Clair Obscur & Drive Beyond Horizons: subgenre + execution = hit!

We look at one high and one lower-profile hit, as well as lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Since time immemorial, we’ve been honoring the game discovery gods with delicious offerings. So, as we sacrifice another Steam Deck (mm, silicon innards?) on the exalted altar of the Discovery Queue, let’s do more scrying into the gamediscofuture, shall we?

Before we start, we have amazing news: ‘Hollow Knight: Silksong will be playable in September 2025!’ Wait, we didn’t read all of the headline. It ends ‘…at an Australian museum’?! So yes, ACMI’s Game Worlds exhibit will include it, but we’re yet to learn if everyone else can play the Metroidvania before then. (Cosmic peace depends on it.)

[MANDATORY DISCLOSURE: signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, data & lots more. And companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 55+ have.]

Discovery news: ARC Raiders goes hard in alpha..

As everyone stares at the new Grand Theft Auto VI trailer, it’s another week, another set of notable game platform & discovery news, and it goes a little something like this:

GameDiscoverCo's countdown of 'trending' unreleased Steam games by 7-day follower velocity from April 28th to May 5th (above), saw Embark's multiplayer extraction shooter ARC Raiders surging to #1, thx to a well-received 'tech test'. Next Soulslike Wuchang: Fallen Feathers hit #2 due to pre-orders & a new trailer.

Also surging to #3? 'Papers, Please x zombie apocalypse' mashup Quarantine Zone: The Last Check, whose alpha hit big with influencers. Otherwise, we see ‘the usual suspects’ (Dune: Awakening, Subnautica 2, Rematch) & a Steam version (#9) for 'horse racing but with girls' mobile megahit Umamusume: Pretty Derby.

Epic’s Tim Sweeney told GameFile’s Stephen Totilo that he’d like Epic Games Store on console, but “console economies are increasingly open”, e.g. crosspurchasing in Fortnite. Thus: “I think the world would be a better place if consoles allowed for competing stores, but we haven't ever seen that as an antitrust dispute-worthy issue.”

In ‘U.S. tariffs on services’ news - relevant to games, folks - President Trump announced a 100% tariff on ‘non-U.S. movies’ but later softened his tone to ‘we’ll talk to the movie biz more.’ (We talked about how working out the ‘country of origin’ of games for tariffs is tricky - also an issue for movies, beyond the actors.)

When you have a money hat, you can make your own biz decisions. Hence: Larian’s Swen Vincke on paid DLC: “It’s boring…. we try to be in the DLC business, this was talked about with Baldur’s Gate 3, but just, [there’s] no passion.” So they’re making new games, instead! (Can we have a money hat too?)

More Steamworks back-end mini-tweaks from Valve? An eagle-eyed GDCo premium Discord subscriber (Patrick Seibert!) spotted that, as a dev: “You can now see the history of [your own Steam] store page updates” (useful!), and “You can now link and unlink your dev homepage directly from the basic info tab in edit store page.”

Nintendo got ‘proper mad’ at third-party peripheral maker Genki for showing their own mockup of Switch 2 before the console announce, and is suing it in the U.S. for trademark infringement & illicitly getting access to Switch 2 info early. (Genki says they’re continuing as normal and will show products at PAX East.)

As part of Chandana Ekanayake’s useful ‘lessons from running a game studio’ thread, we dug this discovery takeaway: “Understand genre expectations from players and find ways to subvert them or communicate clearly of what to expect from your game. Set low expectations and deliver something much more.”

Some interesting analysis on ‘indie games’ and streamers in Q1 of 2025 here - for example: “Only 4 games brought in viewership from the Top 100 streamers despite having no sponsors among that group: R.E.P.O., Blue Prince, A Game About Digging A Hole, and Rift of the Necrodancer.”

Fortnite/Roblox news: Fornite’s UEFN platform has just added real-time physics support, which should really help new Fortnite ‘island’ genres expand; the latest Roblox UGC avatar/item trends include animation packs, a ‘no head’ look, and versions of TikTok memes (ahem, Tung Tung Tung Sahur.)

Microlinks: GameStop Canada’s 185 physical stores have been sold and are retro-branding to EB Games Canada; Sony now wholly owns its PlayStation hardware business in China; the newest PC/Xbox Game Pass additions include Doom: The Dark Ages, Revenge of the Savage Planet, Dragonball Xenoverse 2.

Clair Obscur: Expedition 33: subgenre + execution

We thought we’d lead today’s newsletter with two games - one likely over-discussed, one certainly under-discussed - which have launched and succeeded in the last few weeks. We’re poking around under the hood a bit to ask - why, and what can we learn?

So firstly, yes, Sandfall & Kepler’s ‘Western JRPG’ Clair Obscur: Expedition 33 revealed 2 million copies sold in its first 12 days. BTW, GameDiscoverCo estimates the ‘sold copies’ split at over 60% Steam, about 30% PlayStation, and the rest on Xbox. (Clair Obscur - which was a Game Pass Day 1 title - has had >1m players there too!)

That’s a palpable hit, even for a game with ~100k Steam pre-orders. Its first week Steam sales were 6.5x our pre-release estimates, with scaling continuing from there. So instead of a ‘predicted’ 350k+ units by now, it’s >2 million. But whyyyyy? Thoughts:

Clair Obscur picked a counter-intuitive & undersupplied subgenre: there’s been few AA+ turn-based RPGs made by Western devs, except a handful of retro titles like Sea Of Stars. Why? Cos they’re plodding, something Clair Obscur fixed by clever use of real-time QTEs & the overworld navigating closer to a Souls-like.

Its ‘look and feel’ are closer to the Western mainstream than Asian competitors: there’s a whole thread on the ResetEra messageboard about comp titles like Atlus’Metaphor: ReFantazio being a turn-off to those who can’t stomach the ‘anime aesthetic’. Lots of people can - but we do think CO’s look helps in the West.

The game ‘threaded the needle’ for global appeal, esp. in China: having said the above, GDCo’s data suggests 29% of Clair Obscur’s ownership on Steam is in China, followed by 18.5% in the U.S., 8% in its native France (a big outperform!), with 10 countries (including Japan) at >2% ownership.

To further contextualize Clair Obscur’s place in the market, we looked at ‘high Affinity*’ games for players of it. And yes, Metaphor: ReFantazio (34x), Octopath Traveler II (31x), Sea Of Stars (30x) and Final Fantasy VII Rebirth (29x) were some top affinity titles. (*owned by a bigger multiplier of the Steam audience than normal.)

But most of those games had less than 10% player overlap with Clair Obscur, with the exception of Metaphor: ReFantazio (17%). Maybe more interesting is Monster Hunter Wilds (37% overlap, 11.5x normal), and NieR: Automata (30% overlap, 10.1x normal.) The game’s visuals and overworld allow comps to those titles, while being turn-based.

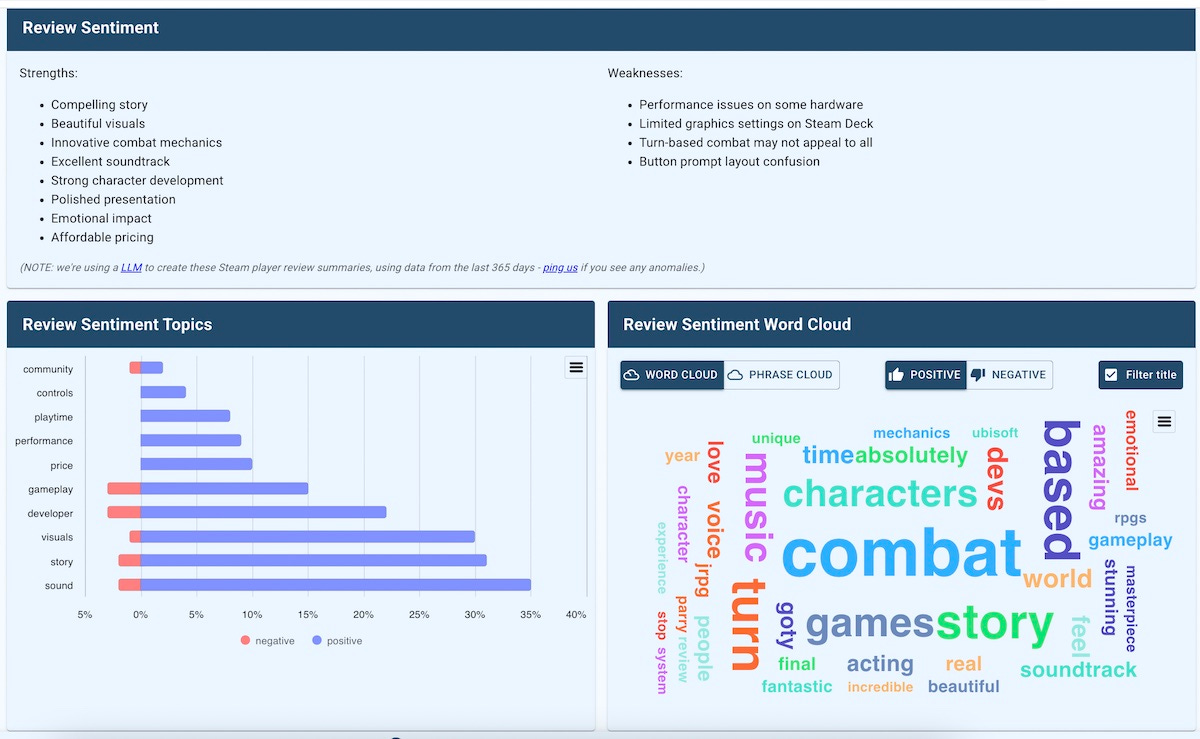

And look, it’s also about execution. GDCo auto-analyzes Steam review sentiment for GameDiscoverCo Pro subscribers, including a summary of strengths and weaknesses & topic-based analysis, and Clair Obscur executed impeccably:

There’s a billion more possible ‘talking points’ on Clair Obscur, which, reminder, had very healthy buzz before it launched, but has officially escaped containment and gone viral. And it was made by a fairly lean team of 30-ish core devs, though that discussion has already degenerated into online back-and-forth, haha.

Concluding: this was a perfect sweet spot for a mid-sized, skilled team - because there’s no way a 3-person team can pull this game off, but nobody is going to fund a 100-person team to make it. Thus: under-developed subgenre + great narrative & art direction + lean, focused team + smart gameplay execution = big hit.

Drive Beyond Horizons: subgenre + execution Pt.2!

So that’s the game you have heard of. But can we talk about Drive Beyond Horizons now? This $25 co-op open-world car scavenging & crafting game did decently on its March 24th Steam release, maxing out just over 2,000 CCUs (concurrents) on Steam.

But look what happened after release! It started nudging up CCUs in April - and maxed out (for now?) last Sunday at a whopping 15,000 CCU on Steam. Folks, this (almost) never happens:

We are analyzing March 2025’s new Steam games for next week’s newsletter. And the median time to peak CCU from launch for the top releases was 3.5 days. Outliers generally are for ‘social video/media virality’ reasons, and included Schedule I (13 days), Nubby’s Number Factory (24 days), and atop the list… this game (44 days!)

But wait… there’s actually a real, weird reason why this happened. It looks like the game got DMCA-ed due to menu music just after release, the Steam store page was unavalailable for a couple of days - and then was playable but not buyable for a month (!) It popped back up for sale in late April, with a lot of buyers waiting to purchase.

Anyhow, even with that issue, we’re estimating Drive Beyond Horizons at 275,000 copies sold on Steam, with a $6 million gross - fairly pleasant, given that revenue figure should double or more over time. But whyyy? Thoughts:

Drive Beyond Horizons picked an undersupplied & imperfectly executed subgenre: 2016’s My Summer Car and 2019’s The Long Drive have proven a market for this ‘car scavenging x crafting and survival’ microgenre. But few games have really tried to follow it up competently, for whatever reason.

There’s a variety of possible mashups & twists on the general formula: we recently covered Excalibur’s Long Drive North, which is leaning into the co-op RV sim angle. Drive Beyond Horizons has many similarities to The Long Drive, inc. zombies, but players don’t care! A top Steam review: “This is a prime example of why video games can copy game mechanics and have a completely different game.”

If you follow up a subgenre starter, you can do other things ‘right’: looking at discussions of The Long Drive vs. Drive Beyond Horizons, it’s clear that Drive Beyond Horizons has more stable multiplayer, modern looking art, more details and stabler physics. (The first of these is particularly important to streamers!)

Looking further into Drive Beyond Horizons - we recommend checking out this ‘ultimate guide’ on YouTube and skipping around a lot - we were struck by how sandbox and openworld-y - and slightly janky, frankly - it is. Almost all car parts are switchable, so you scavenge a busted ‘Mustang’ for everything from engines to gas caps.

Country-wise, the game is interesting, with Germany, Russia and the U.S. having 15-16% of the players each. (That’s a big overindex for the first two, compared to most games.) And China is only 3.5% of the audience, in this case, (This style of game doesn’t seem to have much resonance there.)

Fascinatingly, only 26% of Drive Beyond Horizons’ audience have played The Long Drive, showing that the former game - which is getting insane amounts of influencer pickup - is reaching a somewhat different audience.

The core team from the named dev appears to be around 5 people, though perhaps more people than that worked on the game. But it heavily uses Unreal Engine & feels a tiny bit ‘asset flip’-adjacent, while still executing great on the fun.

And there’s clearly a LOT to do in the procedurally generated world - tonnes of scavenging, basic gunplay to fend off zombies, using a trailer to haul old engines back to your garage, brushing the rust off your cars, blowing up gas stations (!) and more.

Concluding: there’s definitely lessons here in tapping Steam subgenres that have market leaders that aren’t executing optimally. And also in not presuming that everyone has heard of the other games in that subgenre. And in this case, cars + desert + sandbox co-op goofiness = a great $ result, from a super-lean dev team.

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]