Revealed: the stat that tells you how much Steam likes you?

Or something like that. Also: this week's Steam releases and lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, plenty of fresh data and news to explore, sure. But we also wanted to look at data to illuminate if you can tell when your game is ‘best friends with the Steam algorithm’. Is it 100% indicative? No. Is it fun and interesting? It surely is…

Before we start, it’s a fact that British video games from the ‘80s were ‘interesting’. (The Frankie Goes To Hollywood Game, Fat Worm Blows A Sparky, anyone?) So Michael Klamerus made an ‘80s British Game (Concept) Generator tool. Example: “A… beat 'em up where you play as a man in pyjamas in the year 2011 and avoid smelling poo.”

[FREE DEMO OF GDCo PRO? You too can get a gratis demo of our GameDiscoverCo Pro company-wide ‘Steam deep dive’ & console data by contacting us today - ~90 orgs have it. Or, signing up to GDCo Plus gets the rest of this newsletter and Discord access, plus more. ]

Game discovery news: Fable, Highguard get chat..

Let’s kick off with some game platform and discovery new, as per usual, or yr money back:

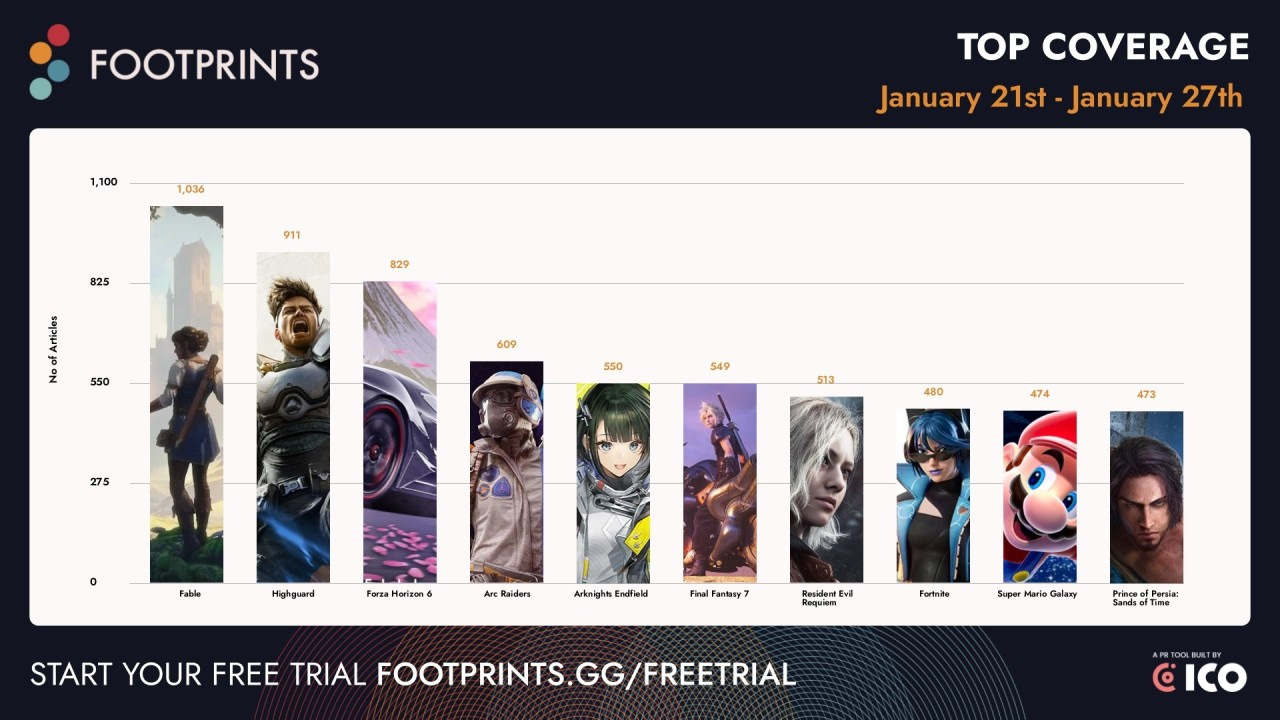

Look at the latest ‘trad media’ mentions from ICO’s Footprints.gg, those Xbox showcase titles - Fable and Forza Horizon 6 - are still getting much hype. Also in there: Highguard (the F2P raid shooter crashlanding on Steam this week), Arc Raiders & off-Steam PC, PS5 & mobile anime ARPG release Arknights Endfield.

Microsoft’s results saw profit up 21% to >$38b (!), yet Xbox didn’t fare so well, with gaming revenue down 9%. ‘Content and services’ rev. was down 5% to $5.27 billion, with no calendar Q4 bump & CFO Amy Hood deeming the drop ‘below expectations’ and ‘driven by first-party content.’ (Call Of Duty doubtless a big chunk.)

And as Xbox exits prioritizing consoles, the 32% hardware revenue decline (approaching 50% units?) might not be a surprise, but: “Xbox hardware $ in holiday 2025 was less than… in Starfield's launch quarter in September 2023. (Jul-Sep 2023: ~$753m; Oct-Dec 2025: ~$688m) [It’s] the lowest holiday $ performance since 2014.”

The fallout from some metadrama about ‘bad indie publishers’? This helpful post from Forklift’s Andrei Podoprigora: “Developing a game is a job; Publishing a game is a job; Some devs are great at both, and love doing both; Others love making games and want nothing to do with publishing.” Is it as easy as that? Perhaps it is.

We don’t cover much AI content, but are squinting at Google’s Project Genie, an “experimental research prototype [that] lets users create, explore and remix their own interactive worlds.” Why? Google’s a platform, Google Deepmind has video game veterans atop it, and it’s making environments that look like video game levels.

Platform microlinks: Xbox Cloud Gaming’s new design teases the future of Xbox console UI; PlayStation Plus’ ‘monthly’ games for February are Undisputed, Subnautica: Below Zero, Ultros, Ace Combat 7; Xbox Play Anywhere (cross-saves and cross-buying) isn’t getting as much third-party support as MS might like.

Want more proof that being on Game Pass is largely a parallel market & doesn’t raise all boats? This Game Developer Collective survey revealed that only 4% of respondents thought being in a ‘subscription service’ increased sales of their game overall. (But 17% thought that IAP/DLC was positively impacted.)

More Circana knowledge to muse on: “53% of U.S. video game hardware buyers in Q4 ‘25 had a household income of $100k+ - a record high - and up from 40% in Q1 ‘22.. average [console price] in the US was $373 in Q1 2022, jumping to $446 by Q4 2025.” And console buyers in <$50k households fell from 31% (Q1 2022) to 19% (Q4 2025.)

Weird game platform news of the week? Not only are Virtual Boy games coming to Nintendo Switch on February 17th, but there are two unreleased titles debuting later, Zero Racer and D-Hopper. (There’s also emulated Teleroboxer and Virtual Boy Wario Land for the odd red-and-black 3D glasses-based ‘90s console.)

Player sentiment company PlayerXP just put out a report on gamer reaction to ARC Raiders’ targeted use of AI: “Overall, sentiment towards AI in ARC Raiders is surprisingly neutral, as while discussion tends to lean negative, the number of Steam Reviews and their positivity towards AI pushes sentiment further towards the positive.”

Microlinks: Amazon Games boss Hartmann reportedly leaving as firm retreats from PC and console; AdHoc reassures Dispatch players on Switch as it confirms Nintendo platform versions are censored; Valve to face UK class action lawsuit over Steam revenue share with proposed damages of £656m.

More Like This: does it tell you if Steam likes you?

How do you get the Steam algorithm to love you? A fundamental truth: external interest from friend tips, influencers & general player buzz - translated into wishlists, sales, and revenue - is largely how Valve decides to favor games. (Not ‘clever tricks’, sorry.)

And in recent years, more of Valve’s discovery surfaces - like chunks of Featured & Recommended, Discovery Queue & more - have been personalized. (Reminder: this excellent video from Steam methodically explains how visibility is prioritized.)

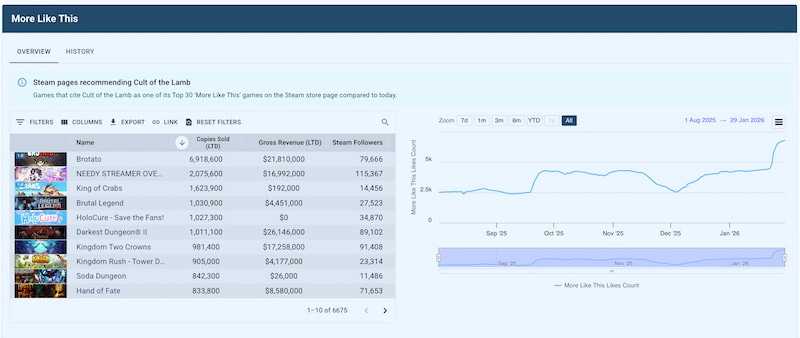

However, one section that appears on every game’s details page that isn’t personalized is the ‘More Like This’ box (above). It’s a set of 30 games randomly displayed in scrollable sets of 4, and that provide great visibility for your game.

We covered this box all the way back in 2021 when it only had 12 games listed, and it’s changed multiple times over the years. It shifted most notably in 2020 when criteria were tightened up (to, we think, high recent revenue & similar individual tags.) This stopped clever devs matching tags in order to appear in high-profile games’ pages.

Anyhow, the result is that today’s More Like This picks feel ‘big-game first’ and 70-80% on-topic. This sometimes irritates smaller devs, but is a good opportunity for us to survey the entire Steam ecosystem to see the # of links games get from other pages. Here’s Cult Of The Lamb - check the jump after its Jan 22nd Woolhaven DLC launch:

So what we’re seeing is ‘get a big interest boost, and your More Like This mentions go up’. Is this actually a ‘how much Steam likes you’ metric, then? Well… kinda. Some tags are more crowded than others, and ‘count’ alone doesn’t indicate reach. (Oh, and unreleased games have trouble making it into this box, unless exceptional.)

But it’s still a super interesting stat to play with. And as well as individual game data, we have a ‘More Like This Explorer’ in GameDiscoverCo Pro which ranks every single Steam game by the most linked-to from other game details pages. Here’s today’s chart:

An interesting rundown, huh? It’s not 100% the current top grossers, but almost all - from RV There Yet? to Enshrouded, Silksong and beyond - are multi-million sellers. And seeing high-concept co-op horror title Mimesis in the mix is interesting.

If the ‘most-linked to’ games are a little ‘usual suspect’-y, we may get some more intriguing data from ‘which games picked up the most extra More Like This links in the last week?’ And indeed we do:

This chart actually feels like ‘oh look, something happened and now Steam likes you’, with some of the trending surprises including:

Dwarves: Glory, Death & Loot is a roguelike RPG autobattler which just hit 1.0 and is having an even stronger 1.0 launch (~5,200 CCU) than its EA (~2,300 CCU)

Escape From Ever After is a Paper Mario-esque RPG which started at 1,200 CCU a few days ago but has decent buzz & is ascending the JRPG ‘More Like This’ recs.

Fable Anniversary, the HD remake of the original open-world fantasy game is trending up due to showcases of Xbox’s new Fable game (and a related discount.)

There’s also various other new games - like F2P PC/mobile life sim Heartopia (which just hit 50k CCU), LORT and Hellmart - doing well. (And long-time hit Cult Of The Lamb is also in the charts, due to the DLC mentioned above.)

So yep - this stat is - kiiiiinda - if Steam likes you currently. And maybe a little tag optimization might help you cross-promote on more Steam pages, if you are already a decent-sized seller of $50-$100k/week or more. But again, reminder: most players want to buy your game before they reach a game store, and that’s where to concentrate.