The hidden levers of game discovery? Supply and demand!

Going back to basics is a way to understand discoverability.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Readers: we’re here once more, infecting your inbox with a complex mix of half-baked writing and partly-considered graphs. Thanks to all supporting GameDiscoverCo recently, both on the free and paid newsletter side of things, btw - it’s a blast.

One note on Ukraine support: the Itch ‘Bundle For Ukraine’ is zooming towards $6 million (!), and dev support has been stupendous. Also wanted to highlight Supercell’s match for Ukrainian humanitarian aid to folks contributing $ directly. We recently donated there, since it has 100% Supercell matching up to 1 Million Euros. (Thx!)

[HEADS UP: we’re doing a 30% off the first year of GameDiscoverCo Plus deal for the next 30 paid subs. You get data-rich exclusive newsletters (what’s really selling and why?), custom Steam/console charts to rank and data-export, two eBooks, a member-only Discord & more.]

Game discovery: it’s also about supply & demand

There’s been a series of articles recently about the number of available video games. You may particularly remember Jeff Vogel’s ‘There Are Too Many Video Games’, which tries to argue inelegantly that: “If my country was healthy, stable, and on a sustainable path, most of them would not exist.” (Uh, no?)

In the last newsletter, we linked VGInsights’ 'Make More Video Games’, which tacks in the other direction, points out correctly that many games are made for fun and not for profit (correct!), and tries to extrapolate that “just under 20% of games released in 2021 have been potentially unsuccessful vs their original goal.”

Well, I definitely disagree with that too - it’s much more than that. And it brings me to a conclusion I’ve reached after the last couple of years of writing this newsletter (and 15+ years of working with indie games, and 25+ years of being in the game biz):

Developers (and publishers) consistently underestimate raw supply and demand when considering the chance of success for their game.

Above, you’ll see a custom chart we did showing cumulative numbers of video games available on Steam since 2006. It won’t be perfect - we added up SteamDB’s chart of releases per year, which is a more common way to view this. But it’s a bit startling.

When you just see individual yearly releases, you may think ‘oh, this year was only a bit more than last year’. But if you look at it all together - well, there were around 5,000 cumulative Steam releases by 2015, about 20,000 by 2017, and there are now 60,000+ games available.

Most importantly, many of these older games are not ‘one and done’. The most successful ones - think No Man’s Sky, Rust, etc - keep updating regularly, and keep selling, continually adding features for a returning userbase.

And heck, some don’t need to update, and keep selling. For example, Supergiant’s isometric ARPG Hades has 3,300 additional Steam reviews - likely 100,000-150,000 units sold - in the last month. Lucas Pope’s superb Papers Please - a game originally released in 2013 - added 550 reviews (15,000-25,000 units?) in the last 30 days.

What’s the ‘no-reset’ PC/console market?

So for me, this relatively new concept of a ‘no-reset PC and console generation’ is significantly changing the market. Which is to say - in olden days, you bought the NES and games for it until the SNES came out. And then you sidelined your old console, upgraded, and bought a bunch of new games for your new device.

But your Steam library has been percolating for 10-15 years now. And both Xbox and Sony has made it way easier to play games you bought in previous generations. (Over time, Xbox is entirely blurring the concept of ‘generations’ with Game Pass, Xbox Cloud Gaming, etc.)

Many people - Valve included - point out that new games can continue to do well on their platform, due to strong platform growth. The above graph, from an April 2020 Steam blog post, clearly shows that. More games on Steam make >$10k in their first two weeks in every single year up to 2019. I’m sure that’s also true for 2020 & 2021.

What’s difficult to graph is the cost of making games and the ROI, though. And it’s my impression that the number of ‘serious’ attempts to make profitable Steam games in the last 3 years are gradually outpacing the (formidable!) user growth on the platform. The same, of course, is definitely true for Switch, PlayStation and Xbox.

So, those sales problems you thought were genre or quality-related? They may be that as well. But I’d wager they are more supply & demand related than you think, exacerbated by the rise in high-retention GaaS style titles. Examples:

Why did some games sell 100-200,000 copies on Nintendo Switch in 2018, but those same games might sell 10-20,000 copies now? (Supply of games outpacing demand!)

Why is the official Meta Quest 2 store such a good place to be right now if you’re a VR dev? (350 games and a 10-12 million headset userbase? That’s supply and demand, baby!)

Why are many indie publishers seeing the majority of their games lose money in 2022, and a few standout titles - hopefully - make all their $ back again and more? That wasn’t the case in 2016. (The shape of the supply/demand curve has changed - big hits are there, but guaranteed returns are not.)

How come select early PlayStation 5 titles like Kena: Bridge Of Spirits hit it out of the park? (The game is good, and PS5 players were looking for titles that showed off the new tech that they just bought. That’s supply and demand at work, again.)

If you look at the market from this perspective, it opens some interesting viewpoints. Rather than seeing Xbox Game Pass and other subscription services as an existential threat to the status quo - perhaps they could be considered a net positive?

In this scenario, it’s not Game Pass or PlayStation Plus or Apple Arcade which is the cause of the problem. Rather, they are a potential solution. They’re using platform funding to aggregate titles that might otherwise fall foul of some of the long-term supply/demand mismatches.

That’s one angle on this supply/demand problem - and not sure that I wholly believe it. Either way, these complexities shouldn’t make us stop trying. You just need to be more analytical on market gaps, work closely with platform holders, and find the ‘recurring success’ titles that can help you navigate through these ever-complex game discovery seas.

Unity’s state of the game biz - stats, stats, stats!

So the folks at ubiquitous game engine/monetization company Unity revealed its 2022 gaming report this morning, via both a press release and access to the full report. Rather than pushing Unity’s market share advantage (a bit of a fait accompli?), it concentrates on aggregating data from all 230,000 developers making 750,000 games in Unity, referencing:

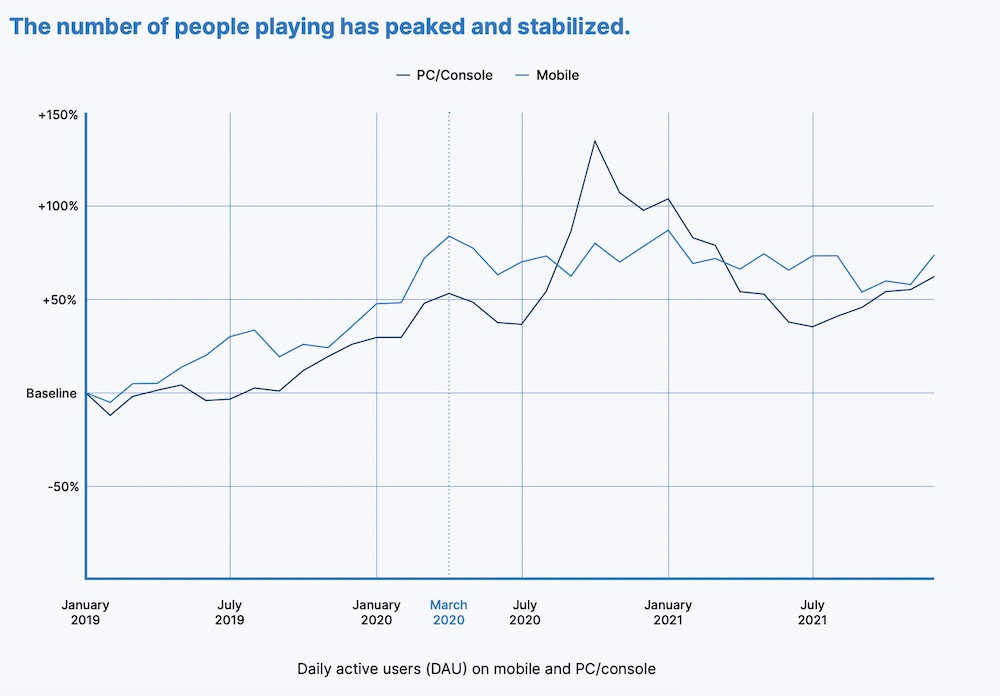

Long-term DAU wins: “The total number of daily active users (DAU) playing games rose from before the pandemic, reached a peak, then settled at far higher levels than before COVID began. PC/Console DAU has increased by 62% since the start of 2019, and mobile DAU has increased by 74%.”

Lots more games being made: “The production slump of the pandemic’s early phase is now far behind us. Mirroring other industry reports highlighting continued growth in the gaming sector, in 2021, the number of Unity creators increased 31% compared to 2020. Additionally, there were 93% more games made on the Unity platform in 2021 than in 2020.”

We probably shouldn’t read these DAU numbers as canon for the whole industry, since Unity may have also been adding market share. But Steam’s MAUs were up 40% from 2019 to 2021, so it’s not a million miles off.

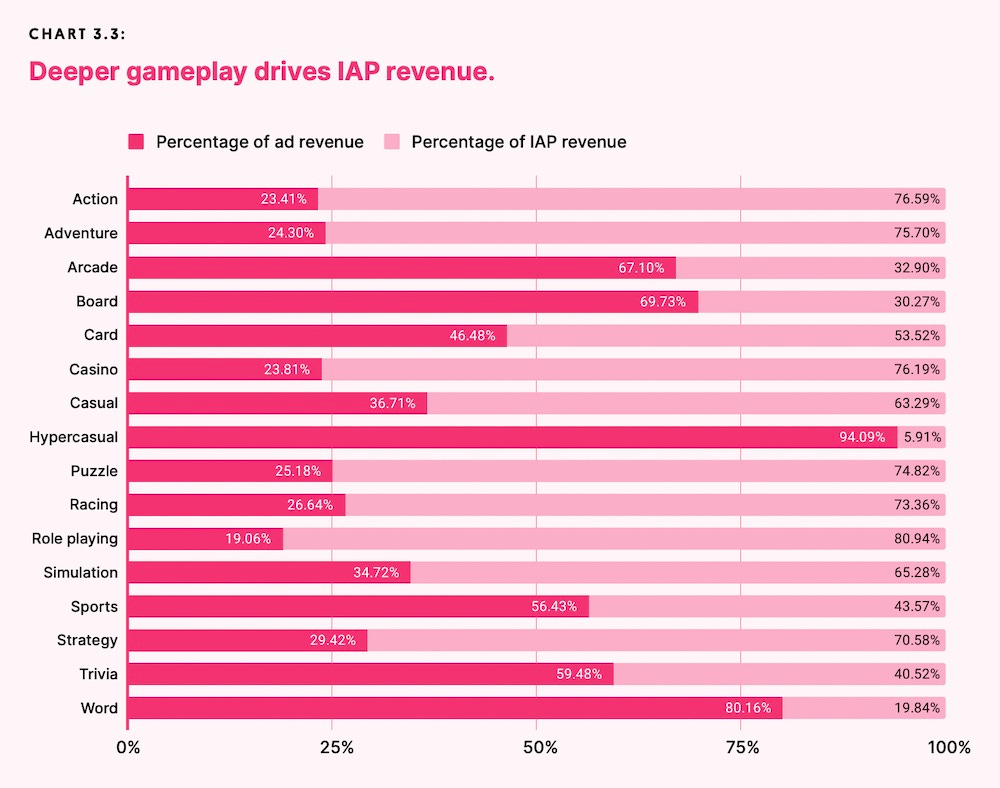

Because the majority of Unity-made games are mobile-first, some of the more detailed report stats seem less relevant and/or mushy from a PC/console perspective. There’s good data on how advertising-led hypercasual games are still surging, and how in app purchase-centric monetization is built around genre depth, though. (See above graph.)

There are also some handy charts in the full report showing that, post-pandemic, people are playing at ‘normal’ hours again - since they have work or school. In addition, this graph shows longterm DAU for PC/console peaking during the height of the pandemic and then coming down - less so for mobile, intriguingly:

Finally, I think it’s worth listing the Unity Gaming Report’s conclusions on future trends:

- game lifespans will lengthen

- cross-platform multiplayer games will become more common

- mobile multiplayer games will become the standard over the next decade

- indie and mid-market developers will invest in player intelligence

- there will be increased adoption of specialized tools and third-party expertise

- metaverse and the blockchain will be tested but not just fully embraced.

Agree with many of these, particularly the first one (see previous newsletter item on high-retention games.) And I’m definitely a fan of increased adoption of third-party expertise. *points at self, gauchely* Thanks for the data, Unity!

The game discovery news round-up..

There’s many miles to go before we sleep, and many links to send out before we go up the wooden hill to Bedfordshire. So let’s take a look at some of the game discovery platform news and info we’ve magicked up for you this time:

There’s more news around the June ‘E3 timing’ window, despite no physical show: Xbox seems to be going ahead with its game showcase, EA is not holding an EA Play this year, and there’s still no confirmation of what the official E3 digital event will look like (lotsa restreams and a handful of originals?), but they’re emailing publishers about it. (And Summer Game Fest still exists.)

There’s a particularly comprehensive Steam platform Q&A write-up from Chris Z, which has Valve talking wishlist importance, the parts of the Steam page that are important, not launching during big sales, and all that good stuff. Quote that I like (and keep telling people): “showing some of your game UI like your HUD elements [in screenshots]… can actually be really helpful for players” - to help them understand how the game plays.

Platform microlinks: Google has announced that some ChromeOS users will finally be able to start testing Steam - looks like a limited alpha so far; Xbox says they have “brought major performance improvements” to iPhones and iPad using Xbox Cloud Gaming; Google also officially revealed its Stadia tech-dependent ‘Immersive Stream For Games’ service.

The latest off-store Meta App Lab success for Quest 2 is physics/weapon simulator Frenzy VR (above), which makes smart use of Unity Asset Store tech. And the dev revealed on Reddit he’d made $700,000 gross in 4 months. Looks like it has 579 star ratings, so sales/ratings is 100x on the 58k (?) units sold! And average daily sales are still growing. Subject’s a little yucky maybe, but YMMV.

Important: the Steam API just added access to ‘private’ release dates for all games. Unclear if this is an error or a policy change, but as SteamDB’s xPaw notes, he is now tracking them all. So although Slime Rancher 2 has a 2022 public release date, SteamDB also shows its private release date - June 1st, 2022. (In reality, many private release dates are also incorrect. But FYI!)

EA’s Origin PC store service seems to be changing things up somewhat: EA titles aren’t currently available on Humble Store and existing EA/Origin keys must be redeemed by March 18th. Wario64 adds: “I also heard EA Origin games delisted last week on various stores (Fanatical, Gamesplanet, GMG, etc.)” This is likely part of a move towards the official EA Windows app, currently in Beta.

Microlinks: China is further tightening game regulation for minors, leading to share price dives for Tencent, NetEase & friends - and likely more Western investment; how the Thirsty Heroes devs hired a company to help with Kickstarter promotions and it (largely) helped; the latest Japanese digital console charts show some Western titles - Human Fall Flat, Among Us, Astroneer - doing decently.

New Blood’s David Syzmanski (Dusk) is talking about his new ‘short horror game’ Iron Lung, which has been a medium-sized breakout on Steam, review-wise, and notes of referrals: “Interestingly, about 70% of the traffic is from Steam itself. Mostly from the discovery queue, followed by the new and trending page. Very little came from Twitter or direct navigation.” That can happen.

Sales milestones: it’s so big that we only have one - From Software and Namco Bandai’s Elden Ring selling 12 million copies already. Oh, and it’s Europe’s biggest new game IP since The Division in 2016, according to GSD’s analysis. Interesting GSD-specific platform breakdown, too: “PC representing 44% of total sales… then PS5 with 27%, then Xbox (16%) and finally PS4 (13%).”

Finally, I was surprised to learn about the state of North Korea’s video game economy (!), from someone who visited Pyongyang multiple times to research the space:

Not that despots should be supported, of course - see Russia as a current example - but it’s intriguing to find out how things actually work in North Korea. (Mainly via existing Android games modified by local studios, apparently.)

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]