What's the top-selling new Switch games of H1 2022 - and why?

We'll do some extrapolation to find out.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the second free GameDiscoverCo newsletter this week, starship captains and first officers. We’ll use the transporter room to beam to the Nintendo galaxy, visit the ‘game expectations’ monolith, and dive into the ‘too much news’ parallel universe.

Oh, and final reminder: only 4 days left for our limited time 25% off Plus deal, for anyone not hooked up with all that extra data, eBooks, Discord, exclusive Friday newsletter, etc. It’ll expire on Monday, so get on it. And… onward.

Estimating the top Switch games for 2022 so far?

Every day, GameDiscoverCo wakes up and asks - what information do we want to know that platforms do a poor job of exposing to us? And sure, there are more transparent platforms, such as Steam - and way less transparent ones, such as Switch.

Since Switch lacks public achievement profiles, CCU info, or user reviews, much of what we can extrapolate about it is from the limited ranking data available on-device on the eShop. But all is not lost! Let us demonstrate.

For GameDiscoverCo Plus, our data nerd Alejandro manually grabs info on the Top 30 ‘recent’ third-party games on the Switch U.S. eShop, such as Monster Hunter Rise: Sunbreak (above) - alongside its overall ranking in ‘most-downloaded Switch games over the past 14 days’.

This allows us to differentiate low-selling and high-selling #1s & how they ranked compared to ‘evergreen’ F2P downloads like Fortnite, Apex Legends and Rocket League. And that’s how we compiled the below chart which is our view on the top new third-party Switch games of H1 2022:

So this lists ‘the highest download ranking on the U.S. eShop’, and the number of weeks that the game stayed in the Top 30 of all downloads on Switch. (If the ‘chart weeks’ column has a * by it, the game is still in the Top 30 right now.)

What do we see here? Some impressions on the trends:

Success is being driven by licensed games & continued franchises: perhaps not surprising, but licenses (Star Wars, TMNT, MLB) and game follow-ups or DLC (Monster Hunter, Cuphead, Rune Factory) dominate the top games here.

‘Games coming to Switch late’ can still crush it: rebooting The Stanley Parable and bringing to consoles worked. Bringing Portal to Switch many years - after all the other versions - worked. Even the Chrono Cross remaster ‘worked’. People will pick up another copy of a game for Switch, if a huge enough profile.

Brand new indie IP isn’t getting higher up the charts - unless very Nintendo-y: OMORI - already a smash on PC and a very Nintendo-friendly Earthbound-influenced JRPG - is one of a handful to make it as a new franchise. (Triangle Strategy is new too, but is from the Bravely Default & Octopath Traveler director and has a big Fire Emblem influence - lots of Nintendo-y heritage.)

Maybe this is a little depressing for smaller indies? But that’s how it seems to be right now on the platform. The other unspoken message here is that it’s Nintendo’s platform, third-parties just happen to live on it. Let’s add first parties to the Top 10:

So yep, all those $60 Nintendo games are killing it, digital sales and revenue-wise. And if you look at Nintendo’s most recent yearly results (.PDF), 78.8% of all Nintendo software revenue is listed as being first-party. That’s quite a bit higher than Sony or Microsoft’s tallies on their own platforms.

As for how many units these third-party games are selling: your guess is a good as ours. We can see official numbers for some lower-selling first party games as a partial benchmark: WarioWare: Get It Together for Switch sold 1.27 million units across physical and digital from Sept. 2021 to April 2022.

And we know Triangle Strategy sold 800k units in its first couple of weeks. So perhaps games higher up these ‘Top 30 of H1’ charts will be selling higher hundreds of thousands of copies or even 1-2 million over time on Switch specifically. And the ones lower down will be in the low hundreds of thousands? (Further down the spiral: the ‘average decent title’ on Switch in 2022 can often sell single digit thousands.)

Anyhow, that’s some partial context as to what non-Nintendo games are actually doing well on the platform nowadays. Hope it helps, and good luck with your titles.

Your game’s reception vs. player expectation…

One of our favorite things to say re: game discovery: when you launch, do you have a ‘hype’ problem, or an ‘expectation’ problem? So we were happy to see Codecks & Maschinen-Mensch co-founder Riad Djemili expand on this concept in a recent Twitter thread. Firstly, here’s what he said:

“Controversial take incoming: STEAM REVIEWS DON'T REFLECT QUALITY. Rather they reflect matched player expectations, i.e. how much your actual game matches your steam store page marketing. I feel lots of game devs are not fully grasping this.

That explains how some super retro text adventures have 100% steam ratings. That explains how some AAA games with ultra-high production values have 70% steam ratings. These review numbers have no relation to how classic video game magazines used to rate games.

It is bad when game devs don't realize this dichotomy because they spend a lot of energy and time blowing up game scope without realizing that improving their communication might be a much quicker and easier path to improving their reviews. (Doing both is probably best.)

One game that really nails this idea is [hit minimalist city-builder] Islanders. I love their trailer which not only talks about what the game IS, but even more importantly what the game ISN'T. More games should do that!”

I definitely agree with about 80% of this ‘controversial take’, Riad. Most notably: when you have a game which has surface-level hook, you need to tune the trailers and visuals to make sure that people ‘get’ what the game really is. The more your game reflects what people think they see in the first 5-10 seconds of a trailer, the better.

Sometimes this is incredibly difficult. The example I’ve been citing recently is Pompom, a cute 2D Super Mario World-esque game where, as the first sentence of the Steam description says: “You don't control Pompom the hamster’s movements, you control everything else.” But how on earth do you explain that visually?

The only pushback I’d have on Riad’s take: if your game gets big enough, its Steam review score can vary a lot based on the type of crowd you have playing, recent patches, and community feelings. And that’s not always expectation-related issues: it’s more like waves of sentiment related to ‘what have you done for me lately?’

And ultimately, you can have 90% positive Steam reviews, and still have a reach issue. So if you’ve optimized your Steam page to perfectly explain your game to your target audience, but your target audience is only 5,000 people? Meh. So expectation is important, lest Mixed reviews sink your game. But big reach is even more so…

The game discovery news round-up..

Starting to wrap up this week’s free newsletters, let’s take a look at the things going on in the world of game discovery and platforms, shall we? And it goes a little something like this:

E3 is even more BACK again, baby, thanks to a ReedPop x ESA hookup for the June 2023 event. Interestingly, the full PR downplays the consumer side, saying it will welcome “publishers, developers, journalists, content creators, manufacturers, buyers, and licensors” but also “highlight digital showcases and feature in-person consumer components” - note the order of operations.

Bonus thoughts: post-COVID exhibit space for all game shows, including ReedPop events like PAX East is way down. So it’s reasonable for folks like GI.Biz’s Chris Dring to op-ed quizzically about his parent’s deal. But ReedPop & key new folks like Guy Blomberg understand game biz practicalities, unlike the ESA (more lobby than dev-vy?) or previous partner Dolaher Events (stuck deep in ‘operations-land’.) Meanwhile, Summer Games Geoff is still lurking….

In ‘more tech regulation’ news, “Europe's two new laws - the Digital Markets Act (DMA) and the Digital Services Act (DSA) - place tough constraints on how big tech standard-bearers like Apple, Amazon, Alphabet and Meta handle competition and online content.” Third-party app stores on iOS & no favoring of platform products (Apple Arcade?) are all possible. But the laws are rolling out staggered from late 2022 to 2024, and pushback is possible.

Jumped the gun in the last newsletter, but here’s the Steam blog about Next Fest for October 2022, and “please register your interest by July 21st.” Also notable in Steam-land - some big games that debuted during the Steam Summer Sale (F1, Sunbreak, Tiny Tina) & lost some discovery juice are getting a ‘make good’ Steam feature right now. First time we’ve seen this…

Game biz analysts* agree on one thing this week: line go down! Ampere’s report on the decline predicts “the world games content and services market will decline in 2022 to $188bn (-1.2%)”, due to Russia’s isolation and mobile privacy issues. On cue, Sensor Tower says mobile downloads declined, YoY and NPD is predicting a 8.7% decline in U.S. game revenue in 2022. And we didn’t even get to the recession bit yet! (*except Newzoo.)

No sooner had we talked about ‘Steam Deck alternatives not made by Valve’ than this AOKZOE-made “A1 handheld powered by an AMD Ryzen 7 6800U processor based on Zen 3+” popped up, showcasing SteamOS 3 & Elden Ring running at a pretty decent framerate. Fascinating to see how this develops…

Meta’s heads-down sortie into the metaverse continues, with Mark Zuckerberg himself announcing that “You won't need a Facebook account to log into Quest starting next month.” Of course, you will need “new Meta Horizon profiles that will essentially be people’s social VR identity” - but they won’t be real-name required, and you can have multiple accounts per device. But Zuckerverse wen?

Government regulation in Europe, Pt.2: the Microsoft/Activision deal getting a surprise late pickup by the UK competition authorities for scrutiny (the U.S. FTC is already all over it), and 18 European country consumer groups making loud growling noises about loot boxes. As you do.

Microlinks: the Meta-owned VR standout Beat Saber made nearly $100 million in revenue in 2021, according to local company accounts; Nintendo is letting you play the first Mario & Rabbids game free for a week if you’re a Nintendo Online sub; imagine if the rise of game sub services led to the lack of perfomrnace transparency currently on display in the streaming TV world?

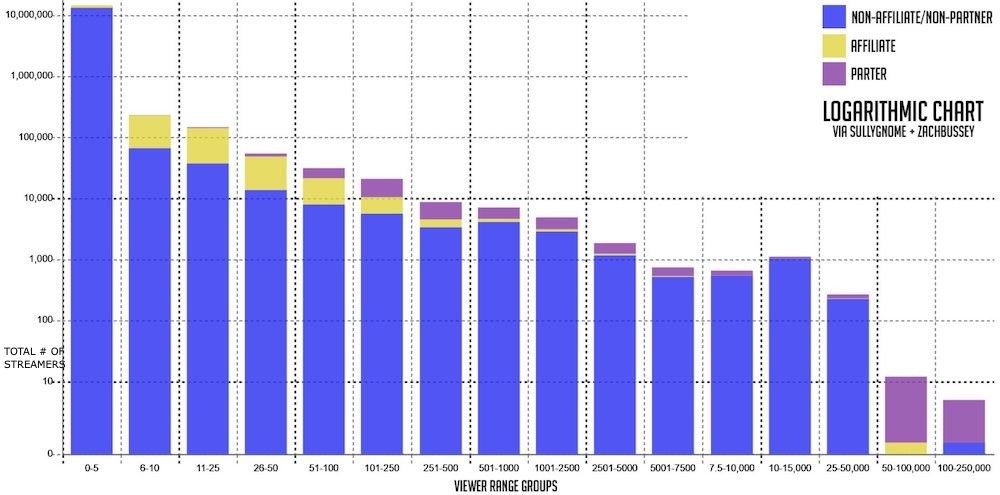

Finally, Today Offstream’s Zach Bussey had an interesting comment and graph on the amount & range of Twitch streamers in today’s busy, busy influencer space:

Specifically, as Zach explains: “The first half of 2022 had 15,014,380 [Twitch] channels go live *at least* once. 11.1% are Affiliates, 0.3% are Partners. If we *only* include Affiliates & Partners: An average of 6+ viewers is top 21%; An average of 26+ viewers is top 5%; An average of 250+ viewers is top 1%.” So there. And see you tomorrow, Plus subscribers!

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]