Sales comps for your game: how not to do it.

Alright - and also how to do it better!

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

‘I remember when this was all fields, you know. The Internet. All we had was IRC, FTP, and a little bit of Telnet. Now you’ve got your Twitch-es and your TikToks - and now we have to worry about whether people notice the stuff we make, too? Pshaw.’

This imaginary comment is courtesy of someone who doesn’t grok that the Internet’s reach has multiplied near-infinitely. Your games can now reach billions of people online, instead of 12 sweaty nerds in a university computer lab* (*including me) back in 1993. So let’s get on & work out how to do that…

[FYI: six days left for our current Plus paid sub discount, if you want to help us keep motoring. It’s 22.2% off yearly subs - so less than $10/month - for extra newsletters, a Steam data back-end with vital stats on 75,000+ games & tags, a member-only Discord & more.]

Sales comps & estimating reach for your game(s)

So, discovery is a vital point of making sure your game gets out there and is a success. But in order to budget the game correctly, you also may need to estimate how many units you think it’s going to sell. (If you don’t do this, your publisher def. will!)

Which brings up an interesting quandary. How should developers think about estimating possible ROI on a game - whether self-funding or not? And how should publishers/funders think about it? Some framing thoughts:

The first obvious point is that publishers have a portfolio of games to manage risk. And in today’s market, I believe they should be expecting a minority of their games to be larger hits & help fund the others. So this changes their risk profile - they’re looking for the 20% of games that can ‘break out’. But they still need to pick realistic comparables.

On the other hand, if you’re a dev pitching a publisher or funder, it’s in your interest to be fairly optimistic with the comps. The funder can ignore those or not - though don’t look naively over-optimstic, devs. But you should come in by framing a significant possible upside, and let the funder produce their own take.

If you’re a dev that is putting down your own money, and you need ROI to self-fund your next game, for example - you need to have a much more conservative risk profile. Or at least a ‘plan B’ - contract work, taking another gig, etc - if the game doesn’t return as you expected.

Traditional methods of working out possible revenue for games often start by looking at key games in that genre or subgenre. And there’s a super-helpful new ‘market study’ Google sheet from the crew at Alt Shift Games (Crying Suns) which really helps with that:

To use it, make a copy of the spreadsheet, then, as Alt Shift says: “enter the AppId and it fills rows from Steam data + some raw estimation of unit sales and revenue.” (If too many people use it at once, it may overwhelm the API. If it’s not working, try later.)

So, if you’re making a 2D Metroidvania, go to Steam’s 2D Metroidvania category page, enter some of the top-selling games as comps, write down the median revenue numbers, and that’s how much $ your game will make. Right? No, that’s what you shouldn’t do. Let’s add some nuance:

To be realistic, try to pick recent games in the subgenre: for example, we noticed Koumajou Remilia: Scarlet Symphony is currently in the top-selling 2D Metroidvanias. Estimating its performance over Year 1 and including it as a comp would be better than just picking the top 10 ‘old’ games. We also like scanning all new subgenre Steam releases to get a general idea of review #s for your submarket over the last few months.

Top ‘evergreen’ comps can be a) much-updated games b) date from an era of less competition: sure, Dead Cells is just a spectacular 2D Metroidvania. But remember that it first game out in 2018, when there were many less games in the genre. And it’s had many years of DLC and free updates. So it writing down its total multi-year revenue as a ‘comp’ justified? (Maybe only as a single, super high-end comp.)

If you’re a dev pitching to publishers, still play up top-selling comps: We evaluate a lot of developer decks as part of GameDiscoverCo’s consulting*. So yes, from a dev perspective, we definitely think ‘three comps that are all 1 million+ units sold’ is just plain unrealistic. But two and a 50,000-seller? Sure! (*Hit us up if you’re a publisher/funder who wants portfolio management & game signing opinions from a third party, btw. We enjoy it.)

Before we finish up, two additional resources. Firstly, Glitch’s helpful Founder’s Kit webpage has that Pitch Decks showcase which includes decks for games like Bear & Breakfast and Button City, if you’d like to see how others are pitching. (Actually, we didn’t see too many ‘over the top’ comps in there, as a whole - good job!)

Secondly, in addition using specific game comps, why not also use the estimates we published last August - from ourselves and publisher Fellow Traveller - that are based around ‘# of Steam wishlists at launch’? Estimate based on your own games, or use GameDiscoverCo Plus Steam follower launch data (followers x10 = wishlists, roughly).

The wishlists-based estimate is the ‘other way round’ , and you may discover you need to get to some unlikely high wishlist numbers at launch to recoup as you intended. Either way, being realistic is key - and finding the right anchors for that is vital.

Epic Games Store: which games are played most?

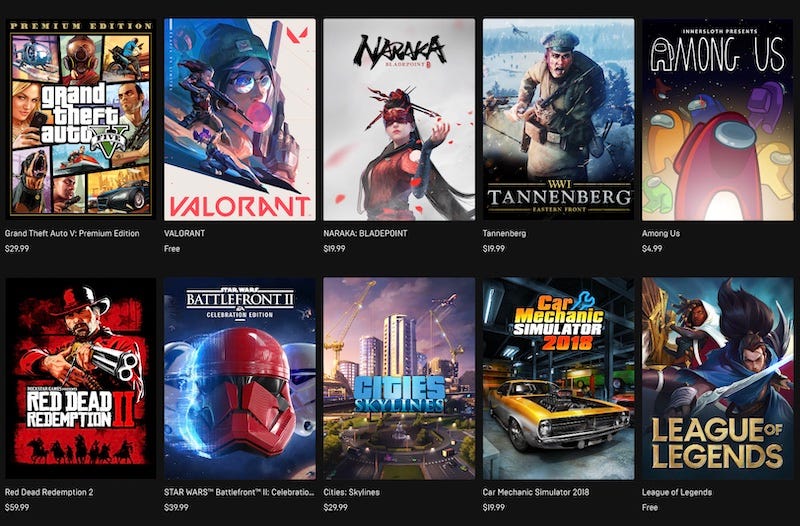

While it hasn’t been the barnburner that Epic had hoped, the Epic Games Store still has a lot of players milling around - particularly playing F2P titles, AAA games, the free games Epic give away, and things that are Fortnite or Rocket League-adjacent.

So when we can get extra data from EGS, it’s always interesting. And over on Github, NikoP is using the data (# of reviews & score) from the recent EGS Store reviews update to make a constantly updated list of game scores & ratings (scroll down for human-readable links!), store-wide.

This is possible because the number of reviews is currently publicly available, although not appearing on the EGS webpage itself - I can see it in Google’s search summary results, though. (Please don’t change this, Epic - it’s interesting.)

Anyhow, reviews are prompted on EGS, so “random players, who have played a game for more than two hours, [are asked] to give a rating on a five point scale”. Thus, number of reviews is more about playtime and uniques combined, rather than something predictive of sales like Steam tends to be.

But sorting by number of ratings per day brings up some interesting trends. Ratings leaders are headed by big titles like Fortnite, Fall Guys, GTA V, and Rocket League (with Multiversus not far behind that, showing its impressive momentum right now!)

But also, some less expected names pop up: WW1 multiplayer title Tannenberg is doing so well because it was free on EGS recently, and Kabam’s shopkeeper sim Shop Titans is F2P, but its ‘free $100 of items giveaway’ seems to have really boosted interest.

[Finally - if you’re in to data mining and the Epic Games Store, the EpicData tracker has a whole bunch more of that, including GitHub source code, a basic ‘new offers’ tracker and more.]

The game discovery news round-up..

OK, let’s polish up this week’s newsletters - at least for you plebs (jk) not getting Friday’s Plus-exclusive one - by poking at the following breaking-ish discovery news:

Nintendo’s financials arrived last night, and even they are having issues with post-COVID supply chain for hardware - “unit sales for the entire Nintendo Switch console family declined by 22.9 percent year-on-year to 3.43 million units.” Good first-party game sales as always - Nintendo Switch Sports at 4.84 mil units - but this earnings slide (above) sums up trends on a down quarter for Mario’s parents.

On supply chain, worth shouting out that Nintendo mentioned that “we expect procurement to gradually improve from late summer towards autumn”. And with Sony also claiming that “[manufacturing] conditions surrounding PlayStation 5 are improving… we plan to front-load shipments for the year-end shopping season”, we could see this holiday season slightly less console-bereft than recent ones.

The Steam Deck Twitter feed has revealed most-played Deck games in the last week, by descending DAU: “MultiVersus, Vampire Survivors, Stray, ELDEN RING, No Man's Sky, Hades, Stardew Valley, Grand Theft Auto V, Aperture Desk Job, MONSTER HUNTER RISE.” Great to see Deck-specific stats here…

Apparently, Unity is considering spinning off its Chinese division. It’s used for big Chinese hits like Honor Of Kings & Genshin Impact, and also has bigger intentions: “Unity's spin-off plan is being driven by a desire to see its software used more extensively in China in areas as varied as smart city modelling to industrial design, as well as in the metaverse.” And with U.S./China tensions as they are….

The latest Xbox/PC Game Pass announcements for August continue with lots of multiplatform (Xbox, PC, cloud) debuts, but also a few more notable PC Game Pass-only titles, including Offworld Trading Company, Expeditions Rome, and Shenzhen I/O - as Microsoft continues to get more aggressive on the ‘PC subscription side of things’.

Logitch and Tencent are partnering on a cloud gaming handheld, which will “support multiple cloud gaming services, and both companies are working with the Xbox Cloud Gaming and NVIDIA GeForce NOW teams, so gamers can play AAA games when they are away from their console or PC.” (BTW, Roku has made a great business of ‘owning the intermediate device’ for streaming TV.)

Microlinks: the NPD says total consumer spending on video gaming in the U.S. totaled $12.35 billion in Q2 2022, down 13% YoY (eek); this NYT piece on how popular streamers deal with stalkers is very well-reported; Snap is making spooky ghost AR games playable in Snapchat.

Some experts weigh in on Google’s alleged ‘hypercasual ad crackdown’ for Android games. Matej Lancaric comments, for example: “There will be some kind of transition period with a lot of Google Play builds rejected and you will need to find new placements for interstitials. But nothing huge is happening. Hypercasuals will survive, as they usually do! They are supposed to be dead already!”

We generally don’t cover individual company financials, but Axios’ Stephen Totilo made a good point on Activision Blizzard’s ‘no bueno’ financials: “Could Call of Duty Vanguard's underperformance explain much of the industry's current slump? Well, here's Activision's just-announced Q2 revenue compared to last year's: - 2022: $1.6 billion - 2021: $2.3 billion - A $700 million dip.” It isn’t just ATVI, but Activision console revenues diving by $300 million is certainly an eye-opener.

Microlinks, Pt.2: a great case study of hate speech in Minecraft servers and methods to ameliorate it; Steam is no longer inaccessible in Indonesia, though some other game services are still blocked; Bungie is pursuing Destiny cheaters and harassers legally, a relatively rare approach which seems to be paying off.

Finally, Mark Brown has a gigantic Game Maker’s Toolkit Jam every year, and he released the engine split for 2022’s jam the other day. Expected dominance from Unity, but there’s more Godot and less Unreal Engine than I expected:

Remember this is a 48 hour jam, though - so simpler tools may often be used. Rune Skovbo Johansen adds that, although Unity lost 0.5% market share YoY, Game Maker (-2.8% of the total, and down 31% YoY) and Construct (-0.7%, down 29%) had notable declines. (Maybe those engines are cannibalized by Godot for now, more than Unity?)

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]