What are your Steam wishlists 'meant' to do after release?

Also: we're looking for your best pitch decks.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back - and you definitely caught up on your entire backlog of GameDiscoverCo newsletter while we were out last week, right? Excellent, we’ll be checking later. Luckily, we’re raring to go, with lots of fresh content between now and Xmas.

And we start with a request: we’re looking for your best PC/console game pitch decks, for a new (free!) section of the GameDiscoverCo website. Why? There are some existing resources out there, sure. But we want more decks, more regularly updated, to inspire others.

How do you get them to us? Just email us a link to the deck, having got permission from the dev and publisher (as necessary!) Extra notes: you can redact the specific $ you were asking for (if you want!), and games can be released or unreleased…

[REMINDER: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, six detailed game discovery eBooks - & lots more. ]

Steam wishlists and discounting: underdiscussed?

You may have heard, ad infinitum, that you really want more Steam wishlists (& followers) by the time your PC video game comes out on Valve’s platform. Why? Then more people will get notified at launch - and every time you discount by 20% or more.

But oddly, there hasn’t been a lot of analysis regarding what happens to your Steam wishlists in the months and years after release. What’s ‘normal’? Can you mess things up by discounting too much and burning all your ‘good’ wishlists?

We’ve been taking a look at this recently - a couple of clients hadn’t been discounting at our recommended frequency of 10-12 times per year on Steam and Switch, partly because they were concerned about wishlist fatigue, or weren’t sold on upside.

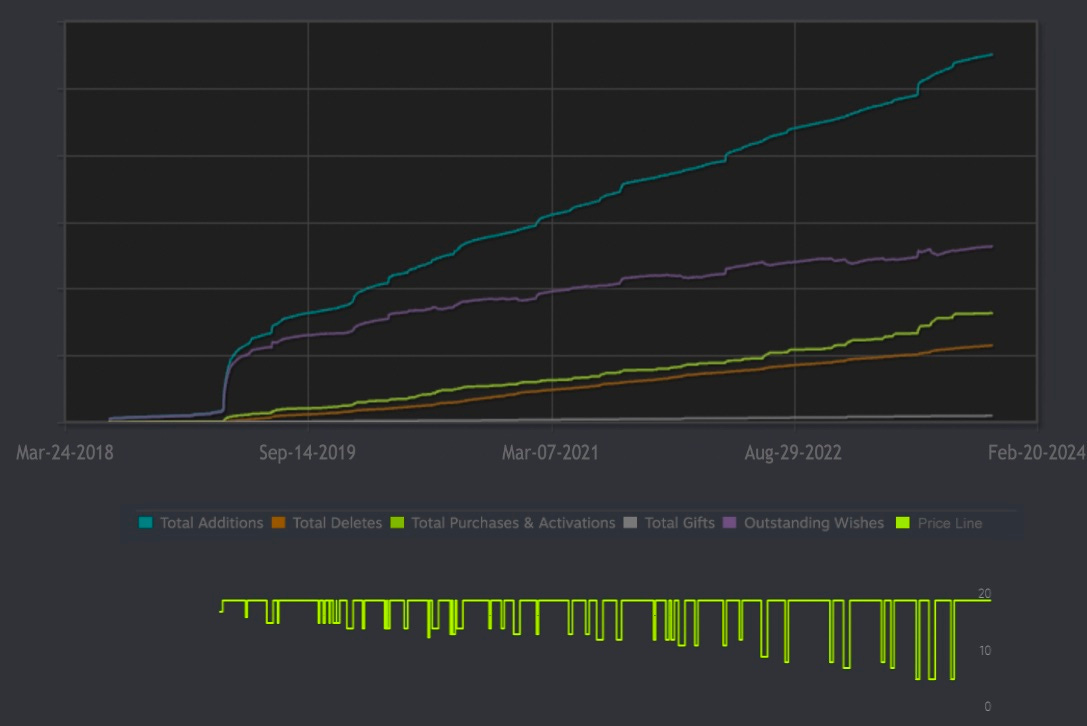

So we’re presenting an anonymous example. And from Steamworks data, here’s what we think a ‘normal’ premium Steam game looks like - wishlist additions are in blue, and wishlist balance in purple.

You’ll also note that we’ve mapped discounts (the green graph on the bottom, sourced from SteamDB) onto this graph, for this premium-first game (well-received, but no major updates or DLC) that’s been out for about 3 and a half years:

The main takeaways from this, bearing in mind that the vertical ‘pop’ at the left of the graph is Steam’s launch day for the game:

There’s often a big wishlist balance boost at launch: though many people buy your game on launch day, lots more wishlist it for ‘later’! Your Steam wishlist balance often tops out shortly after launch, between 2x (lower-end) and 4x (higher-end!) of pre-launch Steam wishlists. So: 100k-200k if you launched with 50k WLs?

Discounting repeatedly adds wishlists, but also purchases and deletes: every time you put the game on sale, you get more wishlist interest (as its discoverability surges), as more people buy from wishlists (green line) or delete their wishlist (very steady, increasing brown line!)

Extra special wishlist addition bumps happen when ‘featured’: you can see the blue line jump up in a few places here. It’s due to front-page Steam visibility - via a publisher sale, a ‘Deal Of The Day’, or being a featured game in a ‘big’ Steam sale. (Suddenly, more people become aware of your game, and WL for later!)

From what we’ve seen, it’s super-difficult to drain your wishlist balance entirely by putting the game on sale. (This game still has a wishlist balance that’s 87% of its peak, 40-ish discounts later!) And in fact, high-profile discounts often boost your discovery.

And since you get many multiples of your daily revenue every time you go on sale - why would you not maximize discount frequency intelligently? (It doesn’t seem to affect ‘resting’ unit sales rate at full price.)

So, for most games (95%+ on Steam?) the wishlist balance does dip a bit over time. But as a bonus novelty, here’s a fan-favorite game where the opposite happens - wishlist balance ‘line goes up’, no matter how many discounts:

At first, we thought this was incredibly rare. (And it is fairly scarce, in portfolios we’ve looked at.) But we talked to clients, and found some others, in the following categories:

‘Good SEO’ games that are well-made: if you have a game that fulfils a particular niche need and doesn’t have many peers, such as ‘X Simulator’, you’ll get a lot of organic search success on Steam, and your wishlist balance will keep +++-ing.

Commercial successes that are in under-supplied genres: we found an example of a hit IP-licensed title in a relatively competitor-light genre, which maintained a steady wishlist balance over many discounts and months.

Having a steady or increasing post-launch Steam wishlist balance isn’t a goal. You shouldn’t change your strategy based on it. And plenty of multi-million dollar grossing games don’t have it! But if you do have it, it’s an indication you have great organic wishlist additions or another USP - you might want to reverse engineer why.

We’ve done a couple of newsletters on discounting before. And to end, we’d like to refer you to these for best practices: : here’s key discounting strategies (Jan. 2021), and here’s why players say you can’t discount your game too often (Sept. 2021). Oh, and Joel Burgess on discounting (Oct. 2022.)

One final question: who is in charge of discounting at your developer or publisher? Sometimes there’s no clear ‘owner’ of discounting, and this can lead to dropped balls (and revenue!), if you’re to believe - as we do - that a detail-oriented, mechanical approach is needed. (Or maybe you’re fine, in which case, we’ll wave you on…)

The state of mobile game publishing in 2023?

We’ve mentioned before that we’re mainly a PC/console (and VR, sure!) game discovery newsletter. We don’t get too deep into mobile, which is a whole other world. (Also a complex and shifting one, btw.)

But we like to check in, which led us to Kwalee’s John Wright and his ‘state of F2P mobile game publishing’ posts on LinkedIn, now compiled together into a giant Google Doc. Wright, a 10+ year veteran, def. knows the market very well.

You should read the whole document. But here were our key takeaways from it, relevant “especially on iOS after the IDFA deprecation”, which makes it way more difficult to target paid ads:

The ad-driven ‘disposable’ hyper-casual game is on the way out: John says: “Hyper-casual games are still present but no longer as dominant as they were two years ago. Games are returning to being more intricate, with deeper meta, longer LTV, and extended shelf lives.”

It’s getting more difficult to break through from scratch: mirroring PC/console issues: “Fewer new games are breaking into the top 20, and even fewer new studios are achieving success. Unlike two years ago, it's mainly the larger players who are dominating the market.”

User Acquisition (UA) has ‘become a more refined art’: he suggested that in the paid UA space, “companies that excel in this field have large teams of experts & the resources to test more aggressively across various channels”, part of a trend where ‘familiar classics’ are crowding the Top 100 U.S. iOS games by revenue.

One thing we found super-interesting was the fact that during the hyper-casual boom, pure ‘idea virality’ could get games to the top of the charts. Wright says: “Two years ago, a game with a 40-50 IPM [app installs per 1,000 ad impressions] would ensure a top chart position and profitability.” But that's no longer the case.

He also talks about a prospective Kwalee-published game which had “an impressive 40+ IPM and a pLTV [player lifetime value] of.. 55 cents”, formerly would have scaled impressively. But in today’s market, “our average CPI [cost per install] exceeded… 80 cents [i.e. $0.80], even with an IPM of 40.”

And even we, with our limited understanding of the super-complex ‘paid ads’ world on mobile, understand that if a game has to pay out 80c to acquire a player, and then gets 55c from that player in lifetime value), it won’t work.

Kwalee - and other companies - are optimizing around this, “testing fewer games” to target those that can make $5-10 million or more lifetime, and “investing 25 times more in user acquisition per title” for those who reach that criteria. Seems smart.

And market-leading games like SayGames’ My Perfect Hotel (above video, as analyzed by Matej Lancaric) are examples of titles that pay to acquire users a bit more inexpensively, due to a casual-adjacent look, but then still monetize them via both ads and IAP. That’s the future?

The game discovery news round-up.

Finishing up for this first newsletter back, we sure have a lot of links to check out. But let’s grit our teeth and get down to it shall we? Hey presto:

Looks like there’s a big Fortnite in-game event happening on December 2nd, which leaks suggest “will star rapper Eminem, and reveal three major new game modes coming to Fortnite: a Lego tie-in, a racing game called Rocket Racing, and a musical rhythm-action game called Fortnite Festival.” Here’s more on the Rocket League x Fortnite crossover rumor - this looks like the big ‘Fortnite multiverse’ expansion.

The U.S. ESA trade association fielded a survey, and 72% of kids really want video game stuff for Xmas, more than any other category (gift cards, clothes, phones): “with the top five specific asks being for game subscriptions (39%), game consoles (38%), game gear/accessories (32%), in-game currency (29%) and physical video games (22%).”

Two notable things after Steam’s new Argentina & Turkey pricing hit on Nov. 20th. First: devs saw a big spike in sales from these countries before changeover. Second: some headlines over giant price increases are cos: “If you don’t add a USD price to [LATAM-USD & MENA-USD], we will default to the standard USD pricing you already have in Steamworks.” So you need to go set a price ASAP, if you didn’t!

Since you can see ‘# of copies sold in last month’ for Amazon items nowadays, people have been adding up SKUs, with at least 132,000 Switches, 103,000 PS5s, and 28,000 Xboxen sold during November. (Clarifying note: “Xbox [Series X] was out of stock… the whole week of Black Friday”, except for a few hours. Huh.)

Microlinks: the 5 biggest indie game press kit mistakes; 32-33’s Michal Napora did a talk on ‘how to say the right things about your game’; a good trends piece called ‘What the heck is happening in live service gaming?’

Checking out StreamElements and Rainmaker.gg’s game streaming trends for Sept and Oct (above), they provide a breakdown of first-week Twitch hours streamed for the top debuts so far in 2023: “Diablo IV - 70M hours; Hogwarts Legacy - 50M; Baldur’s Gate 3 - 22M; The Legend of Zelda: Tears of the Kingdom - 22M; Starfield - 18M; EA Sports FC 24 - 15M; Street Fighter 6 - 12M.”

Netflix things: a survey of UK/US subs reveals that 43% of Netflix subscribers are aware of Netflix Games, and 16% have played one; Netflix’s Leanne Loombe has been talking up the cloud: “Sometimes the games we launch on Netflix will be across mobile and TV and PC through the cloud. And sometimes there’ll be a cloud game that’s playable on TV and it will be really tailored to that experience.”

Charts? Europe’s October 2023 GSD charts show “10.21 million PC and console games were sold… a slight drop of 2.3% year-on-year” due to CoD’s shift into November, and “PS5 sales up 143% over Oct last year” - no hardware shortage! In the UK, Spider-Man 2 has neat stats: “the first two weeks are nearly 9% lower than 2018's original Spider-Man, but 94% bigger than 2020's Spider-Man: Miles Morales.”

Two more Fortnite things: age ratings are now in effect for all Fortnite ‘islands’, including UGC. But the age ratings have “left players frustrated after many popular cosmetic [outfits] have become unusable in certain parts of the game in order to meet ratings requirements.” The fix will be to “auto-adjust appearance based on the island you want to play”, apparently. [EDIT: oh, and they’re rolling cosmetic gating back “until we have a long-term solution in place”, starting on Dec. 3rd.]

At last, “Sony has [re]-introduced Star Ratings on the PS Store, meaning players can get an idea of how any given game has been received by fellow players before making a purchase.” (Yep, this was in Beta for a couple of months on PS5, and used to be available on the PS4 store. But it’s only rolled out widely to all PS5s now.)

Microlinks, pt.2: Nintendo is releasing an adults-only N64 Switch app in Japan to allow 18+ games like GoldenEye; YouTube Playables - playable games on the YouTube app/website - are now available for YouTube Premium subscribers; TikTok owner Bytedance is allegedly winding down its Nuverse division, publisher of Marvel Snap; here’s Steam’s top new releases in October 2023.

Finally, we’ve featured indie dev Luke Muscat’s ‘new game’ YouTube experiments in the newsletter. He’s also known for seminal early smartphone games. both Fruit Ninja (great ‘making-of’ video), and now Jetpack Joyride - check his ‘how I did it!’ vid:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Interesting analysis! I'm primarily a wishlist-wait-for-discount buyer. I rarely pay full price or buy a game at launch. For consumers not consumed by the FOMO itch, it's a much more affordable and interesting approach, especially since you tend to buy games you wouldn't normally consider.