Steam wishlists: total matters, 'proven' playability matters more?

Also: Roblox charts & this week's Steam debuts for Pro/Plus subs.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

How do you do, my fellow video game discovery enjoyers? Are you, like, us, slinging a skateboard over your back and trying to appear youthful in this cruelly ageist world? Well, don’t worry, since on the Internet, nobody knows you’re a dog. (But did you know Apple had a suite of Internet tools called Cyberdog, named after that cartoon?)

Anyhow, let’s dispense with the offtopic, and get down to a detailed bit of analysis, as befits a serious newsletter such as ourselves. Our lead is about Steam wishlists - and there’s debuts analysis for Plus & Pro subscribers, too. But before we get there…

Game discovery news: Battlefield 6 - it popular!

Looking at some of the top game platform and discovery news since we last checked, earlier this week:

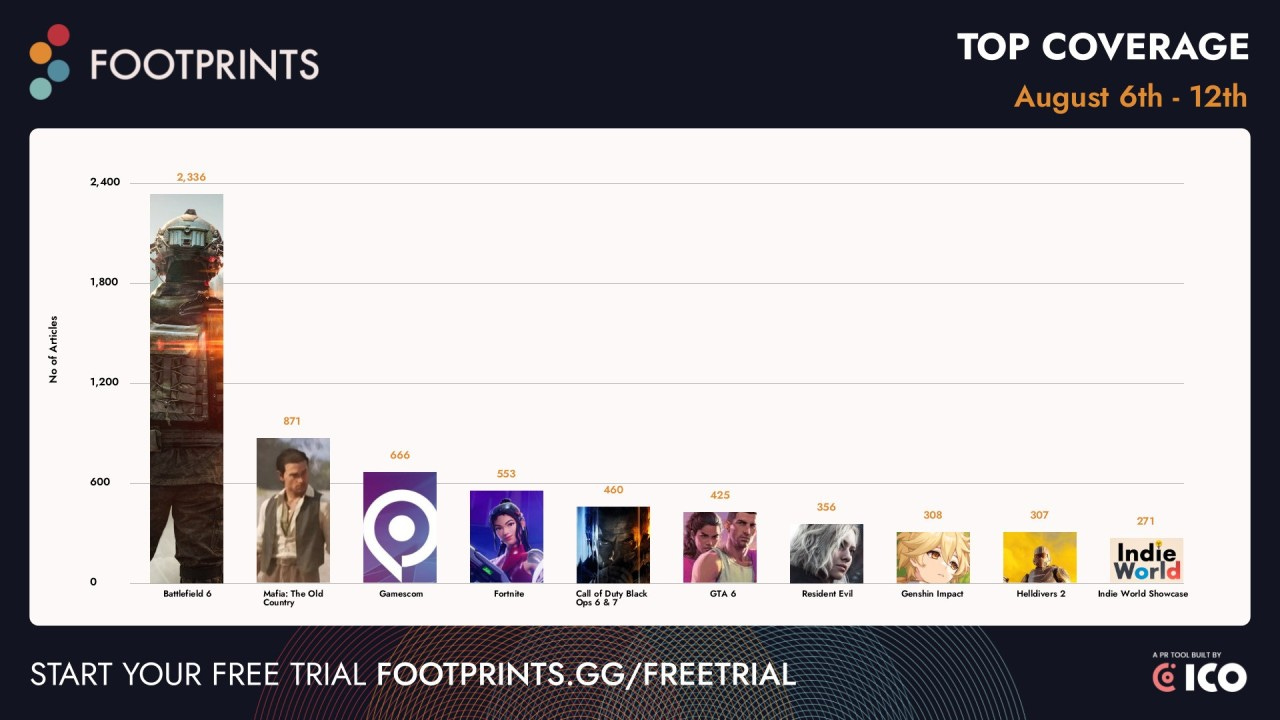

The latest ‘trad media’ mention charts, via Footprints.gg (above) show EA’s Battlefield 6 topping the chart - we estimate 560k pre-orders (and $39m gross) on Steam alone! And coming in second is 2K’s Mafia: The Old Country, which we have at ~750k copies sold already across PC, PS and Xbox, including pre-orders.

The next penny to drop, after Genshin Impact dropping PS4/Xbox One support? That’s be OG battle royale shooter PUBG, which announced that “starting November 13th, PUBG Console will be supported only on PlayStation 5 and Xbox Series X|S.” (Since the whole world has to upgrade for GTA 6, it makes sense, right?)

Good news: Steam has launched beta video support in Steam descriptions (no more GIFs as default!), alongside a beta surprise: all store pages can now be up to 1200 pixels wide, and the main content column is now 780 pixels wide. (There’s a way to test your page in preview mode, ensuring it still looks choice.)

Next week’s Gamescom actually has record exhibitor count, >1,500 (including companies co-habiting country pavilions, etc!), with exhibit space up 1% to 233,000 sq. ft. And game/Gamescom’s Felix Falk actually misses E3 a bit: “It was never a competition, it was more… announce your game at E3 and play it at Gamescom.”

Sassy Chap & Team17’s ‘sandbox dating sim’ Date Everything announced it’s sold 500,000 copies, notable because we’re estimating it at 40%+ Steam, <10% PS/Xbox, and a whopping 40% on Switch 1/2. (It’s the #3 new third-party eShop game of the last 3 months in GDCo’s calculations, behind only Deltarune & Fantasy Life I.)

Integrating further into games, Discord officially rolled out its Social SDK that’s been in closed Beta, including “high-quality voice chat, cross-platform messaging, and linked channels.” (Discord has 200m MAU who spend 1.9b hours monthly playing games while also logged into the platform - not bad!)

Spicy LinkedIn post alert from Fantastic Pixel Castle’s Greg Street: “Everything I hear from European and Asian publishers is there is no way to justify a staff of folks in California or Washington… I’m not saying I like it, but I think games are now following the garment and electronics industries where things can’t actually get made in the USA.”

UK comms/marketing agency Bastion released their latest G2M marketing survey, showing the biggest challenges in publishing were discoverability (31.5%) and market saturation (26%), and ROI is measured primarily in sales & wishlists, among other things.

Why is Netflix’s ‘film/TV IP’-first strategy for games tricky? Production timing! As an example, witness the new mobile title Blood Line: A Rebel Moon Game, based on the non-loved Zack Snyder franchise from 2023/2024. (The game has <100k Google Play Android downloads, despite being ‘free with Netflix’.)

Microlinks: PS+ Game Catalog for August includes Mortal Kombat 1, Marvel’s Spider-Man, Sword of the Sea & more; Fortnite and Epic Games Store returning to iOS in Australia following a court ruling; Sony is testing gradual rollout of its PS+ Catalog additions in Australia, Mexico & Singapore, as opposed to ‘all at once’.

Wishlists: total matters, playability matters more?

The oft-discussed subject of Steam wishlists has reared its head again. (It’s also the subject of our next This Week In Video Games column.). But we were chatting to someone about how much total wishlists matter, versus recent wishlist momentum.

And of course the answer is - both matter! But it’s definitely true that you can sneak your way to 50-75k wishlists via being in a lot of pre-release Steam sale pages, all the while not having a particularly strong organic wishlist rate. Or you can ride a strong trailer premise a long way, but not have the chops to deliver (ahem, The Day Before.)

So we pulled the Top 10 most-wishlisted unreleased Steam games (above) from GDCo estimates. There’s titles in there - particularly first-person bodycam game Unrecord (#8) and the slightly ‘mysterious’ ARK 2 (#9) - which are still scaling, but have fanbase skepticism after delays or radio silence.

(That isn’t to say they won’t launch huge. They just put a line in the sand early with a showy trailer, and now have to deliver on that exciting promise. The same is true for Light No Fire, the ambitious new game from the No Man’s Sky crew.)

Many of the other games - including multiplayer titles Deadlock (#2), ARC Raiders (#4) and Arena Breakout: Infinite (#5), already have playable versions out there. And the remaining titles like Hollow Knight: Silksong (#1), Subnautica 2 (#3) and Borderlands 4 (#6) are franchise continuations with very ‘grokkable’ gameplay.

So we figured we’d pull a ‘fresher’ list - the Top 10 games by ‘wishlists added on Steam in the last 90 days’. And you get a very different set of titles:

What’s fascinating, though, is that we’re seeing a continuation of the same trends thaty you can subdivide the overall Top 10 chart with. Specifically, it’s:

Hyped because players have actually tried it: Quarantine Zone: The Last Check (#4) and Dead As Disco (#6) are prime examples of ‘demo is great, made line go up!’.

Hyped because players have loved previous games in the series: there’s Resident Evil Requiem (#2), obviously, also Atomic Heart 2 (#8) - and IO’s 007 First Light (#9) if the gameplay ends up being Hitman-successor-y.

Hyped on promise alone, which now needs fulfilling: games like ILL (#3) are a great example of this, since it has a ‘gameplay trailer’ out there, but isn’t broadly playable yet.

So it’s interesting: while we started this exercise out believing that it was ‘recent wishlists’ that matter in terms of momentum, it isn’t that simple. All games and franchises have delivery risk profiles - you just have to understand what yours is!

And the lowest risk profile should be ‘got lots of wishlists because people played the demo and loved it’. Medium risk is ‘people haven’t played the sequel, but they adored the old versions’. And straight-out higher risk is ‘people vibed hard on the general idea of this, but don’t really know what it plays like’. (The fix is - release a great demo or final game, lol.)

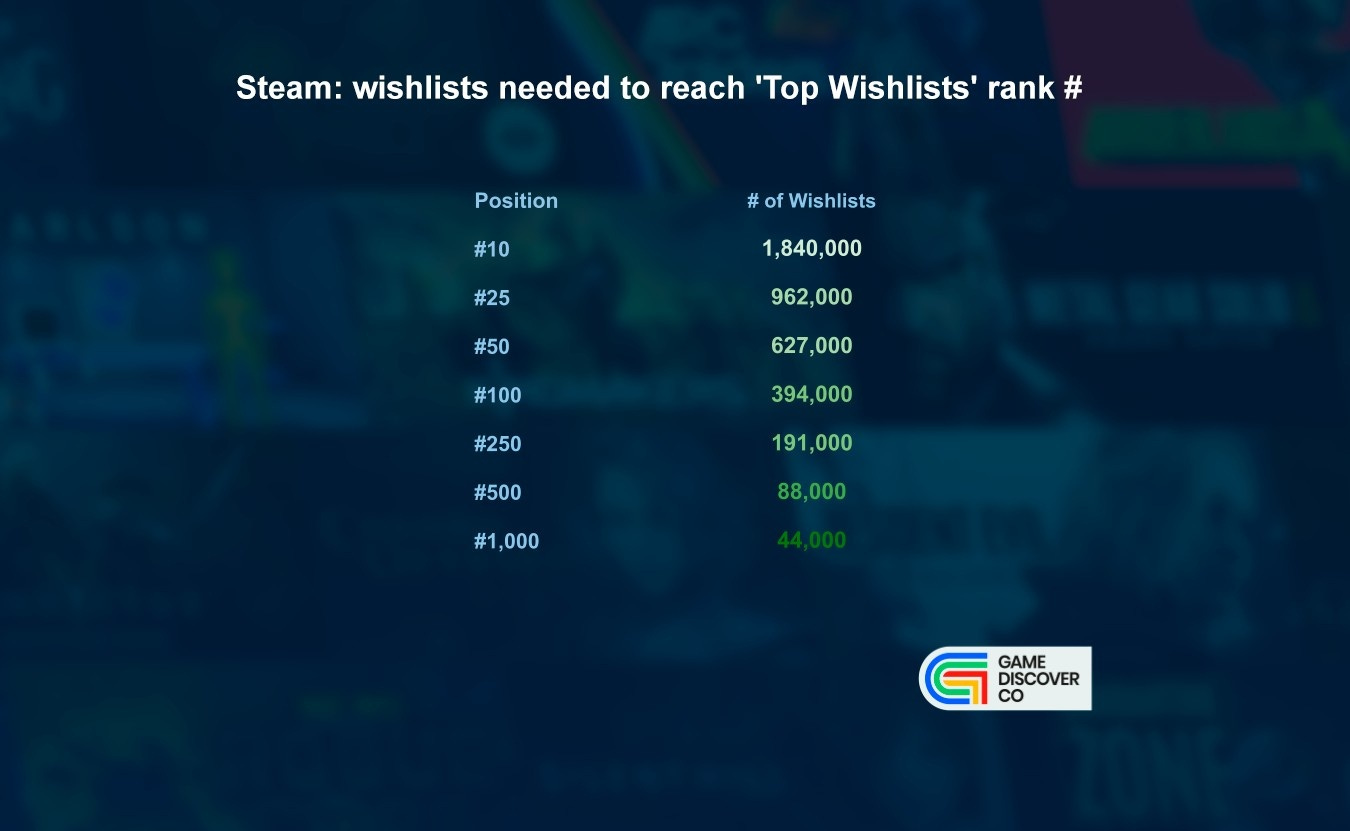

Anyhow, to end, we thought we’d also do an expanded version of a chart we pulled last year, showing how GDCo’s estimates of total Steam wishlists compare to certain ranks in Steam’s official ‘Top Wishlists’ chart for unreleased games:

So yep, of the 33,000+ unreleased Steam games we’re tracking, you need >44,000 wishlists to rank in the Top 1,000, and 191,000 wishlists to be in the Top 250. (Some of which have been there for a long time and aren’t releasing soon, of course.)

Finally, let’s also look at it the other way around - how many wishlists it takes to get a certain rank. Hope it helps to contextualize:

Roblox charts: Growing gardens, stealing brainrot

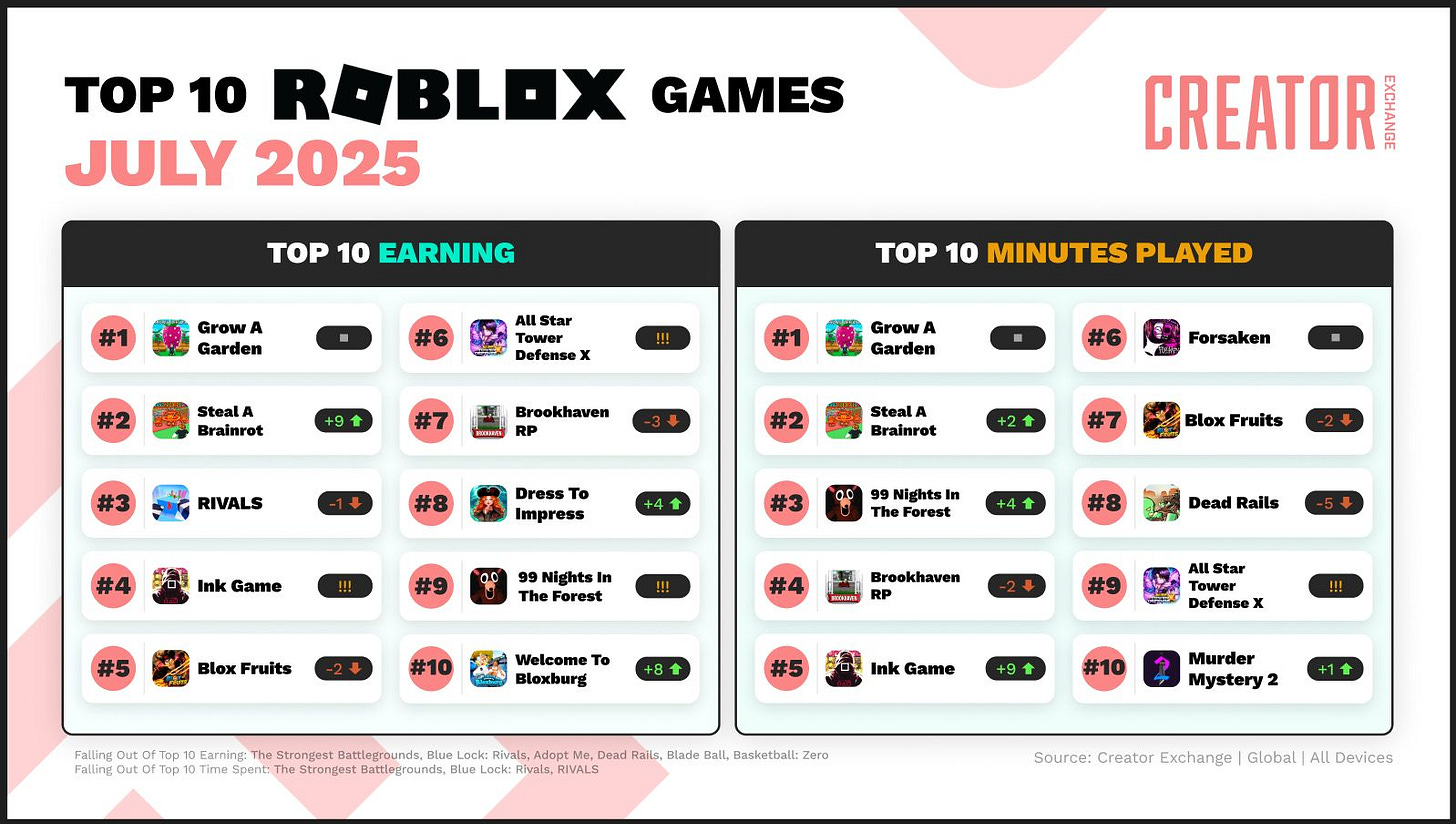

We’re trying to keep up on the Roblox monthly charts as that platform surges - and David Taylor of Creator Games kindly provided us July 2025’s monthly chart [Google link] of the Top 20 top-grossing games, via the CreatorExchange metrics site. Notes:

Steal A Brainrot surged in the charts bigtime: as David says: “a PvP collecting game where players steal and stockpile meme characters jumped +9 spots to become the No. 2 top-earning Roblox game and the No. 2 most played”, with 960k average CCU. (It’s been shepherded by DoBig Studios, who are also involved in Grow A Garden.)

Horror-survival title 99 Nights In The Forest is kicking it: per David, the “narrative-driven horror-social hybrid, continues its sleeper success story... it rose +4 spots to become the No 3. most played experience in July”, and peaked at 1.47m CCU.

The not-at-all Squid Game-y Ink Game (lol) also performed great: it “surged into the Top 5 most played games and Top 5 earners following the launch of Netflix’s latest Squid Game season. Just like Shrimp Game before it, this one Squid Game experience captured more than 50% of engagement in the IP on Roblox.”

Anyhow, check out Creator Exchange for more Roblox-related stats. And we’ll try to keep abreast of this, given that Roblox’s dev payouts are likely to be >$1 billion in 2025. (They were $923m in 2024, and the market is only going up from there…)