What's in a name? Top Steam game titles revealed!

A little fun, plus a look at the post-pandemic PAX scene & lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to the GameDiscoverCo newsletter, kind audience. Since we had a holiday in the U.S. yesterday, this is your one (one… ha ha ha ha) free newsletter for the week. But we’re going to make it… count. (Geddit?)

Oh, and random shout-out for the week? The ‘history of ‘90s Midway’ doc Insert Coin (think NBA Jam, Mortal Kombat, Smash TV) is now free to watch (with ads) on YouTube in the U.S. - & still rentable cheaply elsewhere. As they say: boomshakalaka?

[Good news: our upgraded Plus data suite soft-launched, and you can subscribe to Plus now to get full access to it, weekly PC/console sales research, an exclusive Discord, three detailed game discovery eBooks - & lots more. We’ll be showcasing this all more, shortly…]

What’s in a name? Top Steam game titles by $…

We’re finding that our new Data Fellow, Strahinja is full of good ‘here’s how we can cut up Steam data’ ideas. And the latest one he came up with is entertaining! It’s possibly not 1000% practical, but so irresistible that we had to make it the lead story today.

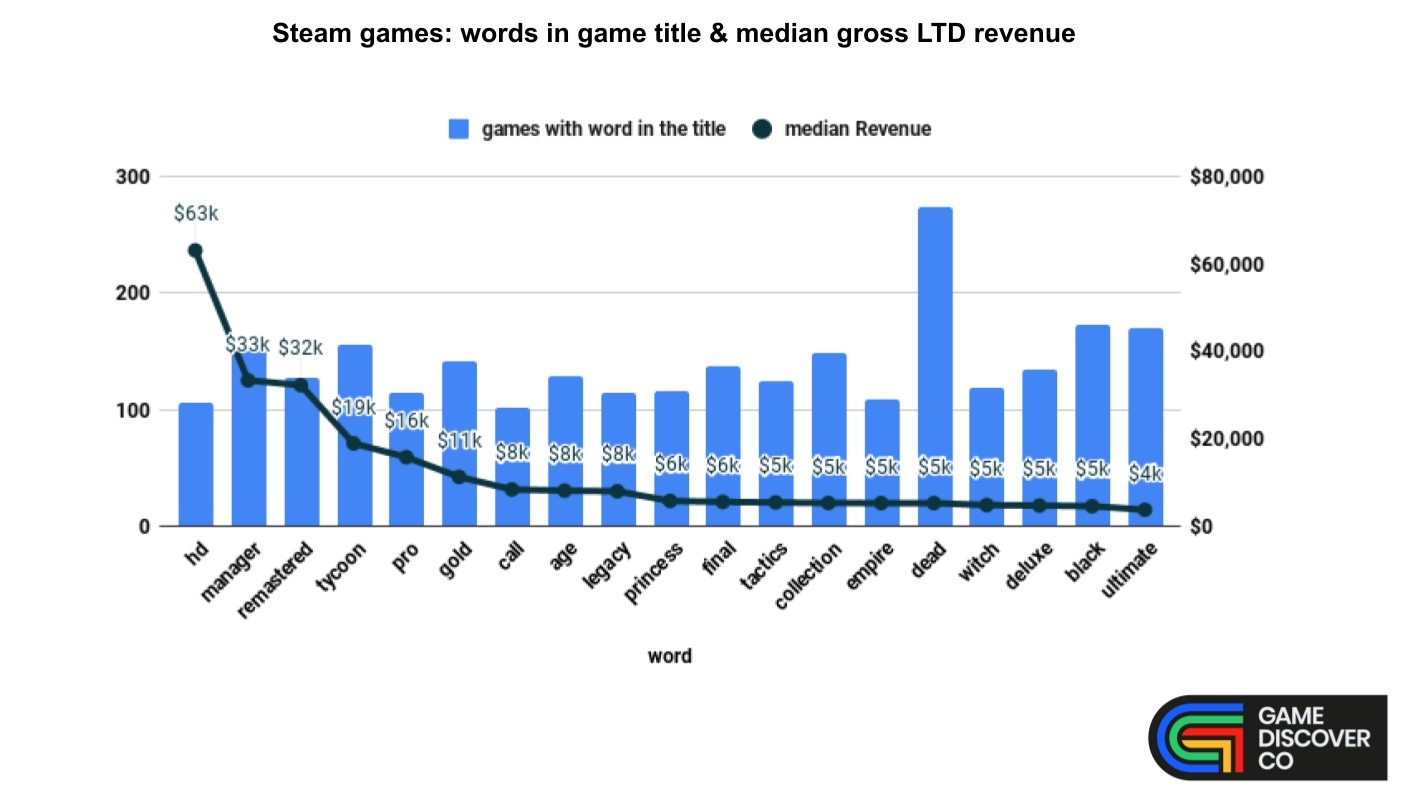

Basically, the thought experiment was - ‘which words in your game’s title on Steam lead to the highest median lifetime gross revenue?’ And the answer - filtered only by common words that are used >100 times in titles across the Steam catalog - is above.

We actually also have the full list of almost 250 words (Google Drive doc), and we wanted to comment on both the above chart, and real trends we see in the data:

Almost all of the median revenue numbers are worryingly low for pros: this should not surprise you, but it gives you a true idea of how busy Steam is. Only the top 6 words had a >$10k gross (>$5.8k net) median LTD revenue across all games that feature them. And half of the words are actually <$1k gross median.

Adaptations of existing games dominate the highest-median grossing: four of the top six words are related to updates of previously available titles - HD ($63k median), Remastered ($32k), Pro ($16k), and Gold ($11k). This doesn’t mean that if you call your original IP game ‘XX Gold Pro Remastered HD’ you’ll go big, tho!

Strategy-centric names do well, likely due to game complexity: you’re not going to get lots of hobbyists quickly producing games with Manager ($33k) or Tycoon ($19k) in the title, bringing up their median. (We also think they are interesting areas to target on Steam, to be fair.)

Steam’s ‘grimdark’ audience comes out in a few of the top keywords: we often claim that cozy-friendly titles are less suited to Steam than Switch - though many can still do well on the platform. As you can see in the above chart, you get higher medians for Dead ($5.2k, with a whopping 274 games!) or Black ($4.5k) than you do Farm ($2k) or Little ($1k).

The lowest-median words imply… over-simplicity? It’s fun to check the database for the smallest gross median results, and words like Tank ($140), Ball ($100), Maze ($90), and Jump ($40) certainly smack of ‘my first game’ vibes. (Not that we’re judging - heck, we’ve never made a game from scratch ourselves.)

So actually, the more we looked at this data, the more we found it intriguing. It feels like it’s a bit of a ‘vibes check’ into the aromas of Steam in 2023. And it raises more questions than it answers. For example, how come Dead has a $5.2k median LTD gross, but Zombies has just a $280 median? Answers on a postcard, please…

PAX West: how are U.S. B2C game events faring?

GameDiscoverCo took a little jaunt up the West Coast to visit PAX West 2023 in Seattle this past weekend, to see how the B2C (business-to-consumer) market in the U.S. is faring in the wake of the cancellation of (both biz and consumer!) E3 this year.

It was actually ReedPop (the parent company of PAX, GamesIndustry.biz and a number of big comic-cons) who tried to partner with the ESA to resurrect E3. And pre-pandemic, PAX West in particular regularly had an exhibitor-packed show floor.

So checking out this year’s event - the first PAX to partly take place in a new Seattle Convention Center extension, with a GI.biz ‘investment’ B2B event beforehand, was intriguing. Here’s what we took away from it:

PAX West 2023 itself felt vibrant and positive: there were hordes of happy cosplayers and game fans. And the new, two-building structure made for lots of walking, but kept crowds from getting overwhelming. (We also dig the community features at PAX like PC, console and tabletop ‘freeplay’ rooms, etc.)

Nintendo Live being concurrent was cool, also awkward: this ‘test run’ for a Nintendo-operated expo only gave out tickets via lottery, and took up half of the ‘old’ PAX main expo floor, with queuing for it in other ‘formerly PAX’ spaces. It was an awesome ‘two for one’, though, if you could get Nintendo Live tickets.

PC/console game companies just don’t feel they ‘have’ to exhibit at B2C events: if you check out the PAX 2018 main expo floors footprint, with Sony, Microsoft, Valve, Bungie, Twitch & more, and compare it to the two show floors this year, you’ll see that many of these companies are… no longer there.

But there’s still plenty to see from small/medium (& some large) companies: as you can see from the 200+ exhibitors, which also included specific game ‘pushes’ from Bandai Namco (Tekken 8) and Paradox (a Vampire: The Masquerade 2 re-announcement), and multi-game booths from Devolver, Square Enix, Sega & more.

But overall, the penny seems to have dropped for game companies that physical events are great for communing with an (often local!) real-life audiences, but a) can put you in attention conflict* with a host of other companies, and b) are probably marginal ROI on game sales/wishlists, if not timed with a major announce.

So, PAX West seems to be morphing back into what it was much earlier in its life, before it became a ‘must-exhibit’ B2C event. The exhibitor FOMO is gone. But the spirit of the event retains, there’s plenty of attendees & booths, and everything from Among Us & Five Nights At Freddy’s, a host of smaller indie games, through AT&T and, uh, Idahoan Potato Shreds can be gawked at. It felt good.

As a smaller dev, talking to (potential & current) fans, seeing how newbies play your game, and running into industry contacts can feel great at PAX - and elsewhere. This is why Gamescom’s B2B/B2C crossover pitch is still working great - though even its B2C side has had defections from giant firms who want to control their own destiny.

[*Attention conflict? But these B2C events attracts lots of people & media, so competing for consumer interest is worth it, you say? The % of attendees who go on to buy doesn’t seem significant enough, media coverage can be subdued in terms of outlets/ROI, & key, biggest streaming influencers are too busy posting videos to attend en masse. So ROI is amorphous.]

Steam’s algorithmic visibility, demystified by Valve

So, Valve’s Erik Peterson gave a handy informational talk on Steam visibility, both at Devcom and the GI Investment Summit at PAX, and the 71-page slide deck is now available directly from Steam. (A video recording might be coming soon, too?)

We’d call this a refreshingly clear, direct way to explain how the various Steam algorithms work - there’s a lot of off-base ‘speculation’ out there. Most of this won’t be surprise for anyone who reads GameDiscoverCo regularly. But just to sum up:

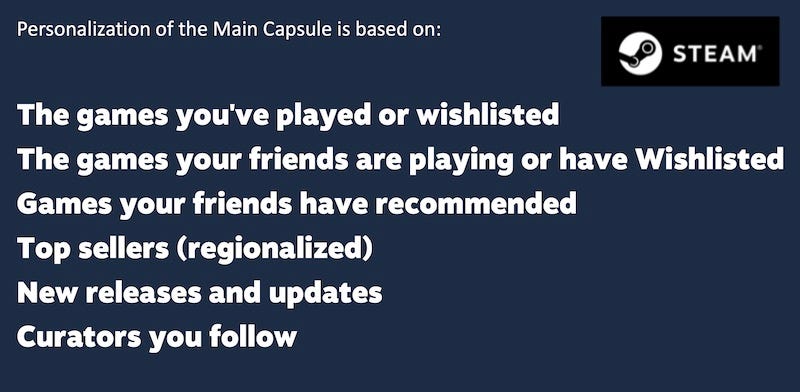

Algorithmic surfacing of popular content is - largely - how it works: you can’t pay Steam for ads/featuring, and there are lots of big sections of the Steam front page (‘Featured & recommended, ‘New & trending’) which use algorithms as their chief arbiter.

Recommendability is based - in large part - on revenue: Valve sez: “When players spend time and money on your game, it’s a strong signal to Steam it could be interesting to other players, too.” It’s not about Steam store page traffic, it’s not reviews (unless <Mixed), it’s not wishlists (except a few pre-release categories) - it’s $ performance!

Curated content exists, and you can ask to be included: examples include: “Daily Deals; Midweek and Weekend Deals; Front page takeovers; Content hub takeovers*.” If you have hundreds of Steam reviews & can do a big/impressive discount, it’s always worth pitching Valve your game. (*Content hub takeovers are rarely discussed, btw, but seem most common on the F2P hub homepage.)

There’s no ‘shadowban’ on Steam: this is worth repeating: “Steam never makes a permanent decision about your game… Every game has a chance to be successful. That’s by design.” And we’ve definitely seen this before, though quite rare - with games like Among Us, which had been dormant for months before blowing up big in mid-2020, driven by streamers, but further boosted by Steam algo visibility.

Anyhow, there’s more details in there - confirmation that New & Trending is both regional and chronological, as we recently wrote about, a good list of the criteria that everyone’s personalized Steam front page ‘main capsule’ is based on (above), & more.

So please read the slide deck [.PDF], take some of the recommendations from it - that localization (in particular!) & tags are important. And end with this stirring (and actually slightly heartwarming) Valve statement: “All kinds of games can find an audience, and success, on Steam. There’s room for everyone.”

The game discovery news round-up..

Since we just have the one free newsletter for this week, we’re looking at a whole bunch of interesting discovery news & links, uhh, right now:

There’s ‘new’ Nintendo Switch hardware bundles - a Switch Lite Animal Crossing bundle for $199 (U.S.), which seems like it might sell, and an oft-repeated Mario Kart 8 Deluxe bundle with ‘regular Switch’ for $299 (U.S.), as well as a Switch Sports bundle in Europe. (Nintendo’s still bundlin’ for the holidays, possibly the last one that the OG Switch will be its lead console for…)

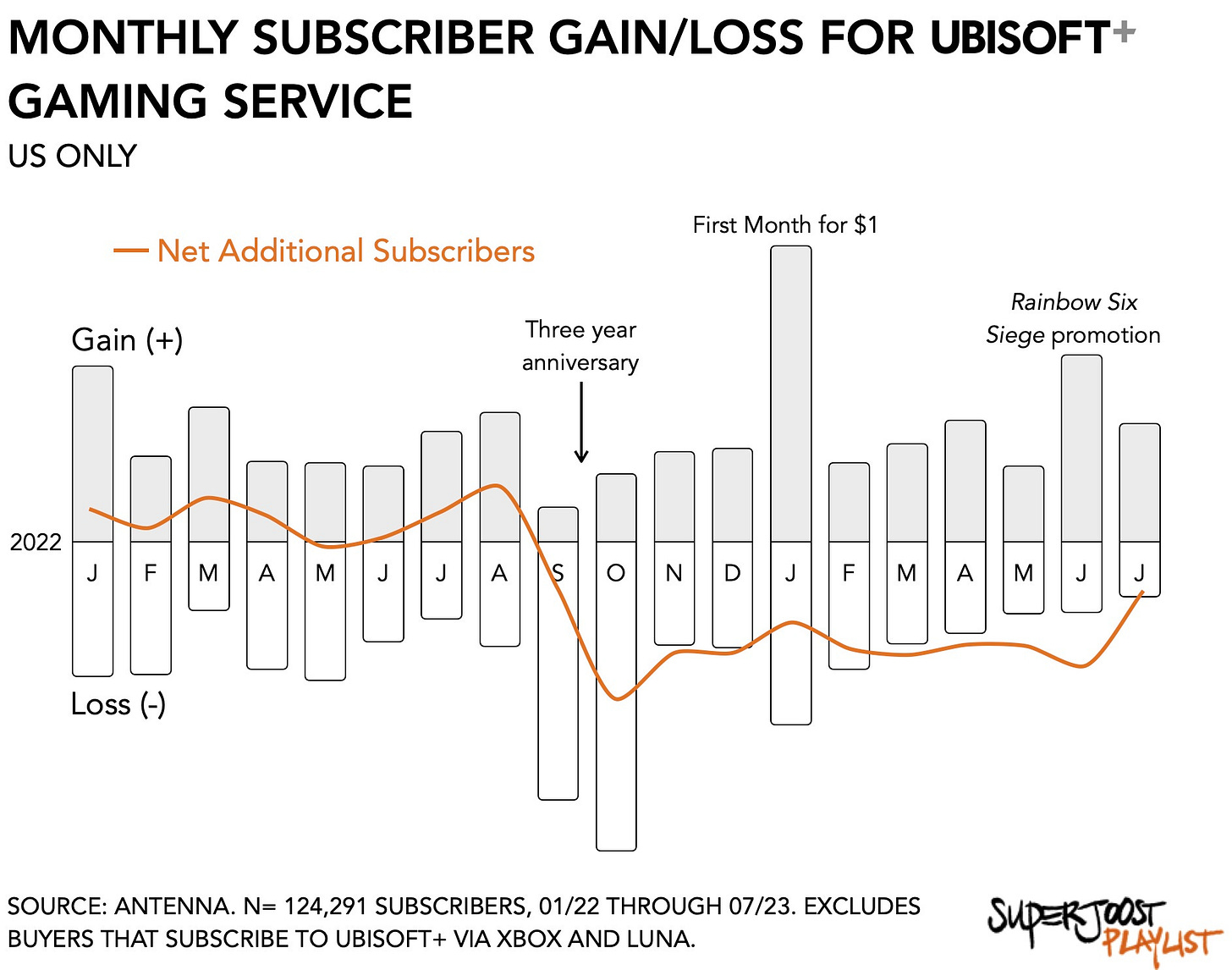

Didn’t realize that ‘market intelligence for the subscription economy’ company Antenna also tries to track game subscriptions, and the latest SuperJoost Playlist newsletter looks at Ubisoft+ PC sub service estimates, which are not necessarily going in the right direction - see above. (Joost, get us Xbox GP/PS+ ones next!)

Tinybuild took a gander at the decent EA success of I Am Future, another of their recent releases, which has done >$500k gross and peaked at 2,600 CCU, showing wishlist charts, marketing plans, etc. (They did the ‘release demo to influencers early to get on Next Fest algorithmic radar’ thing that others are now, smartly, trying.)

Amazon Prime Gaming’s September 2023 free games/IAP include Football Manager 2023, Luna cloud-streamed games like Jackbox Party 9 and Arcade Paradise, and free IAP from Pokémon GO, Diablo IV, and Dead By Daylight. (We feel like the ‘big game’ IAP gets redeemed way more than the games do?)

A good, if ‘pessimist realist’ take on the changing role of games media from Brendan Sinclair: “I've seen the focus shift from magazine subscriptions to ad-driven sites centered around reviews and previews and then podcasts and then short-form video and then Skyrim coverage forever and then strategy guides and walkthroughs.”

Correction from last week’s piece on Metroidvania title Doomblade: we said its ‘pre-release Hype to reviews’ ratio was slightly above median. But - after fixing a code bug - the real number was about 50% of the median. (Still, the game would only have done 6-8k units LTD, even with median sales conversion. So we don’t think it changes the broad strokes of the piece.)

DFC did an interview with Amazon Games head Christoph Hartmann, which does a good job of running down the giant’s first-party efforts. Interesting quote re: the upcoming Amazon-funded Tomb Raider game: “Crystal Dynamics leads development with our team’s support, input, and financial backing. Whether it goes beyond games, I don’t know yet, but I could imagine a future where we tap into the IP in new, entertaining ways.”

Serkan Toto’s rundown of Kadokawa ASCII’s ‘2022 in the Japanese game biz’ research has some intriguing parts: “There is the Japanese PC gaming market, which has been expanding quickly in recent years. For that segment, Kadokawa ASCII reports another significant jump year-on-year, up a whopping 43% from 131.3 billion yen (US$0.9 billion) to 189.2 billion yen (US$1.3 billion) in 2022.”

Steam Deck’s most-played games in August 2023 have been posted, and Baldur’s Gate 3, Elden Ring, and Dave The Diver are the ever-impressive Top 3. (We also spotted some new titles like Armored Core VI and free vTuber fangame (!) Holocure debuting for the first time, further down the list.)

There’s been more Chinese gov game approvals specifically for foreign IP or foreign-dev games, with 58 now approved for the year - largely mobile - including The Lord of the Rings: Rise to War and Avatar: Reckoning. (Even these titles mainly have strong Chinese publishers behind them - and over 600 domestic IP games have been approved in 2023 so far, so you can see the direction here...)

Microlinks: RoadToVR suggests that PlayStation VR 2 is lacking a pipeline of key, exclusive content; interesting piece on mobile publishers ‘resurrecting’ old F2P games like Tiny Tower to improve monetization; former Sony exec Mena Sato Kato joins Xbox to direct Japanese partnerships; there’s a new U.S. union-conducted game dev survey which found: “when asked if working in games is sustainable, 42.9% said yes, 37.9% said no, and 19.2% said they were unsure.”

Finally, the famed Nokia N-Gage phone/handheld console was a flop, sure. But look at the weird-ass visuals for this 2004 N-Gage promo video dug up by Noclip - a triumph:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

I am grateful for this article full of sweet refined data.