Lost in the shuffle? Launching a game with no marketing in 2021

Yes, this is something that somebody intentionally did.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to Monday’s newsletter! We’re going to kick off with an interesting guest section from Patrick Seibert. He’s a marketeer who also releases his own ‘0 marketing’ Steam games, and uses them to test how much ‘natural’ visibility Steam gives you if you do, well, nothing.

And he decided to ask the question, after a successful 2019 GDC talk on the subject - can we see how Steam’s baseline visibility has changed since his original 2018 experiment, by launching another ‘0 marketing’ game in 2021 and comparing the two?

Bear in mind that these games are selling modestly - GameDiscoverCo is guessing probably in the hundreds or low thousands of copies. And it’s tricky to track a) Steam improvements b) back-end changes c) the ‘more games’ effect, simultaneously. So this isn’t a ‘how to’, as much as an intriguing experiment. But hope you enjoy!

[Don’t forget - 20% off yearly subscriptions for our GameDiscoverCo Plus paid sub for only the next 7 days - it includes an exclusive weekly ‘why are games hits?’ Plus newsletter, an info-filled Discord, a data-exportable Steam Hype back-end, two eBooks, & lots more.]

Launching on Steam with 0 marketing: 2021 vs. 2018?

Hi - my name is Patrick, and I do marketing for indie games at my company Too Indie To Fail. But once every now and then I get the itch to create a game of my own. But since I already do marketing for a living, I really didn’t want to invest a huge amount of my spare time in marketing my hobby project.

So I wanted to try a little experiment, and back in 2018, I did the total opposite: released the game on Steam with ZERO marketing, and gave a talk at Game Developers Conference in 2019 about it, also comparing 2 more games launched previous to that. Seeing how games are shown to the Steam audience with no marketing at all produces some interesting baseline data on visibility and discovery.

Right after the pandemic started, I felt that itch again. One year later I released my second game - once again without any marketing. The first game was released in 2018 and the second one in 2021. A lot has changed on Steam in that time. But how did both the changes & the massive amount of new titles available evolve visibility for games? Let’s try to find out by looking at both data sets.

Comparing two games is always difficult. But at least I can say that if you played Game 1, you would most likely also be a target audience for Game 2. With the data comparison, I focused on numbers that are the least likely to be influenced by the nature of the game itself. (That means no sales, conversion rate or click-through comparisons.)

As with the original talk, the identity of the games is not revealed here. I want this to be purely about the data, and even the store page layout is minimal. But if you’re curious, by all means, it’s pretty easy to find the titles with a little bit of digging.

Debuting your Steam page: the first two weeks

This was a little difficult to compare, since back in 2018 Steam didn’t track/separate out traffic from sources such as “Direct Navigation”, “Bot Traffic” and “Other Pages”.

But if I remove all those traffic sources from the 2021 data, we end up with a graph like this, for page visits on both games’ Steam pages:

It looks like the games are getting somewhat similar traffic after a week or so, ignoring the announce spike in 2018. (And it’s pretty slow overall - less than 100 page visits per day. A big reminder that just putting a game on Steam alone isn’t an act of marketing!) But the source of the traffic may have changed.

In 2018 most of the referral traffic - 63% in this case - was coming from the Discovery Queue. Yet in 2021, this percentage went down to only 8%. Maybe this reflects the Discovery Queue being tuned away from unreleased games, or just more games on Steam? And the traffic sources from within Steam in 2021 are now more diverse - which is probably good.

When it comes to ‘impressions’ - the places where an image/link to your game was shown elsewhere on Steam - these are significantly down in 2021. But I’d argue that their quality may have improved in aggregate.

What do I mean? Well, 2018 saw 61% of the impressions coming from the game’s icon/title on “Coming Soon - Full List”. You’re part of a giant list, and this is somewhat useless, unless your capsule burns itself directly into the consumer’s eyes. Not all impressions on Steam are created equal - some are far higher-yield than others!

Conversely, remember the “More Like This” section? In 2018, I still got 13% of the game’s impressions from there. But in 2021 this category didn’t make my chart - maybe reflecting the lack of smaller pre-release games appearing on ‘main’ game pages since algorithm changes. Or just many more games being available?

And overall, in 2021 the majority of the impressions came from “Browse Search Results by Tags”. This once again shows the importance of having your game tagged correctly, and how deep and wide the Steam catalog now is for themed searches and tag homepages.

The week before Steam launch

It is interesting how the impressions seem to line up as the games reach launch (on day 7), even three years apart, perhaps showing how Steam has grown in size, even as it’s grown the number of available games:

Once again, the “Coming Soon - Full List” impressions were dominating in 2018. But the overall amount of impressions didn’t increase as I got closer to launch in 2021. This may be since, if you’re not in the Popular Upcoming section, which launched in July 2018, you don’t get much visibility immediately pre-launch? So - really try to get into that section!

The majority of impressions I saw in 2021 were coming from “Browse Search Results”, which provided a much better click-thru rate (0.95% in 2021, vs 0.16% in 2018). But I’m not sure this is representative for the majority of games, because I did not see these numbers from any other game I worked with in 2021. So please bear that in mind.

The launch week on Steam

At first glance it doesn’t look like much has changed - besides 2021’s game receiving a lot more visits on launch day. (2021’s game had accumulated six times as many wishlists before launch, because it was on the store for much longer before it was released.)

The distribution of the traffic creating the visits appears to still be the same for both 2018 and 2021: “Discovery Queue”, followed by “Tag Page”. But the amount of initial “Discovery Queue” visits has been reduced from 2018. And the newer game has a bunch more visits from a wider range of sources instead - again showing the extra discovery options Valve has built into Steam since 2018.

One review to rule them all?

With every game launch coming up, I tell my partners how important it is to reach 10 Steam reviews ASAP. Once you reach 10 reviews, the game unlocks an entire ‘visibility layer’ - including summary score (‘Positive’), thumbs up/down on search results, and more. In addition, your game can start potentially showing up in the New & Trending sections of tag pages and other important places on Steam.

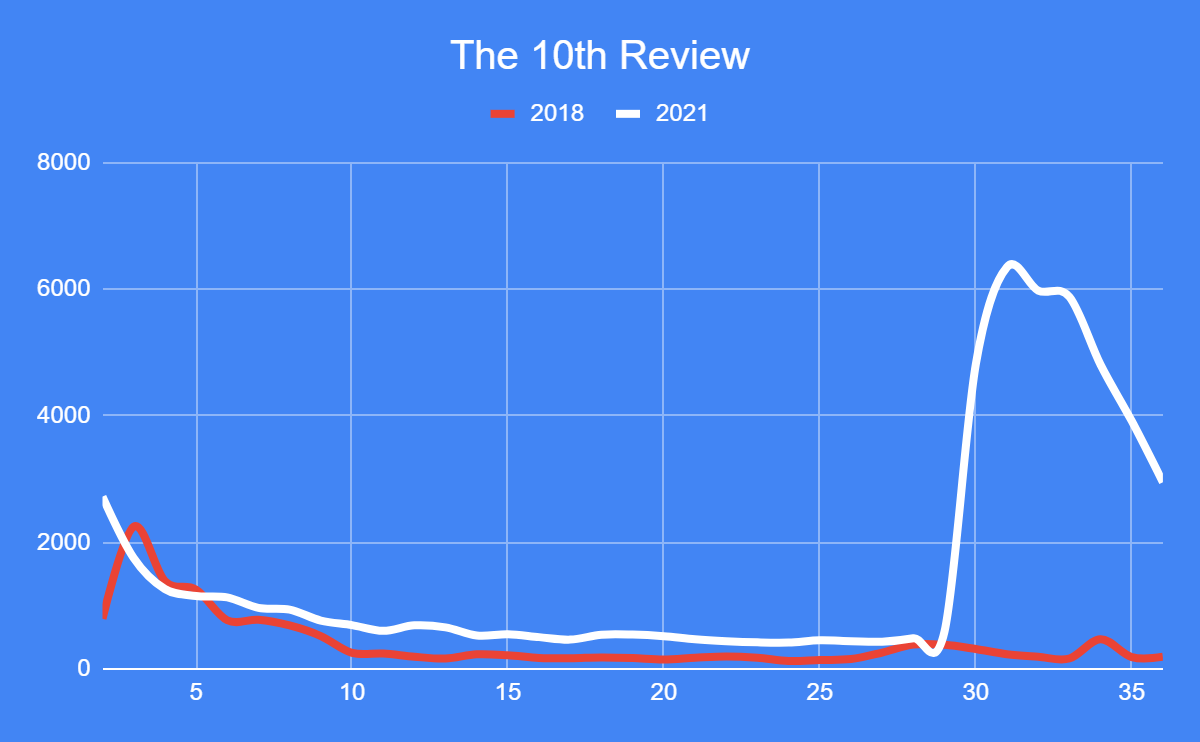

I knew this was a very important metric to reach. But boy, seeing the effect it had on Steam page visits was mind-blowing - and worlds ahead of 2018:

Yup, it’s insane. The source of the spike is - of course - the “Discovery Queue”, which now showed the game as “New on Steam”. The initial peak lasted about a week, and it took a bit more than a month until the line stabilized again.

If we compare to the previous game, in 2018, the 10th review was reached at about day 27. This has a way smaller change, and is visible by a slight bump in visits in the chart above on the red line.

Because it looks so spectacular, here the actual 2021 graph from the Steam backend, with the yellow line being the traffic from the “Discovery Queue”:

General takeaways

I could go on forever with showing you graphs. But let’s slowly bring this to an end with a few general takeaways that I noticed:

In 2018, I saw a lot of Steam achievement hunters jumping onto my game right away. This was completely absent in 2021. This is because Steam is now limiting Profile Features - like publicly displayed Achievements and Trading Cards - until a game has proved itself, e.g. generated enough sales. This is a system which was not yet in place when I launched in 2018.

2021’s game had a brief period of having a “Mixed” rating, where sales dropped by 80%! (Valve has said that it only penalizes on the algorithm level at below ‘Mixed’ - so this must be players choosing not to buy.) This was fascinating to see for me, because I experienced the same drop in sales back in 2017 while working on someone else’s game. Both Game 1 and Game 2 have >80% positive Steam reviews currently, by the way.

If someone leaves a Steam review and refunds the game afterwards, the review still counts towards the overall rating. Or at least until the person deletes the review. I had always assumed it would stop counting because this could be abused - but apparently it is not the case? (It is marked as ‘game refunded’ next to the written review, though.)

Overall, 2021’s game has been generating twice the revenue in its first 1.5 months compared to 2018. And I’m very eager to see where the long-term comparison will fall out.

So I guess the indiepocalypse didn’t happen after all? (Just kidding!)

[Thanks so much for providing the guest column, Patrick. You can find him on Twitter at @somniumlg - where he sometimes posts about Steam. Or you can reach out to him directly at patrick@tooindietofail.com.]

Ad platforms for PC/console games: which to pick?

So the folks at Gamesight, who run a SaaS business tracking ROI and influencer discovery for PC and console games, just put out a report on the top ad platforms for our space in 2021, based on an aggregate of all ads that clients were tracking through its service, and it’s… pretty interesting?

The clients deal in both premium and F2P PC and console games, and here’s some of the data takeaway:

Not surprising that Google Ads was the top result, given it includes three major components: Google Search Network, the Google Display Network, and the YouTube Network. Gamesight does note: “Google Ads had a lower aggregate conversion rate this year compared to last year (2.8% vs. 4.6%), due to the fact that we saw increased usage in premium titles compared to F2P games in 2021 vs. 2020.”

You might not be surprised to see Snapchat listed - it had a high (almost 40%) 7-day retention rate, though the report mentions it “has a middling conversion rate, middling conversion volume, and very low [worldwide] reach.” Bing Ads might be a shock, though - it “was extremely effective in its conversion rate, pumping out the highest percentage conversion (6.67%) of all ad platforms utilized in our 2021 campaigns.”

The comments on Facebook improving its ad offering for non-mobile games are also intriguing, given its historical reputation. And finally, it’s not surprising that (paid) influencer - YouTube/Twitch - marketing was also a big deal: “the third-most-effective form of advertising based on the total advertising score we calculated, and ranked highly for all metrics we used.”

I’ve been on record as saying that paid advertising for non-F2P games can be very tricky, due to lack of ‘click tracking’, or clear ways to measure ROI. But I’ve also been convinced - by smarter people than I - that premium titles can make money on paid ads if they cost enough to buy, and have ‘targeted enough’ advertising. (It’s way easier to get positive ROI on a $40 game than a $15 one, for example.)

It’s just a question of how you track that profitability/ROI and how to best spend your money. And a good start is - looking at data such as this! So thanks to Gamesight for exposing it.

The game discovery news round-up..

Now it’s time to finish off in style with our traditional news round-up, featuring many multitudinous links about what’s going on with game platforms and discovery, right now. Yes, now!

Before we start, a correction from last Wednesday’s newsletter - it was Amazon Luna’s GM that had wandered off to join Unity, not Google Stadia’s, as I wrote, My brain was keen to confuse the two FAANG game streaming services, oops. (Do we have have a GPS tracker on Phil Harrison’s whereabouts, though?) Onward:

Sony has released its PlayStation top-sellers for December 2021, and Among Us unsurprisingly vaulted to the top of the paid downloads chart on console release. Five Nights at Freddy's: Security Breach is also a notable new entry, in the U.S. and Canada, at least. And games new (the non-exclusive CoD: Vanguard) & older (the exclusive Spider-Man: Miles Morales) also fare well.

You all saw the Zynga x Take Two deal, I’m sure. But Transcend Fund’s Shanti Bergel ranked it vs. all-time game deals, which I found illuminating: “$12.7B Zynga -> Take-Two; $10.2B Supercell -> Tencent; $7.5B ZeniMax -> Microsoft; $5.9B King -> Activision; $4.0B Moonton -> ByteDance; $2.5B Mojang -> Microsoft; $2.4B Glu -> EA; $2.0B Oculus -> Meta.” Lotsa billion smackeroonie deals, eh?

Always love to see Independent Games Festival nominations debut, because they really are picked by devs/the community. Some great stuff in here again this year: “Inscryption by Daniel Mullins Games and Unpacking by Witch Beam lead the pack with four nominations each”, and the other Grand Prize noms are Cruelty Squad (above), Loop Hero, The Eternal Cylinder & Unsighted.

Microlinks: yes, Steam hit 28 million CCU the other day, just 6 weeks after making it to 27 million for the first time; on the Reddit successes of attractive citybuilder Laysara: Summit Kingdom; the Not For Broadcast folks have sold 300k copies in Early Access on Steam - pretty close to 60 sales per review, btw.

Thinking about Japanese releases for your game? Famitsu data via GI.Biz says that Switch is the only way to go on console: “Nintendo sold 5.3 million Switch units at Japanese retail in 2021… [it] sold five times as many units as all other consoles combined, with sales of PlayStation 5, PlayStation 4, Xbox Series X|S and Nintendo's own 3DS amounting 1.1 million units.” Though PS5 selling almost 1 million while still being supply-constrained ain’t bad.

It is true that E3 will not be held in person in 2022, thanks to “the ongoing health risks surrounding COVID-19 and its potential impact on the safety of exhibitors and attendees”. And it’s also true that Geoff Keighley immediately announced his Summer Game Fest online showcase is returning, leading Anthony Carboni to correctly surmise: “Help, there’s been a murder.”

Microlinks: Steam’s top sellers for last week are pretty interesting, including Project Zomboid, whom we’ll be interviewing in Wednesday’s newsletter; Meta reportedly canceled a 300-person VR / AR operating system project, but is still working on related OSes; BoxVR is pausing development on Steam and PSVR in favor of Quest 2, showing which platform is dominating VR right now.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]