PC game discovery in China: how does it work?

Also: some clever in-game codes from Inkbound & lots of game discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back - and breaking news, the incredi-viral Palworld just confirmed it’s had 19 million players so far - 12 million paid on Steam, and 7 million ‘Xbox ecosystem’ players, chiefly on Game Pass, with around 3m DAUs on Xbox. (That’s better Xbox reach than we estimated last week.)

So as we continue to stare adoringly at that PC/console discovery success story, we also have to move on and publish a few newsletters that are not about Palworld. And in this latest one, we take a look at how China finds out about PC games…

[REMINDER: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to our Steam data back-end for unreleased & released games & weekly PC/console sales research, Discord access, seven detailed game discovery eBooks - & lots more. ]

PC game discovery in China: how does it work?

So we had a chance to chat to Aldric Chang of the Singapore-based Spiral Up Games - who are looking for new worldwide or Asia-friendly titles for publishing, they urge me to tell you! We pinged them because of two China-friendly PC hits they just published:

Back To The Dawn is a pixel-y ‘prison break planning’ lore-heavy game with almost 3,000 Very Positive Steam reviews since Nov. 2023 - and ~75% of the owners from China, GameDiscoverCo estimates. At the time we spoke to Aldric, the game was “on its way to 100,000 copies sold in its first month” - good numbers.

We were surprised that ‘pixel-y animals breaking out of prison’ would be hot in China. But besides the game being great & marketed strongly in the country - key elements, haha - Aldric tells us “a series of late 80s and early 90s Hong Kong blockbusters focusing on prison life have become iconic in Chinese cinema [and] the American TV series 'Prison Break' enjoyed immense popularity in China.” Aha!

The other game we spotted was Wandering Sword, a “Wuxia-style pixel RPG” which Spiral Up told us sold 200,000 copies in its first month on sale late last year. GameDiscoverCo data has this as high as 80% Chinese ownership on Steam, btw! And again, it’s a legitimately good JRPG-style game - this time with a Chinese history theme.

This game is much more obviously catnip for Chinese gamers. Wuxia is incredibly mainstream in China, and we’ve commented before that the Wuxia vibes of Team Ninja/Koei Tecmo’s Wo Long: Fallen Dynasty led it to big PC & console sales in China.

Key Chinese services that power game discovery?

We know the grey-market opportunities in China can be significant, since ‘worldwide’ Steam isn’t directly banned there. This is despite a government-approved Steam China still existing - and requiring ISBN approval for games to be on it. Reminder: your game is not meant to be played in China at all without an ISBN number.

Sure, Wandering Sword might not even be objectionable to Chinese authorities - not sure about Back To The Dawn. But there’s just a tremendous approval logjam, and a ‘working with Chinese company’ forcing function to get ISBN numbers. Yet you can skip this by ‘just putting your game on Steam with Chinese language*’ (*If you’re not a big China-based company - since that would get the authorities mad at you.)

Anyhow, we asked Aldric about how Spiral Up Games engages to stoke discovery in China - quite successfully, btw. He explained: “Our main sources of traffic are Bilibili and Douyin, which are akin to YouTube and TikTok in the West. While a significant portion of our promotion is paid, organic promotion also plays a key role, especially when content creators choose to feature our games more extensively due to positive audience reception.”

Even better, he was kind enough to show us - for Wandering Sword - actual web links re: how people have been showcasing the game in video form, as follows:

Bilibili (YouTube equivalent) - here’s the top-watched Wandering Sword videos - the #1 video has over 700,000 views, and its title is machine-translated - possibly incorrectly - as “Wang Laoju teaches you how to detoxify and flirt with girls”, lol.

Douyin (TikTok equivalent) - yep, Douyin is basically ‘the Chinese version of TikTok by the same people’, and here’s the top Wandering Sword videos on there. Most are fairly short, much like TikTok videos, but some are as long as 11 minutes!

Bonus: Douyu (Twitch equivalent) - here’s where you can see archived Wandering Sword videos from Douyu (scroll down), and yep, you can see longform playthroughs of the game, much as you would if looking at Twitch archives.

For anyone based in China, you may be thinking ‘OMG GameDiscoverCo, this is an incredibly basic newsletter?’ But for those in the West, it’s new info that helps us ‘mind map’ how games are found on Steam from China. (We hadn’t explored this.)

And it also showcases why getting local Chinese marketing or publishing help may pay off. Why? Because these ecosystems are complex, and for every game that ‘just goes viral’ in China with solely a language translation, there must be many that get stuck because nobody is stoking the system with free keys, paid promo, etc…

How Inkbound gave away ‘cosmetics’ for emails..

You might know Shiny Shoe’s ‘turn-based tactical action roguelike’ Inkbound as either a) the latest game from the Monster Train devs, or b) that paid game that turned off its optional IAP, and got a big discovery/positivity boost as a result. (Interesting!)

And we were intrigued when Shiny Shoe founder/CEO Mark Cooke mentioned, as a way of building newsletter subscribers for the game: “We give out cosmetics in Inkbound to e-mail newsletter subscribers. We have a code redemption system like Steam and can generate single-use personalized codes and send those to subscribers.”

That’s a smart idea, since many game devs want easy ways to incentivize their players, but we haven’t seen too many people do this. And it seems to work perfectly for smaller, cool things that provide a ‘nudge’ to players. We got Mark to explain more:

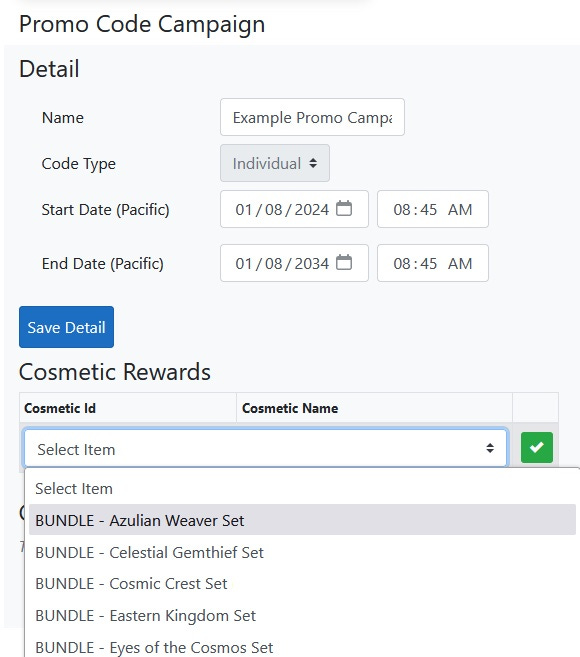

“In-game, we have a code redemption system the player can open while playing. We have a way for people on the team to generate codes - either unique one-time use codes like Steam keys, or alternatively ‘global’ keys that can be re-used any number of times, once per player.

We use the one-time codes for things like newsletter promos and the global codes for things like ‘bonus for joining our Discord’ - where we don't have a real issue if that code is widely known.” Here’s a pic of the interface at work:

In addition to newsletters and Discord incentives, Mark notes that the promos extended a bit further: “We’ve… done some influencer-specific cosmetics with Wanderbot, Retromation & FightinCowboy that had redemption codes, and have used codes for various customer service scenarios as well.”

Mark & team often build smart player-centric tools. We covered their approach to the Monster Train demo back in 2020, where they had “had a UI element on screen… that said ‘press F8 to send us feedback.’ It opened a simple UI to type in your thoughts and automatically captured a screenshot, the player's log file, and the player's save game.” (This is also very slick.)

And Shiny Shoe’s Cooke does say this in-game code redemption system has “proven more handy than I expected initially”. That’s a sign that it might be one of those small things that enlivens your community in positive ways - if you have time to make it!

The game discovery news round-up…

Finishing off for the week - unless you’re a smartie GameDiscoverCo Plus subscriber, of course, in which case you’ll still get a newsletter from us on Friday - here’s news:

Xbox’s first post-Activision acquisition results showed a 49% increase in revenue, with MS CEO Satya Nadella saying “we now have over 200 million monthly active users” across the combined game division. Those who deconstructed the data like Derek Strickland (above) show ‘sans Activision’ Q2 up YoY, behind only FY2020 & 2021, but Xbox hardware revenue only up 3% YoY, despite some big $$ discounts.

There’s reports that Apple’s Vision Pro headset sold around 200,000 units since pre-orders started on January 19th. (We’re not sure what we were expecting?) And The Verge’s review of Vision Pro does a good job of breaking down its “sounds amazing, and sometimes it is… but also represents a series of really big tradeoffs” vibes.

A longform Ben Thompson interview with Netflix co-CEO Greg Peters has a section on video games, with Peters saying: “We’ve done almost entirely licensing so far, and that’s because… it literally takes two, three, four years, and sometimes longer [to build games].” Also notable: “Until Grand Theft Auto, we hadn’t seen what I would say as a measurable acquisition benefit. We saw it there - we saw players who came clearly just to play GTA and have that benefit… we’ll see how they retain.”

Well the PlayStation 5 sure sold well in Japan in 2023 - 2.6 million units, “the biggest year in [Japanese] hardware sales for a PlayStation system since the PSP in 2010.” Though as we’ve discussed, given the slow physical software sales, we think a lot of those PS5s are going straight to China, to buy digital games from ‘Hong Kong’.

Microlinks: Genshin Impact got to $5 billion gross after 40 weeks on mobile, quicker than any other iOS/Android game; the acclaimed Gamecraft podcast switches from ‘historical game biz stuff’ to ‘new game biz stuff’ for Season 2; how Rovio added a web store with in-app registrations to Angry Birds Friends.

Analyst company Newzoo has a ‘what’s up in 2024?’ free report up (summary!), including “Growth in subscribers to subscription services will slow down… companies are returning to the development of Premium (buy-to-play) games… mobile developers are moving towards developing for PC and consoles.”

Roblox is trying to kickstart its Unity Asset Store-like economy for those making Roblox games by renaming the Creator Marketplace to the Creator Store, and even more importantly, an imminent “rollout of our USD price-based Creator Store” which will “enable you to keep 100 percent of the proceeds from the sale of your plugins and models sold in Studio or Creator Hub - minus sales tax and payment processing fees.”

Future Friends Games’ Thomas Reisenegger has been experimenting with Instagram’s Twitter competitor Threads, and is pleasantly surprised: “Posts seem to get decent organic traction. Not hundreds of thousands of likes like on viral TikToks but up to a few hundred or thousand likes for good posts.” Some good tips within…

All three PlayStation Plus Essential titles for February 2024 have been confirmed, with Square Enix getting a head start on players for its Splatoon-like Foamstars by including it at launch. (Also available for PS+ subs: third-person shooter/Tony Hawk mashup Rollerdrome and alt.history ARPG Steelrising.)

Microlinks: the game engines used in Global Game Jam 2024 saw use of Godot up, and Unity down; why Steam wishlists still matter, even if they don’t impact store visiblity directly; a great ‘how to do live-ops schedules & events’ deconstruction for the top-grossing mobile game Clockmaker.

Finally, and echoing our lead story in ‘explaining Chinese trends to the West’, the People Make Games crew has done a wonderful job of ‘video explaining’ Jubensha, the Chinese murder-mystery storytelling craze.

It’s described as a "mix of Cluedo, Werewolf and LARP" - and its popularity has contributed to social deduction video games we’ve featured like Goose Goose Duck & Dread Hunger going mega-viral in China:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Hi Simon. Great article. Arcus Key has been providing these services to Western publishers and self publishing devs for almost 4 years now. Clients include Team17, Nacon & Gamigo to mention but a few. Shout if you would like to learn more about promoting Western games in China without an ISBN license. Dave Clark