The state of Steam wishlist 'conversions': 2024-2025

Also: the big Steam debuts of the week, and a hunka chunka news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and - love or hate us for it - we have a bunch more handy information for you about PC and console (and some other!) game platforms. Or your money back. Which, if you’re not paying us anything, could be tricky.

Before we start, our buddy Chris Baker wrote something great about the new manga exhibit at the De Young Museum in San Francisco, which we just visited. Gotta say - seeing original One Piece, JoJo’s Bizarre Adventure and Ranma ½ art - plus a mini-exhibit on the printing process - felt like a wondrous ‘high art/real art’ bridgepoint.

[WANT LOTS MORE DATA? Companies, get much more ‘Steam deep dive’ & console data SaaS access org-wide via GameDiscoverCo Pro, as 80+ have. And signing up to GDCo Plus gets (like Pro!) the rest of this newsletter and Discord access, plus ‘just’ basic data & more. ]

Game discovery news: Battlefield 6 dominates…

Starting off with that hunka chunka game platform & discovery newsola, it reads as follows:

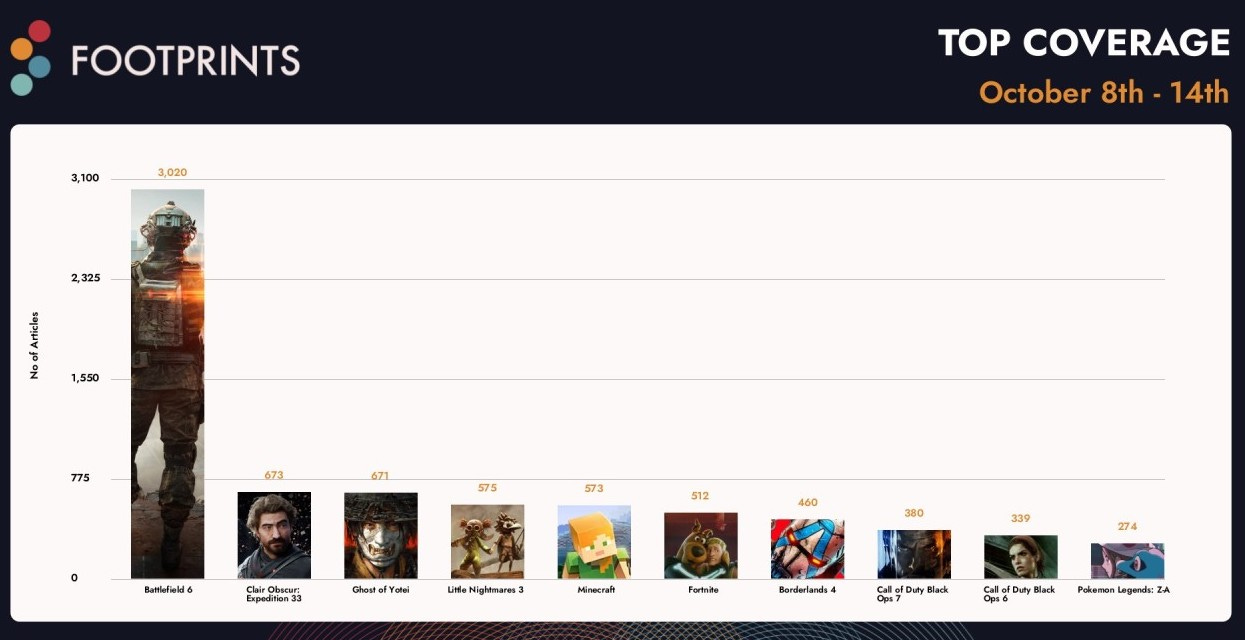

The latest Footprints.gg ‘trad media’ charts (above, put together by our friends at ICO) show EA’s Battlefield 6 - which sold 7m units in its first 3 days - absolutely dominating the charts. Also in there: Clair Obscur (5m copies!), Ghost Of Yotei, Little Nightmares 3 & more…

Bloomberg is reporting ($) that “Nintendo… has asked suppliers to produce as many as 25 million units of the Switch 2 by the end of March 2026.” (Y1 analyst estimates are currently 17.6m.) David Gibson adds: “Production was already at 24/7, but what is likely to be happening is that the normal reduction in production Oct-Feb does not occur.”

The dev of house design game Furnish Master has done an excellent, detailed postmortem on selling 100,000 copies on Steam, listing top sales drivers, viral TikTok posts, Steam festivals, and a Daily Deal among them. One note: “the wishlists from ads were of worse quality [and] converted into sales less effectively.”

While Xbox native console releases aren’t dead, they continue to fade away a bit - the devs of Absolum recently clarified: “it’s pretty rare for us to release on EVERY platform and in this case, [launch on] Xbox… wasn’t a priority.” (However, a “stay tuned” update from Dotemu indicates they might now be thinking about it.)

As VGC notes: “Microsoft support for Windows 10 officially ends today, but a third of Steam players still use it.” And yes, that means no security updates as default, although as Microsoft says: “The consumer Extended Security Updates (ESU) program can protect your Windows 10 device up to a year after October 14, 2025.”

The folks at Itch.io have been having a rough time with getting DDoS-ed, with a multi-hour downtime because “our host’s DDOS ‘protection’ is to just turn off our site.” (Yes, they did an ‘emergency migration’ - wonder if it’s the same DDoS source which was potentially involved in Steam/Riot downtime the other week…)

Steam things: Valve added a public page to see all bundles related to a game, as previously, only the Top 3 by revenue were shown; the top new Steam releases of September 2025 page is up, with the Top 50 titles sorted randomly within tiers.

Gurning at this LinkedIn post from No More Robots’ Mike Rose: “How to succeed in video games in 2025: Step 1. Find success between 2015 - 2021.. Step 2. Don’t let it go to your head.. Step 3. Use that success to springboard to more success in 2025.. Step 4. All the new people in 2025 will think you had success out of nothing.. Step 5. Watch as other people try to clone the success you had, unsuccessfully, because they missed Step 1.”

Roblox things: the curation team explains how it picks the editorial ‘Today’s Picks’ homepage section - quality, size, game health; Kongregate co-founder Jim Greer (at Roblox for a while!) is running a new internal team “dedicated to bring ambitious games in diverse genres to Roblox”, working with trad devs, publishers, IP.

The ROG Xbox Ally PC game handhelds are out, and reviews differ - Tom’s Guide digs the $1,000 Ally X, but The Verge feels like the OS and overall experience “isn’t fully baked”. Oh, and Roblox announced an Xbox Ally SKU, saying: “Players who [play the game] across multiple devices… spend 2.5x more and play 20% longer.”

Microlinks: the PlayStation Plus Game Catalog additions for October includes Silent Hill 2, Until Dawn, V Rising, Yakuza: Like a Dragon; Apple releases a second-generation Vision Pro with “considerably less fanfare”; ‘games as platforms’ bulletin = PUBG Mobile added a horror-ish 4 vs. 1 mode. (Via GameRefinery.)

The state of Steam wishlist ‘conversions’: ‘24-25

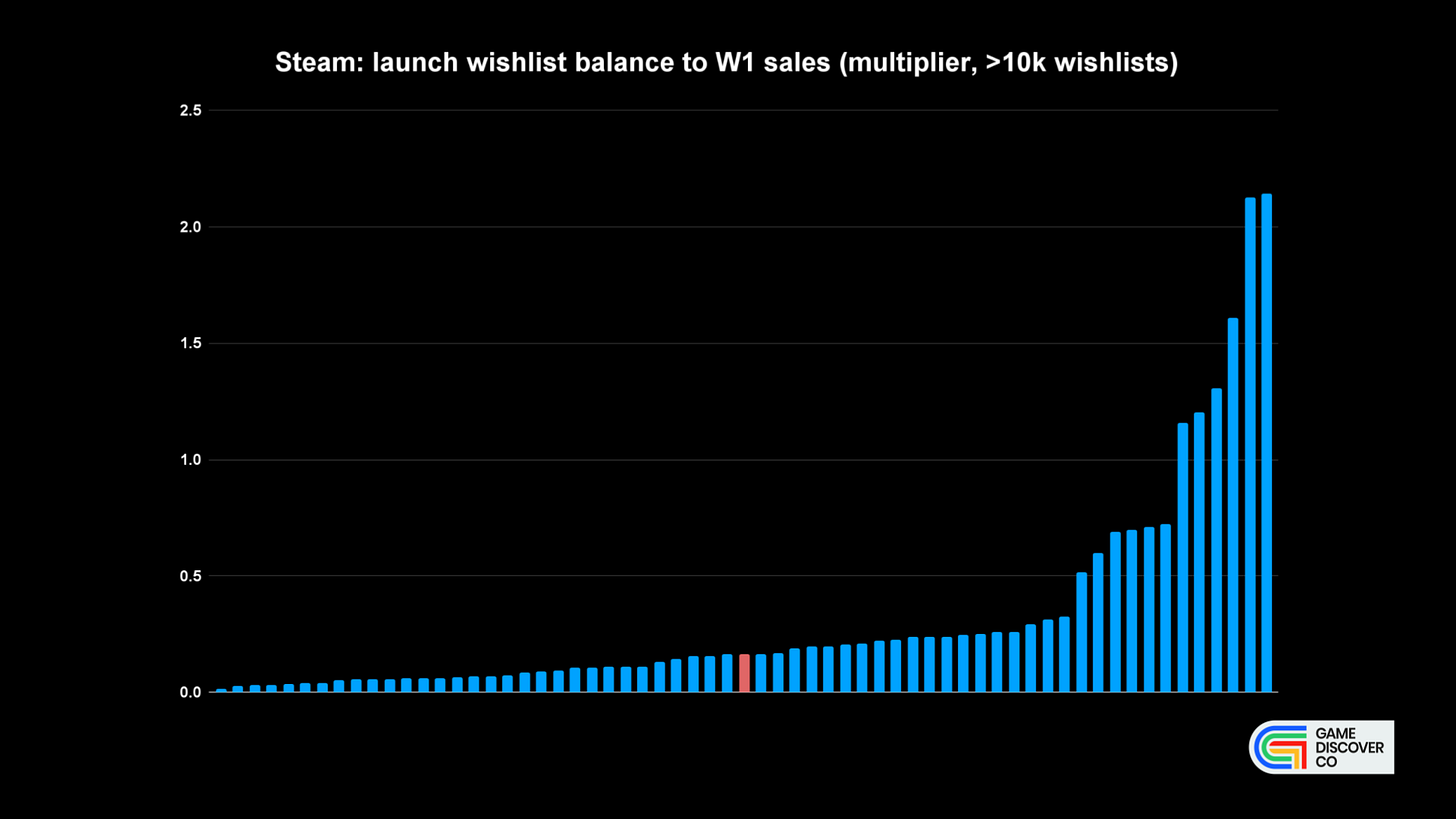

To start off: yes, we’re aware that the idea of wishlist ‘conversions’ on Steam as some kind of reliable metric is near-fatally flawed. Why? Because the performance range of ‘wishlists at launch’ compared to ‘sales at the end of Week 1*’ varies by 10-20x, not 10-20%. (*We’re including both ‘purchases from wishlist’ and organic purchases in this number.)

We’ve covered this a few times, and here (above) were the results of an anonymous publisher/dev poll we did in 2024. The median was 0.17x if you launched with >10k wishlists (so: 50k wishlists, 8,500 total sales at end of Week 1), but it was as low as 10% of that, and as high as 10x that. So…. that’s great for your forecasts, huh?

But we still think this data is useful, for two reasons. Firstly, it allows us to basically quantify possible outcomes, and see if they differ by month or by type of game. And secondly, it lets us group together high and low performers and work out what happened.

So, having added ‘wishlist balance to Week 1 sales’ estimates for all Steam games over the past 2+ years for GameDiscoverCo Pro subscribers, we’re yoinking that (externally estimated!) data for the first time, and doing a macro-analysis of it.

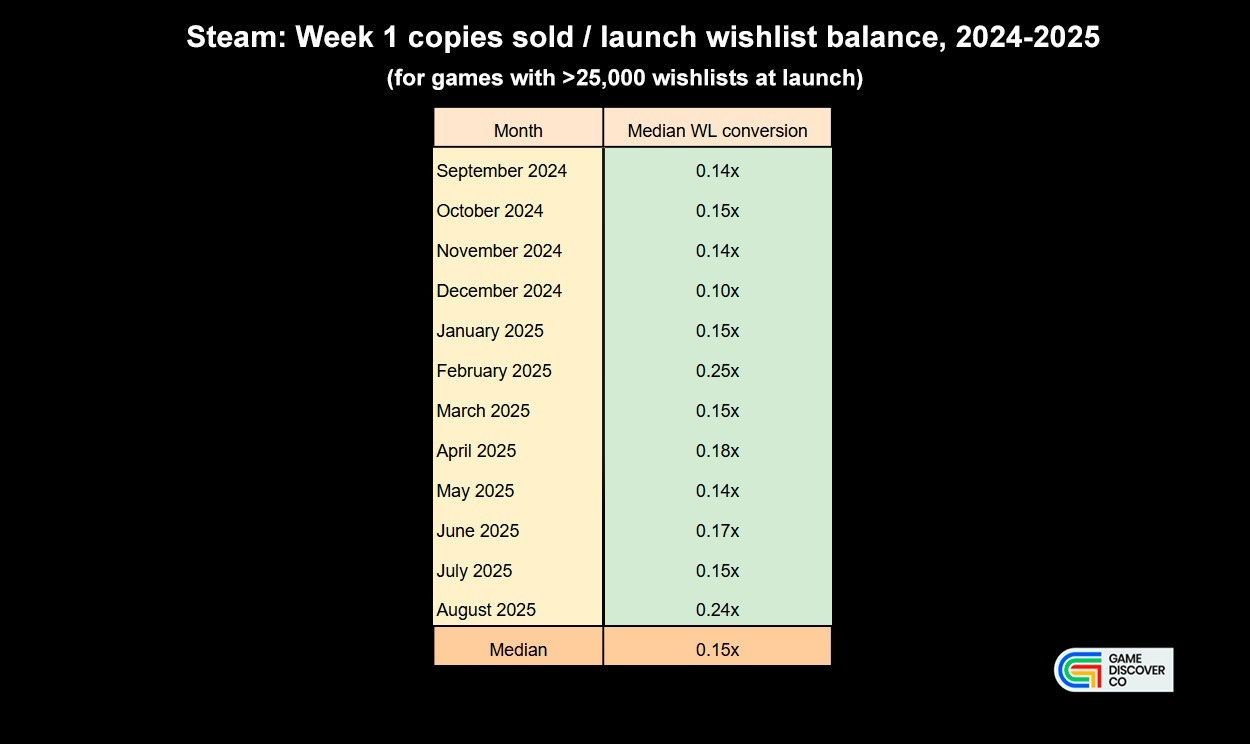

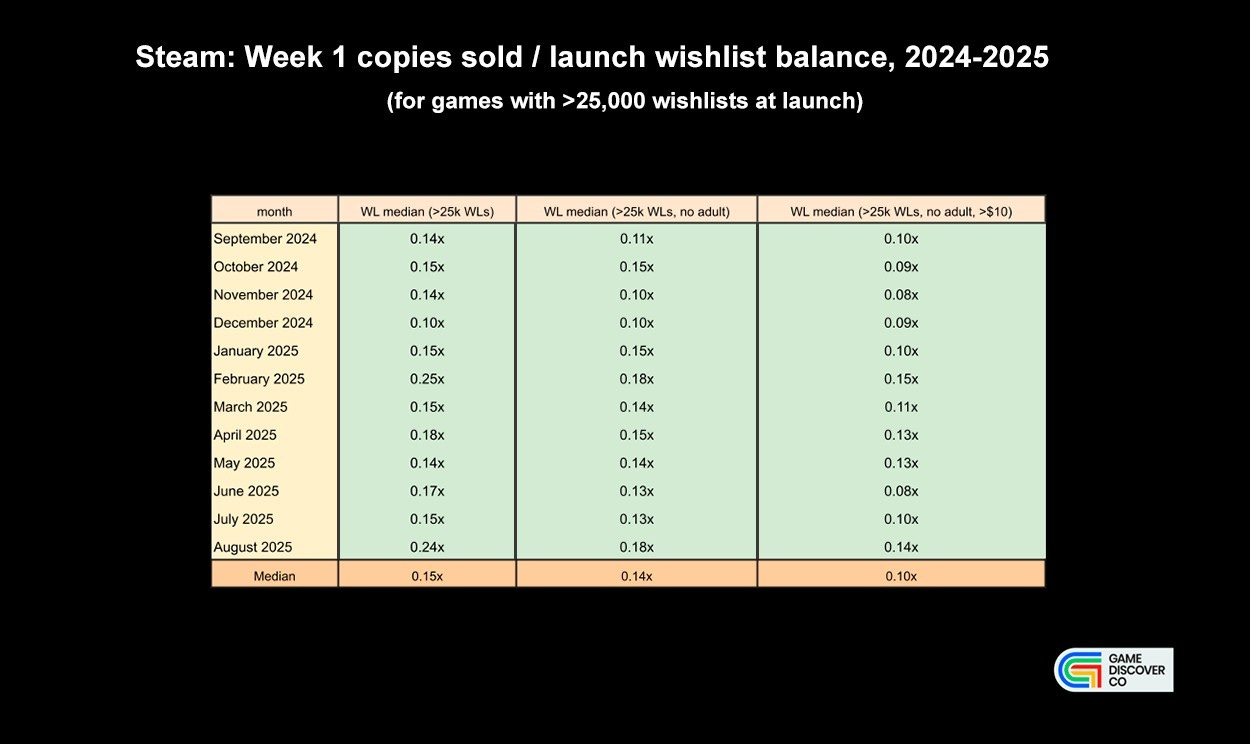

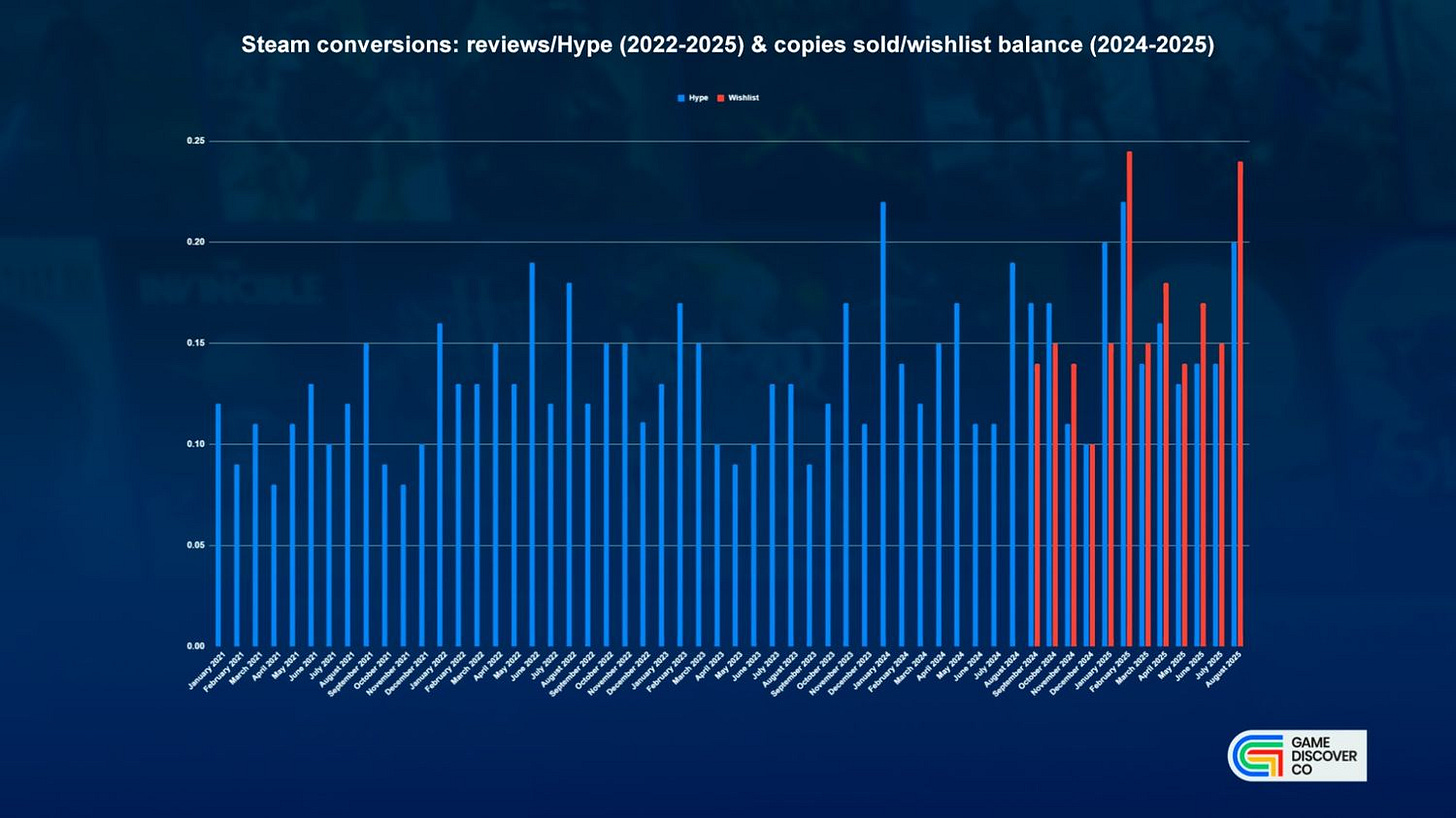

The first thing we wanted to look at was median ‘wishlists to sales’ conversion by month, and for the entire last year to Aug. We’ve looked at ‘which month is good?’ before, and come to the conclusion that there wasn’t a special standout. This time?

Looking only at games with >25k wishlists at launch, it’s a median of 0.15x - with ups and downs in terms of performance. But besides December being full of Winter Sale and poorly converting, there’s not really a giant trend at play.

Sure, there’s median conversion spikes in Feb. and Aug. But we don’t believe your game would convert 50% better if you moved it there. In our view, it’s going to be more about the types of (likely niche-ier!) games that get released in those months.

But this got us thinking - those top-end median conversion numbers are quite a bit higher than we expected. Why? Well, we were pulling every single game that launched with >25k Steam wishlists. And we found two categories that were boosting the stats:

Firstly, we looked at the top-converters, and found quite a few NSFW (adult!) games. We can see why the ‘adult only’ market on Steam would be an outlier - hardcore (ahem) fans that are more likely to convert. But most of you aren’t working in that genre.

Removing adult games only drops median conversion from 0.15x to 0.14x, but it does wipe out most of the ‘big’ peaks in February and August. That makes sense. Secondly, we know that very inexpensive games convert better, and we didn’t look at price.

So if we sort only for games that cost >$10 at launch, we see a median drop all the way down to 0.10x. In this data configuration, Q4 looks a bit rougher, and H1 a little better. But maybe this number is - unfortunately - more realistic for regular priced games in 2024-2024. (So that’d be: 100,000 launch wishlist balance, 10k sales Week 1.)

Side note: there’s been discussion of whether median ‘wishlists to sales’ ratios have been majorly degrading over time. We’ve been tracking ‘# of reviews in Week 1 vs. our internal Hype score’ since 2022, and here’s a graph of it with the ‘copies sold vs. wishlists’ (similar metric!) overlaid.

We don’t think they are slipping, according to this data. There’s just lots more games out there that everyone has to compete with, so it’s harder to get WLs:

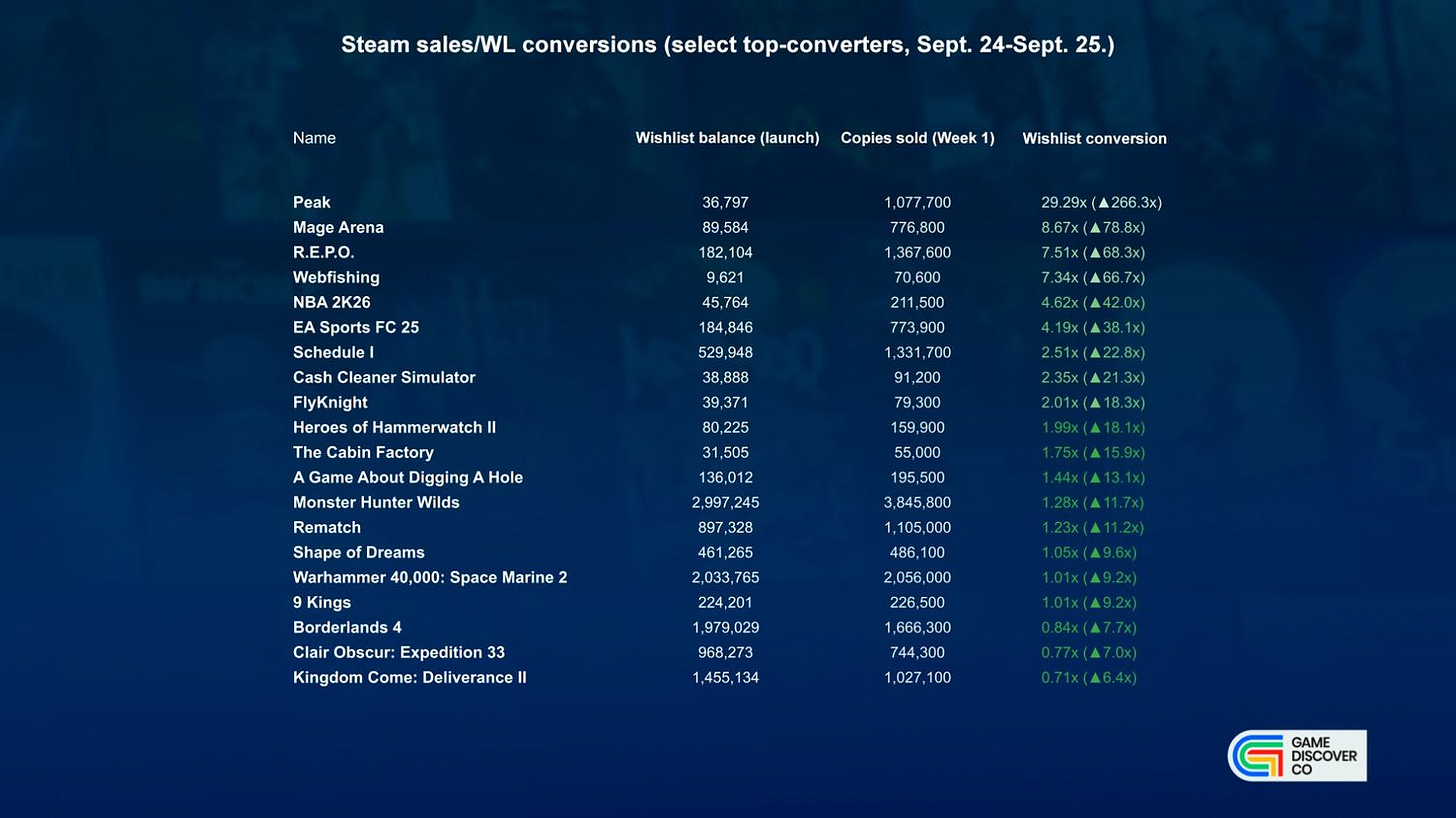

OK, so that’s the macro-ness out of the way. But let’s delve down to a per-title basis to see some top titles, and how well they did vs. expectations. Let’s start out with the Top 20 ‘Week 1’ sellers from Sept. 24 to mid-Sept. 25, according to GDCo data:

This may not be surprising, but all of the best-selling games also outperformed their median conversion expectations - which we have as 0.11x here. The lowest outperformer was life sim InZOI (3.2x), and the highest Chinese FMV game Revenge On Gold Diggers (539x), with co-op mountaineering game Peak hitting a whopping 266x, too.

Or maybe this is a bit surprising? It just goes to show that the network effects of FOMO and generalized excitement for big releases draw a LOT of new players in. (One caveat: a number of these AAA games had pre-orders or Advanced Access, which is probably unduly inflating their multiplier, cos purchases were made earlier.)

Next, we pulled out select games we knew from the list of top-converters, and got the following titles, all of which converted at least 6 times as well as we expected:

So if there’s a trend here, it’s - obviously - ‘game went extremely viral with influencers and friend groups’. There’s a lot of online co-op centric crewlikes in here, from Peak (266x) and Mage Arena (78x) to the high-retention R.E.P.O. (68x) and much chiller, smaller wishlist Webfishing (67x). (Even the less-discussed FlyKnight (18x) is co-op friendly.)

Also in this list? Big sports franchises that PC ‘casuals’ solely turn up to play, so don’t necessarily wishlist (NBA 2K26, EA Sports FC 25), and single player games that blew up on social video & YouTube/Twitch due to high hook/good execution - A Game About Digging A Hole (13x) and The Cabin Factory (16x) among them.

Of course, there’s plenty of games that got a lot of wishlists, converted those wishlists efficiently (at 1-3x median) and have done great. And we’re not looking at those at all! So just noting - you can not be on the above list and have done great.

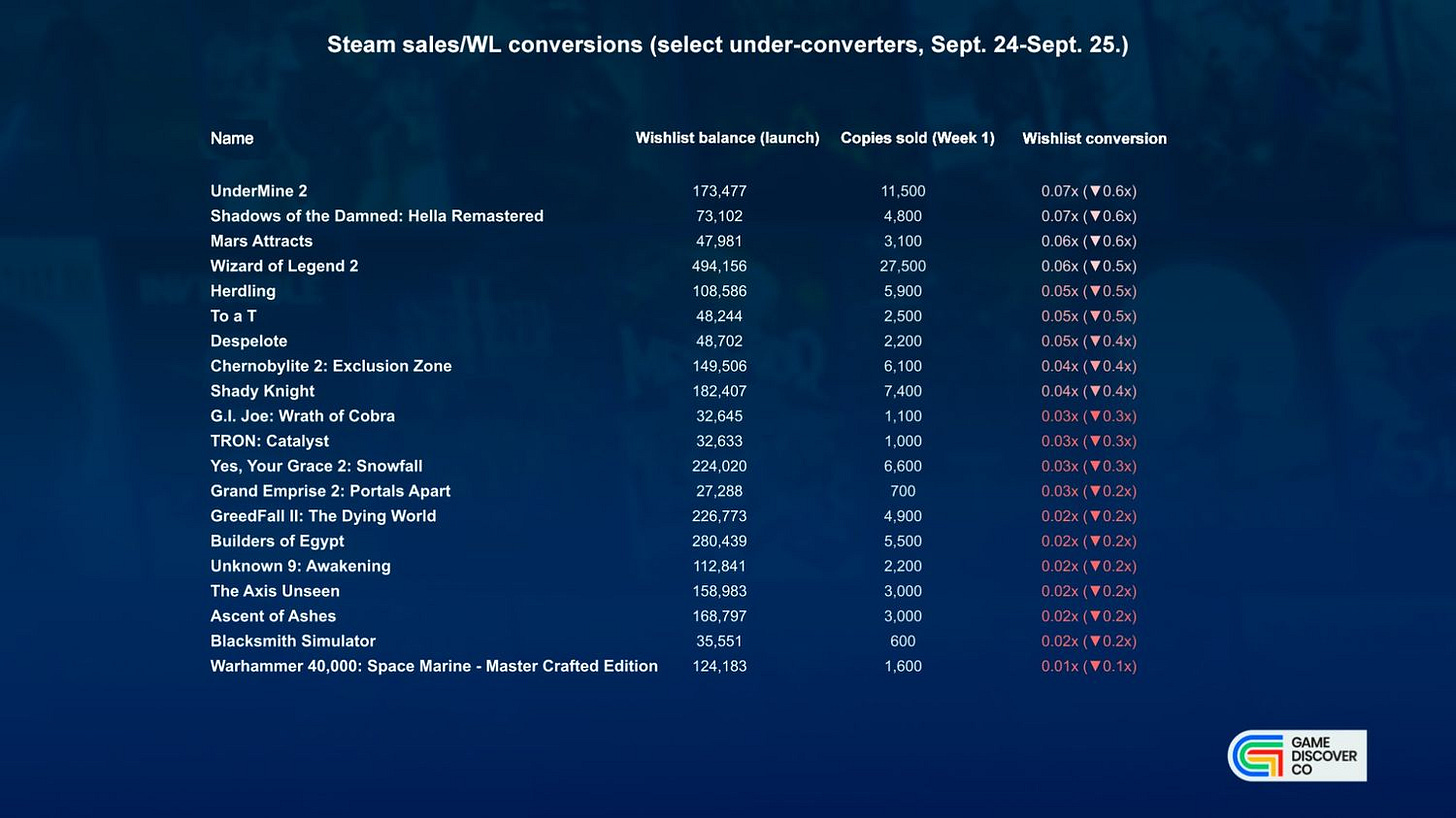

On the other side, we wanted to present a lot of under-converters in the last year - starting at 0.07x, which is only a bit off median. But here’s what we found:

As for why some of these games didn’t do so well? One reason is certainly what the audience thought of them. The median Steam player review score of these games is 67% (Mixed) after 7 days, compared to 91% (Very Positive) for the select Top 20.

There’s also the fact they’ve had a lot of time to generate wishlists, so their organic daily wishlist rates are lower. (And slower organics are an indication of less interest.) They have an average of 411 days on Steam before launching, vs. the Top 20 select converters having 214 days.

We don’t want to punch down, but two other thoughts. One - sequels can be hard, not least because people have v.strong expectations and the original game is on deeper discount at launch. And two: there’s an undercurrent of ‘boutique indie’ in a few of these games, likely to get ‘oh, this looks interesting’ WLs, but not necessarily a buy.

But it’s so difficult to tell! We don’t know. You don’t know. If we did, desert island, living on, we would be, etc. But hey, here’s some data to torture yourselves over in the meantime, while you ponder the ineffable complexity of it all…