Why Sony's betting on 'spectacular' GaaS revenues for PlayStation

Also: two new Valve presentations, & lots of discovery news

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to another week, folks. This time out, we’re going right ahead and rooting around in those ‘FTC vs. Microsoft’ lawsuit files once again - and this time coming up with something that’s actually… Sony related!

It’s possible that the Microsoft acquisition of Activision Blizzard will finally close at the end of this week, btw. But we’re still living through a golden age of access to (often redacted) internal platform documents, so let’s make hay while the sun shines…

[NEW & HOT: our upgraded Plus PC game data suite is here - you can subscribe to Plus now to get full access to it, weekly PC/console sales research, an exclusive Discord, six (!) detailed game discovery eBooks - & lots more. Check out this newsletter for details on new features.]

Why Sony's betting on 'spectacular' GaaS revenue

The second cache of documents in the now-abandoned FTC vs. Microsoft anti-competitive U.S. court case debuted late, then got pulled due to serious ‘unredacted Xbox document’ leakage, and are back up again in a correctly redacted state.

While everyone’s eyes were drawn to the unredacted Xbox data, there’s plenty of interesting lower-profile material. For example: a transcript of outgoing PlayStation head Jim Ryan’s meeting with Fidelity investment managers [.PDF] in February 2022.

For those who don’t know, public companies often need to do ‘dog and pony shows’ to explain their business to major asset manager and funds. Fidelity has $10.3 trillion (!) under administration. So persuading them that Sony stock is a good bet? A great idea.

There’s absolutely no bombshells in here. But this was a private conversation (at least before it was subpoena-ed by the FTC!), and so it goes a bit deeper on PlayStation’s strategy than we’ve seen elsewhere. Here’s what we particularly noted from it:

Sony is talking a big game on ‘live service’ launches: Fidelity notes that the goal is to double first-party game revenues in the next 4 years, and Ryan says: “You can assume that a significant portion of our AAA IP will find its way into a live service game”, and it’s absolutely an “untapped revenue opportunity” for them. (Live service likely means multiplayer & recurring IAP - Battle Pass, cosmetics, etc - btw.)

One big reason? It may help to increase margins: the Fidelity managers noted that the profit margin for Sony’s game division have been in “the low teens”, percent-wise, but Activision’s business - which has big GaaS hits like Candy Crush and Call Of Duty - are in the 30%+ range. Ryan notes: “On a margin basis, [our profit] would go up if the games are successful.”

PlayStation’s big goal is to become less reliant on third parties: especially after the bombshell of the Activision deal, still fresh in everyone’s minds at this point, Ryan notes the strategy is “to become less reliant on 3P [third party] games and 3P royalties, and to make more 1P games.” Hence the internal investment - and external acquisitions like Bungie (Destiny 2, above!) - on GaaS titles.

Sony will continue to make ‘traditional’ big-budget $60 AAA games: Ryan is clear that this is a gradual re-orientation, and not a big pivot: “These… graphically beautiful, narrative rich games will continue to be the bedrock of our first party publishing business.” (Something that is absolutely happening this holiday with Sony and Insomniac’s Spider-Man 2.)

The need to expand past the PlayStation console is referenced several times, too. Sony is looking for acquisitions that are “growing our first party publishing business across multiple [platform] formats in a way that we have not in the past.”

But ultimately, the holy grail here - always the plan for Sony, but turbocharged by Microsoft’s announcement of the Activision deal? Ryan says: “Having a business model where you own elements from the top to the bottom increases your ability to be self-determinant. And when you get it right, particularly in this live services area, the financial upside is absolutely spectacular.”

This is quite bold talk, ahead of actual launches. So where are we in October 2023, 18 months later, with this plan? Well, here’s GameDiscoverCo’s estimates on the top 50 game market share by total DAU (daily active users) on PlayStation:

There are 7 PlayStation-owned games making up their 7.3% of the Top 50 by DAU. And nearly half of them - two Spider-Man games & Ghost Of Tsushima - are also in PS+ Extra. (The others? Gran Turismo 7, God of War Ragnarök, Astro's Playroom & Destiny 2.) Clearly some ground to be made up here…

In terms of announcements around new, signature ‘live service’ games from first party studios? The May 2023 PlayStation Showcase revealed “competitive modern heist game” Fairgame$ from Haven Studios, which seemed to land with a bit of a thunk.

There’s also Bungie’s next game, PvP extraction shooter Marathon, which has a lot of buzz due to studio heritage, old IP re-use, and stand-out art direction on the reveal. (Oh, and whatever Concord from Firewalk Studios - a recent acquisition based on ‘live service’ promise - is going to be. It may be good or bad, but Sony needs to consider overly cryptic CG trailers carefully.)

And that’s it, so far. And we note this newish Kotaku news story related to Naughty Dog (The Last Of Us) contractor layoffs: “A multiplayer spin-off for the zombie shooter based on the first game’s Factions mode has struggled in development. Bloomberg reported in June that Sony had diverted resources away from the project following a negative internal review by Bungie... One source now tells Kotaku that the multiplayer game, while not completely canceled, is basically on ice at this point.”

So, in as much as Jim Ryan’s departure can be explained as ‘he’s retiring, folks!’, we do also wonder if this unrealized ‘live service games have great margins, we have popular IP, let’s GaaS-ize all our big IP’ biz model decision is playing a small part. (Are IPs like The Last Of Us and God Of War really ones people want live service games of, btw?)

PlayStation has been very public over this tactic. And, as logical as it is from a pure business perspective, saying you are going to have hit GaaS titles in today’s crazy busy market - before having them - is a potential recipe for problems.

Heck, according to GameDiscoverCo estimates, we can’t see any game that launched in the last year on PlayStation settling into >100k DAU on that platform in the long-term, with the exception of yearly sports game refreshes (EA Sports FC, NBA, Madden), or big premium hits like Hogwarts Legacy. Oh, and God of War Ragnarök.

All we’re saying is - giant PC/console GaaS titles are generally a) old and b) giant partly cos of that. Which is why we see tactics like Xbox just straight-out buying Activision with parent company $ to get legacy (mobile & PC/console!) GaaS gems, or Tencent’s minority stakes in promising firms, in case they hit with a GaaS game.

So, if you were to tell us in 3-5 years that the only big new ‘live service’ hit from this big Sony push was, in fact, Bungie’s Marathon, we would not be surprised at all. And we’re wondering if this realization is dawning over at Sony HQ too, especially given Sega’s late cancellation of GaaS wannabe Hyenas.

Our thought? Maybe it’s better for Sony to improve post-launch monetization of its traditional games via DLC, or just buy more Bungie-like entities with current GaaS hits*, rather than try to pivot existing studios to GaaS or build from scratch. (*If they can afford them - other platforms have parent co-s with deeper pockets.)

But then again, we haven’t yet seen the majority of these ‘live service’ titles up Sony’s sleeve! And one giant hit will make a monkey out of this entire newsletter. So go ahead, PlayStation, make a monkey out of us. (We won’t be upset!)

Steam platform discovery - Valve’s video, new .PDF

Regular newsletter readers will be aware that we already did some analysis of the .PDF version of Valve’s conference talk on how games get surfaced to players on the Steam platform. (Which is kinda an important subject!)

Well, Valve now posted a video version of Erik Peterson’s talk (above), and we recommend everyone who sells games on Steam checks it out. It’s only 25 minutes long (or less at 1.5x or 2x speed!), and clearly explains the algorithmic vs. editorial featuring across the entire store.

And while we’re on the subject of official Steam presentations, the .PDF of Erik’s recent Platform Update talk given in Kuala Lumpur is now available. There’s not a lot of major new info in there, but we did note the following:

Internationalization of your game was encouraged: the new stats? “Over 60% of Steam users have selected a non-English language as their primary language… Simplified Chinese is now the second largest language on Steam.” And Indonesian just rolled out as an official ‘main’ Steam language, of course…

Early Access was mentioned as a major tool: An interesting stat here: “About 30% of the top releases each month are entering or exiting Early Access.” Perhaps this is due to two bites at the ‘top games’ cherry, but it also shows how the status is useful for discovery!

More official themed sale events are coming: we already know some of this, due to early 2024 ‘official’ Steam sales being announced, but: “This coming year will see twice as many [official sales] as 2023… electing a variety of narrower themes lets us highlight more games.” Some of these themes are very narrow, mind you, like pirates & ninjas.

So that’s your ‘Steam bulletin’ for this newsletter. (We’ll try not to turn into a parish magazine for the platform. But it clearly is the most dynamic PC game platform out there right now.)

The game discovery news round-up..

Finishing things off for this fine Monday, let’s take a look at the major platform & discovery news since the middle of next week. It goes a bit like this:

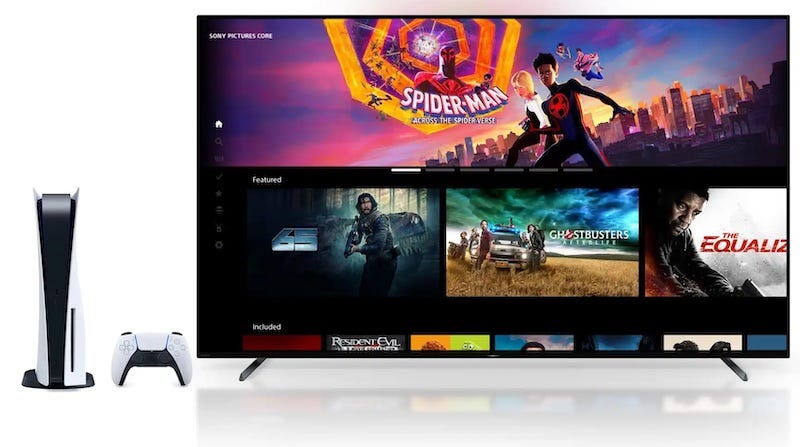

Bundling PlayStation Plus with a sub benefit beyond games? That’s what the roll-out of the Sony Pictures Core app on PlayStation does: “If you’re a PlayStation Plus Premium/Deluxe member, you’ll get access to a curated catalog of up to 100 movies [to watch for free]… such as Looper, Kingsglaive: Final Fantasy XV, Elysium, and Resident Evil Damnation.” (You can also rent new Sony movies like Gran Turismo, ahead of other rental platforms.)

The Unreal Fest 2023 keynote from Tim Sweeney was written up by GWO from a YouTube video, with some honest comments on layoffs: “Epic Games realized it was running into financial problems about 10 weeks ago… layoffs affected only 3% of the Unreal Engine engineering team, but more than 30% of the business, sales, and marketing teams were let go.” Oh, and the company “will move to a seat-based enterprise software licensing model for non-game developers” in 2024.

You may have noticed that Steam Next Fest’s October 2023 iteration is live, with over 940 demos playable. We’ll have a full newsletter on top games next Monday, but notable: ‘most wishlisted upcoming games’ is the Next Fest front page default tab, as opposed to ‘trending’, which is more prone to devs possibly ‘gaming’ it.

The dev of social deception-adjacent party game The Matriach has a great Reddit post about its micro-success, revealing: “One year later, the game sold 84 000 copies, grossed $200,000, mostly driven by marketing on TikTok, and big influencers playing it on Twitch and YouTube.” (Yet again, we’re seeing gameplay video & organic endorsements driving success.)

We like to cover platform & region splits that help us understand the market, hence Cyberpunk 2077 expansion Phantom Liberty’s ‘3 million units in a week’ sales split being of interest: “Sales by Platform: PC: 68% [& the CDPR-owned GOG was 10% of that 68%!]; PS5: 20%; Xbox: 13%; Sales by region: NA: 36%; EU: 35%; Asia: 23%; Others: 6%.” (PC and Asia were higher than we expected, here…)

Butterscotch Shenanigans, the devs of Crashlands 2, have a ‘Steam tools’ page which includes some clever widgets to interact with the Steam back end - including comparing Steam traffic .CSVs over two periods, and bookmarklets for Steam Likes & Steam Regions. (It’s part of their Stitch tools for managing GameMaker projects, but doesn’t need you to use GameMaker.)

The Humble Games Collection membership perk for Humble Choice - which consisted of games you could access in a separate Humble PC desktop app - is retiring on November 7th. (Looks like the move to create a Steam-like interface alternative didn’t get enough traction.)

We know Japan still loves physical console games, but how much? According to a recent CESA survey citing 2022 data: “PS5: 35% digital / 65% physical; PS4: 50% digital / 50% physical; Switch: 23% digital / 77% physical… Overall: 30% digital / 70% physical.” (Our sense is that Europe can still have a physical bent, esp. on Switch and AAA, though not to this degree, but North America is largely not like this?)

Did you wonder where the ‘Epic 5.0’ naming came from in the recent article we ran on Epic layoffs? We were citing Epic layoff victim Sergei Galyonkin, but didn’t realize he himself was referencing a Brian Crecente article on Polygon which listed the first four eras of Epic. (Now you know!)

Microlinks: GeForce NOW just added “nearly 60 new games to [cloud] stream, including Forza Motorsport and 16 more PC Game Pass titles”; you can now straight-on buy Ubisoft games like Assassin’s Creed Mirage on Amazon’s Luna cloud service; Unity’s John Riccitiello got a 2% CEO approval rating from alleged employees on Blind - and that was before the price changes hit (!)

Finally, the Retro Game Mechanics Explained YouTube channel has done some wonderful breakdowns of classic games. But few are better than this latest look at Super Mario Bros 3 & how code errors make its card matching game a breeze:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

I would say that outside of a couple of examples, most of Sony’s live service investment is in new IP from newly acquired teams, or existing teams with some heritage in this anyway. So Haven, Firewalk, Firesprite, Bungie… all new devs making live service games, mostly new IP.

And then there’s London Studio’s fantasy action multiplayer game and whatever Media Molecule is building. Both developers that have done this stuff before

It’s making a few bets with existing IP (namely the Horizon game). But it’s mostly doing what’s been suggested. Buying up new projects and teams developing things in these areas