Rain World: how UGC headlined a big sales comeback!

Also: Netflix's games strategy evolves, and lots more besides.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to GDC week, folks. For those of you not in San Francisco, don’t worry, we won’t be talking about it all the time. (And for those who are: please schedule 30 minutes every day just to sit down and catch up on this newsletter. C’mon.)

Anyhow, our lead story for today looks at something we always love - a comeback story for a game that got ‘slept on’ a little bit. This time, it’s got popular again in part due to smart use of user-generated community content - interesting! Let’s take a look…

[Upgrade today: our GameDiscoverCo Plus paid subscription includes our Friday ‘exclusive’ newsletter, exclusive Discord access, a login to our Steam ‘Hype’ & post-release game performance chart back-end, multiple eBooks & more. Help support us & get great extra data.]

Rain World: new DLC, cleverly adapted from UGC?

Some of you may have heard of procedurally generated ‘ecosystem simulator’ Rain World, which was originally released on Steam all the way back in 2017. It’s known for its meticulously crafted ‘emergent gameplay’ (see above), and being.. a bit of a cult hit?

But what it wasn’t known for was selling spectacularly. It did just fine for developer Videocult and its original publisher, mind you. And it thrived from ‘word of mouth’, with a passionate modding community for the “survival game with physics-based platforming, set in a richly simulated post-civilization ecosystem”.

But these mods were generally available on a separate third-party website, RainDB - with players having to manually install them themselves. There was an active, enthusiastic community, but maybe word wasn’t getting out. How to fix?

Well, after the OG publisher exited the space, enter Akupara Games (Grime, Behind The Frame), who came up with a plan: make a bundled $15 DLC, Rain World: Downpour, bringing together the best mods. Oh, and add a big free base game update with Steam Workshop support, local co-op, quality of life updates & more. The results?

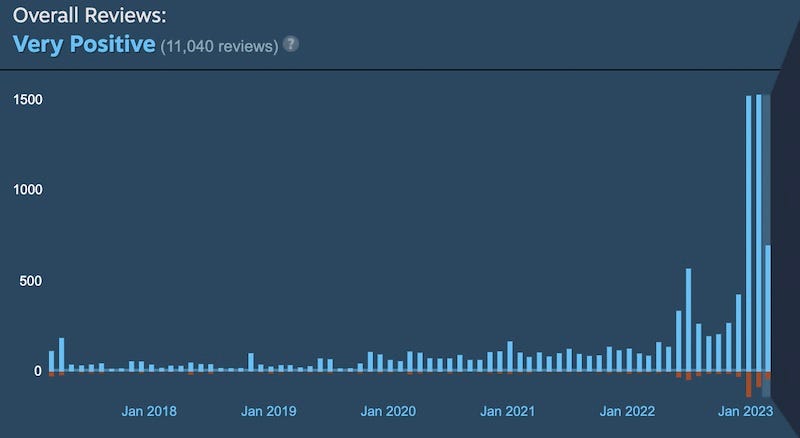

So yes, looking at Steam reviews over time, that seems to have worked out nicely! In fact, the Downpour DLC launch (video!) saw the highest base game revenue, units & CCU for the game, almost 6 years after its launch. Let’s get into some detail here:

The last 12 months have been the strongest for the game: Rain World as a base game sold 280k units on Steam from March 2022 to February 2023, its largest yearly total ever. But the last 3 months (Dec. 2022 to Feb. 2023) saw 182k units (wow!) And the base game sold 82k units around January’s Downpour launch & a timed Steam Daily Deal. (Many of these were at 50-60% off, but even so…)

Interest was surging in the game before the Downpour DLC release: this was in part due to judicious discounts & featuring in sale events, like Winter Sale 2022 (57k units sold), timed with trading cards & badges becoming available. But a concerted ‘we are working on this game again’ effort in Steam news posts really helped bring the ‘hype’ - and a viral video (see below) helped.

Downpour was a mammoth co-ordination job: the dev (Videocult) is working on follow-on games, so assigned a staff member to liaise with Akupara for quality control and integration into the game. But the DLC - which includes multiple complex modes - needed some serious production ‘heavy lifting’. (If you look at the community credits for Downpour, you can see the amount of contributors.)

The publisher hired a community manager, a top modder & contracted 30+ people to make Downpour happen: Akupara’s David Logan tells us: “It was worth it, but it was definitely very complicated.” Why? A number of the modders were younger, and hadn’t really dealt with professional contracts before. (And there was a soupcon of controversy about taking free mods and enhancing them in paid form - but it worked out great in the end.)

The DLC ended up being a major standout, quality & size of content-wise: Downpour has 93% Positive reviews, and has sold 74k units on Steam from its Jan 19th launch until March 3rd. And as one Steam player review says, it’s “…as incredible an experience as the base game. This could well become my favourite game of 2023. It took me roughly 110 hours to complete the five campaigns.” …110 hours?!

One big takeaway from all this? As Akupara’s David Logan notes: “The community was hanging out with themselves… but it wasn’t really spreading past that.” Just because your community is making a bunch of cool stuff, that doesn’t mean other people can see it. And the Downpour DLC definitely fixed that problem!

The other thing we’d say is that Rain World was already ‘coming up’ as Akupara worked on this DLC. When videos about the AI in the game from smaller YouTubers get 1 million views - a big cause of the June 2022 sales spike, alongside the game being free on Amazon for Prime Day - you can see you’re working with something special.

So this is a combination of a) a standout game that still had incredibly unique facets reconnecting with players, at the same time b) a new publisher got aggressive about updating it. And you can’t argue with the results, right? Congrats to all involved…

Netflix: where’s the video game strategy going?

So, ahead of GDC week, Netflix did a media briefing around its video game strategy, covered by a number of outlets with an embargo of today, including GI.biz, the folks at MobileGamer, and also Axios.

There’s a related official announce which notes: “In [just over a year], we’ve released 55 games, with about 40 more slated for later this year and 70 in development with our partners. That’s in addition to the 16 games currently being developed by our in-house game studios.”

Sure, so far Netflix Games has definitely been a little ‘throw things at the wall and see what sticks.’ But this broad approach is intentional, and we’re not throwing shade at it. And here’s some of the takeaways from what Netflix said re: its 2023 plans:

For now, iOS and Android is the main thrust of the strategy: Netflix’s main based around iOS and Android games that are linked via the Netflix mobile app. You can download ‘em for free, and then use your Netflix logon to access them. Advantages here: mobile is the biggest platform, and they can license good PC/console titles for mobile (TMNT: Shredder’s Revenge, Into The Breach, etc.)

The correct Netflix IP tie-in can really boost discovery: Netflix’s VP Leanne Loombe identified an early stand-out on that front: “One of our most-played games to date, Too Hot to Handle: Love is a Game, is based on our wildly popular unscripted dating show, Too Hot to Handle.” (There’s a new game based on the IP coming, too.)

The company’s doing longer-term planning around transmedia IP: it’s always been an issue co-ordinating TV/movie production & game development. It’s being tackled: Netflix’s Loombe revealed a new deal with Super Evil Megacorp (Vainglory, Catalyst Black) on “an exclusive game based on an upcoming Netflix release”, telling MobileGamer “we are very much focused on creating an ecosystem around the streaming content and the game.”

Cloud gaming is still part of the long-term strategy: Loombe confirmed: “We are working on our own cloud streaming technology… we are very early in that side of our journey, but we are very committed to making sure that games can be played wherever you have Netflix, essentially.” This may be a big platform deal for extending reach, long-term.

The other announcements - Ubisoft’s roguelite Mighty Quest: Rogue Palace debuting in April, Ustwo’s delightful puzzlers Monument Valley 1 and Monument Valley 2 coming to Netflix in 2024 with “more to come” (new franchise extensions?) after that, hint at the diversity at play in what Netflix Games intends to offer.

As Loombe says: “members will discover indie darlings, award-winning hits, RPGs, narrative adventures, puzzle games and everything in between.” Given the cost of content for Netflix’s (chiefly TV & movie) output - $16.84 billion in 2022 - you can see why spending hundreds of millions* on its games initiative is just a drop in the bucket.

So if nothing is a ‘big bet’, the company can afford to be chill - for now. (Especially if App Store rules may eventually be relaxed to make it easier for Netflix viewers to play games in the same app as they watch visual content.) (*Or whatever the real figure is.)

The game discovery news round-up..

Finishing off for this particular newsletter, we’re leading off the game platform and discovery news with a happy little portable game device’s birthday. (But who’s picking up all that confetti? The Deck doesn’t have arms!) Ahem:

It’s totally the Steam Deck’s first anniversary, and Valve is offering 10% off the device until March 23rd, as well as adding “the ability to customize startup movies for Steam Deck” (cute, people were already hacking this!), and a special ‘Top 100 most-played Steam Deck titles’ sale - headed by Hogwarts Legacy & Vampire Survivors.

There’ll be more info in Epic’s State Of Unreal talk on Wednesday, but it looks like the Unreal Editor for Fortnite will launch in a couple of days - a big deal for more sophisticated Roblox-like modding for Fortnite. David Taylor has a good round-up of what’s expected - wonder if creator payouts will change or not?

The latest round of Amazon layoffs - around 9,000 people - is notable because Twitch has been affected. The total laid off there seems to be around 400 employees, which Zach Bussey has been told is close to 20% of staffers. Our condolences to those affected…

Want an easy way to grab a game’s Steam store and library image assets to examine or be inspired by them? Kevin Ng made Steampoacher, which does just that: “Make better Steam capsules. A simple tool for viewing and downloading the store and library image assets for any Steam game.”

The Chinese government just approved 27 new ‘foreign-made’ games for distribution in the country, including mobile smash Merge Mansion. Game World Observer has a larger list - looks like some PC indie titles (Gorogoa, Wizard Of Legend) got approved too, and will presumably pop up on WeGame as a result.

From a couple of weeks back, but the UK’s Digital Entertainment Retail Association put out its annual report, including some intriguing UK-specific data estimates: “50.5% of digital sales comes from Steam, followed by PSN at 37.9%; FIFA23 sold over 2.5m units; Elden Ring sold ~865k with 76% digital.”

We might all want to keep an eye on the U.S. government asking for TikTok to be sold, or risk a ban, due to geopolitical issues over its Chinese ownership. (Sounds like TikTok is ‘flooding Washington DC with influencers’ to push back against the move, but there may be continued instability here…)

Hopefully we’ll be doing a DLC-related update on The Riftbreaker soon-ish. Bbut in the meantime, EXOR’s Pawel Lekki did a super-detailed talk for the Polish GIC event, talking about ‘marketing engineering’ for the 500,000 unit-selling tower defense x shooter. (Good stuff!)

Microsoft is being a bit more explicit about plans for an Xbox mobile store, with Phil Spencer noting in a new interview: “Today, we can’t [serve Xbox players very directly] on mobile devices, but we want to build towards a world that we think will be coming where those devices are opened up.” He’s talking about the EU’s Digital Markets act and third-party app stores: “I think it’s a huge opportunity.”

Microlinks, ‘other forms of media’ edition?The rise of a multimillion-dollar dubbing economy for YouTube is an interesting story. As is this rumination on why streaming TV boxes, by and large, suck. (Though the Nvidia Shield, which does cloud gaming as well, is called out as an exception.)

Closing out with a musical gem - who wouldn’t want to hear Nirvana’s classic grunge album Nevermind, reconstructed with Super Mario 64 instrument samples? C’mon:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]