Revealed: new data on Steam ‘wishlist conversions’ & the hit-driven market

Also: a 'high hook' announce and the most-streamed Nov. games.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back - did you miss us? You’re still digging out from November’s GDCo newsletter barrage? Pshaw, you’ll never get up to speed if you don’t make your daily 10,000 steps words, discovery trend fans. And Dec’s (mental) workouts kick off now….

…well, almost now. First, a key reminder: our Steam refund % survey will close submissions at the end of this week, and we’re looking for a few more games to enter their details anonymously. Full results will be in this newsletter for free! (In January?)

[YOUR BEST PRE-XMAS PRESENT: support GameDiscoverCo by subscribing to GDCo Plus right now. You get basic access to our ‘core’ Steam data back-end, full access to our second weekly newsletter, our lively Discord, eight game discovery eBooks & lots more.]

Game discovery news: Path Of Exile 2 arriving hot!

Kicking off things, we have 10 days of game discovery and platform news to catch upon - so that means a lot of microlinks, in today’s dense round-up. Let’s hit it:

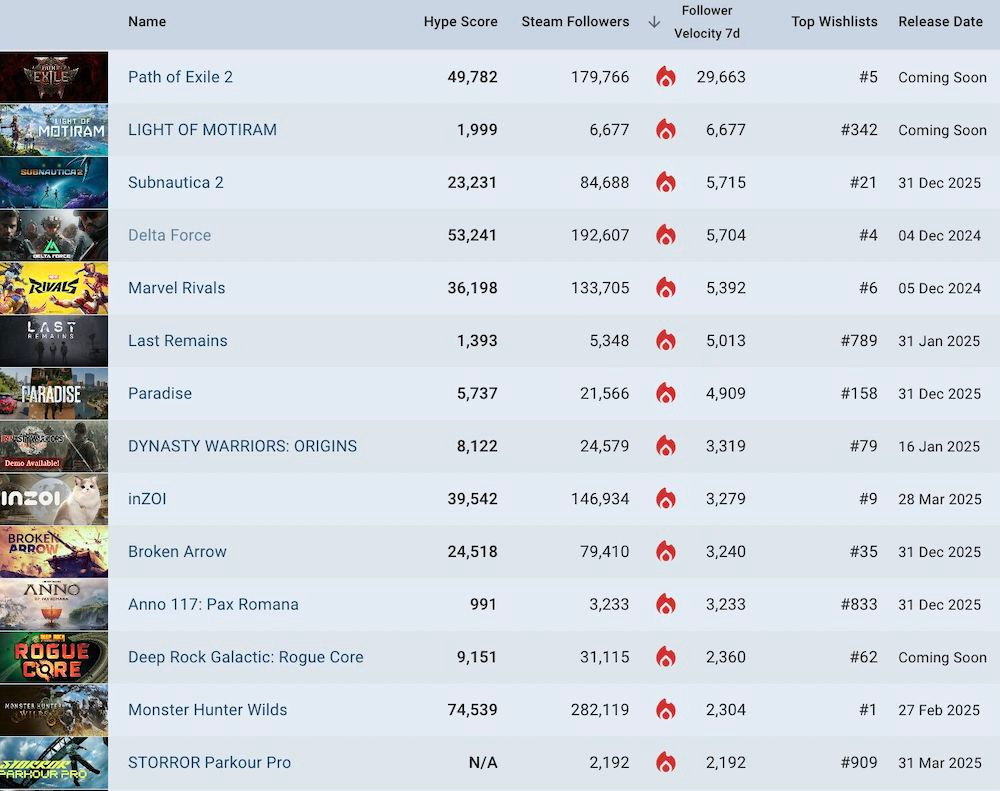

We’ve got two weeks of GDCo’s ‘trending’ unreleased game charts on Steam for you: Week 1’s chart has Path Of Exile 2 and Dynasty Warriors Origins blowing up big, and Week 2’s chart (Nov 25th-Dec 2nd, above) is also headed by PoE 2, which is looking to launch huge, with controversially Horizon Zero Dawn-ish survival crafting game Light Of Motiram at #2, after launching its Steam page.

Further down this week’s chart: Chinese-developed zombie city survival-er Last Remains (#6) also charted, and new entries included Ubisoft's latest citybuilder, Anno 117: Pax Romana (#11), STORROR Parkour Pro (#14), as well as a resurgence for DRG spinoff Deep Rock Galactic: Rogue Core (#12) due to a new teaser trailer.

Wolfire & Dark Catt's antitrust suit against Steam has been certified as a 'class action' [.PDF], with 'all Steam devs who got paid out since 2017' now part of the eligible group suing over 'forced content & price parity' and the 30% price cut on the platform. (Doesn't mean the lawsuit succeeded, but it's a notable milestone.)

Microlinks: Apple reveals 45 app and game finalists for the 2024 App Store Awards; Steam removes Oct 7 game [in UK] at request of UK counter-terrorism unit; why Balatro is one of the most successful ‘premium launches’ on mobile.

Bloomberg had the scoop that Sony “is in the early stages of developing a portable console that would play its PlayStation 5 games on the move”. It’s not cloud-streamed, like the PS Portal, although it’s “likely years away from launch and the company could still decide against bringing it to market.” (Make sense given trends, though.)

Roblox/Fortnite ‘platform’ update: Fortnite hit an all-time high 14.3 million concurrents (!) recently, due to the Remix ‘live’ event starring Juice WRLD, Snoop Dogg, Eminem, and Ice Spice; Roblox is giving 25% more Robux to players who buy outside of iOS & Android, and David Taylor has a breakdown of how they buy.

FYI: if you’re ‘surprised’ a game suddenly got lots of Steam reviews during the Autumn sale, it’s due to a little gamification! Max badge level for the Steam Awards Nomination Committee 2024 badge involves players reviewing - or updating a review - for a game they’ve nominated in the Steam Awards.

Console microlinks: Game Pass’ first December games include Indiana Jones and the Great Circle, Crash Team Racing, Wildfrost & more; indie game champion Shuhei Yoshida is retiring from PlayStation after 31 years (!); PlayStation Plus’ ‘essential’ games for December are It Takes Two, Aliens: Dark Descent & Temtem.

Since Amazon added ‘units sold’ to its game console SKUs in the U.S., John Welfare is crunching the numbers monthly. For Nov. 2024, he has “[PlayStation 5]: 153,000 (+25% YOY), [Switch]: 56,000 (-61%), [Xbox Series]: 32,000 (-16%)”, noting: “PS5 had much better discounts and the Pro launch, and Amazon did not sell the [Switch] Mario Kart bundles at discounted prices like other retailers.”

Kwalee VP John Wright has some 2025 trend predictions for mobile gaming, and besides the obvious (web stores, D2C/alt stores), one of the bullet points is: “Big publishers dominate, small studios pivot to Steam.” We’ve seen this already with devs like Nokta Games (Supermarket Simulator) - but it’s busy over here, too!

Steam things: a new CCU peak for Steam during Thanksgiving and Black Friday weekend, from 38.4 million in September to 38.9m last week. (In-game, it’s ~11.75m CCU.) Also: “leaked 3D models hidden in a recent SteamVR update appear to show off a new VR motion controller”, possibly part of the rumored ‘Deckard’ standalone headset.

Microlinks: more shovelware tragedy over at the Switch eShop, with ‘Unpacking: Deluxe Edition’ being completely unrelated to the hit game of the same name; the Microsoft browser overlay for finding info about PC games without leaving your session is available to beta testers now; Nintendo Switch eShop and online services are ending in China in 2026.

Steam wishlist conversions & a hit-driven market!

Predicting how your PC game will sell on Steam? Just… ugh. But no, seriously, we’ve been feeling a bit self-conscious that we might be peddling ‘pseudoscience’ in terms of how your game might sell after getting X wishlists, even when a) Valve notes the relationship can be pretty indirect, and b) we’ve signposted huge variance in the past.

But we’re still in the ‘wishlists are somewhat indicative and a handy indicator’ camp. And so when a GDCo buddy came to us with a recent ‘underperforming’ release and asked why, we thought it was time to re-examine ‘wishlist to sales’ scenarios. And the results - you probably won’t be happy with them?

We’ve previously done an opt-in dev survey back in April which showed that games that launch with >10k wishlists had a median of 17% of their wishlist balance at the end of Week 1. (So: 100k wishlists, 17k Week 1 sales.)

But we realized that dev surveys may well bias towards people who perform a bit better. So, using some newer wishlist estimation tech, we looked at every single Steam release in Aug, Sept and Oct 2024 (Google Drive doc) with >250 GDCo Hype score* at launch, estimating launch wishlists and Day 7 unit sales. (*Largely games with at least 5,000 Steam launch wishlists, but a few smaller ones with weird anomalies slipped in.)

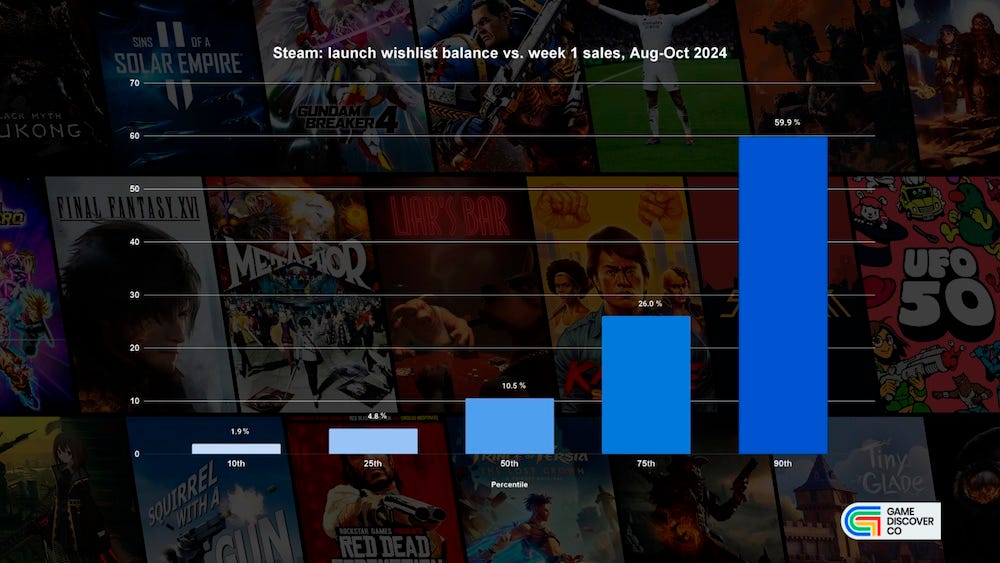

And here’s what we have. It’s an average by percentile across all three months, from about 120 games that launched in August, and ~150 in September and October:

So there’s that! Some immediate takeaways from this data:

The median ‘conversion’, at 10.5% for Week 1, is lower than we’d hoped: we can’t tell you easily if it’s decreased over time, but GDCo’s Revenue Predictor, based on Fellow Traveller’s spreadsheet, is using 20% for Month 1. This would be closer to 13-14% median for Month 1. (Maybe FT just makes better converting games, too.)

The consequences for being outside the median escalate quickly: this has always been the case. But the above graph shows it more clearly than before. Being in the 25th percentile (so ~90th ranked out of 120 games in August, not that far out) gets you ‘only’ a 4.8% conversion rate. 10th percentile is just 1.9% conversion, ouch.

The high-end ‘good-converting’ games are few and far between: best case scenarios like Warhammer 40,000: Space Marine 2 - a ton of wishlists and also converted well - approach 100% ‘conversion*’. (*Not really conversion, since some of the sales are from wishlists, and some are organic.) But there’s only 15-30 games per month with >50% conversion, and a number of those had only 10k-ish wishlists.

To give you more context from the document, here’s what we identified as the top-converting Steam games from October 2024:

It’s a really motley crew, and seems to be a combination of the following:

Big-name franchises that were slightly under-wishlisted compared to overall interest: and were also well-executed, of course: Dragon Ball Sparking! Zero, Dragon Age: The Veilguard, and Romancing SaGa 2 among them.

Games that genuinely went viral with streamers just after release: multiple, generally less expensive to make/buy examples, including Liar’s Bar, Karate Survivor, and Storage Hunter Simulator.

Unpredictable ‘surprise’ hits: we probably should have guessed, given how beloved it is in the U.S., but the Backyard Baseball ‘97 reissue did great! (And wasn’t the style of game that people would necessarily wishlist beforehand.)

Some of the questions you may be asking now are: why are you doing this to me? Have wishlists become more ‘useless’ over time? Why don’t we just all go sit in a hole in the ground?

So: we think possibly (very possibly!) wishlist conversions for new games have gone down. But a lot of it is simply the lens you are looking through. If you use an opt-in survey, you’ll get nicer answers. If you limit minimum sales numbers differently and use older dates too, you’ll get nicer answers. (Our estimates will also not be perfect.)

And look, we know the market for new games is a tough one, with so many great older ones either a) being heavily discounted or b) retaining an audience. Look at Hearts Of Iron IV, which just hit a record 93,000+ Steam CCU, eight years after release, as Paradox re-invests in ‘evergreens’.

So to win, you need a chunk of back catalog, and you need some bets on new hits. And boy, if you get that hit, you can really clean up. We have the Top 5 new Steam games in 2024 grossing, wait for it, $2.22 billion. (That’s Black Myth, Helldivers 2, Palworld, Space Marine 2, and Dragon’s Dogma 2.) Yes: all this new revenue is hit-driven - that’s what the data above really says. So we should all be realistic about that.

How The Cabin Factory went viral - 3x - on reveal!

The folks at Future Friends Games & International Cat Studios just had a nice viral moment with the announce of their horror game The Cabin Factory, and FFG’s Thomas Reisenegger has a post up describing what happened.

It’s actually a great case study on the effects of Twitter and TikTok on the most viral ideas, because it “was announced almost exclusively via social media, with some minimal press coverage and Reddit test ads on top.” Here’s what Thomas noted:

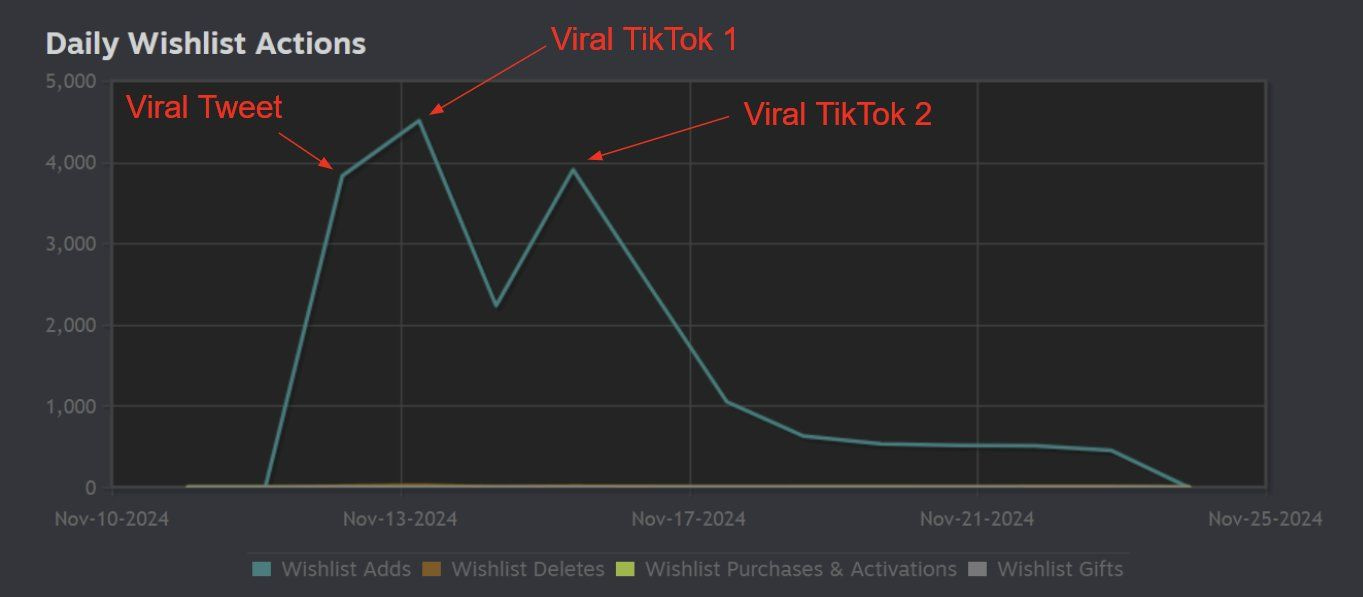

There were three separate ‘viral moments’ around the reveal trailer: on Nov. 13th, the viral announce Tweet (3m views, 63k likes, 4.5k shares), then on Nov 14th, a similarly hot TikTok (1.4m views, 213k likes, 63k shares), and a different viral TikTok on Nov 16th (1.2m views, 122k likes, 15k shares).

This led to 20,000 Steam wishlists in 10 days: also, 6k followers on TikTok and 900 followers on X got added. Thomas notes: “the original [Twitter/X] post did not include the Steam link or studio profile but only the follow-up post… that will have lowered conversion”, but with marketing-y links it might not have trended.

Why successful? The hook’s the thing: Thomas highlighted the “super strong and clear game pitch (you inspect cabins and need to report if they are haunted or not)… short kick-ass trailer by Owen T… popular and trendy genre (3D horror game)… posts look natural (short, no links)”, and, uhh, luck!

Here’s the Steam back-end wishlist graph, so you can see the impressive effects from the viral trailer:

When we originally saw this game’s trailer go viral, we also felt like the concept was standout - some Cabin In The Woods vibes, even? Obviously, there’s now player expectations over how they feel the game should play. But interested players you have to manage expectations with? It’s way better than no interest at all…

Q: Nov. 2024’s most-watched streaming games?

Yes, once again livestream analytics platform Stream Hatchet - which looks at all the major (non-China) game streaming platforms from Twitch on down - has provided us with basic Top 100 data for the previous month. (We loves it, we does.)

So, as per usual, here’s the full ‘Top 100’ for November (Google doc). The top games tend to stick around near the apex of the charts - you’ll always see LoL, GTA, Minecraft, Fortnite, Valorant, and Counter-Strike up there. But interesting changes:

Call Of Duty: Black Ops 6 and World Of Warcraft both had good months: We’d expect Black Ops 6 (#7, 56 million hours watched) to pick up interest in November, since it had an Oct. 25th release date, but World Of Warcraft (#8, 55m hours) also did great, thanks to the 20th anniversary celebrations for the popular MMO.

S.T.A.L.K.E.R. 2 was the highest new entry, at 20m hours watched: we discussed how GSC’s post-apoc survival game did great, despite launch ‘anomalies’ galore. And #19 and 20.6m hours watched is very good, given it launched on Nov. 20th.

Rust and Teamfight Tactics also saw interest double, month on month: brutal sandbox game Rust (#17, 24.3m hours) does a server wipe every November, leading to a scramble for new territory. And Riot’s mobile-first Teamfight Tactics (#16, 25m hours) had new characters from Arcane playable in-game.

Other new entries? we’ve been tracking the Steam CCU success of Farming Simulator 25 (#32, 9.4m hours watched), so no surprise that it also got viewed a lot. Also officially launched in November: F2P standout Supervive (#53, 4.7m hours), and oldskool remaster Dragon Quest III HD-2D Remake (#55, 4.6m hours).

And one game we hadn’t heard of: F2P card based autobattler The Bazaar (#44, 5.5m hours), looks very slick, had a beta and is getting some critical plaudits - there’s also plenty of YouTubers playing it. It’s also - notably - avoiding Steam as a distribution platform for now. And that’s all we’ve got - see you on Friday! Toodles…

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Any chance for a follow up on how The Cabin Factory converted in terms of wishlists to week 1+month 1 sales?

Thank you!