In-depth: inside China's 'hidden' game console market

Also: why can't you discover old games? And lots of news...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we continue to drift into summer madness, aka summertime, welcome back to the GameDiscoverCo newsletter. Of course we have the SPF 50 for your cerebral cortex, so that only the most filtered rays of game discovery sunlight reach your brain stem!

This time out, we’re kicking off by looking at an interesting phenomenon you may know from the PC market, but will be less accustomed to on console - the hidden market of ‘unofficial’ Chinese players, possibly bigger than you think…

[On this fine Monday, support us via a GameDiscoverCo Plus paid subscription. You’ll get our an extra data-rich weekly PC/console game trend analysis newsletter, an interactive Steam ‘Hype’ chart back-end, two ‘how to’ eBooks, a member-only Discord & more. Sign up today.]

China & game consoles: a ‘secret’ player base?

So, if you release a game on PC via Steam, having a Chinese translation is definitely worth it - despite Steam International being ‘unofficial’ in that country. (Why? China’s population, at more than 1.4 billion, is more than 4x that of the U.S., and more than 20x that of the United Kingdom - and craves uncensored content.)

But much less discussed is the extent to which current game consoles (PlayStation, Xbox, and Switch) make their way to mainland China after having been purchased in other territories (Japan and elsewhere), and the large ‘hidden’ market of console players there.

For example, game industry consultant Serkan Toto recently Tweeted this about the console buyers in famed Japanese electronics destination Akihabara:

Of course, the PlayStation 4/5, Xbox and Switch do have official presence in China. But they start out with mainland China-locked hardware*, featuring extremely limited, government-vetted game availability. (*Though PlayStation and Xbox often have ‘loopholes’ that can reset the console to international regions.) The real market? Way bigger.

So how can we quantify this? Fortunately, the folks at Asia/MENA game market intelligence firm Niko Partners just released a China Console Game forecast & report which tries to do just that, by surveying players & the market. Top-level points?

Console games are a multi-billion dollar market in China: Niko is suggesting that China’s console market generated $2.3 billion in 2022 (up 8% YoY) from 16.7 million console gamers (up 8% YoY), even stymied by hardware shortages. This includes “revenue generated from hardware and software via both legal sales and the grey market.”

Nintendo and PlayStation dominate console in China: Niko’s Daniel Ahmad reveals: “The Nintendo Switch is the market leader in terms of cumulative unit sales, [but] PlayStation 5 cumulative sales (legal and grey) are over 1.4 million in China.” With many more millions of PS4s also out there. (Xbox is a factor, but much less of one.)

Most Chinese players buy games outside of ‘in-country’ digital stores: Niko says: “78.4% of console software and services revenue in 2022 was generated via the grey market”, though hardware revenue is “more evenly split”. (Bearing in mind you can reconfigure many China-bought consoles to play less locked-down software.)

As for the kind of games Chinese PlayStation gamers play? Niko’s survey of actual players reveals: “Console exclusive games, predominantly first party titles, are most popular on PlayStation. Titles in the God of War, The Last of Us and Gran Turismo franchise were most played over the past 3 months.”

However, there’s a lot of interest in the F2P console ‘big guys’ too, including at least one domestically-created game: “Free to play titles such as Genshin Impact, Destiny 2 and Apex Legends are popular on PlayStation, with the first two being the most played titles by average weekly hours.”

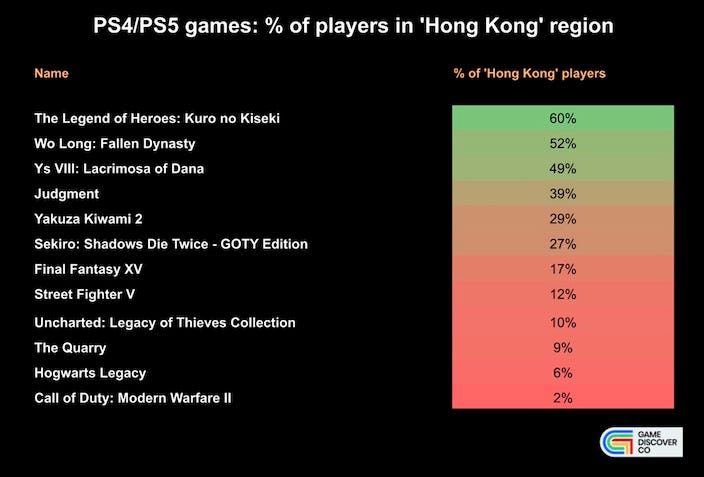

But how about the console games with the largest percentage of players in China? For another data point, GameDiscoverCo analyzed public profile data for many thousands of PlayStation 4 and PlayStation 5 gamers.

We’ve spotted that for some Asian-centric games, a ‘Hong Kong’ PSN player account makes up a big player base. (It’s the non-mainland China territory setting that allows you to play with a complete, non-government censored set of PlayStation games.)

So - here’s a select set of PlayStation games, with the percentage of players with their PSN profile set to Hong Kong:

We can’t prove that all of these ‘Hong Kong’ players live in mainland China, of course. But some of the stats are eye-opening: for example, 52% of Wo Long’s estimated 1.5 million PlayStation players are using ‘Hong Kong’ as their location.

This makes sense, though. Although developed by Japanese companies (Team Ninja & Koei Tecmo), the game is “set during a fictionalized version of the fall of the Han Dynasty”, so is in the kind of Chinese mythology setting which is catnip in China. (Even on Steam, the game has more than 75% Chinese language reviews.)

And the popularity of the Yakuza / Judgment / Like A Dragon series in China shown here probably helps explain why Chinese game giant NetEase recently established a whole new Tokyo-based studio around its ex-Sega creator, Toshihiro Nagoshi.

If nothing else, we think this data should make console devs and publishers think carefully about Chinese localization for your game. (And maybe about upside for tailoring certain types of games for this ‘hidden’ market?)

[Once again, thanks to Niko Partners for providing data for this write-up. They’re 20+ years old now (wow!), and a super-useful source for game data beyond ‘normal’ Western markets...]

Historical game discovery & relying on platforms?

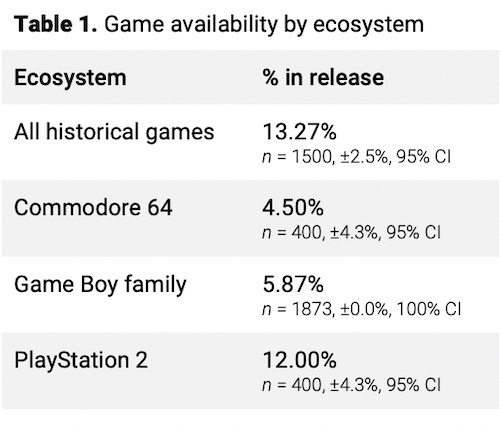

Freshly released today is a study by the Video Game History Foundation (disclaimer: I’m a board member!) & the Software Preservation Network on the commercial availability of classic video games, and “the results are bleak. 87% of classic video games released in the United States” are unavailable to buy right now.

The full study is available on Zenodo, and there’s also an ‘explainer’ by survey author Phil Salvador, with a lot of sensible opinions. And yes, this is a data-centric broadside against U.S. DMCA exemptions, which are arguably overly broad, since:

“Libraries and archives can digitally preserve, but not digitally share video games, and can provide on-premises access only. Libraries and archives are allowed to digitally share other media types, such as books, film, and audio, and are not restricted to on-premises access.”

Getting deeper into the data, there are some takeaways for us, though. (Besides y’all telling the Entertainment Software Association, who represents the game industry in the DMCA discussions, to be more understanding of game archiving.)

In particular, the research looked at three historic platforms - the Commodore 64, the Game Boy family, and the PlayStation 2. Here’s the ‘you can play this legally now’ score:

But we wanted to highlight the ephemeral nature of platforms themselves. The VGHF report discusses how “digital marketplace volatility threatens the availability of game reissues”, and points out a few concrete examples:

“When digital game stores and services shut down, that means games will go out of print. The 3DS and Wii U eShop closures are big examples. An estimated 1,000 unique games fell out of release when those stores closed. Microsoft and Sony have suggested that shutdowns are also coming for the Xbox 360 Marketplace and PlayStation 3 and Vita stores, respectively.

But it’s not just that game stores are closing. We also found that classic games are sometimes only re-released for a single platform, meaning if that platform goes down, those classic games will disappear too.

The worst offender we spotted is the Commodore 64: Most classic Commodore 64 games are only available through a single service, Antstream Arcade. If Antstream shut down, the availability rate for Commodore 64 games would plummet to an apocalyptically low 0.75%.”

As game platforms - digital or physical - become outdated or non-commercial, you suddenly get commercial unavailability. This is complicated by the fact that ‘remasters’ of classic games (Res Evil 4, TLoU) are become increasingly popular.

Phil admits that keeping ‘every’ game available to buy in its original form isn’t necessarily a problem that the game biz is good at solving itself: “Like any media business, the game industry has its own commercial interests, and we can’t expect them to make history their top priority and preserve every single video game.”

But what we can do is measure and understand this gap, fund preservation attempts, & maybe let official libraries and archives find some way to legally share ‘out of print’ games and ephemera, rather than reflexively labeling all attempts as ‘piracy’. Right?

The game discovery news round-up..

Finishing things up for this newsletter, let’s take a repeated speedwalk around the track that is ‘game platform & discovery news’ - and no lifting those heels:

Remember when Xbox took away its ‘first month for $1’ Game Pass trial offer in March? Well, it’s back: “The introductory offer lets players get their first month of Xbox Game Pass Ultimate or PC Game Pass for $1 / £1 (the deal is not available for Game Pass for console).” This is just after subscription prices got raised.

Apparently, Meta has been in talks with Tencent about getting the Quest VR headset distributed in China somehow. The WSJ report notes that “the effort faces challenges, in part because Chinese executives worry that [Meta CEO] Zuckerberg isn’t seen as friendly to China”, given the ban on Facebook there.

June 2023’s top-grossing mobile games worldwide? Tencent’s Honor Of Kings tops charts with $104.9m, per Appmagic, but Mihoyo’s Honkai: Star Rail is #2 with $89.9m - a most impressive ‘long tail’ on its recent release. (The month’s top worldwide downloads are headed by perennials Subway Surfers & Roblox.)

Twitch appears to be adding “a mobile-based clip discovery experience that will pull in clips likely to encourage people to watch live [Twitch] content.” Experiments launch soon & a full launch in Autumn. (Spotted via the latest ‘Today Off Stream’ newsletter.)

The folks at Metaverse Marcom did an interesting post about brand integrations into individual Roblox games, looking at Lego City embedding in Livetopia, Netflix’s Nimona in Sharkbite 2, and Bebe Rexha in Warner Music Group’s own Harmony Hills - including metrics.

TweakTown’s Derek Strickland crunches numbers to see the ‘big 3’ console companies by revenue (above pic) & profit from April 2022 to March 2023, as he fiddles some stats around: “PlayStation - $26.791 billion ($1.846 bn op profit); Microsoft/Xbox - $15.43 billion (unknown); Nintendo - $12.042 billion ($3.792 bn op profit).” (Remember that Xbox includes Game Pass & Minecraft revenues.)

Anti-piracy firm Denuvo, the subject of complaints that its tech degrades performance, told Ars Technica that it’s “working on a program that would provide two nearly identical versions of a game to trusted media outlets: one with Denuvo protection and one without.” The firm will also be “leaning more and more toward things like detecting and preventing cheating” in the future.

Not content with Steam being the only ‘demo showcase’ platform in town, Xbox is rolling out its ID@Xbox Demo Fest starting July 11th. Apparently: “Running until July 17, you’ll be able to experience over 40 game demos on your Xbox console”, including Demonschool, Lies Of P, and more.

ICYMI, U.S. physical game retail firm GameStop has announced a new ‘distribution system for web3 games’ called GameStop Playr, which “includes game hosting, tournament management, game discovery pages and social capabilities.” (Unfortunately, this is super blockchain-y, as seen by another hookup with Telos.)

Esoteric media links: how TikTok influencers became an essential restaurant discovery method in New York; Amazon’s ebook charts (on Kindle Unlimited) are full of AI-generated spam; former Amazon exec Roy Price on original IP discovery opportunities for sub <$30m box office movies.

Finally, ‘don’t worry about the IP, we’ll just borrow lots of good ideas’ Chinese shopping store Temu seems to be trending in the U.S. recently. So we were amused to note that one of its current offers to us is ‘Horror Game Red Spider Train Assembly Toy’:

Can’t imagine where they got this concept from! (OK, OK, it’s clearly indie horror game sensation Choo Choo Charles, and we’re not sure if they should be flattered...)

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

"But what we can do is measure and understand this gap, fund preservation attempts, & maybe let official libraries and archives find some way to legally share ‘out of print’ games and ephemera, rather than reflexively labeling all attempts as ‘piracy’. Right?"

Yes, thanks for mentioning old games! This is spot-on. I've long bemoaned how the ESA started targeting abandonware game sites. I sometimes wonder if the industry has any interest in preserving all but the most fashionable of gaming history?

Thanks for flagging the problem of disappearing games. I wrote about some potential legal solutions to the problem here: https://www.bu.edu/bulawreview/files/2021/10/LEMLEY.pdf