Is there a ‘best’ month to release your game in?

Also: a popular hole-y game, and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to *checks calendar* the 142nd week of 2025, according to our mental, possibly inaccurate, tally. But we all soldier on - and we’re extra excited to present you a lot of bar graphs, some of them possibly intelligible, in today’s GDCo newsletter!

Before we get started, we’d like all of you to read Doug Shapiro on defining ‘quality’ in media. It’s written from more of a TV/film perspective, but makes vital points for games, too. The key: “A lot of consumers are changing how they define quality in media… for executives at incumbent media companies, it’s a big blind spot and a big problem.” Yes!

[HEADS UP: we’d appreciate support for GameDiscoverCo by subscribing to GDCo Plus. You get basic access to our ‘core’ GDCo Plus Steam data back-end, full access to our second weekly newsletter, a link to our peer Discord, eight game discovery eBooks & lots more.]

GameDiscoNews: Civ VII & Kingdom Come II loom..

Let’s begin the beguine, however, with a bunch of game discovery and platform news we’ve lasso-ed together with a lariat since the end of last week:

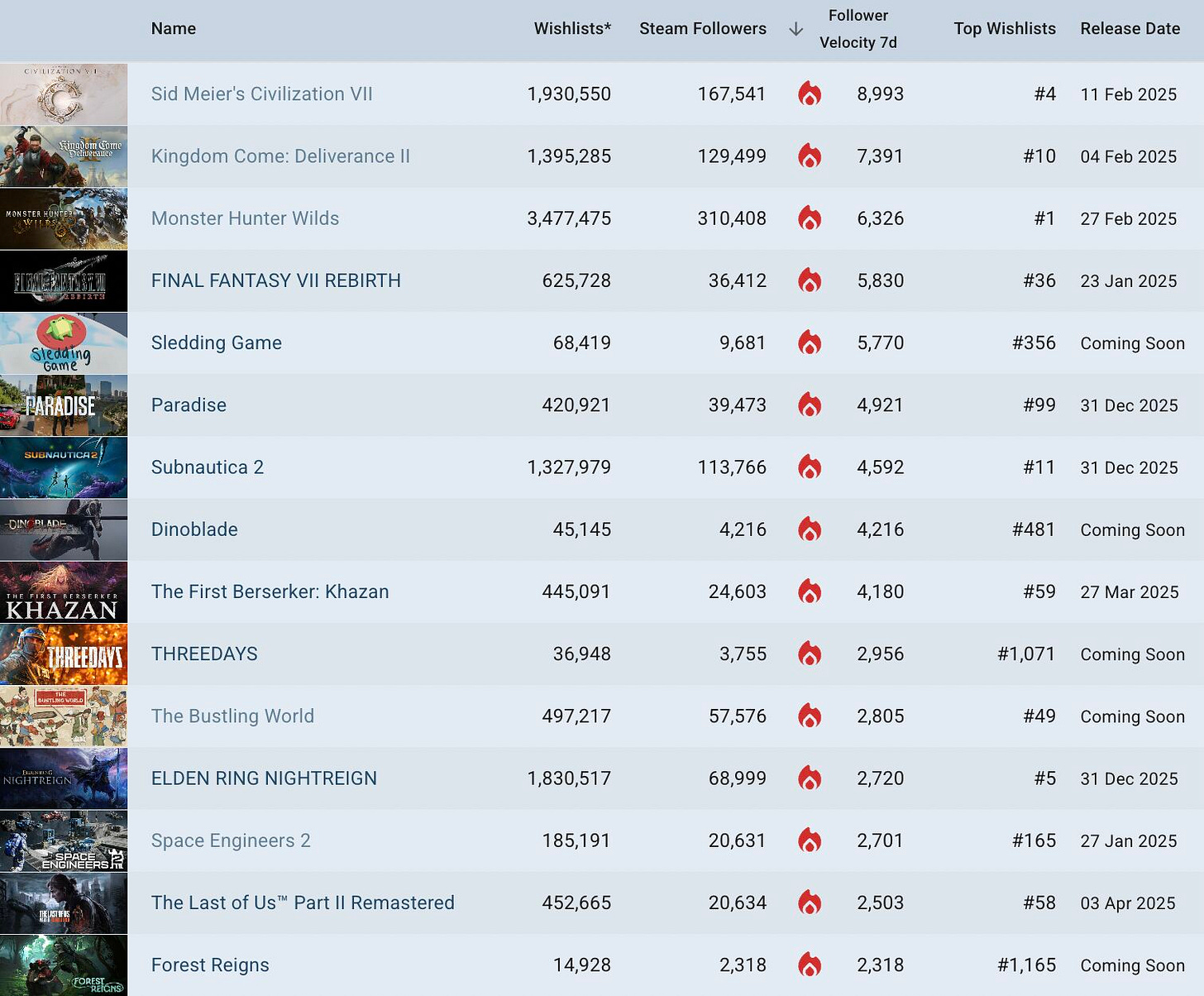

Starting out with GDCo’s weekly countdown of ‘trending’ unreleased Steam games (above), we can see Sid Meier's Civilization VII is still #1, and Kingdom Come: Deliverance II is #2, as both approach release. And chill co-op Sledding Game (#5) is a Webfishing-y experience that people like buying (inexpensively!) nowadays.

Newly announced Steam games? Dinoblade (#8) is a 'dinosaurs with swords' (?!) Sekiro-like with virality on YouTube, THREEDAYS (#10) is "a tactical shooter inspired by real events of the war in Ukraine", and Forest Reigns (#15) is "an emergent FPS set in post-apocalyptic Paris overrun by an evolving forest and its deadly creatures.”

A French YouTuber has been tracking Quest achievements for Batman: Arkham Shadow - bundled with Meta Quest 3 and 3S - and the first achievement, “which typically happens within the first 5 to 10 minutes of gameplay” was unlocked by <400k players before the holidays, but >800k by Jan. 7th. Decent scaling, then.

Can we sum up TikTok & the U.S. easily? Not really, but it was banned and then unbanned at the weekend, via potentially dubious Trump executive order, while a bunch of Nuverse and Moonton-published mobile games also got removed, including Marvel Snap, tho the latter is now back and vowing to shift publishers.

Indie dev Tomas Sala (The Falconeer Chronicles) has an opinion: “Improving the [Steam] developer follower system into something that allows devs to establish a usable following across games and rewards support and community is 100% the solution to the discoverability problem.” (Maybe not the solution, but read the thread…)

Is the Switch 2 using ‘Hall effect’ controllers to prevent the ‘Joy-Con drift’ issues that have plagued the Switch? This VGC report notes that a leaker who got some other stuff right claims this - btw: “Hall effect sticks (named after US physicist Edwin Hall) use magnets and electrical conductors to measure the position of the stick.”

The gacha-heavy Genshin Impact settled with the U.S. FTC for $20m for breaking COPPA rules around marketing the game to kids, but also claims it “deceived players about the odds of winning particular sought-after “five-star” loot box prizes and how much it would cost to open loot boxes to win the prizes.” (The loot box ‘fixes’ are all-ages: will this activist FTC approach continue in the new admin?)

How do you make good, catchy game trailers? Satisfactory creators Coffee Stain Studios just uploaded a whole video about their trailer process, noting that “some trailers are there to build hype” for players who’ve never seen the game before, and others are to re-engage existing users. Lots of good thoughts in here.

The latest announced Xbox Game Pass debuts include some bigger-budget titles with Day 1 GP deals - Sniper Elite: Resistance, and Eternal Strands - as well as Citizen Sleeper 2, and a set of games going into Game Pass Standard (the base subscription tier), including Case Of The Golden Idol and Tchia.

Love this clear-eyed HowToMarketAGame post on the difference between Steam algorithm effects and the ‘human algorithm’, i.e. player behavior. Example: solely launching a Steam page gives you no explicit algo boost. But if players come in and wishlist, that’s a human effect that might lead to some Steam upside.

Finally, a minor correction from Friday’s Switch 2 newsletter: we meant to say that Feb. 4th (02/04 in the U.S.) got confused with April 2nd (04/02 in the U.S.) by Switch 2 leakers due to the Euro/US/Japan date format diffs - not Feb. 2nd and April 4th. (Look, we’re British but live in America, we’re date-distracted, OK?)

Is there a ‘best’ month to release your game in?

Sticking on dates: a question that we get asked about often, and is an interesting one - does the month of release have a substantive positive or negative effect on your PC and console game? So first, we’ll tell you what we reflexively say. And then - analysis!

GDCo’s default response on release window nowadays is as follows: “Don’t release during a Steam quarterly mega-sale for visibility reasons. Don’t release the same week as a major competitor in the same subgenre for ‘influencer reach’ reasons. And maybe Q4’s a bit dicey, possibly, maybe. Otherwise, have at it!”

And look - the original reason for release windows being vital for games - retail ordering and space for boxed games - is increasingly irrelevant. Heck, if you asked Matej Lancaric and ‘paid UA on mobile games’ friends about the best month to release in, I’m pretty sure they would laugh at you. (Ad networks don’t sleep.)

We know why release date is often obsessed about though. You can’t control your game’s popularity, but you certainly can control when it comes out. And it doesn’t NOT matter. So we’ve done some research on this before, and we went and took another look.

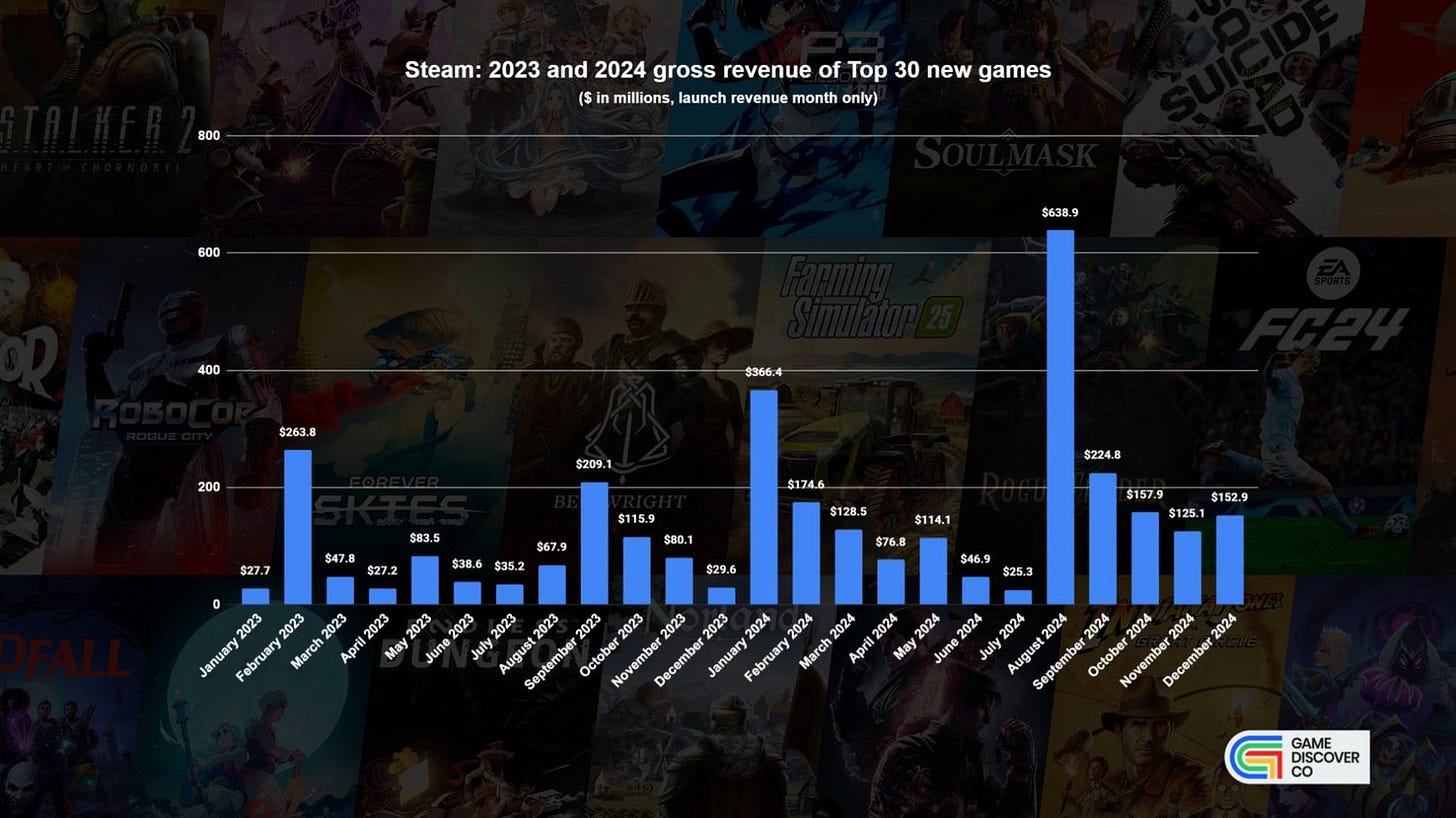

We started by examining the launch month gross revenue of the Top 30 new games on Steam for each month in 2023 and 2024. And we pulled results which are, to quote a popular kids book series, ‘too bumpy’:

When you have Black Myth: Wukong wrecking August 2024 with its hundreds of millions of dollars gross, this view will have limited utility. So - how about finding some way to strip things back to an underlying Geiger counter-style ‘$ radiation level’?

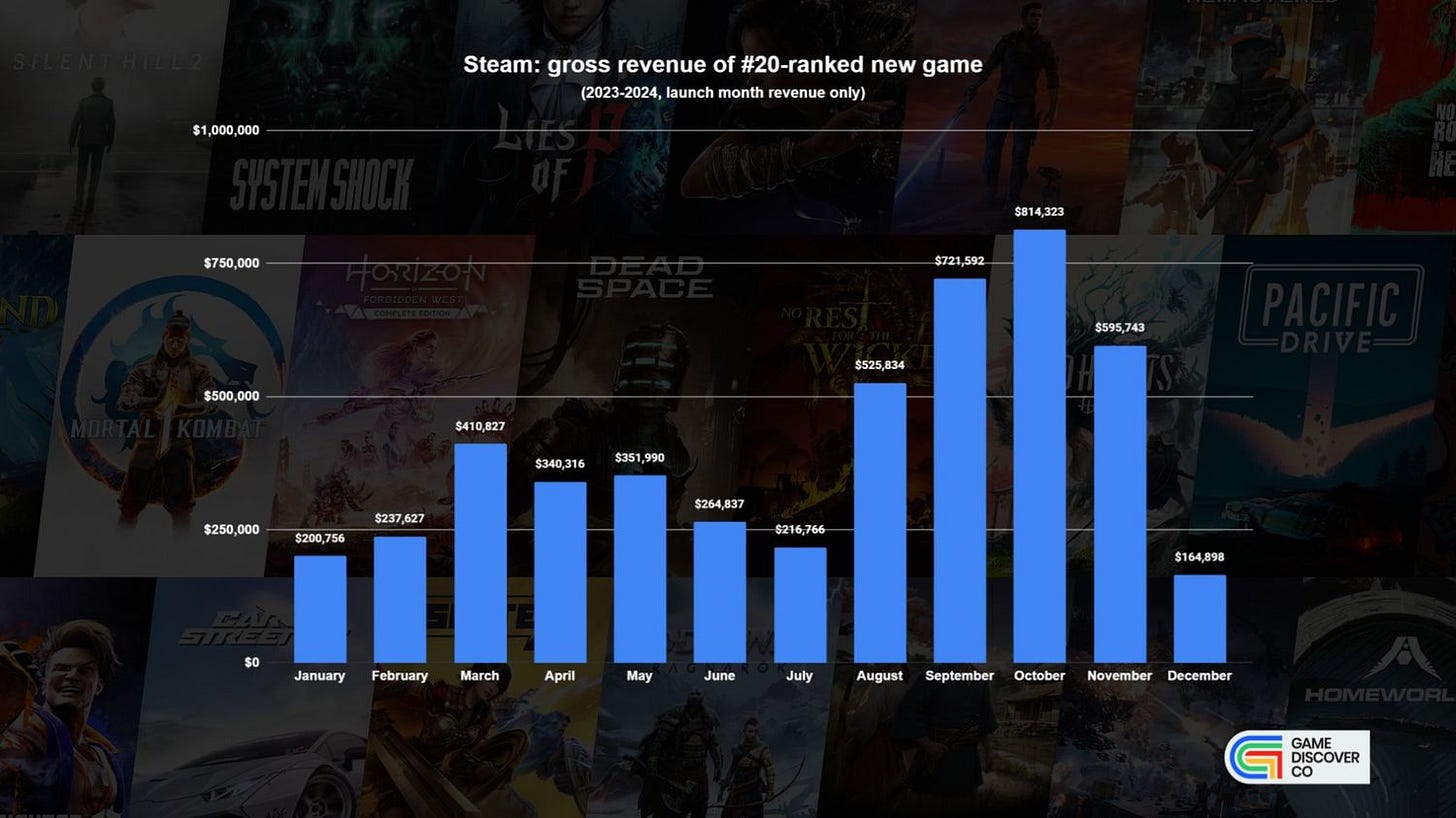

The solution we devised for this was ‘what’s the gross launch month revenue of the #20-ranked new game?’, averaging the two figures for 2023 and 2024 on Steam. And this gave a pretty useful result for how ‘busy’ a particular month is on Steam:

Yup, we’d like to laboriously frame and lavish attention on this graph, since it shows:

December ($165k) and January ($201k) are the ‘quietest’ months - but remember that Steam sales rule out a bunch of December (and a bit of Jan).

The ‘Spring surge’ tops out in March ($411k) - and dwindles down to a mid-year low in July ($217k), when a lot of holidays are happening.

The Autumn/Fall season is by far the busiest: we see September ($722k), October ($814k), and November ($596k) as the three largest ‘#20 ranked revenue’ months.

So this is what is happening in the market. But this simply tells us when publishers and devs have chosen to release games, and the PC market’s reaction to them. To see more, we would need to look at pre-release interest in games.

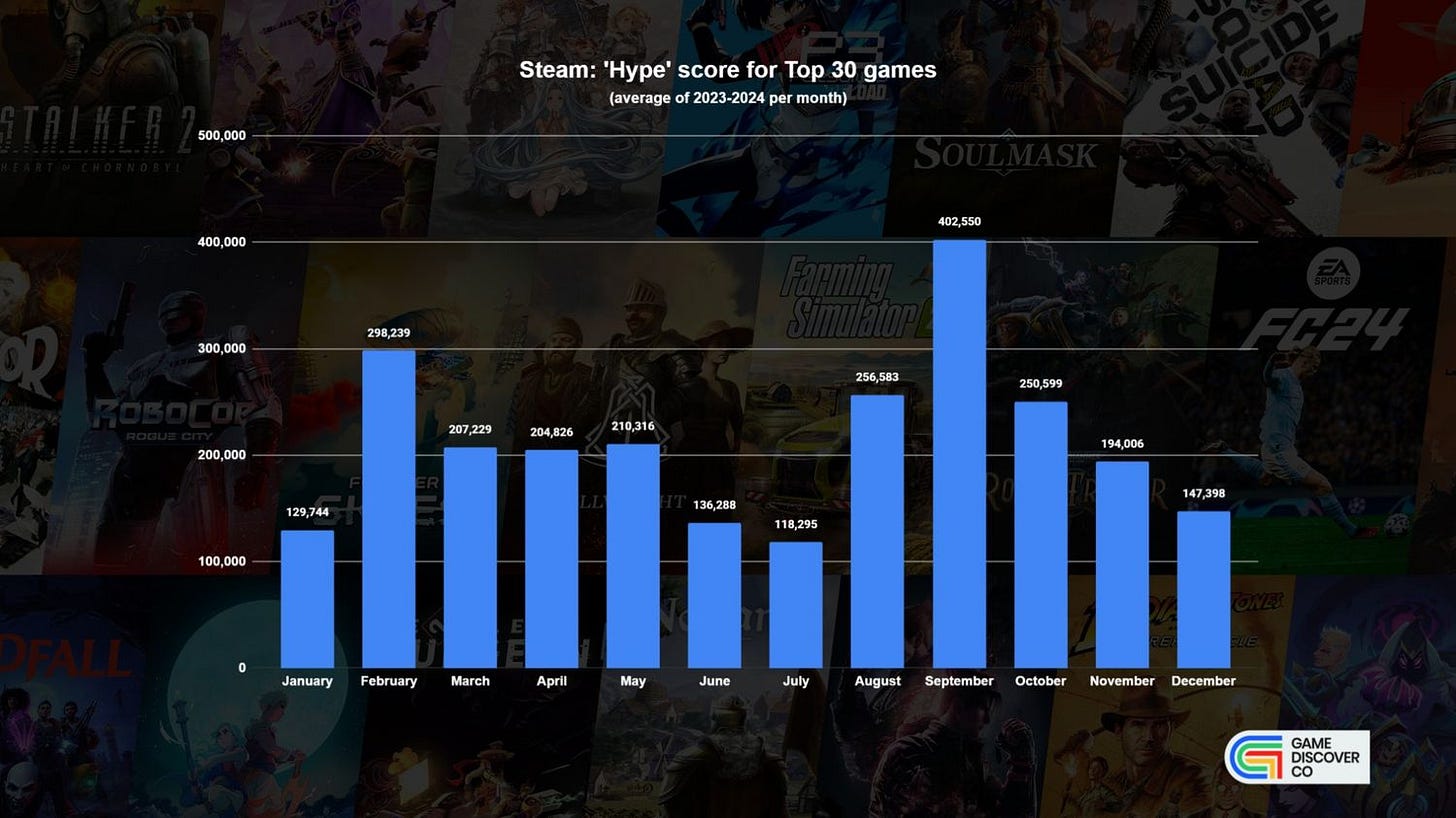

And we have GameDiscoverCo’s ‘Hype score’ at release - an amalgam of Steam followers, wishlist ranking, forum traffic - to do that with. Here’s what we see for the Top 30 games (by Hype score) releasing in a particular month in 2023-2024:

So again, we think this is an interesting alternate view with a somewhat - but not completely - similar graph shape. It shows that:

You are competing against the least ‘Hyped’ games if you launch in January, June or July - makes sense, since these are less desired timings.

A lot of the rest of H1 is similar, except a spike in February: quite a lot of ‘delayed past Xmas’ giant games tend to launch there nowadays, huh?

Q4 is busy, but September is actually the biggest month: we were a little surprised, but a lot of publishers like pre-empting Q4 with their bigger games.

Finally - now we have the two, we can try to do a comparison of ‘does Hype score of the top games in correlate to new game success more in specific months?’ And this is where it gets tricky. You can’t really compare the two above graphs, because it’s showing ‘Geiger counter’ #20 rev compared to the most-Hyped games - not ‘apples to apples’.

So we tried removing extreme outliers (both high Hype and high revenue!) to ditch the Black Myth-s, and comparing Hype and results. And weirdly, it showed February as one of the ‘worst’ conversion months ($176 per Hype score point), and September-November as some of the best ($450-$550 per Hype score point).

We think that’s ‘cos some AAA (Q4!) titles underperform on Hype but do great on revenue, due to casual buyers already bought into those franchises. (Look at the Hype score of these titles, pre-release, if you don’t believe us.) So we dug deeper. And having pored over multiple further views, here’s our view: there’s simply not a generalized ‘best practice’ to be explained here.

Thus, as much as we have a conclusion, it’s this: your game lives in its own discovery bubble. If you’d like to launch in a quieter or busier month, it’s up to you. The busiest months may make it trickier to fight for influencer or press attention. (Though if you’re pushing alpha or demo access to streamers early, that will matter way less.)

But look - Omori launched on Christmas Day and has sold nearly a million copies. It’s really the virality and popularity of your game - way less controllable - that matters way more than your (more controllable!) release date. So please embrace uncertainty…

Yes, A Game About Digging A Hole went viral…

You know how certain ideas are ‘conceptually pleasing’ to people, and the high level of hook means everyone jumps on them? (At least, from an enthusiasm view, which is half the battle nowadays…)

Well, Rokaplay’s Adrian Kaiser has revealed the impressively viral results of the launch campaign for the solo-dev game A Game About Digging A Hole, a side project from one of the Solarpunk devs which “combined the scrapped voxel technology from Solarpunk with the Flash game Motherload.”

Kaiser noted that the game firstly launched during the German Indie Showcase event, to decent but not giant effect. But what helped the game go viral? A carefully re-edited trailer playing up the hook, and posted on short and longform video sites.

The total? 82,000 Steam wishlists in just four weeks, with 5 million views on this TikTok, 14.5 million on this Instagram reel, and 2.2 million on this YouTube Short. (The IGN YouTube channel version of the trailer has >100,000 views, also.)

But why did it work so well? Adrian notes, “as my good friend Thomas Reisenegger says”, the following points kicked interest into high gear:

Super strong and clear pitch & hook: “digging a hole to find a secret.”

Short, kick-ass trailer: and “[social media] posts look natural (short, no links).”

Luck!

Adrian says in the LinkedIn post: “With this post, I want to encourage every dev that they don't need to develop a Triple-A game to succeed, you can create a viral hit after just 3-9 weeks of development, as long as you have the right idea.”

Which is basically true - though the game clearly benefited from rejected Solarpunk tech and (we think?) some of that upcoming game’s art assets. But still - what’s super smart about Hole is that there’s resource management ‘topping’, squishy voxel digging - and a mysterious hinted-at twist - to add to the killer ‘everybody loves to make holes’ initial hook.

So it does feel like there could be some meat to the bones here - another of these bite-sized, appropriately priced games that can do well on Steam in 2025. We’ll see how player expectations compare to the reality of hole-digging on Feb 7th, hmmm?

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]