Who 'won' October 2025's Steam Next Fest?

Also: lots of discovery and platform news, including new Steam Deck game pages.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and we hope you had a pleasant enough weekend, and weren’t attacked by any tentacled horrors from outer space. (Not that it’s very likely. But with Treehouse Of Horror XXXVI having just aired - yes, really - we were worried that Kang & Kodos might be surprise pre-Halloween guests.)

Before we start, you’re probably aware of Nintendo’s 1984 arcade classic Punch Out, right? But how about their 1985 title Arm Wrestling (video)? This rare release shipped as a ‘conversion kit’ for Punch Out, has a heck of a lot of button mashing, and includes some ‘crazy out-there’ digital speech. (We just found out about it, and are fascinated.)

[NEED BETTER INSIGHT? Companies, get much more ‘Steam deep dive’ & console data SaaS access org-wide via GameDiscoverCo Pro, as 80+ have. And signing up to GDCo Plus gets (like Pro) the rest of this newsletter and Discord access, plus ‘just’ basic data & more. ]

Game discovery news: Steam Deck verified pages!

OK, let’s get things started with a little game platform & discovery news, kicking off with a fun new Steam feature:

Valve just sent out a note to everyone with a Steam Deck Verified game, adding a special ‘Steam Deck verified’ store page for specific game, as noted by the Primal Planet folks. (It’s been used for Steam Deck main page ‘features’ before & you can modify Primal Planet’s URL by changing the AppID to see other Verified pages.)

Xbox’s Sarah Bond has been chatting with Variety about the ROG Xbox Ally launch, also reassuring y’all that there’s still internal Xbox hardware on the way: “We have our next-gen hardware in development. We’ve been looking at prototyping, designing. We have a partnership we’ve announced with AMD around it.”

ICYMI: it didn’t seem to be DDoS related, but Amazon’s AWS cloud servers had some big issues early on Monday, European time, with affected services including PlayStation Network, Fortnite, Roblox, Pokémon Go, Clash of Clans and more. Things are back to normal now.

Checking in on the latest U.S. Switch third-party eShop charts for new games ($), it’s roguelite hit Ball X Pit that’s atop them, closely followed by Hades II, Hollow Knight: Silksong, Just Dance 2026, Absolum, and Little Nightmares III. (Sales of even ‘charting’ games on eShop still seem a tad anemic for some, though?)

We’re in-between ‘streaming showcase’ flurries right now, but the Galaxies Showcase is happening on Thursday 23rd, with companies participating including Behavior, Owlcat, Devolver, Playside, Kepler, Team17, Blumhouse and more. (And a free Twitch Drop for Dead By Daylight - smart.)

The latest Pokemon leaks - sorry, Game Freak - include some specifics on dev budgets, with claims of the following: “Pokémon Sword and Shield: 2.498 billion yen ($16.4 million); Pokémon Legends: Arceus: 2.175 billion yen ($14.4 million); Pokémon Scarlet and Violet: 3.298 billion yen ($21.8 million).” (These numbers? Low…)

Microlinks: Google’s new (Android app store) deadline for Epic consequences is October 29th; is community engagement and retention more important than wishlist surges?; how Apple’s Games app and Google’s Level Up/’You’ tab are deepening game features in mobile app stores.

Giving back, Owlcat Games and a number of others (Midwest, Fireshine, Gaijin, 11 bit) have “revealed GameDev Learning Drop, a collaborative initiative wherein participating developers and publishers share educational resources like free tools and software, online courses, masterclasses and tutorials.” (It’s lists, but useful lists…)

‘Games as platforms’ news? Yessir - hit multiplatform hero shooter Marvel Rivals is “getting a new PvE Zombies mode with musou vibes”, switching the gameplay up notably, with Thor, Blade, Magik, Jeff, and the Punisher fighting “what Danny Koo, executive producer at Marvel Games, calls ‘endless waves of zombies’.”

Some useful context on Battlefield 6’s European launch, via GSD and The Game Business: “Battlefield 6 delivered a huge opening week across Europe, beating launch sales of Call of Duty: Black Ops 6 and EA Sports FC 26 (GSD data, combining physical + digital sales). Its launch was four times bigger than Battlefield 5…”

‘Deep thought’ link: we talk about ‘filter bubbles’, but Julia Alexander goes further: ‘We passively take in free stuff every day that is designed to fit within our new worlds, creating entirely separate realities for a growing number of communities, reducing the number of shared experiences, beliefs, and truths or realities that we can all agree upon and participate in.” (Not about game discovery, but ‘everything’ is a superset, right?)

Who ‘won’ October 2025’s Steam Next Fest?

Yes, GDCo has been covering Steam Next Fest demo trends for ages. Here’s our pieces from June 2025, Feb. 2025, Oct. 2024, June 2024, February 2024, Oct. 2023, June 2023, and February 2023, if you’d like to rewind. But what’s great? Everyone’s monitoring of Next Fest - which had ~2,900 demos this time - has been getting more sophisticated.

In fact, Valve itself put out a Top 50 demos of Next Fest yesterday by unique players, not even randomized (like some of their charts!), something they didn’t do a couple of years ago. So this gives us a great comparison point to all the super-detailed data on every single Oct. 2025 Next Fest demo (Google Drive doc) we’ve once again pulled.

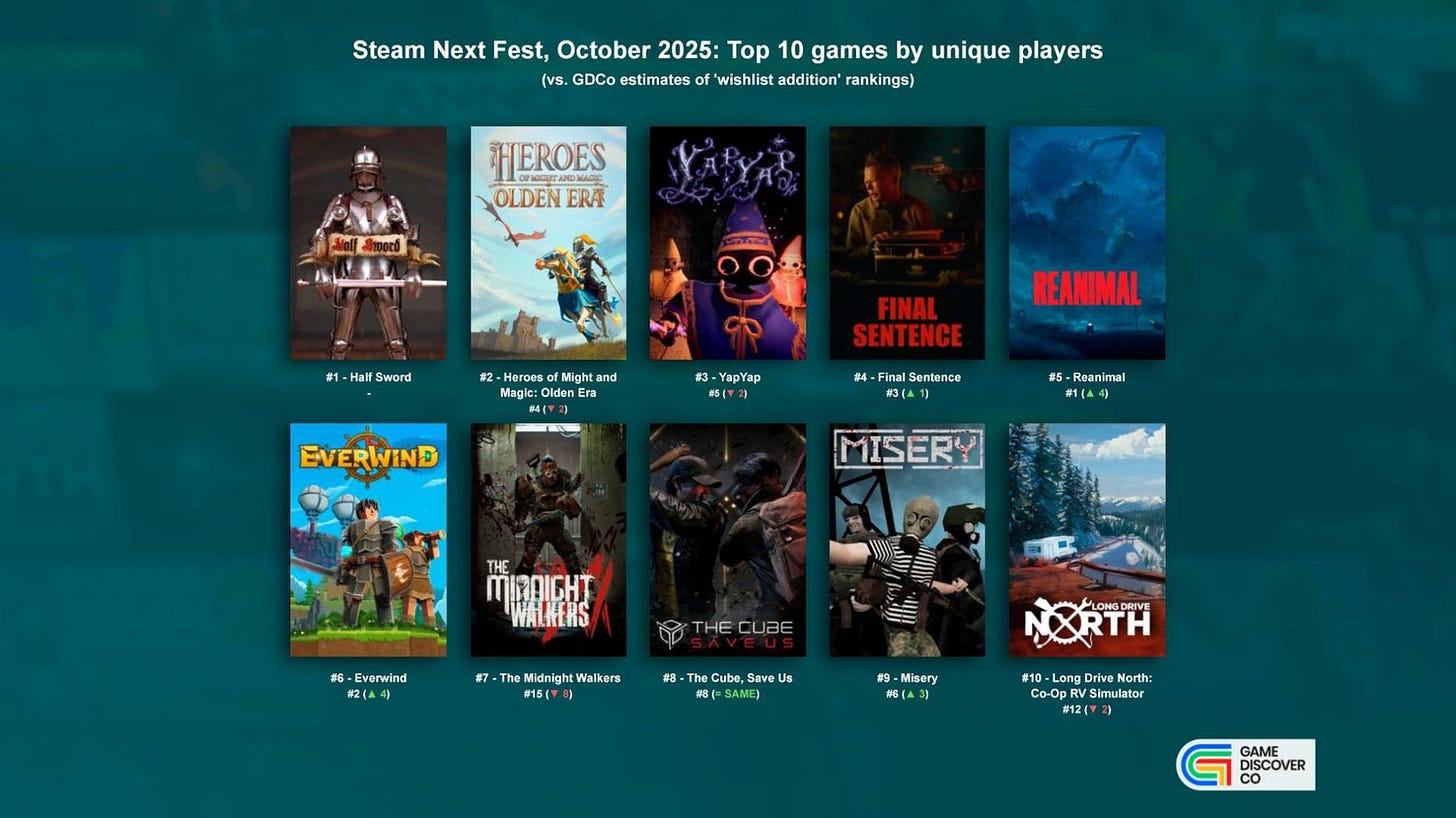

We thought we’d use Valve’s own Top 10 chart (above) as a starting point, because - with one major exception - it ties in very well with our own numbers. You can see the rankings compared to our ‘most wishlists added’ estimates above. Some notes:

Existing IP isn’t a big deal to the leading Next Fest games: only one of the games in the Top 10 - much-awaited strategy sequel Heroes Of Might and Magic: Olden Era - at #2 - has an existing IP. (There’s a few more in the Top 20, including a Star Trek Voyager strategy game, a reboot of FPS Painkiller, and Powerwash Sim 2.)

An easily ‘grokkable’ & definable style of game is definitely the key: we can make snap commentary on a lot of these top games: YapYap (#3) is a co-op goofy wizard crewlike, Reanimal (#5) is a co-op horror adventure from Little Nightmares’ OG devs, Everwind (#6) is a co-optional Minecraft-lookin’ voxel survival crafter.

There’s always one game that makes you say - ‘wait, what?’: in this case, it’s Final Sentence (#4), which is a ‘battle royale typing game’ with Buckshot Roulette-ish vibes, in which: “Type fast and type accurately - your life depends on it. There’s a revolver pointed at your head… with one bullet in the chamber.” Yes, really.

We’ll get to the rest of the Top 10 below. The one exception that didn’t make our ‘most extra wishlists’ list? Gory weapons sim Half Sword, which is #1 for unique players, but whose demo has been pulling in 5-15k CCU for months anyhow! So it’s doing great, but a lot of its uniques are returning players who already wishlisted, haha.

Next, let’s take a look at GDCo’s wishlist increase estimates during Oct’s Next Fest. Remember, some of these games - like Might & Magic - had their demo available pre-Next Fest, so already picked up a lot of interest at demo launch. We have five games (Reanimal, Everwind, Final Sentence, HoMM, YapYap) at >100k extra wishlists for NF.

We’ve already talked about the Top 5 games here, but just commenting on the others briefly: Misery (#6) is a co-op nuclear horror survival-er with procgen Roadside Picnic vibes; Car Service Together (#7) takes the first-person refurb sim into co-optional multiplayer, and The Cube, Save Us (#8) is a meaty extraction shooter.

The only cozy title in the Top 10 is Starsand Island (#9), which already had a popular Kickstarter and hits the Royal Flush for cozy village sim fans (“Fish, farm, raise animals, and befriend or fall in love with locals.”) And Godbreakers (#10) is a co-op behind-view ARPG with boss rush elements and some snappy combat.

And here’s all of the Top 30. FYI; the two other games we estimate at >50k extra wishlists during Next Fest are medieval hack & slash co-op roguelike Tears Of Metal and co-op RV simulator Long Drive North - both of which had significant momentum coming into the Fest.

That’s actually one takeaway we wanted to stress. In this complex, fragmented world where we can barely even keep up with what the Top 50 games are, you’re going to get continued momentum from games that already sparked interest - especially now Next Fest recommendations are randomized to start for algo tuning reasons.

So you’re seeing a lot less of ‘this game broke out from nowhere during Next Fest’ - as you’d expect with almost 3,000 choices - and a lot more of ‘this already-popular game layered on the extra interest with its demo’.

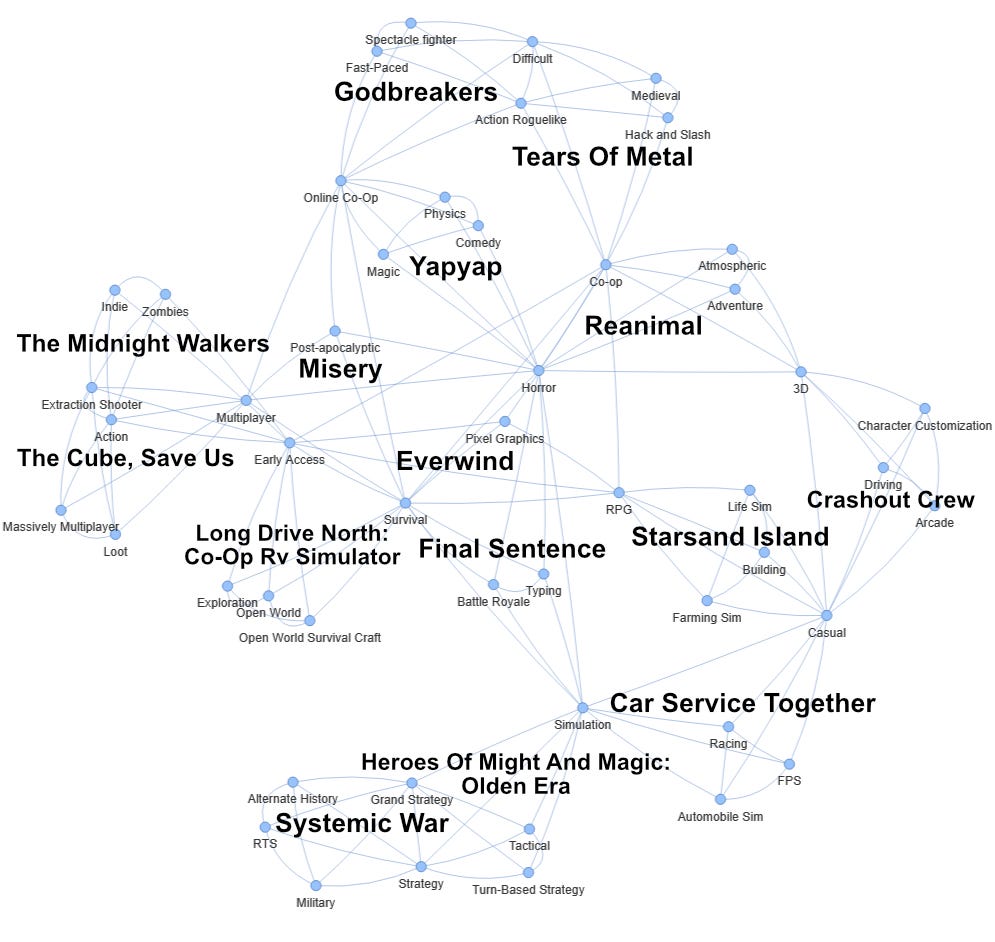

Thanks to Michael Chan for cooking up the above viz, based on the Top 5 Steam tags for the Top 15 ‘new WLs’ games. Games we didn’t discuss: Systemic War is a modern grand-strategy game, Crashout Crew is physics-based co-op mayhem from Peak’s co-devs, and Midnight Walkers is a zombiegrim extraction shooter.

Anyhow, we’re not seeing one particular style of game win out here - besides the co-op and co-optional approach. (Well, maybe a soupcon of survival, extraction shooter, and horror.) Rather, it’s a sampling of new games in a lot of the popular current genres and subgenres - or at least, the ones we think are hot.

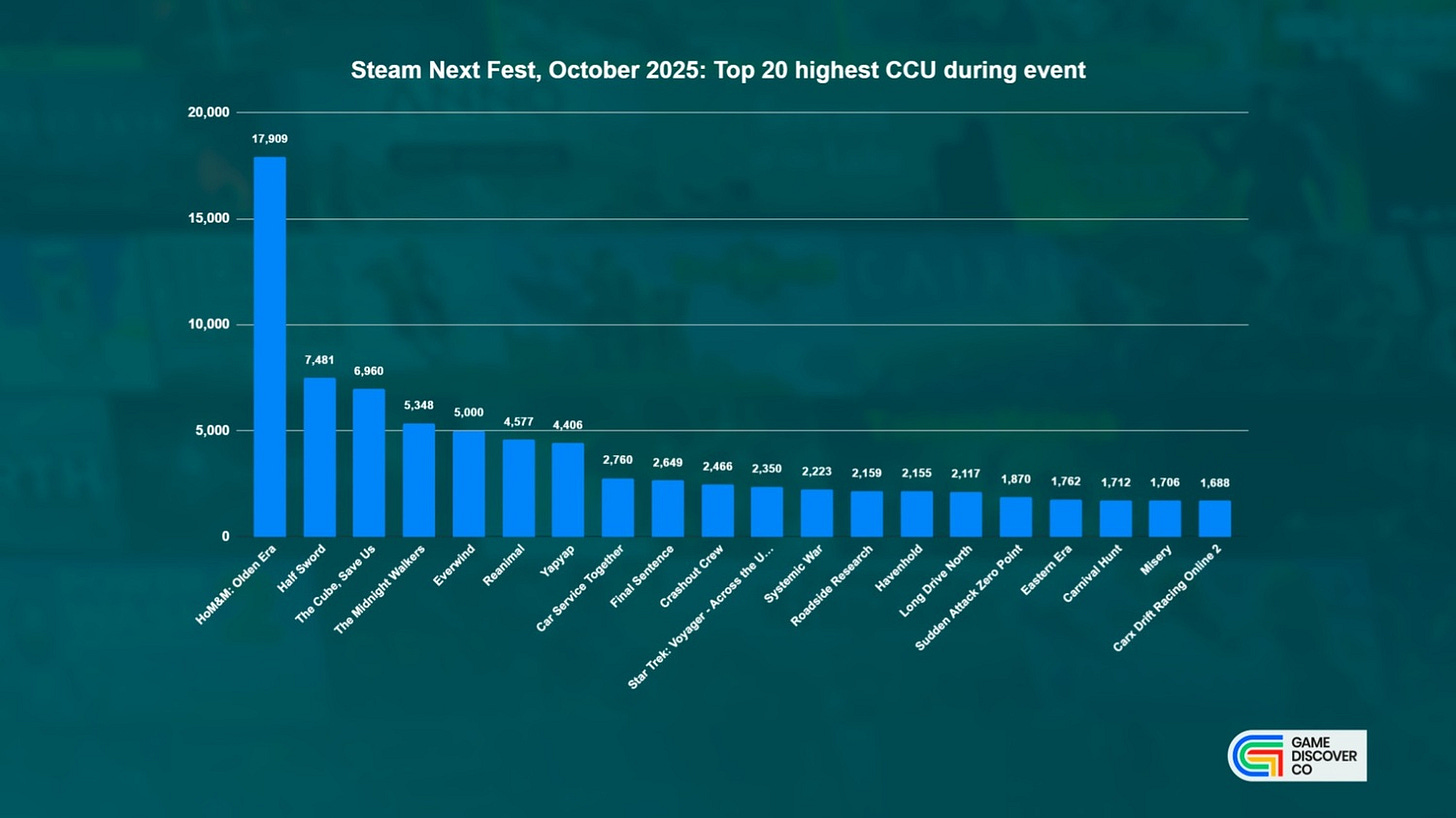

Now, concurrents. All of this is in the full GDCo-created NF doc, but for the record - seven of the top game demos in NF managed >4k CCU during the event, and fifteen made it to >2k CCU. (One of those, Long Drive North, launched its demo pre-Fest but only hit the ‘email our wishlisters about the demo’ button at Fest start - smart idea.)

And FYI: four of these Top 20 games - Heroes of Might and Magic: Olden Era, Half Sword, Everwind and Roadside Research - actually had bigger all-time high CCU counts before the Next Fest event. (Showing that Next Fest isn’t the be-all, end-all.)

Finally, let’s look at overarching trends across recent Next Fest events. Firstly, number of demos per edition, as far as we can estimate (numbers go up and down throughout the Fest):

There’s nothing surprising here - the halcyon days of 800-1,000 demos of 2023-early 2024 are gone, and we’re up at the ‘2,300-3,000 demos’ frequency that we’ve been seeing since last 2024. And we presume those numbers aren’t coming back down, ever.

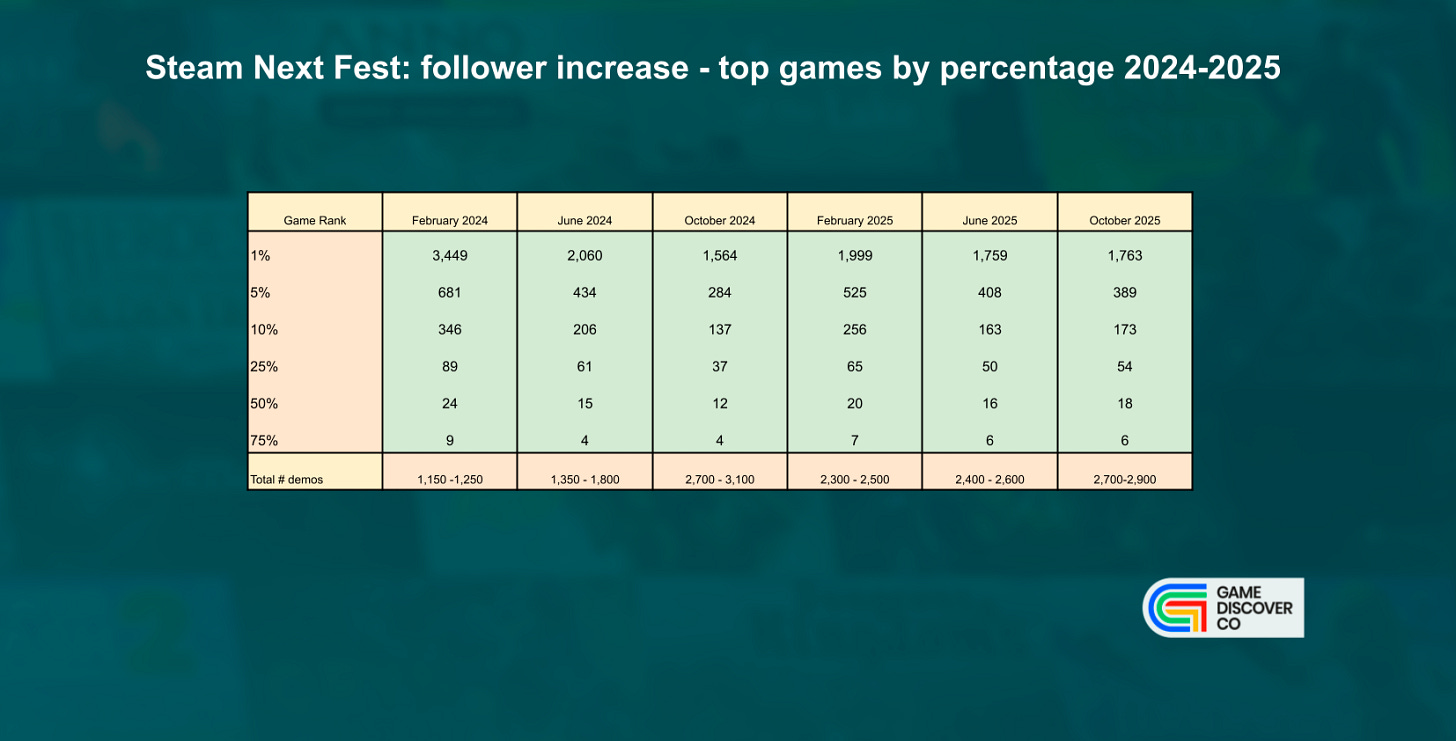

Secondly, we used Steam follower increase to look at how well certain percentages of games have been doing over the latest 6 Next Fests - if you’re in the Top 1%, Top 10%, etc. And the results were very similar to June’s totals:

What this means: if you were in the top 5% of all Next Fest demos, you added 390 Steam followers (probably ~7,000 wishlists), the top 10% got 173 new Steam followers (about 3,000 wishlists), and the median game added 18 followers (<500 wishlists) - whee?

Two more brand new stats, to finish everything off with a bang:

The majority of games (but by no means all!) decided to have a standalone demo page for their Next Fest demo, allowing reviews. (We have a tab showing lifetime Steam demo reviews in our giant doc.) 21.5% of all Next Fest demos had at least 10 reviews by the end of the Fest, and 45.5% had at least one.

How about AI usage for Next Fest demos? As Techraptor noted, “the exact total of games disclosing generative AI was 507 games out of 2960 titles in Steam Next Fest”- about 17%. Techraptor sampled usage for 100 games and found marketing/Steam store page assets top, followed by in-game art assets and audio assets.

Yes, we also have an ‘AI usage’ tab in our doc, identifying games, if not specific assets. And mega-thanks to GDCo’s Alejandro for putting together and visualizing all of this data. (If it’s any consolation, it’s not Sisyphean torture for him - he actually enjoys it.) And that’s it until the next next next Nest Fest - toodles…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]