Ready Or Not's 1m console sales? Hot, not the norm...

Also: how Steam bandwidth is changing year on year, and lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we drift towards Gamescom - and also those exciting summer holidays - GDCo is still providing you with much PC and console discovery news - as is our whim. And we’re leading with console data this week, something we chatter about less…

But before we do, shout-out to the Summer Games Done Quick speedrunners, who just raised >$2.4m for Doctors Without Borders/MSF. You can browse all the 140+ SGDQ 2025 speedruns here on YouTube - and we recommend this RollerCoaster Tycoon speedrun (!), and a really interesting Blue Prince speedrun, for starters.

[WAYS TO SUPPORT GDCO? Signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, basic data & lots more. And companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 70+ have.]

Game discovery news: big? Persona and soccer…

Starting out, let’s have a look at some of the notable game platform & discovery goodness which surfaced since last time:

Looking at GDCo’s ‘trending’ unreleased Steam games by 7-day follower increase, July 14th-21st: top of the charts are new Steam pages for JRPG remaster Persona 4 Revival (#1, announced in June's Xbox Gaming Showcase) and EA Sports FC 26 (#2, latest in the uber-popular yearly soccer franchise formerly known as FIFA.)

Wuchang: Fallen Feathers (#3, 1.15m wishlists) is riding strong Chinese interest with a Black Myth-adjacent vibe, & 2K's Mafia: The Old Country (#8) is out shortly with 1.25m wishlists. Also trending: open world base builder StarRupture (#9), with ~400k WLs & Animal Shelter 2 (#12) with pre-release streamer interest.

VGC has a spicy angle for Microsoft not selling movies or TV shows on Xbox/PC, as of July 18th, 2025 - it “seemingly marks a complete shift away from offering video content, 12 years after the disastrous Xbox One launch, which positioned the console as an ‘all-in-one home entertainment device’.” Xbox & Netflix still works, though?

Trailer maestro Derek Lieu wrote an interesting ‘behind the scenes’ piece on making Skin Deep’s launch trailer, talking about ‘hooks’ and ‘anchors’ for the well-reviewed game, which was maybe too esoteric for its own good. (“It's like Die Hard, if it were an epic and goofy first person immersive sim where you save cats from pirates.”)

More on the ‘adult games removed from Steam’ furore: PC Gamer got Valve to confirm it was because “loss of payment methods would prevent customers from being able to purchase other titles and game content on Steam”, and the Collective Shout campaign claimed responsibility - here’s more info on them and sister orgs.

Physical games are niche, but GfK has charted the top 2025 H1 games for many European countries. Overall, EA Sports FC 25 was the most-bought physically in Europe*, with Assassin’s Creed Shadows at #2 and Minecraft (helped by the movie) at #3. (*But Kingdom Come: Deliverance II was #1 in the Czech Republic!)

Some tricksiness around Switch 2’s console ‘piracy’ bans: “A Nintendo Switch 2 user… got his brand-new console banned by Nintendo after buying used Switch 1 games… an unscrupulous seller can copy the game they’re selling to another microSD Express Card… and then sell the original cartridge as a used game.” (The ban was reversed.)

Steam’s added a new Trade Protection option as part of the latest Counter-Strike 2 update, so “you can easily reverse the last seven days of [in-game item] trades on your account at the touch of a button” - helpful for hacked accounts! The FAQ says it’s only for CS2 right now, but “we plan to make this available to other games on Steam.”

Kotaku did a piece on shovelware-y Italian Brainrot games on the PlayStation Store, saying: “If you hop over… and search for “Tralalero Tralala,” you’ll discover about a dozen ‘games’ with artwork featuring a shark wearing shoes.” (Since it’s an open-source-ish IP which is also hot on Roblox, we’re not surprised…)

The top-grossing mobile publishers of H1 2025, according to AppMagic, are headed by Tencent ($3.2b, with Honor Of Kings & PUBG Mobile 42% of that!), then Century Games & Funfly (+112% and +90% YoY thanks to Whiteout Survival / Kingshot & Last War: Survival) - followed by Dream Games, Scopely, and Playrix.

Microlinks: Why did Nintendo handle Switch 2 pre-orders so differently in Japan and the US?; can you market a game if you have zero social media following as a dev?; Xbox Insiders with Game Pass Ultimate can now stream (select) console games - beyond Game Pass - on the Xbox PC App.

Ready Or Not’s 1m console sales: hot, not the norm

When we spotted that tactical FPS Ready Or Not had already announced 1 million copies sold on console in less than 4 days - which also “pushes [the game] past 10 million lifetime units sold across all platforms”, we were pretty impressed. And it reminded us - why don’t we talk about console sales numbers more at GameDiscoverCo?

The main reason, as you’ll see, is that Ready Or Not - which has been in Early Access on Steam since Dec. 2021 and released its 1.0 version in December 2023 - is a bit of an exception, its ‘Rainbow Six x SWAT’ content being perfectly in the ‘mainstream’ console gamer sweet spot. (Xbox fans are especially Rainbow Six-pilled?)

So we wanted to contextualize, using GameDiscoverCo estimates for PlayStation and Xbox. Since the start of Q2 2025 - the past 4 months, basically - where did Ready Or Not place compared to all other game launches? For starters, on PlayStation (ignoring PS+ debuts), it’s already in the Top 10:

Some things we’ve noted from the above Top 10 chart on PlayStation:

AAA-looking action and sports games dominate: this is what console owners wanted 10-15 years ago, too. So perhaps it’s not surprising that an Elden Ring spinoff (#2), EA College Football (#4), and Death Stranding 2 (#6) are all high in the mix.

Late-launching titles with latent interest also dot the charts: lots of PlayStation owners wanted to play Forza Horizon 5 (#1), and love ‘mainstream’ racing games, but it was Xbox-only. Make sense it tops the charts, then? (And that Ready Or Not did well, so fast, given similar ‘latent interest’.)

There’s still a few ‘surprise’ mid-sized entries: they didn’t have AAA budgets, but Clair Obscur (#3) twinned competitive visuals with real-time & turn-based RPG mashups, and of course, Rematch (#5) did soccer differently. (It helps that its ‘gameplay sibling’ Rocket League is still in the Top 10 DAU across Xbox and PS!)

So yep, for a few games perfectly pitched for console - generally ones that feel like they could have been published by EA or Activision in 2005 - you can still sell well, often helped by physical retail copies. This market is topheavy, though. We estimate ~15 new games released on PlayStation in 2025 with >500k unit sales - but only just over 30 with >100k sold.

One other example of ‘overperformance’ on console is Test Drive Unlimited: Solar Crown, a very ‘straightahead’, console-friendly racing game, where a dev said recently: “A lot of players are watching Steam [concurrent] numbers because they’re the only statistics available. But the Steam community [for TDU] is not the biggest, and the difference can be very big between PS5, which is the most active platform for our game.”

And it’s true, at least according to GameDiscoverCo Pro’s estimates. We see ~600k copies sold for the game since Sept. 2024, including >300k units sold on PlayStation (aided by physical distro & ‘60% off’ digital sales), another 150k+ on Xbox, and ‘only’ 110k on Steam. Having console formats outsell Steam is - again - rare, but possible.

Before we end, we wanted to highlight our Xbox charts - excluding Game Pass, where a majority of key titles often debut - which rules out five of the top ten games (!) that charted on PlayStation:

It’s worth remembering that Xbox is particularly strong, console hardware-wise, in the U.S. and the UK. This explains why the latest EA Sports College Football update - extremely American-centric - is #1 by far.

You can then see Elden Ring Nightreign at #2, and Ready Or Not already making its way to #3 overall. (BTW, we’re estimating the U.S. at 56% of Ready Or Not’s sales on Xbox, and the UK at 10%, with Canada at 6%. So ‘North America & UK’ is 72% of the current players.)

As Xbox continues to push Game Pass and a multi-platform approach, you’re also seeing weaker standalone sales on console. So, we estimate there’s two new games launched on Xbox since Q2 with >500k sales, and only five with >100k sales. (But on Game Pass, 18 of the 23 launches we tracked had >100k players, and 6 had >1 million.)

This explains comments from folks like Moon Studios, whose “next title No Rest for the Wicked might skip Xbox at [1.0/console] launch, with the firm suggesting a focus on PlayStation after ‘looking at the numbers’.” But we still think doing Xbox versions for Game Pass & multiplatform parity is likely worth it?

Anyhow, this whole article is a longwinded way of explaining why we don’t talk about console so much. Why? Significant upside on console for new games is limited to a smaller amount of ‘traditional’ AAA-looking game genres. (It’s pretty rare.)

And your game needs a lot of online buzz to break out of filter bubbles and be noticed by more casual console players. We’ve spoken to multiple PC => console publishers recently who’ve seen their games go nowhere on console launch - despite being good - because they just can’t get that type of visibility traction. Oof.

Steam traffic: is it really getting more Asia-heavy?

Over in the GameDiscoverCo Plus/Pro Discord server, we’ve talked recently about the fact we seem to be talking about Chinese (and other Asian) games more, when we look at the top new Steam releases of the week.

If only we had some way to see which regions were getting more or less popular on Steam? Well… actually we do, in ‘brute force’ terms, via Steam’s global 7-day bandwidth traffic map, which Valve very transparently makes available.

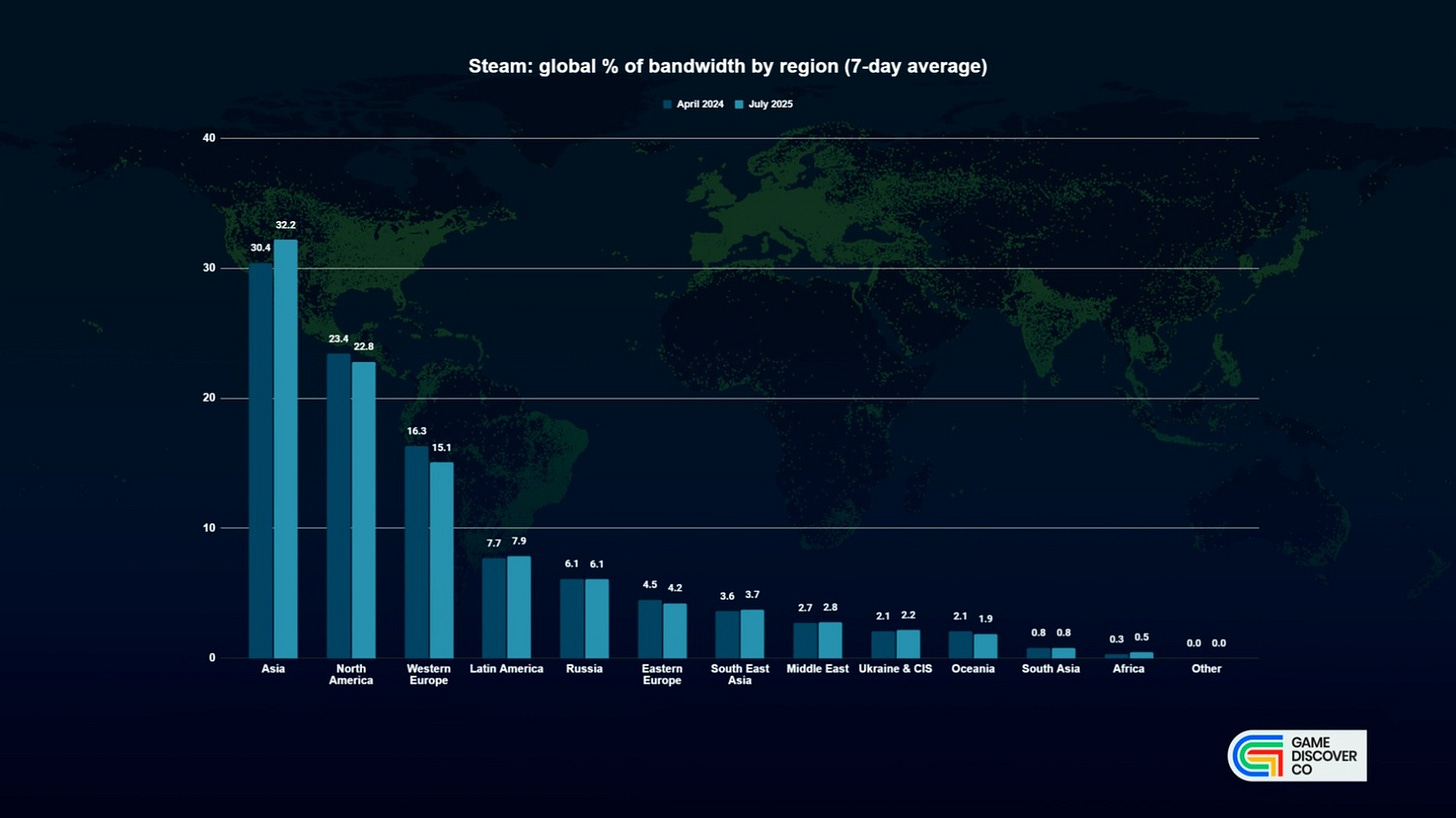

GDCo doesn’t regularly capture this, but we did last grab a snapshot in April 2024. So we grabbed another in July 2025, and have compared them both via this spreadsheet (Google Drive doc, includes countries), and the above graph. Some notes:

Steam interest in Asia seems to be on the (relative) rise: Asia is now 32.2% of global Steam traffic, up 1.8% from 30.4% last year. This includes China moving from 25.6% to 26.1%, and Japan from 1.9% to 2.5%, as well as Taiwan from 0.8% to 1%.

North America and Europe both shrank in % - but still grew overall: North America traffic was down 0.6% - from 23.4% to 22.8% - with the U.S. edging down from 20.6% to 20.4%. And Western Europe was down 1.2% - from 16.3% to 15.1%, with the UK, France and Germany all down. (But overall bandwidth was still up.)

Latin America, Russia and Eastern Europe are kinda holding their own: Latin America was up ever so slightly from 7.7% to 7.9%, Russia is static at 6.1% (remember, this is bandwidth, not purchases), and Eastern Europe actually sneaked down from 4.5% to 4.2% - though no one country had a major shift.

We’re not saying this is a perfect way to look at regional interest on Steam. For example, one large game patch for a particularly region-popular title during one of these 7-day periods would significantly skew numbers.

And as games get bigger and bandwidth gets cheaper, 7-day transfer amounts are swelling massively. The U.S. increased from 255.9 petabytes (April 2024) to 404.8 petabytes (July 2025), and China from 251.4 petabytes (April 2024) to 518.7 petabytes (July 2025.) Tho it’s also the summer holidays, which’ll boost things further….

Anyhow, we still think it’s a good general indicator of interest. And it reinforces the fact that, while Steam is growing overall worldwide, it seems to be outperforming its Western growth in Asia (albeit at lower average price per game!) Interesting stuff…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]