Steam publisher sales: how does having a big hit affect one?

Some great YoY data. Also: 'games as a platform' and lots of news...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

‘Are we nearly there yet?’, ask the game discovery kids in the back. ‘Not quite!’, says the game discovery parents (us?) in the front seat. Have some snacks, but there’s still more to learn about the state of PC/console games, so… try to stay awake back there?

Oh, and we’re launching a new survey today, on your unreleased Steam game(s)’ ‘follower to wishlist’ ratio. (We last looked at this >2 years ago, and are wondering if it changed.) It’s 100% anonymous - please fill it out (once per game!) if you possibly can…

[Reminder: talk to your peers & get many goodies via a GameDiscoverCo Plus paid subscription. This includes an exclusive Friday PC/console game trend analysis newsletter, a big Steam ‘Hype’ & performance chart back-end, eBooks, a member-only Discord & more.]

Steam publisher sales, pre and post a big hit…?

So, Canadian developer & publisher Kitfox Games is ‘captained’ by Tanya X. Short, and has just celebrated 10 years in business (woo!) They put out their own titles like Boyfriend Dungeon, and most recently, published Dwarf Fortress on Steam.

For context, Tarn & Zach Adams’ Dwarf Fortress existed for 20+ years as an ASCII art roguelike, with legendarily complex & cool ‘emergent’ simulation. But it was free & funded via (a dwindling) Patreon. Until an ‘enhanced’ Steam debut on Dec. 6th.

The success of Dwarf Fortress on Steam is awesome: around 630,000 copies sold on Steam, as of March. The ever-transparent Adams-es revealed their recent paychecks: $15k (via Patreon), $15k… $7.23 million?! (Then $1.1 million, then $300k - and the $30 game still hasn’t been any more than 10% off, so no extra wishlist emails triggered.)

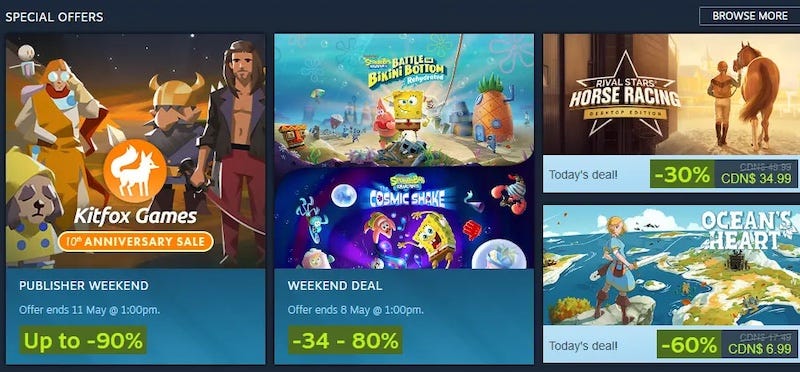

Anyhow, Tanya just wrote up a really interesting comparison of this month’s Steam Kitfox publisher sale, compared to 2022’s sale, which is before they had launched Dwarf Fortress. Here’s some of the key takeaways:

Getting a publisher sale is great, even tho there’s a lot of ‘em: they’re present almost every week of the year! Tanya notes that “the following weekend, there were actually 2 simultaneous publisher weekend / weekend deal combos occurring, for Annapurna and Team17.”

Even so, the visibility & sales boost is significant: you can clearly see that for Boyfriend Dungeon (below), the 2023 publisher sale was better unit-wise than any other recent event, except the 2022 publisher sale and the game’s free DLC launch. (Some of that is wishlist notifications from being 35% off for the first time, and some is related to the front page feature.)

Dwarf Fortress’ massive success messes with most comparison points: as Tanya says, “At this point Dwarf Fortress has outsold all of our other totals combined, so obviously they are the majority of our playerbase, by headcount alone.” This makes overall Kitfox YoY revenue comparisons pretty, uhh, useless.

Publisher sales are a super-helpful event for those with a high-profile enough catalog to get them from Steam. (We think discounting for Boyfriend Dungeon without publisher sale attached would have only brought in 30% of the revenue it actually got.)

Latterly, Tanya tries to delve deeper into the cross-promotion element. Does having a massive game - or similar games - help you cross-sell? Some thoughts on this:

Cross-selling your friends’ games? Not a ‘publisher’ thing any more: Tanya notes: “In 2022 we had a ‘Friends of Kitfox’ carousel with other indies we wanted to highlight... This year, that was explicitly banned by the Steam Publisher Sale guidelines.” Guess it makes sense that sales are either a) themed or b) publisher-specific.

Would the sale have got more of an uplift if wishlist emails had gone out for Dwarf Fortress? Just spitballing here. Tho it depends how much people click on the ‘this is part of X sale’ banner on a game’s Steam page. Perhaps if later Kitfox publisher sales have the game at >20% off, we can A/B test those against 2023’s.

Is there much evidence that cross-selling is ‘a thing’ at all for publisher sales? Tanya notes: “within the new restrictions, a branded Publisher event is more about upselling than about conquering new territories.” But in the end, maybe all publisher sales on Steam are 90% upsell - ‘click through, see a game that interests me on sale, so buy it’, and a small minority ‘look through other games & and buy them’.

In other words, games in these publisher sales are behaving as if they got a ‘mega feature’ on Steam. If a publisher puts out games extensively in a certain genre, the cross-selling opportunity will increase. But if the precise persona overlap is poor - which it is for the majority of publishers - then these sales are upsell, not cross-sell.

As for why it’s difficult to draw concrete conclusions? Here’s what happens to your publisher unit sales graph on Steam when a Dwarf Fortress lands on top of it:

Still, Tanya notes that the 2023 sale “sold roughly the same number of total units as last year, but… 3.5x more dollars, and almost 150% more wishlists total.” Again, so much of that was Dwarf Fortress that it’s pulverized comps. In.. a nice way? Congrats!

Games as a service? No, try ‘games as a platform’…

If any of you were paying attention to Electronic Arts’ recent financials, they were pretty decent, with quarterly net bookings up 11% to $1.95 billion. And you’ll note a lot of talk in the earnings release about “record live services performance”, especially from the FIFA soccer game franchise (shortly to be EA Sports FC.)

And overall, the trend of blockbuster GaaS franchises powering large PC & console companies’ growth continues. (EA and Activision release a fraction of the volume of PC & console games they did a few years ago.)

But we were particularly interested in the language used by EA execs in this latest Q4 earnings call - here’s an official transcript [.PDF]. In responding to a question from an analyst if “gamers are kind of coalescing around the biggest titles” in a post-pandemic world, EA’s CEO Andrew Wilson seems to be trying to push a phrase.

Specifically, Wilson said: “Consumer spending continues to strengthen over time… there will be opportunities for new titles and new brands. But what we don't think that will outweigh is this movement to these broader social ecosystems at our games, games as platforms.”

He continued: “At the very core, we are a games company, but what we are seeing is the evolution of the definition of a game. And you hear us talk about play, watch, create, connect. And it's really that last piece, that connection piece, that is driving the future of our business.

And as we think about building [EA Sports] FC for the future, as we think about building The Sims for the future and Battlefield and Apex and skate. and other properties in our portfolio, we really think about that in the context of building ‘games as a platform’ or ‘content as a platform’ to drive these long-term businesses across play, watch, create, connect.”

Wilson did then follow these remarks up by noting “not to take away from the opportunity to launch incredible things like [Star War] Jedi [Survivor]”. (Which GameDiscoverCo thinks has already sold way over 2 million units, btw, and should sell 5-10 million over time. Not bad for a single-player cinematic experience!)

But yes, EA’s biggest ‘evergreen’ game franchises can be seen as platforms, especially if you can play them, watch streamers do great things in them, and create and share your own in-game content easily (see The Sims 4’s recent official UGC roll-out).

As for the ‘connect’ piece, other Wilson comments get into this: “Games are the social networks of the future… Our strategy is to help players make new friends, build their social network and create community. These in-game social experiences were rolled out in FIFA 23. Among players that interacted with the new feature set, engagement increased over 150%.”

Is this catchy wordsmithing, part of a much bigger trend - or both? (Our vote: both!) But given how important stickiness & retention are in today’s PC and console market, ‘games as a platform’ is a phrase we think we’ll see used a lot more in the future.

The game discovery news round-up..

New week, fresh news, right? That seems to be the case if we sniff the general aroma of game discoverability. So let’s take a look at the latest fruit out of the packing crate:

Alongside its big seasonal ‘25% off’ coupon, the Epic Games Store intro-ed Epic Rewards, “a brand-new way to earn 5% back in Rewards on every eligible purchase you make on the Epic Games Store.” The deets? “All you have to do is buy any games, apps, add-ons, or virtual currency on the Epic Games Store – even V-Bucks [it will] be added to your Rewards Balance two weeks (14 days) after completing the associated purchase.”

For some reason, we haven’t talked about ‘mid-generation console refreshes’ much for PlayStation and Xbox. So thanks, GI.biz, for asking Take Two’s Strauss Zelnick - who assures everyone he’s not hiding a ‘GTA 6 in FY25’ logo on his (well-muscled) arm, btw. He says: ‘We probably will” see a mid-gen refresh, “and they did not affect the business very much” either way. Very straightforward, that man.

Know why MiHoYo’s Honkai Star Rail is monetizing so well on mobile and PC? This LinkedIn post explains how the Genshin Impact approach to gacha works so ‘well’: “Why do players roll for these very rare 5* characters if the base chance to get them is 0.6%? It’s all thanks to the ‘pity’ timers and guarantees that will eventually hit.” ..woo?

Xbox things: this Sarah Bond interview references ad-supported games & “timed slices of games” as things MS could explore; select Xbox games are now rolling out to GeForce Now members, as Xbox signs yet another cloud gaming deal, this time with Boosteroid. (So many niche cloud suppliers!)

Oops, all apps on the Meta Quest Store briefly listed 'Quest 3' as supported when viewed from the in-VR Store app: “The headset, yet to be formally revealed, appears in the More Info section of all apps on the Quest Store, listed after Quest Pro. If you view the store from the mobile app however, you'll see 'New Quest' instead, and from a web browser you'll see 'Unknown'.”

Microlinks: June 11th’s (likely to be interesting!) PC Gaming Show streaming event has “55 games [&] over 15 brand new announcements”; Europe’s April 2023 hardware/game sales saw strength for PS5 & Star Wars Jedi: Survivor; Valve got sued by Immersion in a patent infringement lawsuit related to haptic technology.

A recent Japanese interview with PlayStation’s Jim Ryan talked timing on the PC versions of Sony’s top titles: “I often have the opportunity to ask game fans for their opinions, and when I ask them about the time lag, they say that selling the PC version two or three years after the release of the PS version is accepted favorably.” (Not saying all titles will wait that long, just an off-the-cuff comment! More excerpts here.)

Roblox founder/CEO David Baszucki wrote a thinkpiece about how the company is determined to mix the younger (now!) and the older (soon!) without added safety issues: “With developers over 17 creating the majority of our top 1000 experiences, many seek to create experiences for older audiences so they can interact exclusively with those their age.” (With 55% of Roblox users now older than 13, it’s vital to get right.)

We recently noted Valve’s new ‘community rules’ for Steam, which PC Gamer compared against older versions. But we didn’t focus on ‘skin gambling’, which Cody Luongo at Sharpr just wrote up: “The new guidelines may be used to deter users from engaging with skin betting sites at the risk of losing their accounts.” Not clear how/if this will be enforced for CS:GO or other games, though.

Esoteric microlinks: how idle RPG Unleash The Slime monetizes so well on mobile; Instagram’s new ‘text-based app’ could let you create Twitter-like posts on a timeline; why Garry’s Mod recently decided “nazi glorification” crosses the line.

Finally, the Unauthorizon bootleg game console database has just launched, offering a ridiculously complete look at all those weird ‘grey market’ (or worse!) Nintendo and Sega-a-like consoles. So I went trawling for weird company mascots:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]