The state of Quest 2 VR games: 2023 edition!

Also: why Early Access can be a double-edged sword, and lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Mid-week madness here in the GameDiscoverCo newsletter, as we look from our discovery mountain across an ocean of complexity, and pretend to be Zeus overseeing his majestic domain - before remembering we’re typing on a MacBook Air from home.

BTW, we have some amazing PC game success stories in the newsletter over the next couple of weeks. But we’re also interested in ‘not success’ stories, especially Steam conversion disappointments. Anyone want to postmortem those with us? Hit us up…

[Heads up: 9 days left for our 25% off all ‘Plus’ subscriptions deal. We like chatting to y’all in Discord, sending you the extra Friday ‘what’s big in Steam/console & why?’ game analysis newsletter using our Steam Hype dataset, sending you 2 excellent eBooks & more: details here.]

Quest 2 VR games: where are we now, exactly?

Back in January 2022, we ran a ‘state of Meta Quest store’ article from Cassia Curran of the Curran Games Agency. As we said: “Cassia’s background at NetEase, Jagex and Wings Fund has given her much industry insight” - and she’s now specializing in VR.

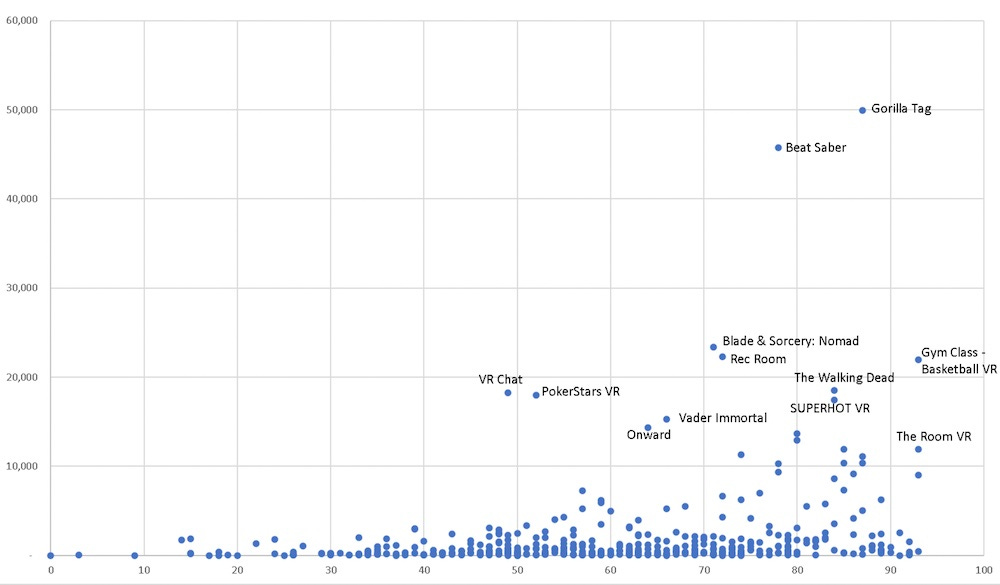

The Meta Quest store is still pretty small - see above chart. Imagine if Steam only has 275 paid games? Joy (Of course, this is because Meta is curating the store carefully, with more than triple the VR games/apps available off-store on Quest App Lab.)

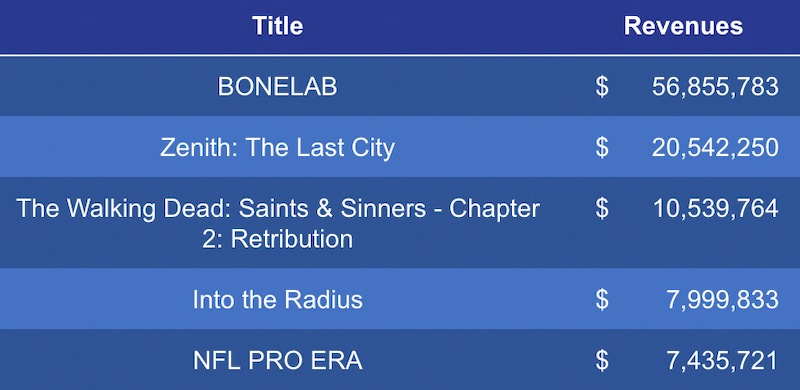

And the top ‘evergreen’ games on the store are doing great! Here’s Cassia’s estimate of the lifetime gross base revenue (excluding DLC/IAP) of the top Quest paid-only games, as commissioned by FOV Ventures, an early stage VC fund focusing on VR and the metaverse.

The below data is based on an estimate of 110 units sold for each Quest store user ‘star rating’:

You should definitely bear in mind that ‘110 sales per Quest rating’ is a rough median - we’ve heard 75x can be common for more niche games, and Among Us VR’s 1 million sales came with a ratio closer to 250x or more, due to a very casual audience.

But it’s a good approximation to give you an idea of general performance. And if you apply the same multiples to games released in 2022, you’ll get the following results:

So, sure, Among Us VR would also probably sneak in there in reality due to its high multiple. But the general message here is - only select new games are breaking through in a more crowded market with a lot of ‘evergreen’ hits.

Still, VR physics sandbox shooter Bonelab (below) has been the major new Quest 2 hit of 2022, due to its overall quality as well as a higher $39.99 price point. But VR MMO Zenith: The Last City has also performed exceptionally well.

On this point, Meta’s head of third-party games Chris Pruett made comments during his GDC 2023 talk: “The cohorts of Quest customers over time, the ones coming in recently, look very different than the early enthusiasts.. their expectations are like those of a modern game console.” And both of these games fit that bill, actually…

Other data highlights? Cassia’s analysis of the top 20 genre tags on the Quest store by median revenue excludes genre tags with less than 10 titles, and uses median rather than average revenue, “since titles like Beat Saber can heavily skew averages.” Here’s the intriguing results:

This actually ties in fairly well with Chris Pruett’s GDC 2023 comments on genre: “Top game genres include multiplayer competitive, physics combat, horror adventure, fitness and workout, social collaborative, and shooters.. growth categories include single-player narrative adventure, boxing/golf and sports, RPG, simulation, and survival.”

In addition, Cassia notes that multiplayer titles are performing better than single-player titles: 155 Quest Store titles have multiplayer (108 premium, 47 F2P), with premium base revenue averaging $5.2m, with a median of $1.6m.

Conversely, 286 Quest Store titles are single-player only (224 premium, 62 F2P), their premium base single-player revenue is an average of $3.5M (just over 30% less) and a median of $800k (50% less than the multiplayer games median!)

Still, those $ totals sound tasty in general, right? (Bear in mind that a lot of the bigger Quest titles have had multiple years to run up the gross revenue, and newer games coming in have double or triple the number of competing titles to contend with.)

Finally, we dug this graph Cassia put together which has number of Quest ratings (left axis) compared to the percentage of 5 star reviews the game received (bottom axis):

You’ll see some popular F2P titles in there, in particular ubiquitous F2P multiplayer jam Gorilla Tag, which made $26 million in App Lab even before graduating to the main Quest store. (There’s also VR basketball sim Gym Class - Basketball VR, which has been an absolute smash.)

You’ll also see more controversial games like PokerStars VR, one of the only Quest games that actually prompts for reviews in-game (!), and seems to have its top reviews filled with complaints about being banned and, uhh “kids who split 10's on hard 20”.

So while we hope there aren’t too many 11 year olds hanging out inside a virtual casino (ugh!), it’s a good reminder that all kinds of biz approaches can work, even in VR - and F2P is still a real business model even in virtual reality.

Thanks again to Cassia and FOV Ventures for providing all this excellent info. And we’ll keep an eye on Quest - the most dynamic space for selling VR games by a large margin - in the future.

Is ‘Early Access killing indie games’, we wonder?

A couple of people pointed us to this LinkedIn post from A-List Games’ Steve Fowler, which has the above title, & starts out as follows:

“We had a negative experience last year with our release of [F2P multiplayer tactical arena brawler] Kingshunt. While some developers have found success through Early Access, others (like us) have experienced negative consequences that may outweigh the benefits…”

What were the issues that Steve particularly wanted to highlight? Looks like it came down - in particular - to the following:

Early Access can lead people to early, harsh judgment: Steve felt like his F2P title was being unfairly judged, and quickly: “Within hours [of Kingshunt’s release] we had many negative reviews, mostly from people who had less than one hour play time.”

You ‘start the clock’ on a dev update grindstone when you launch Early Access: “The constant pressure to update and improve the game can be overwhelming, and negative player feedback can exacerbate the stress and anxiety experienced by developers.”

Getting money early is good, but your 1.0 release may suffer: “The revenue generated from Early Access can also be a double-edged sword. While it can provide developers with an early source of income, it can also harm sales when the game is fully released.”

Well, the third of these points is the subject of a recent newsletter of ours entitled ‘Your Early Access launch? It (kinda!) is your launch...’ But we wanted to expand on the other points, because what you should launch in Early Access can be confusing.

In particular, thinking that you can launch a game that has obviously unfinished parts into Steam Early Access can be… a mistake. We no longer see it as ‘your game is finished at 1.0’, we see it as ‘your game is feature complete at Early Access, but you’re layering tiers of cool new things on top of it throughout EA’. Which is different.

Not saying Kingshunt did the former! Read Steam reviews from committed players that say “This game is an Early Access game that people are giving 30 mins of their time and expecting miracles from”, and sympathize with the devs. They’re doing good things, but lower-commitment F2P gamers are dipping in… and then out.

But - as we’ve discussed ad nauseum - the market is kinda brutal. There are a large amount of F2P games that have stacked up 5-8 years of content for gamers to immerse themselves in on Day 1. That - more than the Early Access status - is probably what makes ‘barrier to entry’ so hard in the space.

So, what solution? Doing a LOT of private and semi-public alphas and betas, so that you are retention-honed to within an inch of your life at initial launch of any kind on Steam/console. (Heck, mobile games have ‘soft launches’ for months or even years.) It’s not a fix - but it takes into account that the players’ attitudes aren’t, uh, malleable?

The game discovery news round-up..

Finishing up here, there’s a cacophany of news to sift through, so let’s get to it, and get it disbursed into your general area:

E3 continues to cycle the ‘who is out or in?’ gossip pipeline. Apparently, Sega and Tencent are definitely out, with some others saying they will have a smaller presence at Summer Game Fest’s media/influencer only Play Days. But look, Limited Run is at E3: “E3 has always been an extremely important business networking event for us. Summer Game Fest and other digital events do not fill that same void.”

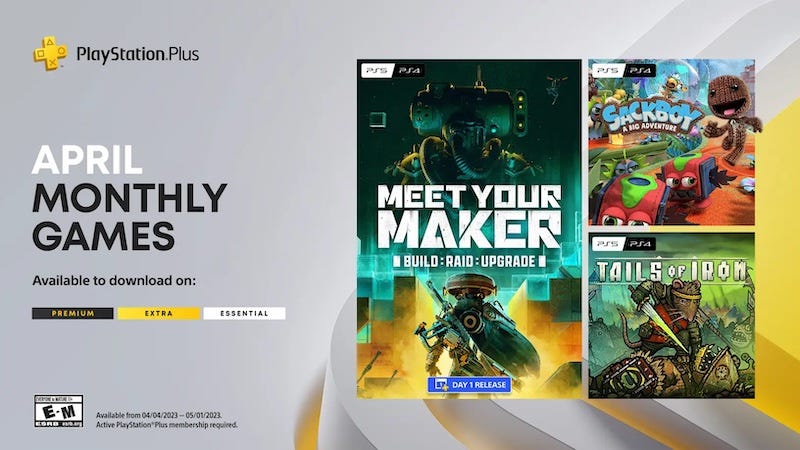

The PlayStation Plus monthly ‘Essential’ game picks for April are out, and are Meet Your Maker, Sackboy: A Big Adventure and Tails of Iron. The first of these is particularly interesting, because it’s Day 1 PS+, “a post-apocalyptic first-person building-and-raiding game where every level is designed by players”, and its creator, Behaviour Interactive is using PS+ to boost multiplatform launch CCU/DAU.

Here’s yet another TikTok x games success story, this time China-based: “In January of this year, the [PC & mobile] indie game LoveChoice became immensely popular on Chinese TikTok, amassing an impressive 200 million views on the platform.. five years after the game’s release.” Thus: “the game's popularity had brought his small team approximately 500,000 USD in revenue, which allowed [the lead dev] to pay off his mortgage.”

ATVI’s Bobby Kotick posted his latest internal note on the Xbox deal, saying re: Sony’s ‘Microsoft might break Call Of Duty on our platforms’ claim: “This is obviously disappointing behavior from a partner for almost thirty years, but we will not allow Sony’s behavior to affect our long term relationship.” And Microsoft lobbyists are getting U.S. Congress reps to claim that Sony is messing with Xbox in Japan. (The war continues on several fronts!)

Obsidian’s Josh Sawyer commented on a recent MinnMax interview re: Xbox funding Pentiment (since they own Obsidian): “Maybe I’ll get in trouble for saying this… but they didn’t really care about it making money.” It’s OK, Josh - media platforms have prestige projects to attract awards & interest, it’s a thing.

You want wide-ranging charts? We’ve got them! Firstly, Circana (formerly NPD) put out its February 2023 U.S. game market results, with Hogwarts Legacy ruling game sales & hardware spending up 68% YoY, led by the PS5. Secondly, Sensor Tower’s ‘State Of Mobile Gaming in 2023’ report - as summarized by Game Dev Reports - has a wealth of ‘1000 ft. view’ charts on the mobile game biz.

You may be aware that U.S. Congress had a 5-hour shout at TikTok CEO Shou Zi Chew late last week - which “inspired little faith in social media or in Congress”, says The New Yorker. But did you know that Bytedance’s VR platform the Pico 4 got a delayed U.S. launch allegedly because Pico’s parent company - also the TikTok owner - wanted to wait until the yelling was over?

Steam things: if you look at this page from the EU, you’ll see: “During the six-month period of August 1, 2022, to January 31, 2023, Steam had an average of 26.3 million monthly active recipients from the European Union.” Also: “As of January 1 2024, Steam will officially stop supporting the Windows 7, Windows 8 and Windows 8.1 operating systems.” Also: plz peruse the official ‘top games of February 2023 sale’ from Steam.

Seems like Take-Two has bought GameClub, which Ampere’s Piers Harding-Rolls describes as a “mobile multi-game subscription service… offering its service across iOS and Android, competing with Apple Arcade and Google Play Pass.” Possibly more of an acqui-hire, but we’ll see what it’s used for?

Microlinks: Morgan Stanley says: “We estimate the impact of a potential Microsoft App Store on the iPhone would be limited to <3% of App Store revenue and <0.5% of EPS, but it still represents the biggest potential threat to the App Store today” ; more on the ‘hypercasual onboard to hardcore strategy game’ UA tactics on mobile; the design secrets behind mobile hit Ssnaker, from the Archero/Survivor.io crew.

Finally, we think this is kinda cool. The AARP (formerly known as the American Association of Retired Persons!) is doing a summit on “the lucrative and growing 50-plus gamer audience” next month. Video games - not just for ‘the kids’:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]