘line of best fit’) on the same graph as those Steam tags (blue). A lower ranking is ‘better’, obviously:

It’s not a 100% clean relationship. But this does seem to show that genres with lower Steam ‘follower to wishlist’ multipliers have more pre-release ‘Hype’, in general*. In other word, they have a lower wishlist multiplier and are more popular. (*There will always be exceptions!)

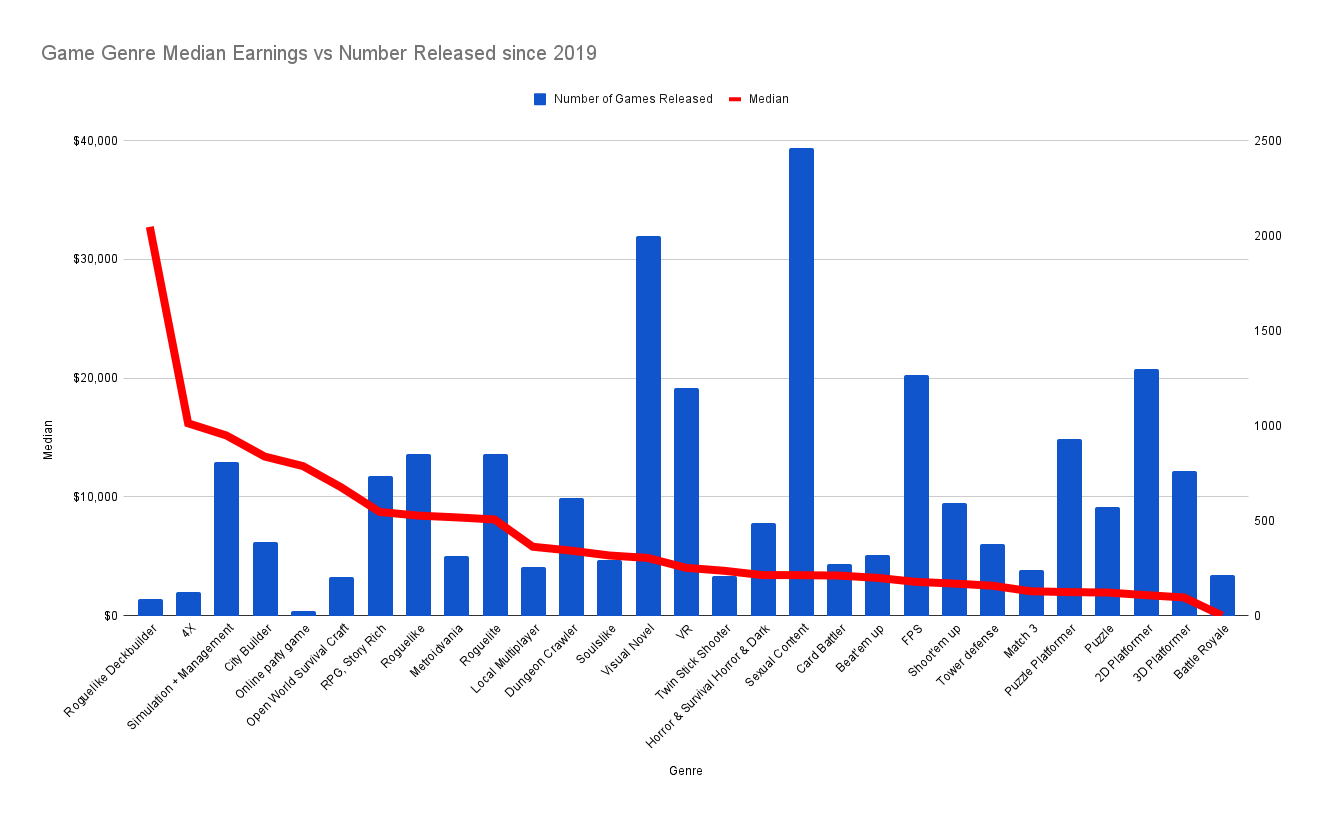

Finally, does this hold true post-release? Yep! You can look at sites like Games-Stats, which have median revenue per tag, or HowToMarketAGame & VGInsights’ own graph on the matter - red line is median earnings, blue bars are # of games:

So - all this data is really about genre & perceived depth, yet again. Genre begets interest, begets ratio. And no, you can’t ‘morph’ a puzzle game into selling like a 4X by incenting people to follow your game and getting your follower ratio down, lol.

But our survey has proven two things. One: Steam’s ‘follower to wishlist’ multiplier is going up over time. Two: lower multipliers & higher sales are expected if you’re in a deeper PC game genre, where players expect GaaS-style news updates & multiple layers of gameplay mechanics. (You should provide those updates!)

How a mobile climbing game got reach - if not $?

Over the past few months, we’ve been talking to Ben Dressler, who ‘in real life’ is a veteran of companies like Spotify, but has also been doing a lot of interesting experimentation with free & paid iOS/Android (and now PC) games.

The first game he tried so far - and the standout in terms of downloads - is Crux: A Climbing Game, a clever climbing/puzzle-y free game which launched in September 2020, and has had 256,000 iOS copies and 73,000 Android copies downloaded LTD.

Ben prepared GameDiscoverCo a super-detailed document (Google Drive link) which includes a lot of the thinking and metrics behind the title’s relatively viral organic success on mobile. We particularly thought it was worth highlighting his annotated download chart, so you can see where organic reach comes from on mobile:

Of course, organic reach only gets you so far on mobile. And although Ben later added level packs & character skins IAP and eventually some ads, none of them monetized significantly. The game has grossed $1.5k on iOS and $500 on Android, lifetime.

So what next? Ben said: “As a former Spotify data guy I’ve seen first-hand the power of a strong free product to sell a stronger premium product. And that’s where I wanted to take Crux.” So he made Crux: The Great Outdoors, a $4-$5 product extending the franchise.

Did this work? Well, kinda. As he notes: “The press coverage felt pretty similar and from what I can tell, Apple used the exact same promotional regime. Comparing the two games on the App Store today, the sequel has gotten about 50% of the prequel’s impressions, shipped 1% of units and made about 12 times more revenue.”

But the issue with premium-only iOS/Android games is that they rarely gross major amounts in the end. So even though it was 12x the revenue, it was still 2,000 copies (and $8,600) on iOS and 260 copies (and $1,000) on Android. And the Steam version of the game really flopped, grossing just $100 or so from less than 20 copies.

Where’s he going from here? Ben says: “After 4 years releasing almost exclusively on mobile and learning the painful lesson of underestimating community building (twice) I’m now shifting course.”

So he’s started the ‘GameDevInAVan’ YouTube devlog and TikTok account “where I’m sharing how I’m making my new game and how it is to make a game in a camper van (spoiler: quickly becoming a fan).” The new project is “card-based blacksmith simulator” where you use your card deck to build items & sell those items to heroes.

Thanks for sharing all this great data and insight, Ben! Our main takeaways:

you need to be super-aggressive on in-game ads or IAP when the game is released to make $ on free mobile games.

you can only get so far on mobile without having paid UA, and you need really good monetization to allow for profitable UA. So it’s just not ‘trad indie’ friendly.

premium mobile titles do get some love from platform featuring by Apple and others, but the scale just isn’t there, most of the time.

Still, we wish him luck, and it’s good that we get transparent info like this. (And it’s awesome that hundreds of thousands of people played and enjoyed his games!)

The game discovery news round-up..

This is the final free newsletter for this week, so we’d better go ahead and get all your interesting platform news outta here in one piece, so it doesn’t get marooned:

Aha, Xbox announced increases to its Game Pass sub costs, as of July 6th: “Game Pass Ultimate will move from $14.99 per month to $16.99.. the base Xbox Game Pass for Console pricing will also move from $9.99 a month up to $10.99. Microsoft is not changing PC Game Pass pricing.” This was teased: first volume, then yield!

There’s some new stats for PlayStation Plus’ Game Catalog(ue) via a Sony competition, including Sunday being the most popular day to play, 7.4 games being played per PS+ user, and the Top 3 Game Catalog titles to date being Stray, Spider-Man: Miles Morales & Ghost Of Tsushima.

Ubisoft’s Yves Guillemot suggested that “the publisher failed to heed Nintendo’s advice by releasing Mario + Rabbids: Sparks of Hope too soon”, telling GI.biz of the disappointing title: “Nintendo [has advised] that it’s better to do one iteration on each machine. We were a bit too early, we should have waited for [the next console].” (Eh, maybe. There just may be little demand for another of those games overall?)

Oh, a second piece of ‘Xbox raising prices’ news - the Series X will increase its price outside of the U.S., moving to £479.99 (up 6.6%) in the UK, €549.99 (up 10%) in Europe, $799.99 (up 6.6%) in Australia, and $649.99 (up 8.3%) in Canada. Presumbly the strength of the US dollar is why it’s staying at $499 in the U.S.?

Yep, Nintendo just rolled out another Direct at short notice. And of course, it was 100% about games, and 0% about Nintendo’s eShop, which could do with some discovery improvement. Still, more first-party goodness - including Super Mario Bros. Wonder and a remaster of Super Mario RPG - got debuted. (And plenty of third-party titles, come to that.)

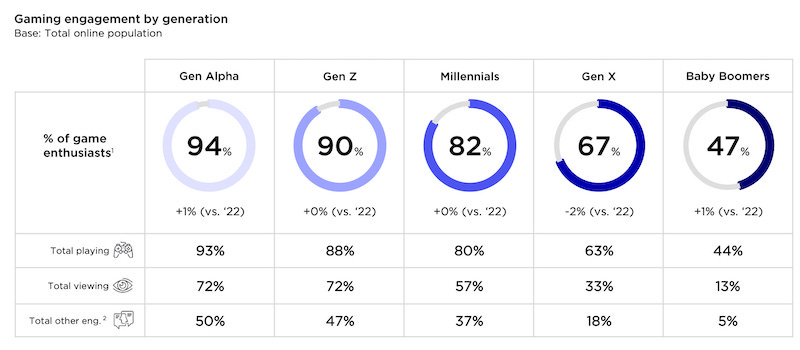

Newzoo has a new survey on how consumers interact with video games - a broad subject, but interesting. Different ages are surveyed (above), and also platform overlaps: “There are 35% of users who are playing only on mobile. It’s much more than those who are playing only on consoles (9%) and only on PC (8%).”

The latest set of Xbox Game Pass titles for the rest of June got announced, and it’s another interesting melange: spooky Scandinavian folk tales (Bramble), stylized racing (NFS Unbound), adorable Harvest Moon-y stuff (Story Of Seasons: Friends Of Mineral Town) and even a Chinese myth-based franchise (Sword & Fairy: Together Forever.)

Microlinks: Steam has been getting banned at certain Indian local ISPs, possibly due to misinterpreted government directives; Japan law will require Apple to allow alternate iPhone app stores; Ars Technica rounds up their ‘sleeper hits’ of Summer Game Fest.

Physical game disc distribution weirdos, unite! In the UK, the CEO of GAME is going to be the ‘last man standing’ in physical game distro, he says; in the US, ancient video game/movie rental company GameFly is still around (!), and upping its price to $18/month for 1 game/movie out at a time, and $26/month for two.

Xbox head of studios Matt Booty isn’t interested in Microsoft Studios working on AR/VR titles: “We have 10 games that have achieved over 10 million players life-to-date, which is a pretty big accomplishment, but that’s the kind of scale that we need to see success for the game and it’s just, it’s not quite there yet with AR, VR.”

Esoteric links: inside Yager Development's failed attempt to make Dead Island 2; why the ‘JRPG’ label “has always been othering” - and potentially problematic; a look at the “emerging art and science of building compelling mixed reality apps” - in this case Laser Dance.

Finally - imagine you’re working on Baldur’s Gate 3, and find out your real-life mind flayer costume is minus a tentacle-y bonce? This just happened to Larian Studios:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]