How many PC games get bought - but not played?

Both surveys & real data tell us! Also: 'big get bigger' data & game discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back, all, to the epic video game newsletter where we’re Jim Steinman, and you’re Meat Loaf, and we’re writing 12-minute orchestral-rock classics for you called ‘I Would Do Anything For Wishlists… But I Won’t Do That’. No? Maybe?

One very important ask: we’re kicking off our 2024 Steam wishlists & sales survey - the first one since 2021. And we need you to fill in this brief, anonymous 10-question survey for any game you put out on Steam since 2020. Deadline is March 15th - thx.

[Also: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to our Steam data back-end for unreleased & released games & weekly PC/console sales research, Discord access, seven detailed game discovery eBooks - & lots more. ]

How many PC games get bought - but not played?

Look, humans enjoy the act of buying media, and not always consuming it, whether that be oldskool physical Xbox games (see: above), books (see: my parents’ house), and any number of other media types. And it’s weird that nobody talks much about the idea of quantifying ‘purchased but not used’ media.. right?

So we were interested to see a survey from blockchain-backed PC game marketplace Ultra that came out a few weeks ago which asked a bunch of questions, among them trying to quantify unplayed games by asking 2,000+ gamers.

In that survey, it was revealed that, at least according to players: “Less than half (44%) of the digital PC games in gamers’ libraries are played on a regular basis; almost a quarter (24%) have never been played at all.” Seems like a decently large number!

The context of Ultra’s pitch is that they want digital games, DLC and other assets to be resold using blockchain tech: “The majority (58%) of PC gamers would sell some of the digital games they own if they had the opportunity.” (This is an intriguing idea, if very tricky to get market share on.)

But it got us thinking: can GameDiscoverCo see the ‘real’ number - looking at many tens or hundreds of thousands of public Steam player profiles - of unplayed games? We can, via partners at GamingAnalytics.info, and it seems like players underestimate their number of unplayed games:

On average, 32.7% of the games in people’s Steam library are unplayed. And the median player - the one in the middle of the list showing 'most played %' to 'least played %' - actually has 51.5% of his Steam library unplayed. That’s a majority of all games in their library.

One thing to note here for context: it’s getting a lot more common to have access to a lot of digital media, and not play them all, esp. with subscriptions. You would never say that ‘98.5% of the Criterion Channel movies you have are unplayed, that’s a big problem’.

And there are services like Humble Choice that are ‘subscription-like’ and are responsible for a lot of Steam key redemptions, with a fraction of those being played. (Which isn’t bad per se - you just play the games you want to play in those bundles.)

But beyond bundles, in modeling Steam sales & revenue, we’ve proved that there are more sales for each user review when the game has a bigger discount. This implies that these cut-price games are being bought but not always played (or reviewed). You often buy 5 or 6 games in a Summer Sale and only dip into 2-3 of ‘em, right?

Unfortunately don’t have any historical data here, in terms of ‘are there more unplayed games on Steam than before?’ All we can say is: if you’re selling a lot of copies of your game at 80% off, expect some players to grab but not actually play.

And this type of backlog-building behavior probably accentuates the ‘either buy giant, deep games that I’m serious about playing, or lots of high quality, discounted older titles’ trend that is being exacerbated by the sheer amount of games on Steam. (See: the next section of this newsletter.)

But it’s not the end of the world - because there will always be another discount sale and interesting games to buy (and partially play!) in them. There’s no hard ‘wall’ to hit here. It’s just backloggery continuing.

Before we end, some interesting extra survey data from the Ultra survey (free reg. req.):

Games can be a discount-centric marketplace: “75% of those surveyed find AAA titles ‘too expensive’. 87% said discounts and sales are important in their purchasing decisions, with only 36% of their games bought at full price. 32% are free-to-play, while 32% are discounted or bundled.”

Reviews are looked at very seriously before buying: “When it comes to pulling the trigger on a purchase, [game] reviews have enduring importance, with 94% taking them into account. Over half (53%) of PC gamers say they use customer reviews on the platform… while 49% rely on word of mouth from their friends and social network.”

YouTube is ruling the social networks that players use for game discovery: “38% of PC gamers look to YouTube to find new games, while 34% rely on their friends… TikTok came in at 14%, while Twitch (12%) is significantly more influential than Kick (2%).”

Follow-up: ‘academia on game platform trends’ shocker!

We’ve exchanged a few emails recently on large-scale PC & console platform trends with UCL School Of Management associate professor Joost Rietveld. (BTW, he’s a different Joost to the Joost I normally link, Joost fans.)

Rietveld is an academic who runs the Platform Papers newsletter, and responded to last Monday’s newsletter about ‘the squeeze’ for PC game players with the following, very helpful email:

“I've done extensive research on game sales over platform lifecycles (in the context of both console and Steam). I found similar trends in my research as the ones reported in your newsletter: 1) hits get bigger over time, 2) the bottom of the market struggles, 3) it becomes harder to successfully ship new IP.

I identified several reasons for these trends, again, mostly consistent with what you describe:

Earlier adopters of a platform have a higher willingness-to-pay for games, and actively seek new experiences (e.g., new IP) compared to later adopters.

Competitive crowding increases, making discovery harder:

Relatively more games enter the platform later in the platform's life (compared to new players joining the platform)

New games compete against old games as well as other new games

Later platform adopters are more likely to converge on hit games. For example, in my [2018] research on consoles I found that some of the most successful games that were released early in the platform's life had an attach rate greater than 1.

This means more people bought these games than the console's installed base at the time of the game's release, suggesting that many players who bought the console at a later point in time buy these older, hit titles.

Now, Steam differs from consoles in two important ways: 1) Steam doesn't have generational breaks like consoles [have previously had], and 2) Steam has more curatorial and algorithmic recommendations than consoles do.

The first difference suggests that it is even harder for smaller-budget games to do well later on as the stock of games on the platform simply keeps growing - there is no generational reset. The implication of the second difference depends on how Valve manages its platform: if recommendations direct players towards the top of the market, then this further amplifies the aforementioned dynamics.”

Concluding on these large-scale platform trends on Steam, Rietveld says: “If players are directed to niche content, then this could partially offset these dynamics... [but] the trends in the data certainly suggest that, on balance, it is becoming harder for smaller developers to be profitable on Steam.”

So it’s ‘nice’ to see properly researched data backing up some of these conclusions, even if not the best news. And re: top-heavy - while one month doesn’t make a trend, we’ve been briefing clients on January 2024’s Steam debuts (GameDiscoverCo Plus-exclusive data).

Of the original IPs you have Palworld (which we estimate as $442 million gross LTD), Enshrouded ($42.6 million), and then no other Western-centric ‘brand new’ IP at >$1.5 million Steam LTD. (City builder New Cycle grosses ~$1.4 million in our estimates.)

February 2024 on Steam looks a bit better for original IP, with Supermarket Simulator, Pacific Drive, Balatro and Nightingale in the $2.5m to $10m gross range. But it pales in comparison to sequel Helldivers 2 ($210 million gross LTD.) So it goes…

The game platform & discovery news round-up…

Finishing off for this newsletter, do we have some game discovery news for you? Uh, just checking… oh, good news, we do! And here it is:

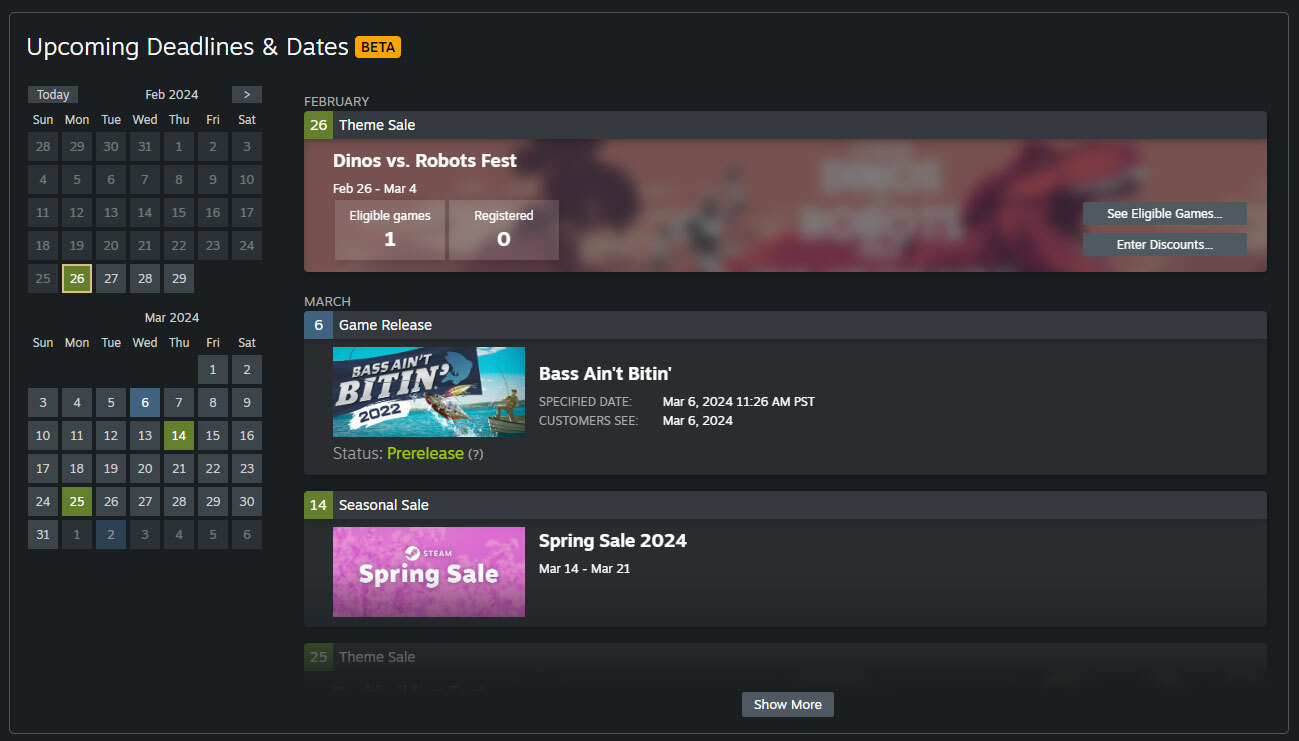

Good news for devs: Steam’s back end has a new calendar view “that gives you a mini calendar with a glimpse of the next two months, highlighting which dates have important milestones, game releases, or event opportunities.” Useful for keeping track of sales, deadlines - and discount possibilities. (And it’s only in Beta right now.)

Entertainment lawyer Simon Pulman wrote a good LinkedIn post trying to summarize recent game biz woes: “Modern model = platform-agnostic. Hit games are multi-platform, sometimes service-based. Persist across generations… Power with handful of biggest titles, not consoles. Outside Nintendo, ‘release and move on’ rarely happens.”

It’s been ‘silly season’ for fake games on Steam, as “Valve has pulled a handful of fake Steam listings for Helldivers 2 that were different games disguised as the hugely popular co-op shooter.” It also happened for Palworld, but $ can’t be the goal, since Steam doesn’t pay out in real time. (So it’s either ‘get people to download trojans’, or ‘for the lulz’?) Name change vetting may be necessary in the future?

Unfortunately, hit poker roguelite Balatro got caught by a PEGI ratings change on the Switch eShop that pushed it temporarily off the Switch eShop in Europe. We actually wrote about a version of this issue in 2021 - in this case, it’s a gambling descriptor problem. Gambling bad, but weird enforcement = worse?

As Derek Strickland spotted, Call Of Duty’s mobile version is getting very cross-platform, XP-wise, with “shared progression with Call of Duty: Modern Warfare III and Call of Duty: Warzone on PC and console”, including weapon progression and player level. Not surprising, but absolutely notable.

The dev of The Ouroboros King tried to work out possible sales from non-sponsored videos to extrapolate what you should pay YouTubers for coverage. For example, his organic NorthernLion video “generated $130 in net revenue [on Twitch] and $2,900 [on YouTube]”, according to his estimates.

Look, it’s an exciting (if granular!) Steam change: “You can now specify how long you wish for your game's launch discount to run, between 7 and 14 days.” Oh and also: your game’s Steam launch discount will only extend partly into a ‘seasonal sale’ if you launch just before one.

Here’s a marketing ‘making-of’ for Timberborn, which shows a lot of hard work went into the game’s promo, but also notes how damn hookworthy the concept is: “Timberborn is highly replayable…. Its USPs (beavers, water physics, vertical architecture..) easily impress… it can play both as a challenging, complex sandbox city-building game, and a cozy sim with cute beavers chilling in a mud bath.”

Apple drama in Europe: firstly, a letter to the EU from Epic, Spotify & others “argues that Apple’s [Digital Market Act] plans only reinforce its control over the iPhone ecosystem.” And secondly, Apple has been fined €1.8 billion by the EU for breaking competition laws over music streaming. (It’s not games, but it’s a non-small fine.)

Microlinks: the top 100 Amazon U.S. video game items sold in Jan-Feb 2024 are headed by lots of digital gift cards (hardware platforms, Roblox, Fortnite); talking of Roblox, this 9-slide platform overview is a good ‘explainer’ on trends; Xbox is doing a new Xbox and PC ‘partner preview’ live stream on Wednesday.

Finally, we’ve really been enjoying these Andrew Chambers YouTube channel design deconstructions of the latest hit games. And with the latest one being “discover how Helldivers 2's game design keeps players hooked and engaged”, we were like, sure. S’good:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

I have almost 2000 games on Steam alone, mostly thanks to being a Humble Choice member since around it's second or third month. I've played only about 30% of the games I owned and finished fewer. It's not that I'll never play them, it's just that as I get older and free time is rare, I just haven't had the chance to get into many of the larger games. I'm just now on the third entry of the Hitman series despite owning almost all of them from around the time they launched and I just recently finished the Metro series despite owning them for many years. As far as looking for new games I might not have heard of, Youtube is absolutely the way to go. There are entire channels dedicated to just covering the indie scene and I've made so many purchases off of those recommendations. Those are all games I might never have even known existed as the major websites do a lousy job covering indie games. They'll post multiple articles a day on one single game but can't be bothered to cover lesser known titles despite demand for that.