What genres do PC gamers want - and does it change?

We bring some time-based data to the equation.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Another week, another set of game discovery facts, figures, and suppositions to lob at y’all, eh? Hope you had a fine weekend, before being parachuted back into the complexity of the PC/console game market. Hopefully with a helmet & body armor.

Well, there should be lessons in today’s newsletter for you all, even if you haven’t raised $500 million lifetime-to-date for your game, like Star Citizen now has. (Yes, it really has. We can’t believe it either.) Anyhow, onward to the show…

[Only 8 days left for that 25% off a GameDiscoverCo Plus paid subscription deal, my little pretties. This includes an exclusive Friday PC/console game trend analysis newsletter, a big Steam ‘Hype’ & performance interactive data set, eBooks, a member-only Discord & more.]

PC game genres - the best places to play over time

So, we saw that Armello creators League Of Geeks finally announced its second title last week, Solium Infernum, a “hellish turn-based grand strategy game” for up to six players. It’s all about playing politics to become the ruler of Hell, and intriguingly is based on a cult 2009 game by Cryptic Comet.

Anyhow, this looks like a great title to announce for a ‘core PC’ audience, and it piqued our interest. Do we have data that would back up that claim, and how is that changing over time? (Do the core subgenres of the original still make sense in 2022?)

Many of you are aware that it’s possible to grab and rank the ‘top tags’ on Steam for released games. Some of you may also be aware that we do the same for unreleased Steam games in the GameDiscoverCo Plus data set, based on our ‘Hype’ score.

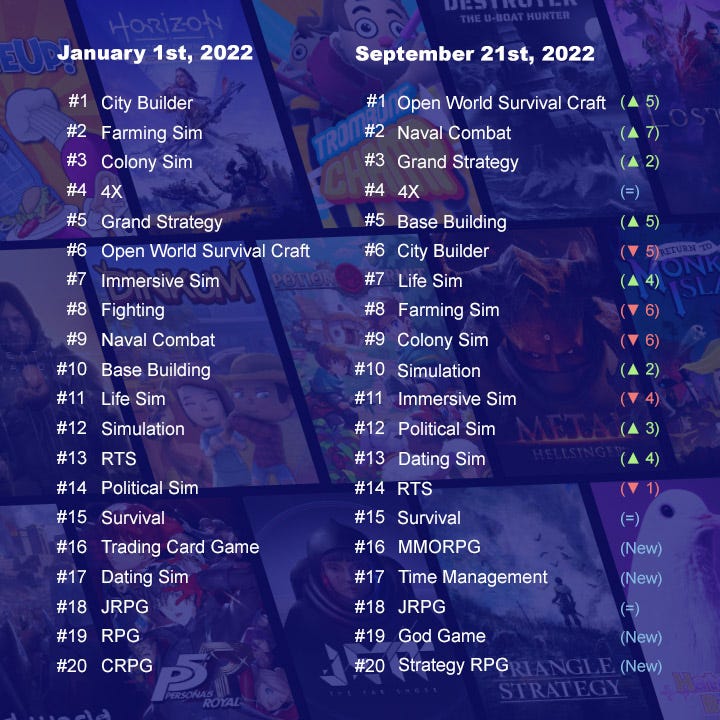

Now we’ve been doing this for a while, we can look at the top genre and subgenre-based tags over many months. Here’s the most-awaited PC genres, ≈10 months apart:

Interesting, huh? Firstly, it looks like Solium Infernum’s core subgenres still make sense in 2022. Grand Strategy is either #5 (10 months ago) or #3 (now) - and Political Sim is also in the top 15. But let’s talk about larger lessons from PC genre trends:

Over time, specific subgenres stay in high/medium/low bands: the most-awaited PC games nowadays are deep, strategic ones. These tags are inching up and down by 5-10 spots, but are overall still highly ranked & good possible targets. They have ≈5x-10x median interest as the lowest-interest genres.

More complex genres are higher barrier to entry: Perhaps ‘grand strategy’ or ‘life sim’ titles cost more to design and make - so there’s fewer of them, but they’re higher quality. Yes - but that doesn’t diminish the fact that players are more excited about the games that do get made in those genres.

Player interest changes - if at all - over years, not months: I get asked if this type of data can predict particular genres to get in or out of. The answer is: possibly, but it’s difficult to differentiate bobbles from trends. For example, Farming Sim - white-hot right now - dipped from #2 to #8 this year. If it drops out of the Top 20 in another 12-24 months, that’s a trend. (It might go back up!)

‘Easy to make’ genres often cluster near the bottom. You can’t see it here, but from the 93 Steam genre tags we follow, 2D Platformer, Top-Down Shooter, Puzzle Platformer, and Twin Stick Shooter are all in the bottom 25. This is an indication both that it’s super simple to make these (lots of Unity Asset Store starter kits, etc), and that interest is lower for them overall.

We also discovered - when doing client work - that trending pre-release tags (especially less used non-genre ones) can be affected by the release of one super-hyped game. For example, around Stray’s release we saw a big boost in tag ranks for Cats & Cyberpunk - fun, but not necessarily an indication of cat games taking over?

So, in conclusion: the data still needs a lot of interpreting, and there are all kinds of caveats. But deeper strategic and sim-centric gameplay for a ‘core PC’ audience has a greater chance of ‘hype’ (and sales) on PC nowadays. Any genre can still be a hit, though.

Of course, the problem for legacy publishers is that this won’t always fit with their wish to have multi-platform winners. There are still some multiformat crossover game genres: farming sims and Metroidvanias in particular for indies, and AAA level RPGs and 3D action games on the high end. But.. threading the needle is getting harder?

How the games press sees the game biz in 2022?

The folks at PR firm Big Games Machine have been kind enough to publish a giant survey where “over 160 journalists share their thoughts on the state of game journalism in 2022 and what PRs and game studios can do to improve their chances of coverage.”

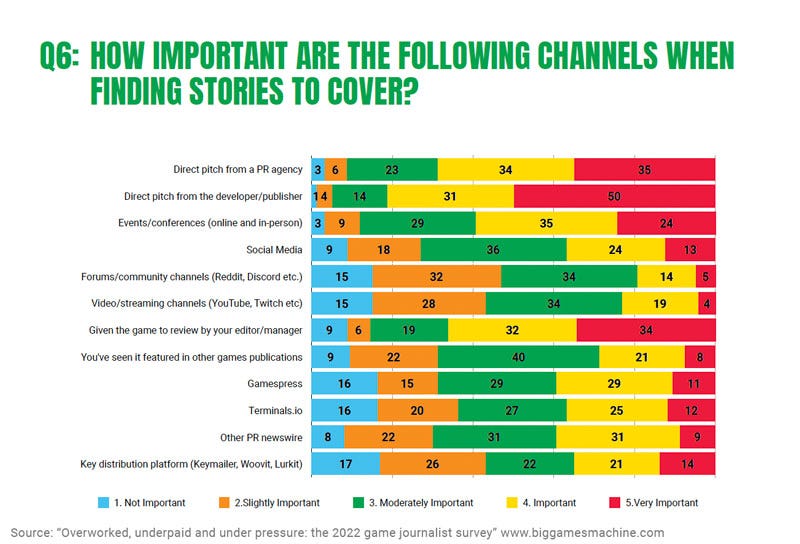

While - as we’ve discussed in the past - streamers seem to be a more important method to discovery than the trad games press, there’s still much worth in pitching for coverage. And this very handy survey has some of the following takeaways:

There’s a LOT of incoming interest from developers: The survey notes: “Over half of the journalists we surveyed receive between 11–50 pitches and/or review requests every single day, and over one-third receive 20 or more. Amazingly, 8% of respondents said that they receive 50 or more... Every. Single. Day.” Yikes.

Don’t think the ‘press’ just writes words on a website: over 50% of those surveyed also participate in on-demand or streaming video, and 40% are engaged in podcasting in some way. So remember you can be possibly be featured in custom video or audio, too.

Direct pitching is a very acceptable way of getting coverage: as you can see from the above graph: “Over 80% of respondents said being pitched a game directly from a developer or publisher was ‘important’ or ‘very important’.” But PR and events are also fine - and these folks pay a bit less attention to streamers for discovery.

These people appreciate pitches that get to the point: Three direct quotes from journalists: “Don’t make me ask for assets. I should have everything I need within your first email to write a story.” And also: “Try to shrink the pitch. Get directly to the point in just 2-3 paragraphs.” And: “Include basic game info in a nice summary block somewhere (platforms, ESRB rating, release date, dev name, publisher.” Yes..

The full survey also has a bunch of other insight on subjects as abstruse as preferred way to access media assets (Google Drive and Presskit come out top), how soon before release they want to be given a review build of a game (three weeks!), and lots more.

Oh, and there’s an unrelated but relevant Twitter thread by Aura on this exact subject - getting trad press attention - that it’s worth citing, to end: “A combination of way more indie games and the games press crunch means the surface area in press coverage is almost not a thing… if you're expecting to send out press releases and have anyone cover them, understand the chances of that are near-zero.”

Still, she believes you can occasionally get lucky with indie-focused writers, or get on people’s radars by being in a showcase event, which can help the press combine with demos and streamer coverage to create… a good discovery time for all?

The game discovery news round-up..

Well, we’ve reached the game platform/discovery round-up endgame. We have almost 30 (!) items to sift through here - so let’s make a start on cutting it down to size:

E3 2023’s Los Angeles Convention Center dates are confirmed - “‘Business Days’ from June 13 to June 15 and ‘Gamer Days’ open to the general public on June 15 and June 16”. And GI.biz’s Chris Dring - involved as part of ReedPop - is continuing to liveblog the thinking behind the event, which is aiming for a ‘big tent’ approach. (The meeting app will feature companies not even exhibiting at the show, for example.)

Microsoft’s CEO Satya Nadella appeared on Bloomberg TV and was asked - predictably enough - about the Activision deal. Derek Strickland has the full quote ‘in the open’, but Nadella feels “very, very confident” the deal will close, adding: “We’re number 4 or number 5, depending how you count in gaming, in fact the number 1 player in this case, Sony, even in this period has acquired 3 companies.” OK.

So yes, the Pico 4 VR standalone headset announce rolled out, but “will initially be available in Japan, South Korea, the UK, France, Germany, Spain, Italy and eight other European countries.” Huh - Bytedance is avoiding a U.S. hardware war with Meta for now, despite signing Ubisoft’s Just Dance as an exclusive & announcing Pico Worlds (above). (More good coverage via Protocol.)

In the F2P mobile space, Matej Lancaric is delving even deeper into the evolution of fake ads, pointing out ‘fake core gameplay’ is starting to become prevalent: “Top War also uses merge gameplay that is the center of the onboarding, and later on it also transitions into a 4X game.” Imagine your user acquisition team injecting gameplay concepts deep into your game? That’s totally what’s up.

Platform microlinks: Microsoft eases DRM restriction on many disc-based Xbox One games running on Series X consoles; Apple is the top funder of the lobby group that says it represents small developers; the Android-based Amazon Appstore - including games - is rolling out to 31 countries on Windows 11 machines.

What’s new with Netflix Games? There’s a new Helsinki-based internal dev studio headed by former EA and Zynga exec Marko Lastikka, and the platform’s Tudum event rolled out the Netflix version of Oxenfree (since Netflix bought the dev, Night School!), also trailing games like Spongebob Squarepants: Get Cooking, Nailed It! Baking Bash, and Stranger Things: Puzzle Tales.

ICYMI: Steam rolled out a whole new set of Top 100 weekly/real-time charts. We actually talked about this a lot more in Friday’s Plus newsletter, including some discovery ramifications for ‘Top-Selling’ now including F2P/IAP-driven games. (Yes, there’s more top F2P titles in the Featured/Recommended box.)

Some interesting anecdata on Core’s reach in the latest Naavik newsletter: “A developer of one of the top games on Core told me their game has about 10-15 concurrent users on average. With 100 or so daily active users in a top game and only 1-2% of players spending, the revenue is barely enough to pay a creator’s phone bill.” (The piece is maybe too credulous on Core’s Web3 pivot, but hey.)

There’s a new ‘Steam data benchmarks’ page at HowToMarketAGame, which uses a fresh ‘cut’ of survey data of GameDiscoverCo’s for one of the answers - ‘How many of my wishlists will convert in the first week?’ It’s also a good rough guide to big questions like ‘How many wishlists should I earn on a typical week?’

Non-platform microlinks: What do games actually look like during development?; unlike those young folks, 80% of all 50-plus video gamers play video games alone; Rami Ismail on the difference between a prototype and a vertical slice is a very well-done explanation of a complex problem.

Finally, loved this chart from Axios’ Stephen Totilo and Tory Lysik (go sub to Axios Gaming!) on the NPD U.S. sales rankings boost for select PlayStation Studios titles, following their PC launch:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]