The state of Steam Early Access 'graduates' in 2025

Data? We've got hella data. Also: musings on Switch discoverability & news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Rapidly reaching mid-December, there’s only trois GameDiscoverCo newsletters left in 2025 after this one. These will include: a ‘top games of 2025’ round-up and a proper analysis of The Game Awards’ trailer discovery winners later next week. (And one other newsletter besides, since three is a magic number - no more, no less.)

Before we start: we had a couple of reports of our GDCo newsletters slipping into non-primary inbox folders (or even spam?) So if you haven’t, you can whitelist emails from us - here’s the explanation for Gmail, scroll up and down for other email platforms.

[NEED PC/CONSOLE INSIGHT? Companies, get a free demo of our GameDiscoverCo Pro company-wide ‘Steam deep dive’ & console data by contacting us today - ~85 orgs have. And signing up to GDCo Plus gets the rest of this newsletter and Discord access, plus more. ]

Game discovery news: God Slayer, Daughter hype?

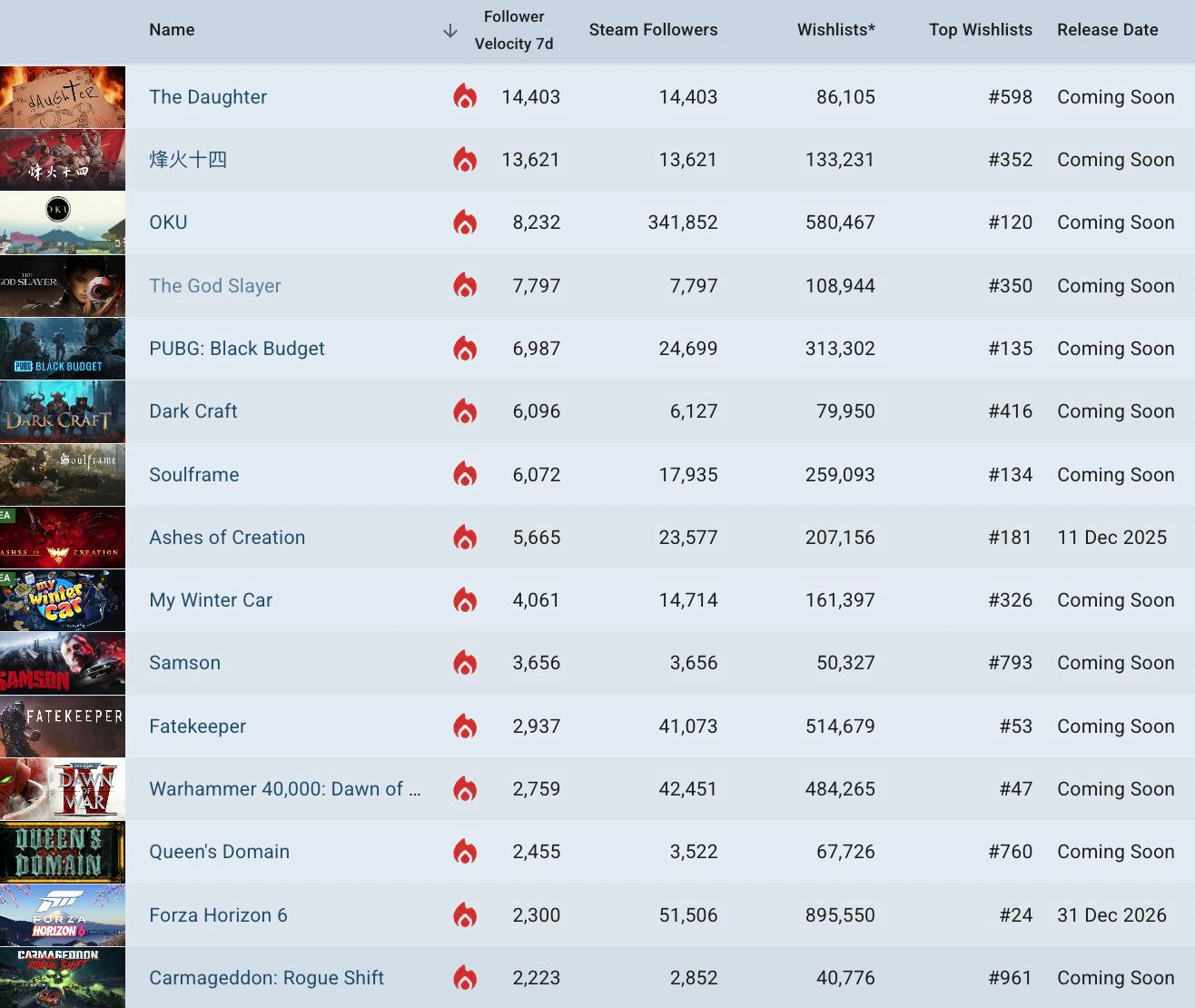

OK, let’s start out our game discovery and platform news with a look at - well, this:

Unreleased Steam game interest? First-person horror game The Daughter tops GDCo’s ‘trending follower’ charts thanks to a French YouTuber making it, and Sino-Japanese War FPS (!) Fourteen Years Of Flames is trending at #2, but only in China. And Pathea’s ‘Eastern-inspired steampunk metropolis’ RPG The God Slayer (#4) also hits.

Elsewhere, Souls-like MMO Dark Craft (#6) hits, as do multiple games from the PC Gaming Show Most Wanted showcase: Liquid Swords’ Samson (#10), plus Queen’s Domain and Carmageddon: Rogue Shift, then Substructure, Starship Troopers: Ultimate Bugwar!, SOL Shogunate, and Dungeons Of Dusk. Busy!

The Valve x Wolfire antitrust lawsuit rolls on, and there were 1,674 dev exclusion requests (out of 46,789 companies!) opting out of the ‘class action’ lawsuit, which you too can peruse if exceptionally bored. Those included Klei, Sega, CCP, Coffee Stain and more. But 96.5% of all Steam devs are now strapped in for the ride.

Minecraft-like Hytale has been elaborating on its decision to skip Steam (to start with!) for its post-Riot PC launch: “We want to spend our time in Early Access working with the community and improving the game, rather than overindexing on negative reviews from players that aren’t as well-informed yet about what we are doing.”

More on that NEX Playground Kinect-like family console? It beat out U.S. Black Friday week sales of individual Xbox SKUs - PS5 had 47%, Switch 2 24%, and NEX had 14%. And Install Base notes it debuted in 2024, but’s bigger in 2025, hitting 500k units. (It has Bluey, TMNT & Sesame Street games & a $89/year game sub.)

One fascinating takeaway from HTMAG’s deconstruction of Ball x Pit? The core gameplay was inspired by one of Habby’s less-known mobile games, PunBall. With Vampire Survivors riffing on Magic Survival to mega-success, maybe more PC roguelite devs should be looking at mobile games for inspiration?

Black Friday shopping week in the UK, according to NielsenIQ & The Game Business, had console hardware revenue up 14% YoY, and unit sales up 7%. Overall: “PS5 was the only console to do better this Black Friday than the previous one, with unit sales up 16%… PS5 had a 62% share of the console market during the week.”

The top-grossing (on-platform!) mobile games of November 2025? They’re headed by LastWar: Survival, Roblox, Monopoly Go!, Whiteout Survival and Royal Match, all topping $100m, with merge game Gossip Harbor (analysis) up to $63m, and China-first tactical shooter reboot Delta Force also hitting the Top 10 with $55m.

ICYMI: Russia, not content with banning Steam solitaire games, has also restricted Roblox, saying the content “may negatively affect the spiritual and moral development of children.” (Russia’s on a Western game/app banning spree right now, also restricting Apple’s FaceTime and WhatsApp last week.)

The biggest video games in Google’s search trends report for 2025, globally? ARC Raiders, Battlefield 6, Strands (!), Split Fiction and Clair Obscur are the Top 5, shortly followed by Path Of Exile 2, GTA 6, Pokemon Legends: Z-A, Minecraft, and Roblox.

Microlinks: the winners of the 2025 Apple App Store Awards include Pokémon TCG Pocket, Dredge, Cyberpunk 2077: Ultimate Edition and What The Clash; Report: Meta planning massive cuts to Reality Labs metaverse division; check the winners of the 2025 Streamer Awards to better know key genre-specific streamers.

OUR SPONSOR: A Simple Way to Track Game Marketing Opportunities

The Metaroot Opportunity Bot alerts you to Steam event submissions, funding opportunities, and content creators looking for games. Get instant notifications and deadline reminders. This year alone, we already covered around 300 opportunities to help developers maximize their chances to get discovered.

Get 20% off your first year or month with the code GAMEDISCOVERCO. Sign up now on Patreon or just search for Metaroot Opportunity Bot and claim your trial.

2025: the state of Steam Early Access graduates

The subject of your Steam Early Access to 1.0 transition - the point where PC devs say ‘look, this game is done now’ - has been a complex and underquantified one, with a few overperforming standouts (including the above games!) but lots of more ‘boring’ results.

We last tried to quantify this back in late 2023. Then, we suggested - based on 3-month EA and 1.0 data from 2015-2023 - that your 1.0 release might at median do ~70% of your Early Access release in terms of units. (Of course, with many outliers.)

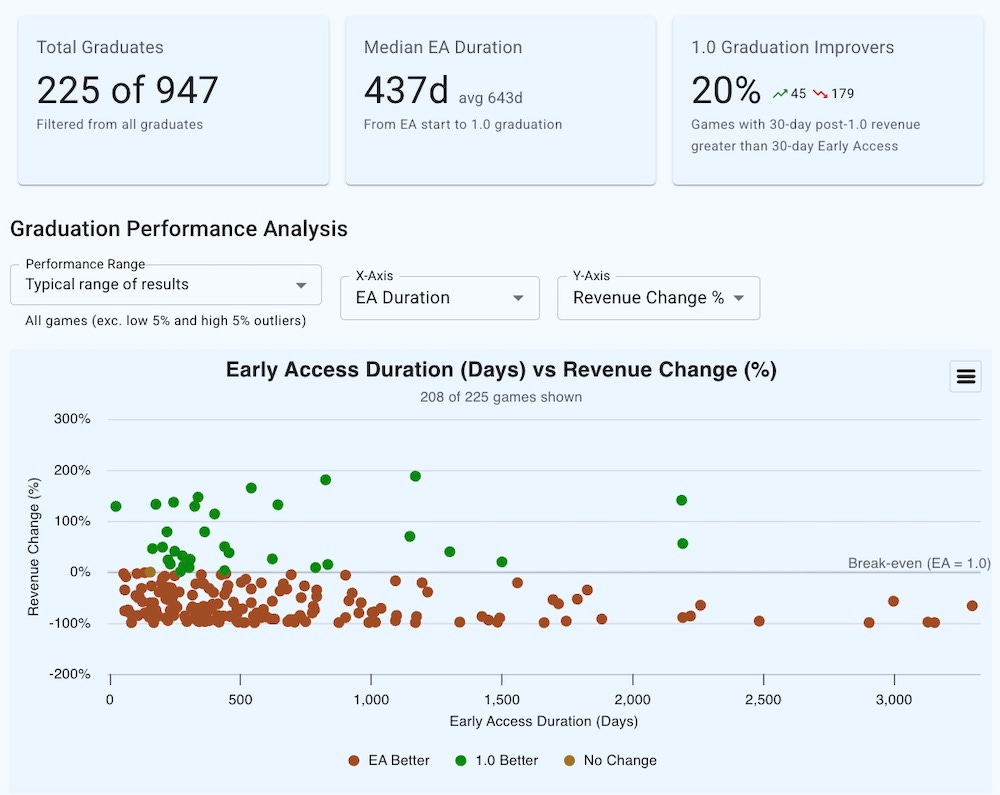

Well, our GameDiscoverCo Pro subscribers (be one! free demo!) now have access to an ‘Early Access Graduates’ page where we use our daily estimates to algorithmically track every single 1.0 release on Steam. Here’s what it looks like for all 2025 Early Access graduates which had >5k copies sold in EA, ignoring extreme high & low outliers:

This is based around the first 30 days of Early Access for these 2025-debuting games, compared to the first 30 days of 1.0. And you’ll quickly see some interesting stats:

Of the 225 Steam games emerging from Early Access, only 20% (45) did better at 1.0 than they did at Early Access. 180 or so games did worse.

The median Early Access duration for these titles was 437 days (about 14 months), and the average was 643 days (21 months).

Most importantly, the median 30-day revenue at 1.0 across all these titles was about 40% of the median 30-day Early Access revenue.

This is, unfortunately, quite a bit worse than our 2023 estimates, which were for the entire history of Steam. Sure, there’s always outliers - like Tainted Grail, which we covered and whose +1272% revenue (!) at 1.0 would have screwed up the above chart.

But I do think the concept that a slow launch can be ‘redeemed by a 1.0 release’ is increasingly out of step with reality. Your 1.0 debut is really another notification to wishlisters and marketing ‘beat’, right? So if it’s a major upgrade & you’ve discounted seldom, it may be a bigger deal. But it’s perhaps over-rated as a state change in Steam?

Anyhow, rather than make you all depressed, here’s three brief example of games that had great Early Access debuts in 2025, all pictured above:

News Tower: this newspaper sim had an OK start ($350k grossed in M1 of Early Access), but a big interest spike at 1.0, with rev up 138%, CCUs tripling to 3,500, and ~170k sold, with the debut month not done. (A novel idea which re-viralized.)

Escape The Backrooms: the creepypasta co-op horror exploration game started slower in 2022 (~$500k). But it’s such a big evergreen seller - we have it at 6m copies LTD - that a 1.0 up +189% is only a slight increase on its hot monthly pace.

Mars First Logistics: a genuine example of a 1.0 jump-up, this super-cute Mars rover sim hit ~$300k in its first month back in 2023, but a far better 181% revenue increase for 1.0 to hit 150k units. (Why? Adding lots of languages helped reach!)

As for games that did less ‘great’, we wanted to highlight these big hits. They’ve all done well, in fact. But for most games that update often and discount during Early Access, 1.0 is just another update, and the sales/revenue reflects that:

Supermarket Simulator: seeing as this first-person sim standout grossed $10.7m in its first month on sale in early 2024, you’d expect 1.0 to be quieter. And indeed it was, with rev down 95% and barely visible on the curve. (But hey, 3.2m units.)

Slime Rancher 2: this excellent open-world sequel hit 1.6m on Steam, with 11k CCU at 1.0 in Sept, compared to 22k CCU at Early Access launch in 2022. But many of those folks are EA players jumping back - rev was down 85% from launch.

Backpack Battles: another great game with a strong start, it had $6.7m during M1 of Early Access, ‘only’ doing $850k at 1.0 in June, down 87%. (You can see the copies sold bump for this one, but post-1.0 is only 13% of its 1.35m units.)

So: just because CCU beats Early Access launch at 1.0, doesn’t mean sales will. For example, Hades II’s 112k CCU at 1.0 is impressive and an all-time high. But we think revenue in M1 of 1.0 was down 75% compared to EA to, uhh, ‘just’ $11 million. (They’re crying into their money hats, folks.) It’s still very good - but heed our context…

eShop discovery changes: the expensive wins out

Back in June 2025, we covered a major change in Switch eShop discovery algorithms, as both the Switch 1 and Switch 2 eShop changed its charts to rank the top-grossing games over the past 3 days, instead of the most-downloaded over the last 14 days.

Six months later, we decided to revisit the eShop and ask - did this change really lead to big shifts in a) the kinds of games showcased b) actual sales? We do have some thoughts - and also some data.

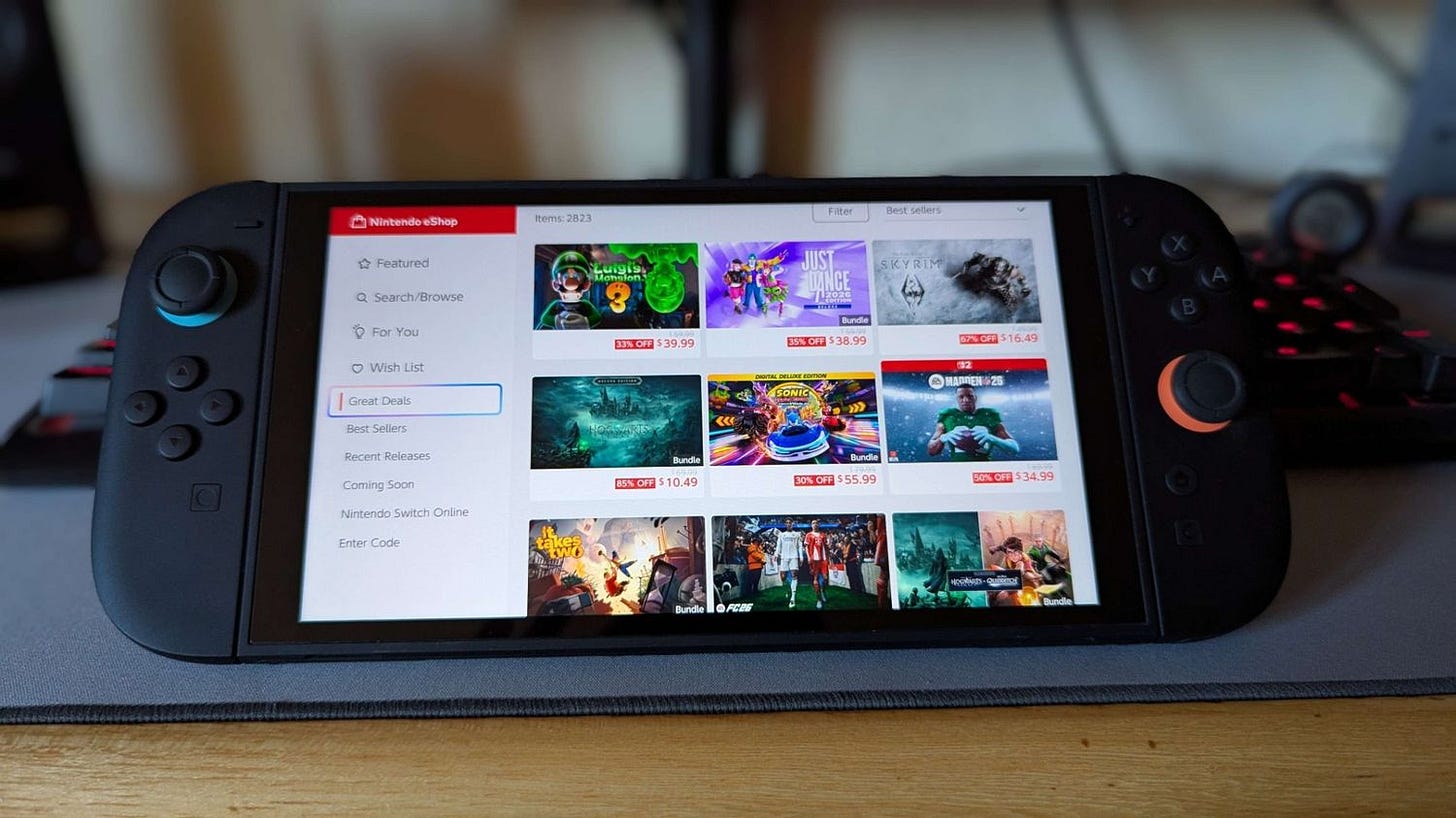

Visually speaking, we’re 100% sure that we see more $60-$70 games in the best-sellers area on the eShop. Looking at the Switch 1 best-sellers (above), all of the Top 9 have a default price of $60-$70 except Minecraft ($30). The Switch 2 part of Best Sellers is the same, except Hades II (also $30).

But there were some first-party and $60 titles in best-sellers anyhow. What’s extremely different, though, is the ‘deals’ section in the eShop. Historically, there were plenty of 90% off games that normally cost $20 in here. Now, let’s see:

Yep, looks like all of the top ‘deals’ - when we checked a couple of weeks back - are for $60-$70 games - or more - that are discounted to $10-$40, whether that be Skyrim, Just Dance, Luigi’s Mansion 3, Hogwarts Legacy, Madden & more.

This has really changed visibility on the store - and may be one reason why a lot of indie/mid-sized Switch titles are having reach issues recently. (Sheer number of games on the store & 84% of Switch 2 owners having large Switch 1 catalogs would be the other major factors…)

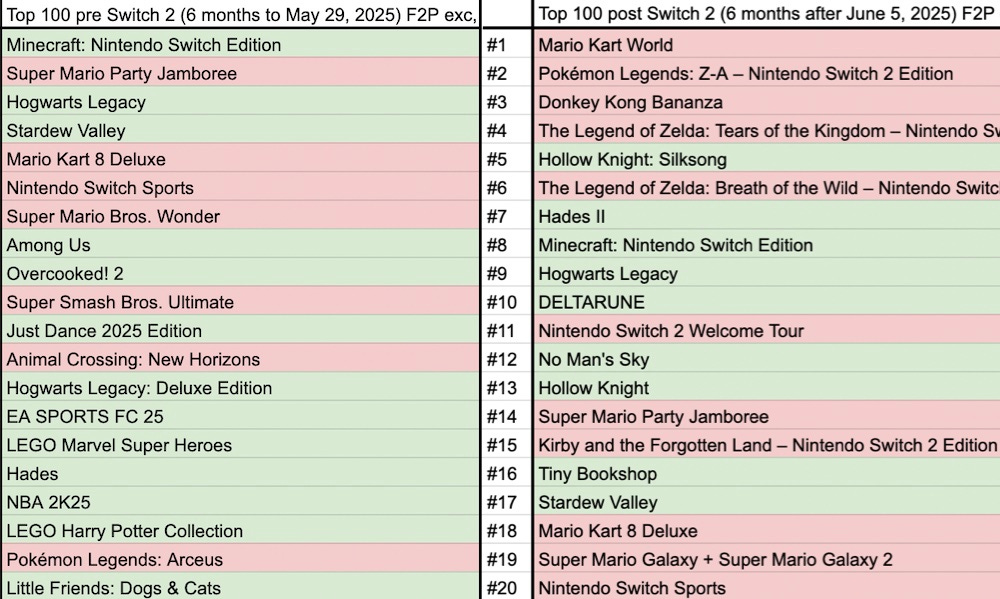

But that’s all ‘anecdata’ - how about some real data? Well, here’s our estimates of the Top 20 positions in the Western Switch eShop Top 100 by units (excluding F2P!) created for a) the 6 months before the Switch 2 algo change b) the 6 months after that:

There’s definitely no smoking gun in here - different games are popular because of the Switch 2, and we’d expect that. (And there are seven first-party games in the Top 20 before, and 11 after. But again, Switch 2 means new platform exclusives & upgrades.)

What we did notice is a couple of things, though. Firstly, the median default (non-sale!) price of games in the Top 100 most-downloaded went up 14% - from $37.50 to $42.90. So yes, games with a more expensive MSRP are doing better.

And secondly, some of the extreme discounting just doesn’t work as well. For example, Little Friends Dogs & Cats hit #20 in units in the months before the change, thanks to some 95% off discounts for the $50 Nintendogs-like. It continued that discounting after the change, but ‘only’ made it to #99, with ~35% less units sold.

That’s still a lot of units, no doubt because people find the extreme-discount game via Reddit deal sites, etc. But a game discounted from $49.99 to $2.49 is no longer going to be in the Top 10 in the ‘deals’ section - visibility no longer works like that. You’re better off discounting a popular $60 title to $10-$30 for chart visibility nowadays…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]

Great breakdown of how Early Access graduation is evolving on Steam, especially the data around visibility and long-term performance. It highlights how clear scope and strong core loops matter more than hype. That same principle applies even to smaller casual titles like https://slicemaster.net/

, where focused design and polish can drive sustainable engagement over time.

I've always wondered about EA and How that corralates to 1.0 releases. Thanks for the insight and data! Would you rather have a smaller game with a short EA and/or straight release? Or a game like Project Zomboid which has been in EA for quite awhile and coming for bigger games? But maybe that's an outlier