Rematch, Peak, Broken Arrow top big week for Steam debuts!

Also: some PlayStation & Switch 2 analysis, and lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Continuing on at a leisurely pace, it’s your final GameDiscoverCo newsletter of the week. We’re checking a busy Steam launch week (for our GameDiscoverCo Plus & Pro subscribers), with much analysis on PlayStation, Switch 2 & other platforms besides.

Before we start, shout-out to Japanese dev Kairosoft, just releasing their 60th (!) sim game, Skating Rink Story, on Steam. Yes, that’s 60 games on Steam since March 2022, and 5 this year already! (They’re also on Android & iOS - and Switch - as premium titles. But wow, what a multiplatform grind-based biz model, for a tiny studio…)

Game discovery news: device business as usual?

Let’s start off by looking at key game platform & discovery stats from all over the Internet, as we do, we do, we do do do:

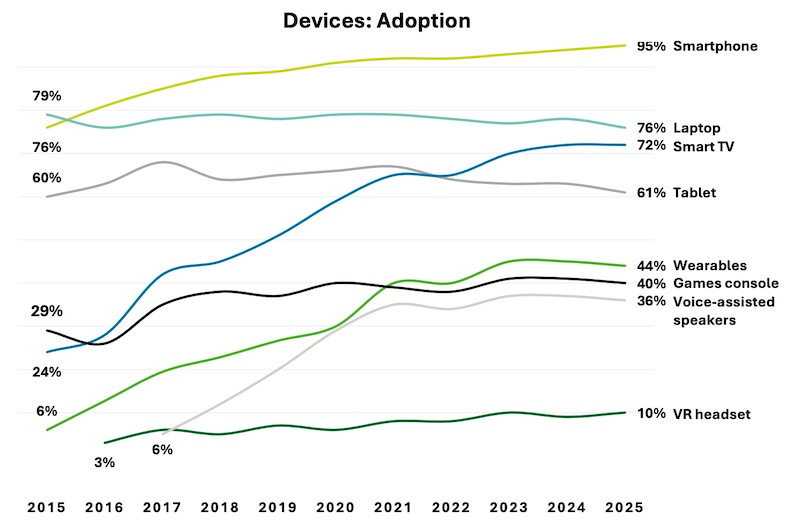

Deloitte’s UK division has been surveying British adults for a decade on ‘digital consumer trends’, which is how you get handy graphs like the above. Game consoles are at 40% adoption, and VR at 10%, but: “All major consumer electronics devices may have reached a plateau, and no new form factors have emerged in the 2020s..”

At The Game Business, Christopher Dring gets a choice quote re: Switch 2 & third-party games: “Most third-party Switch 2 games posted very low numbers. One third-party publisher characterised the numbers as ‘below our lowest estimates’, despite strong hardware sales.” We’re not surprised at all - personally, we grabbed Mario Kart World & reloaded some Switch 1 games, and are waiting for Donkey Kong.

What’s more, here’s the U.S. Switch eShop’s combined Top 100 for June 19th (GDCo-created Google doc). Look: 78 of the 100 games (by 3-day $) run on Switch 1. And 44 of the top 100 - and 12 of the top 20 (!) - are first-party Nintendo games. Cyberpunk (#4), Fantasy Life (#8) & Deltarune (#10) are the top 3P Switch 2 SKUs, the latter two also available on Switch 1, and not that different there.

On physical note in the U.S., via Mat Piscatella: “Third party unit share of Switch 2 physical software during week 1 reached… [~]40%. For month 1 of the Switch launch it was less than 20%.” Not bad, if presumably Cyberpunk-led. Elsewhere, GDCo has viewed recent Switch 2 eShop sales for a popular (non-Top 30, but 100s of units per day on sale!) Switch 1 game. A brief 'copies sold' spike (1.5x?) on the 3-4 days around Switch 2’s release died down… fast. (Our general conclusion: Switch 2 will do fine, but building engaged installed base for 3P games is a multi-year process!)

According to The Verge: “Microsoft is confirming today that it’s working on a next-gen Xbox console in partnership with AMD. Xbox president Sarah Bond [announced this] in a minute-long video posted to YouTube, promising to deliver ‘an Xbox experience not locked to a single store or tied to one device’.” Also see AMD’s CEO announce!

Steam’s doing more sterling work on platform accessibility, revealing: “Today's Steam Client Beta update adds accessibility options for players in Big Picture Mode, and on devices running SteamOS (Steam Deck, Lenovo Legion Go S)… [including] UI scaling, high contrast mode, and reduced motion features.”

YouTube’s 20-year anniversary culture & trends report [.PDF] notes that Minecraft videos passed 1 trillion views (!) on YouTube in 2021, and has now hit >2 trillion views in 2025. Also notable: “60% of YouTube’s 1,000 current most-subscribed channels have uploaded at least one gaming video.”

A quick follow-up on Tuesday’s Steam Next Fest newsletter: we removed the ‘all wishlist increase estimates’ tab from the mega-doc, cos some estimates were WAY too low. Why? 4-day rolling sample size & high NF-specific ‘follower to wishlist’ ratios. (Just use CCU/follower estimates for rankings, you’ll be fine…)

Kickstarter-backed JRPG Alzara Radiant Echoes (294k Euros raised!) is ending on a sour note, with the studio shutting down due to no publishing deal, “despite having a playable demo, a senior team [and] half of the funding secured.” Backers aren’t happy at all, feeling like they were promised the full game - crowdfunding trust issues.

PlayStation VR 2 is not especially hot. But it’ll still hurt Sony that Meta’s Beat Games division is announcing that Beat Saber is ‘end-of-lifing’ on the platform: “Players on PSVR and PSVR 2 will continue to be able to play and purchase Beat Saber after today”, but no new DLC, and no multiplayer after January 2026.

ICYMI: Digital Foundry’s comments on the Xbox ROG Ally are worth checking, with Oliver Mackenzie saying Xbox’s attempts to “pitch [the Ally] as a console-like experience… I think is a dramatic overstatement of what the device is likely to deliver.” (The Q is around how much you need to cloud-stream to get Xbox AAA games?)

Microlinks: Nintendo is already nuking Switch 2 console accounts for players caught using [backup/piracy-y] flash cartridges; in UGC news, inZOI’s official ModKit with Curseforge has rolled out; new on Xbox Game Pass is Rematch, Warcraft I & II: Remastered, Warcraft III: Reforged, Call of Duty: WWII & more.

PlayStation’s strategy in 2025: five key graphs

For anyone who didn’t spot it, Sony’s Game & Network Service division - i.e. PlayStation - did a ‘business segment presentation’ for investors a few days ago. (Yes, you can watch the whole thing - starring CEO Hideaki Nishino and creative/dev studio head Hermen Hulst - yourself.)

But we were enchanted by the pretty graphs in the presentation (.PDF), so wanted to slap a few of them up with some commentary on PlayStation’s commentary. Let’s do it:

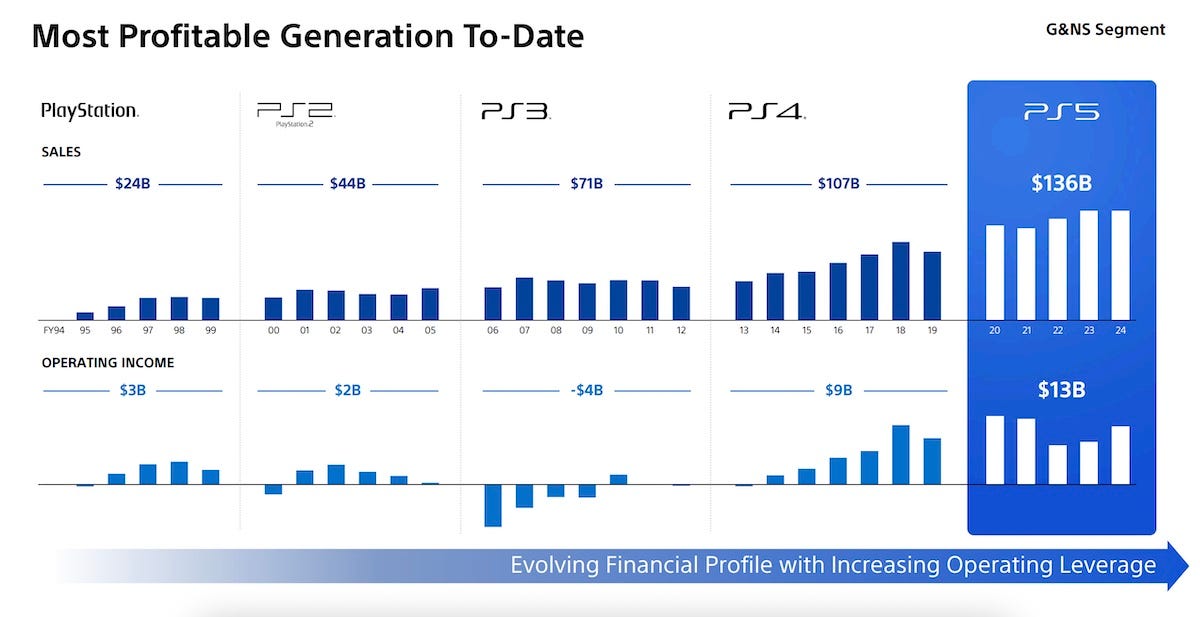

#1: PlayStation 5 is solidly, progressively profitable for Sony

With the minor caveat that recent weaknesses of the yen vs. the dollar (look at the 5-year view!) really help Sony’s financials, PlayStation 5 looks really good at $136 billion USD in revenue and $13b in profit, vs. PlayStation 1’s $24b revenue and $3b profit. (PS1 would be ~$50b revenue if inflation-adjusted - so it’s still 2.5x that much.)

Side note: it’s fascinating how much Ken Kutaragi’s too-complex Cell-led hardware for PlayStation 3 messed with that platform’s profitability. Ahead of its time or not, it was a definite mis-step, which Mark Cerny & friends rectified for PS4 and PS5.

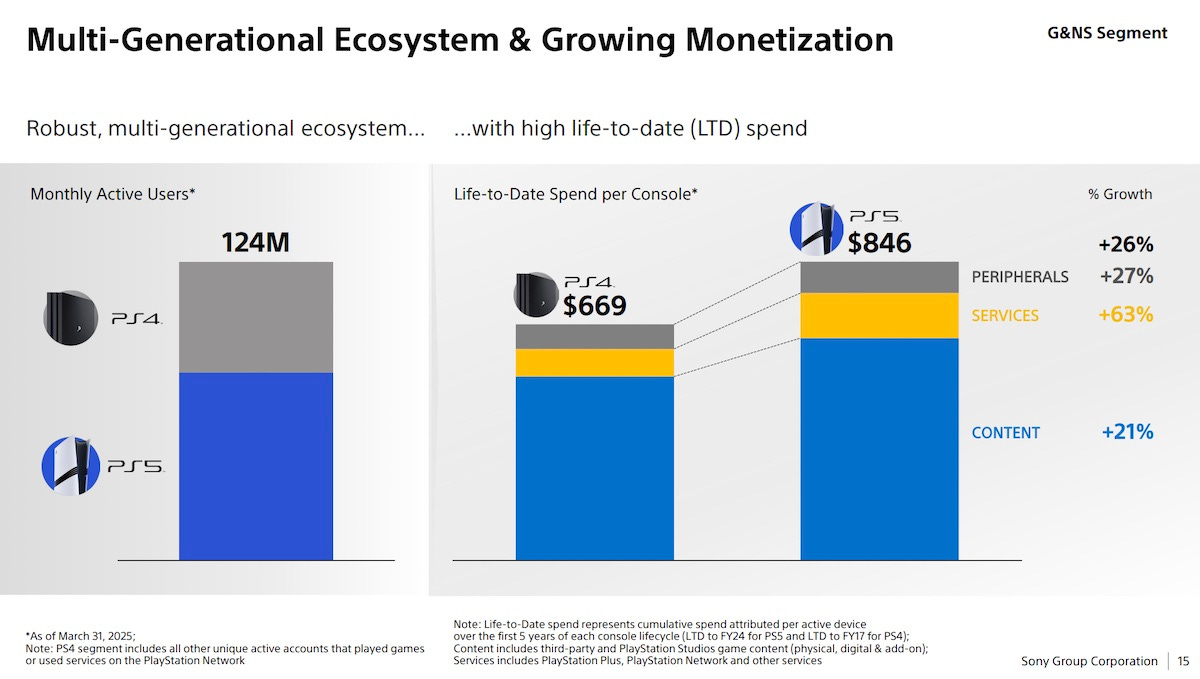

#2 - PS5’s current monthly actives finally topped PS4!

A lot of us on the bleeding edge forget how much older console generations are still used - perhaps for ‘Fortnite and chill’, but still. And given that last year, Sony said PS4 MAUs and PS5 MAUs were still 50/50, it’s a milestone that a clear majority of the 124 million PlayStation Network console users every month are now on PS5.

Otherwise, the PlayStation 5 spend increasing 26% from the previous generation is semi-impressive. But the ‘services’ increase of 67% - being PlayStation Plus - is probably the only banner number, given pricing power of $100 in 2013 is $137 today. (We’re just going to talk about inflation for this entire newsletter, apparently.)

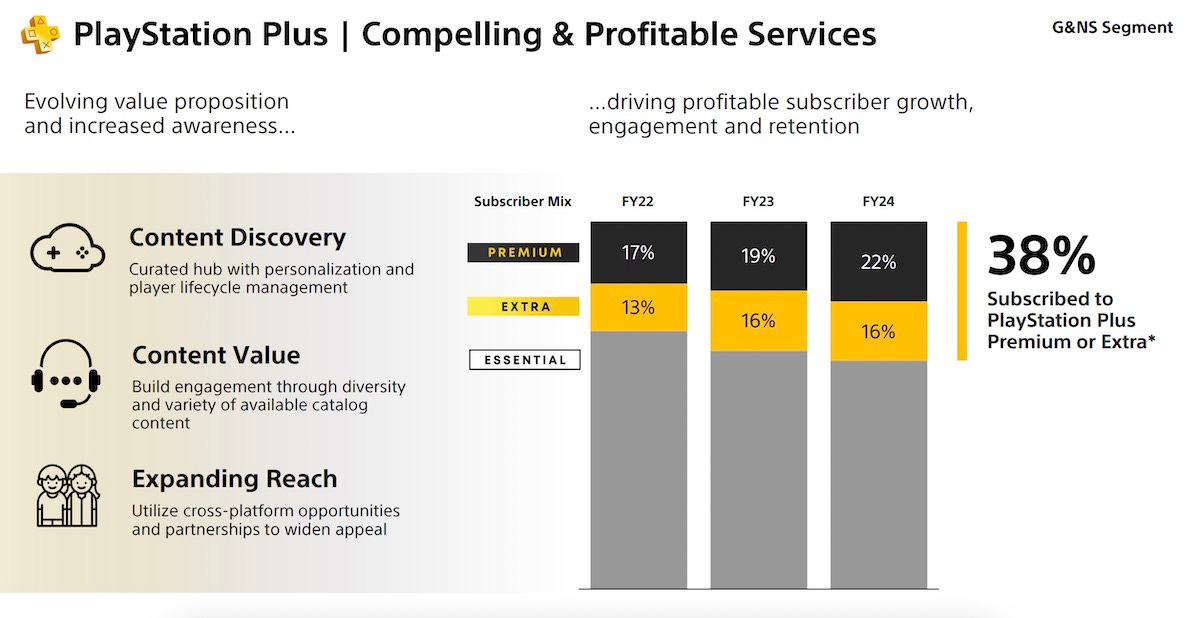

#3 - Upsell on PlayStation Plus has helped increase revenue

There’s no clear sign of an explosion in Sony’s PlayStation Plus active user-base - in the same way that Xbox Game Pass has been, TBH, fairly plateau-y. But with loyal PlayStation Plus subscribers, you can upsell them - which is what Sony’s been doing.

As you can see (above), Extra subscribers (Game Catalog & Ubisoft+) and Premium subs (Classics, PS5 Cloud Streaming & game trials) have grown from 30% of total PS+ users in the 2022 fiscal year to 38% in 2024, even as price rises have hit for various tiers.

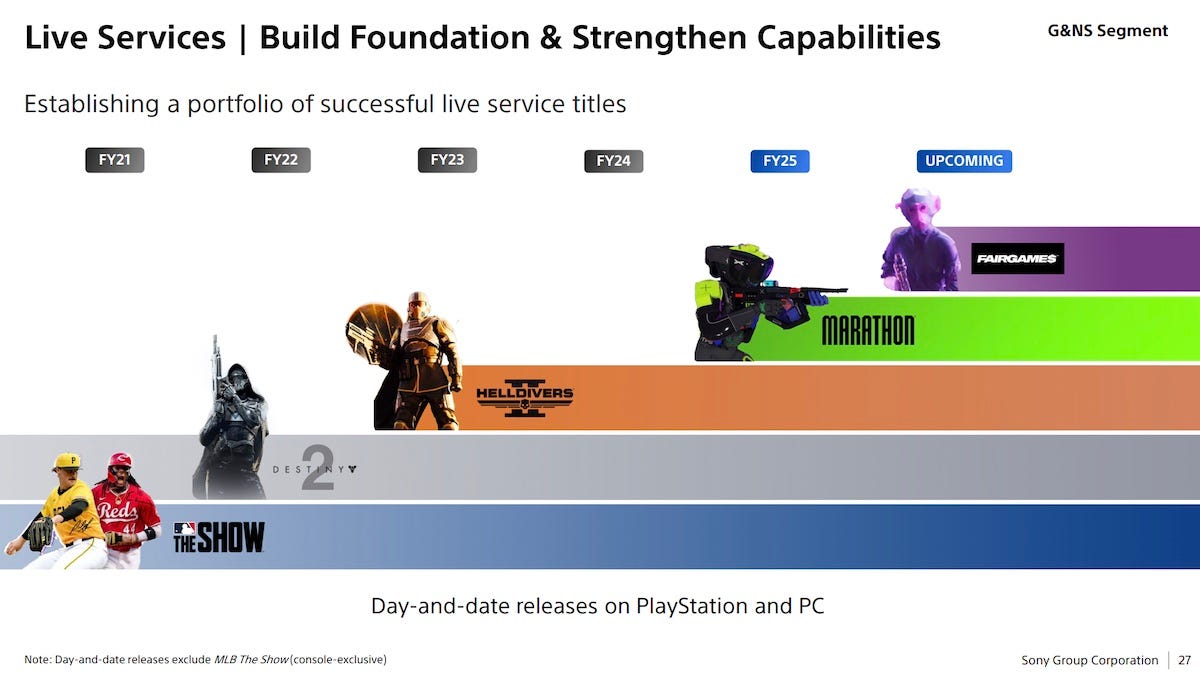

#4 - Sony’s live service aspirations are significantly cut

We’ve talked about the Sony’s live services pivot extensively. As recently as February 2022, former SIE head Jim Ryan was saying that “a significant portion of our AAA IP will find its way into a live service game”, and it was absolutely an “untapped revenue opportunity” for them.

Fast forward to today, and baseball stalwart MLB The Show (est. 2006) has been sneakily classified as a ‘live service’ game, alongside the legit Destiny 2 (est. 2017). With Helldivers II an actual (premium-first, IAP-light) live service win, but Marathon and Fairgame$ both ??? at release, this is the tail-end of an, uhh, reverse ferret.

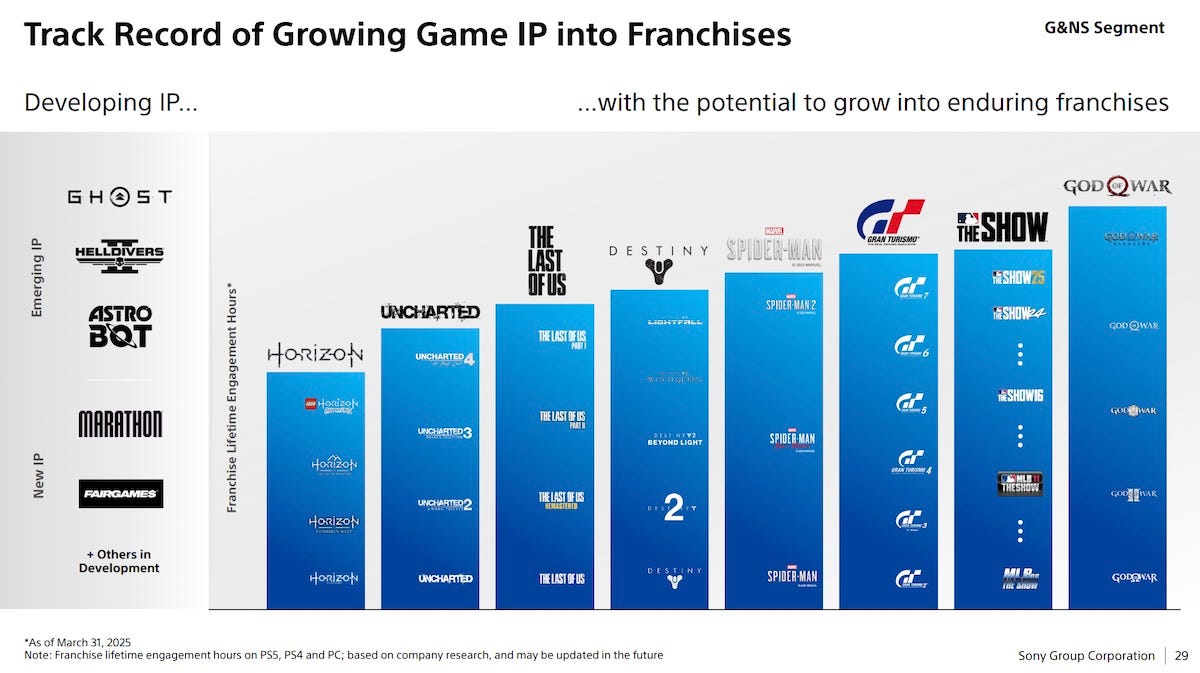

#5 - ‘Franchise engagement hours’ is the new sales…

This view - showing franchises by ‘engagement hours’, whether they’re monetized that way or not - is actually an interesting one that we haven’t seen before from Sony. And it does present a more holistic view of franchise popularity within PlayStation!

It’s also a little odd - is Gran Turismo really that vital to Sony success, or just have hardcore players eating up playtime like crazy? But it shows franchise depth - even if Sony doesn’t have a Minecraft-level engagement juggernaut like Xbox does.

Concluding: a lot of the language we see in this SIE business update is emphasizing stable, diverse revenue sources. “Durable, predictable revenue base” is underlined more than once. Why?

Games - like movies, another Sony division - get an investor rep for being hit-driven and patchy from a deliverability point of view. And in today’s game biz - where it’s non-easy to predict hits - we see why projecting an image of stable serenity is good!

But yes, PlayStation does have better, less hardware-first revenue diversity than a few years back, and a loyal userbase. We do wonder on upcoming challenges tho, given a) unresolved U.S. tariff issues b) a scrambled first-party game production schedules, after the move into - and out of - aggressive live service game production. We’ll see!