Steam survey: do wishlists and sales line up meaningfully?

We've got some graphs AND some charts.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the second free GameDiscoverCo newsletter of the week - and this time, we’re back looking at our Steam survey data again. For those who missed it, we fielded an anonymous survey in August that got more than 75 responses from Steam devs/publishers, all for newer games that launched in 2019, 2020, or 2021.

Our first results from this data examined ‘long tail’ revenue for your Steam game, with some very useful top-line estimates. And our next survey results are looking at something everyone wants to know about. Initial sales compared to Steam wishlists at launch - is there a provable relationship?

[REMINDER: we have a 20% off deal for new members of our GameDiscoverCo Plus paid subscription, thanks to adding Derek Yu’s Spelunky eBook. Perks? Exclusive newsletters, a Discord, our Steam Hype back end, a ‘Game Discovery Toolkit’ eBook, & lots more - sign up!]

Steam wishlists compared to sales - does it track?

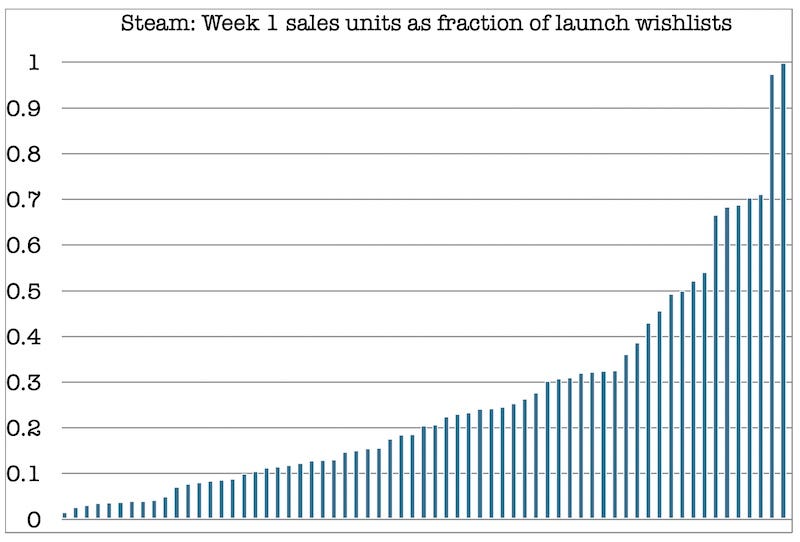

You may recall we surveyed this correlation for all ages of Steam games back in June 2020. On a broad basis, the answer we get this time is the same - a game’s first week unit sales have a median of 0.2x its total Steam wishlists at launch. The above graph is the full data set from our new survey, in ascending order.

If you look at the two ‘battletested’ spreadsheets we published recently - from GameDiscoverCo and Fellow Traveller - both of these use 0.2 (aka 20%) sales as the most obvious option - one for Week 1, one for Month 1. So that’s good news! But we really want to drill down on the possible range, because Week 1 sales on Steam span anything from 1.5% to 100+% percent of launch wishlists.

This is a crazily high range, given that the other things we survey - like Week 1: Year 1 revenue multiples or even Steam units sold compared to number of reviews - are often within a ‘3-fold’ range - i.e. the highest likely result is 3 times the lowest. In this case, the highest likely result is 60+ times the lowest!

So it seems like the correlation is very loose across a large number of games, and you should not ‘take your wishlists to the bank’. (You may have been aware, but this is further confirmation.)

Median unit sales for different amounts of wishlists?

However, we wanted to drill deeper and try to discover closer correlated elements in the data. And we did find ‘some things’. Here’s the median Week 1 Steam unit sales, compared to the amount of wishlists a game launched with:

What’s interesting here, if you look at ranges? Well, for games that have anything up to 20,000 wishlists at launch, you get an incredibly wide range of results, when excluding the top & bottom extreme outliers. (The maximum sales unit result is often 10x the minimum and the biggest range - for 10k to 20k wishlists - has the maximum sales as 70x the minimum, youch.)

But for games with more than 20,000 Steam launch wishlists, things seem to narrow a bit. You can still get ‘disappointing’ conversion rates - there’s a title in there with 85,000 wishlists that only sold 3,000 copies during launch week, for example. But the maximum is closer to 5x or 6x the minimum. This is not amazing, but slightly better correlated - in our semi-professional view.

We do have a relatively small amount of sample points here, of course. But here’s a potential theory. We still think it’s possible to juke your way to 10-20k Steam wishlists if you a) have your game on the site for a longer period of time b) release multiple demos, and c) appear in a bunch of pre-release ‘features’ - and maybe even get in Popular Upcoming too.

And if you have 30k, 50k, or even 100k wishlists at launch? A bunch of players cared about you, independently of all of the marketing beats you had. So the extreme outliers go away. But frankly, it’s still fairly all over the place. Here’s all the results we got for games with more than 50,000 wishlists* at launch, for context:

Anyhow, I think this is all to say - wishlists are a little bit predictive of how you may do at launch, but not a lot. Things that seem important that aren’t encompassed within wishlists are: launch review scores (Very Positive?), streamer support at launch, are you in a genre that people like ‘sampling’ new games in, vs. playing one game constantly? Etcetera.

(*BTW: slight survey error: we asked devs to give us their total number of launch emails, not launch wishlists. As somebody pointed out, that initial email count will also include anyone who follows that game’s publisher page, in addition to wishlisted the game. So the figures may be a bit inflated for ‘bigger publisher’ games. We’ll ask for actual wishlists in the future!)

How about sales compared to ‘organic’ daily wishlists?

As you may know, I’ve been trying to focus on good quality ‘organic’ wishlists, suggesting that your daily wishlists when ‘not much is going on’ are a better indication of possible success than total wishlists.

We did try to ask our respondents this, across the 75-ish games released on Steam from 2019 to the present day. And here’s the results:

So - more organic daily wishlists make for better median unit sales, sure. And it’s interesting that no game with less than 10 organic daily wishlists got more than 3,000 units sold for launch week, I think. (A sobering stat, albeit from a smaller sample size.)

But how about the ranges? As you can see, the lower wishlist tiers are all over the place, with ‘min to max’ sales variances between 15x and 60x. And even 21-49 daily wishlists has a pretty large variance (17x). But over 50 organic wishlists per day, it does narrow down somewhat.

I also think that a few people didn’t fully grok the (difficult to estimate!) question. We looked more closely in the ‘100 to 199 organic daily wishlists’ bucket, and the two lowest results are from people who launched with less than 10k wishlists. This seems impossible - you would have more wishlists than that by launch. Without those, we currently see a range of 15,000 to 60,000 units in the first week for 100-199 organic daily wishlists. This is more like a 4x range.

Look - we just don’t have enough data to do this question justice. But I still think higher organic daily wishlists (without demos, sales, and all that goodness) is a more reliable indicator of eventual Steam success than just ‘total’ wishlists for the majority of Steam games. (Even if the above data doesn’t 100% prove that.)

As for how you get good organic daily wishlists? I do think this is down to having a great ‘hook’ and visual or conceptual angle on your game, being in the right genre or subgenre, releasing gameplay trailers and even demos/streamer versions early on to help hype.

But beyond that, it’s like: why are some pop songs hits, and some flops? Some of this ‘designing for success’ can be irritatingly intangible. And if you could simply algorithm your way to success… I probably wouldn’t be writing this newsletter, I’d be luxuriating in my palatial New Zealand panic bunker?

Finally for this section, I just wanted to highlight - across the entire sample data - the different results you can get for first week unit sales on Steam:

I tried mapping the above graph logarithmically, and it was a more easily viewable curve. But it didn’t truly convey the sheer scale of the possible different outcomes for your Steam game.

So yes - there are entries all the way from the left to the right of the graph, and you can only really start to see them about half-way across. And… that’s how selling games in the 2020s work on Steam. All humanity lives here, and there’s a gigantic range of outcomes. We hope to do our part to get you to the right of this graph.

How many game publishers should you pitch?

This has come up before in passing. But I’ve had a few smaller devs ask me recently about the best strategy for pitching game publishers. Specifically: when, how, who should you contact, and in particular - how wide should you go?

It’s probably not controversial that you should provide publishers with a short PowerPoint deck and a game prototype/vertical slice, ideally - plus a game trailer or a video recording of the prototype in action. You want everything tuned so that a publisher can evaluate the game hook, team, & money needed swiftly and easily.

(BTW, Raw Fury’s developer resources documents are useful here. Not only do they have a pitch deck template, but also their internal game evaluation template, which I personally found interesting, since it shows high-level publisher data points.)

As for how wide you send your pitch? This isn’t discussed as much, but I’m a big fan of simultaneously emailing every possible publisher for your game. ‘Possible’ - in this case - meaning ‘actually publishes PC/console games from small or medium-sized devs’.

There’s definitely an argument you should look for compatible publishers. And you might want to personalize pitches to your ‘best fit’ publishers in some way - by indicating that you think your title might be a particularly good fit. But here’s the main reasons I think a wide approach works:

There’s no disadvantage to going ‘super wide’: you will either create buzz - or discover that people aren’t so interested. And the wider the distribution, the more likely you are to find people who might be interested in supporting or funding the game.

You can’t tell what publishers might be interested in: with only a few exceptions, publishers will consider games in a surprisingly wide set of genres nowadays. So even if you think a publisher only likes certain types of games - they might make an exception for yours.

Publishers want to see more games, not less: although some scouts may be groaning when I say this, a higher volume of pitches is a good thing for publishers. It enables them to understand trends, they can evaluate individual titles fairly swiftly, and more data points are just… better.

If you get interest from multiple publishers, you can ‘close’ easier: Many publishers are evaluating many games at the same time, to be funded from the same tranche of funds. This can make them slower to commit. But if you have multiple publishers interested, you can move to a simple ‘I want to work with you, are you in or out?’ conversation, or give concrete time limits to agree a deal, knowing you have a bit of leverage.

You do want to get to know your prospective publisher, but do it on the back end: relationships are important, and you need to make sure your prospective publisher is a good fit and has the right recoup/royalty numbers for you. (Please audit them and get to know them as people, as much as they are auditing you!) But you can do that with a smaller number of publishers, after you know who is interested.

As for how you get this mega-list of publishers, the best broad list of publishers I’m aware of is on Liam Twose’s Global Games Industry Guide. Although it does have to be winnowed down somewhat, since it’s got even major publishers on it. (You can also do your own research on Steam.)

And a final point: whether funded all the way to launch or not, you can also try the publisher-acquiring tactic of ‘launching your Steam page with a trailer, getting interest from players, and then fielding publisher offers’. At that point, you are in an advantageous position, and can even opt not to work with a publisher. Although launching a Steam page to ‘slow follower’ results may dissuade some data-centric publishers…

The game discovery news round-up..

GameDiscoverCo is off on a brief holiday for the rest of the week - which is why Plus subscribers got a double-sized analysis for last Friday’s newsletter. But before we do, here’s a look at the notable links and news in the game platform and discovery space. As always, there’s a lot to cover:

Well, I guess that massive Twitch source code/data leak happened, ouch. Of most relevance to us is probably “an unreleased Steam competitor, codenamed Vapor, from Amazon Game Studios”. It’s very much unclear if it’s a project being actively worked on, how closely it integrates with Twitch, if it’s a full store where you can buy games, etcetera. More soon, probably.

There’s a few Steam Next Fest things: RockPaperShotgun and PC Gamer both have ‘demos you should try out’ posts, and Buried Treasure played a load of Next Fest demos and picks his favorites; also, Chris Z has some general comments on Next Fest for devs: “middle class games (earning 200-500 wishlists / day of the festival) saw median playtimes of 5-10 minutes. Top earners ([1500-3000] wishlists / day of the festival) had median play times of 15-60 minutes.”

Microlinks: this video review of the Switch OLED version is handy for understanding how much better the screen is; not covering NFTs much, because I’m a backwards troglodyte, but is Axie Infinity sustainable?; would you like to watch talks from an ‘escape room’ conference, RECON ‘21? Now you can!

Here’s an amazing RestOfWorld piece on the rise of the mobile game biz in Turkey - which includes startling contract details on the cut-throat hypercasual biz that's burning out devs: “CONSULTANT shall be paid 10% of the Net Profit generated by the COMPANY..” with a capped payout of $100k. And no payout if profit is below $230k, and a $100 kill fee if day 1 retention is under 30% or CPI is below 30c. Ugh. I’ve talked about hypercasual being morally wrong from a developer contract/churn perspective before - here’s more ammo, folks.

More fuel for the ‘Quest 2 is the platform doing great for VR games, if you can actually get on the darn store’ fire: this announce on VR studio Fast Travel Games expanding into publishing reveals: “For our most recent launch, Wraith: The Oblivion - Afterlife, Quest has accounted for 90% of sales since launch.” The Steam version has 41 Mixed reviews, which gives you an idea of scale if you do a normal ‘reviews to sales’ multiplier.

Microlinks, Pt. 2: Valve has helped co-author some new WiFi tech that’ll help with games - “send every packet on both wifi bands and let them race”; how effective is plugging your game after getting a separate viral Tweet?; the video game deals market is hot hot hot - $71 billion in the first 9 months of 2021.

From a few days back, but some of Tim Sweeney’s ‘metaverse’ points in this Washington Post piece are worth noodling at - particularly that he doesn’t want it to be a ‘walled garden’. “I think the real force that’s going to shape the metaverse into an open platform is the power of all the brands to participate in it.” I admire the optimism - but how are we going to get from here to there?

An update to the previous ‘Steam may disable the ability for players to download old builds’ story - it may have been jumping the gun. Talking to PC Gamer, Valve noted: “We are actually not planning to disable downloading old builds. What we are working on is an approach on handling edge cases involving unowned content, and helping partners more easily take down builds that need to be removed for things like copyright issues.”

Microlinks, Pt.3: Microsoft’s new Xbox web store integrates Xbox Cloud Gaming and wish lists; immersive VR location company The Void - which I really dug - might be coming back; so you want to compete with Roblox? Look, it ain’t that easy…

Finally: The Steam Deck takes its clothes off

To end, would you like to look inside the Steam Deck? Well, Valve itself has just a few minutes ago published a video looking at the innards of the handheld device - and explaining what can and can’t be modified.

As often happens with Valve, this isn’t exactly ‘normal content’ for a hardware company - it’s a “why you really shouldn’t do this” video, since the parts “aren’t really designed to be user-swappable”. Also it mentions possible fire and, uhh, death if you do it wrong?

Even with these dire warnings, Valve’s video happily talks about replacing thumbsticks and SSDs, since it knows people or third parties may end up doing this - and actually says ‘stay tuned’ for a component source for the former.

So there’s definitely a strong point being made about ‘right to repair’ here. Which is appreciated, given Apple definitely does not view things the same way, and the game industry as a whole has been against ‘right to repair’ legislation. Fun times! OK, see you next week…

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]