Is this the future of indie game publishing?

Even if it isn't, it's provocative! Also: most-watched games of Jan & lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re so back - and it’s so on, for another week of trials and tribulations in the video game industry. Is there a kill screen coming up? (That’s good, btw.) Are we all going to beat the record and then flex? Only fate - and, OK, skill & execution - will decide!

One follow-up from last week: we’ve remarked on ‘shovelware/slop’ console games before. But it took a well-researched IGN expose (we presume - otherwise it’s suspiciously timed) to get PlayStation to start quietly removing some of them, including very unofficial titles like Supermarket Simulator Pro and Bodycam Shooter.

[HEADS UP: support GameDiscoverCo by subscribing to GDCo Plus, inc. access to our second weekly newsletter, Discord, basic data & lots more. And companies, get even more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 50+ have.]

GDCoNews: Subnautica 2 piles on the wishlists

So we’re at the ‘poking around and discovering articles on game discovery & platforms’ trough. And we’re info-supping like the little piggies we are. Here’s what we got:

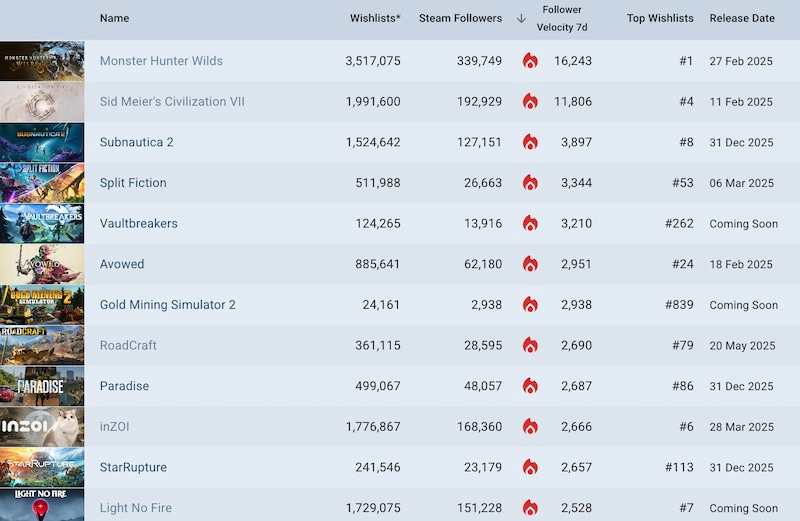

We returned to normal timing for our GDCo ‘trending’ unreleased Steam games by new followers chart, and Subnautica 2's great organic growth boosted it to #3. (It just keeps adding 40-50k wishlists per week.) We're expecting It Takes Two co-op ‘sequel’ Split Fiction (#4) to be a good-sized hit, too - it only announced in Dec.

Elsewhere, Obsidian's third-person ARPG Avowed (#6) is also sneaking up the charts, ahead of its full release in just a few days. And a sequel to a 2017 sim title, Gold Mining Simulator 2 is at #7, proving that Steam players really do yearn for the mines!

The big story from the weekend was a long - around 20 hour - PlayStation Network outage, which Sony has apologized for, called “an operational issue” (rather than a DDoS attack or ‘too many people playing the Monster Hunter Wilds Beta’), and added 5 days to everyone’s PS+ subscription to compensate.

Also notable: Steam making “a dedicated page [saying] that in-game ads or ad-based revenue models are not allowed in Steam games.” Though as SteamDB points out: “This has been reported as a new policy, but… has been the case for at least 5 years… there just wasn't a separate page [detailing it].”

In Fortnite & UEFN news, hackers have apparently worked out how to grab complete third-party Fortnite island code and re-sell it. Not good news, since ‘cloning’ becomes trivial, and Brendan Stock notes: “Folks were even going so far as brainstorming how they could encrypt their code to prevent this.”

What’s up in mobile games? Jan. 2025’s top-grossing charts show a lot of the usual suspects - Honor Of Kings, LastWar: Survival, Royal Match, PUBG Mobile, and WhiteOut Survival - cresting $130m for the month. And notable sequel Archero 2 is sneaking up into the Top 30 with ~$21m for the month.

We’re nodding along to this Chris Heintz op-ed, saying that ‘side quests’ that game studio leaders care “way too much about” include websites, trad media relations, IRL events, excessive analytics and reporting, and over-expensive, non-targeted market research surveys. (Fine, we also get a shout-out at the end.)

Looks like a recently granted Nintendo patent is helping confirm the ‘Switch 2 controller as mouse’ rumors - with the caveat that Nintendo has also patented inflatable horse-riding peripherals in the past, lol. But this looks legit & clever.

Xbox-y microlinks: the latest Game Pass additions include Avowed, Madden NFL 25, and more; Amazon Prime Gaming’s 20 ‘free’ games for February include BioShock Infinite and - a rarity - a free Xbox game, Wolfenstein: Youngblood; upcoming games like Avowed are playable on Battle.net if you grab it on Xbox and have the relevant Game Pass tier. (via Derek Strickland.)

A new non-profit backed by Discord, Roblox and others, Roost will “offer free, open-source, and easy-to-use tools to detect, review, and report child sexual abuse material (CSAM); leverage large language models (LLMs) to power safety infrastructure; and make core safety technologies more accessible and more user friendly.” Good?

Rogue Duck: the future of indie game publishing?

Admittedly, we’re going into this feature a little hyperbolic-styled. Why? Well, the recent history of PC/console indie game publishing efforts from scratch has not been that strong - with a small handful of notable exceptions.

And why is that? Because publishers are signing games to build a catalog of ‘medium expensive (or very expensive!) to make’ $15-$30 games, which was the correct way of building a successful indie publisher from 2015-2021. (Luckily for hit indie publishers back then, they still have back catalog sales keeping them ‘afloat’.)

But nowadays? There’s probably too many games out there for that approach to be profitable. You need to be sharper and more focused on concepts. And we believe you need to semi-swiftly follow popular but under-represented genres and subgenres to succeed. Many success stories we’re following are understanding and acting on this.

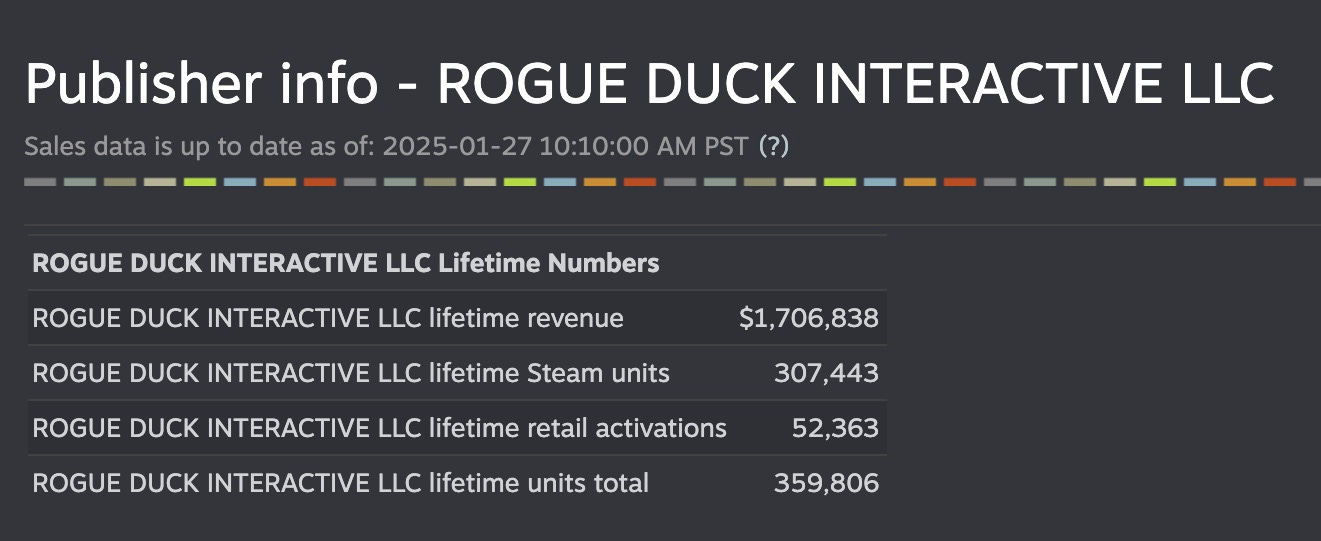

Which is why we were interested to spot Rogue Duck Interactive, a Steam publisher which has really ramped up in recent months, releasing 5 titles since March 2024, including Lost But Found & Dice & Fold. They’re almost all in the $6-$12 price range and really ‘on point’ when it comes to catchy, gameplay-led concepts.

So we reached out to Dora Ozsoy, the former (popular!) Turkish League Of Legends analyst and host who runs Rogue Duck from the U.S. He does so with a core team of ~20 people, 100% remote, mainly based in Turkey (with a merged Singapore dev) & puts out a mix of swiftly made, small internal & external dev games. Here’s the results:

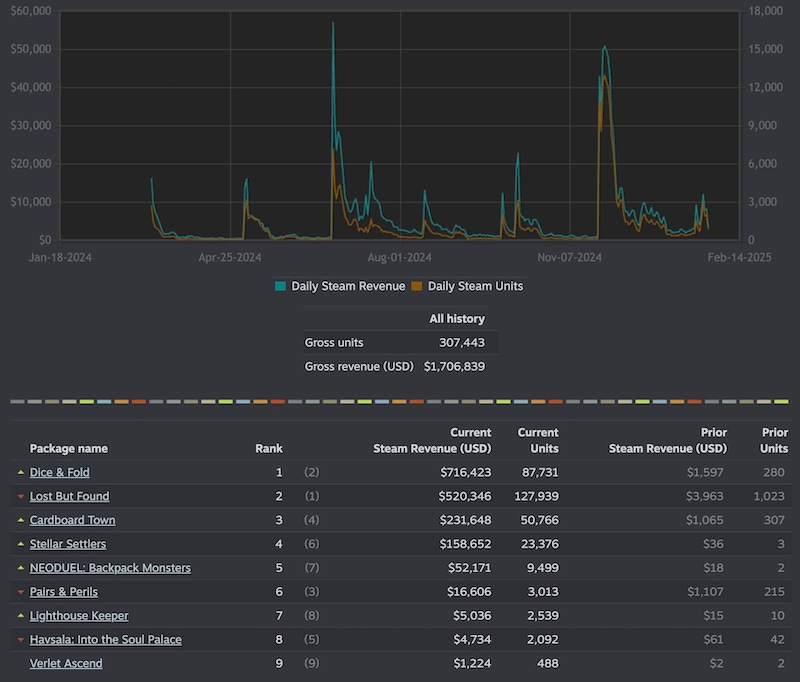

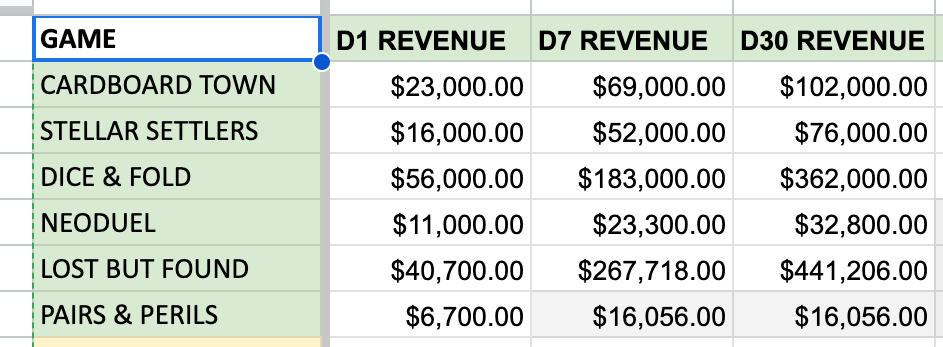

And below is a split of the revenues, bearing in mind that Cardboard Town is missing $600k in older revenue, since it was transferred across from a previous Steam account from a previous publisher Ozsoy co-founded, Stratera Games:

So again, those of you out there with yachts and/or giant rowboats may scoff at this level of success (300k units, $1.75m gross). But Rogue Duck - who works with Gamersky for Asia operations - is likely profitable, given CoL. And there’s a good chunk more ‘long tail’ revenue here, given the games are almost all less than a year old.

So we asked Dora - what was the company strategy, and why does it seem to be working? It’s clear he follows the market very closely, and here were his comments:

The company’s niche? “Crystal clear strategy games” at lower price points: Dora says: “I believe with the shorter attention span and shorter tolerance for hardcore mechanics and learning curves with soooo many games on the market, there was a room for more casual type of strategy games - and so far, looks like I was kinda right.”

Hit gameplay-led solo dev card & strategy games are stimulating demand: titles like Dicey Dungeons or Balatro are deep in people’s brains, and Ozsoy adds that “a [lower] price point and low complexity is starting to show its strength with [newer] titles like Minami Lane.” And which player doesn’t like a cheaper entry point?

‘Perfection is the enemy of excellence’ when it comes to this market: Dora says: “I'm not a patient person - definitely not a perfectionist, and love chasing new sparks. We are like a team of ADHD lovers. We are passionate, our fire burns bright but swiftly, and we jump to another project as soon as we can.”

It’s true that not all of Rogue Duck’s titles hit on release. Dora was disappointed with sales of ‘memory game x roguelite’ Pairs & Perils, saying: “It's a gimmicky game in the end, and we priced it like a regular roguelite strategy game.” But we don’t know how YouTube or TikTok will amplify these titles until they hit the market - and it’s a clever idea.

We were also interested in Dora’s brief explanations of why every game in his entire catalog - and remember, this publisher hasn’t been around long - exists:

Cardboard Town: “‘Hey, city builders are nice but infinite amount of decision making is very tiring, let's limit the options, simplify it and see what happens.’”

NeoDuel: Backpack Monsters: “A newbie dev team comes to us and says 'we think we can make a competitor for this game with a more exciting theme, let's try' so we fund them.”

Dice & Fold: “My partner talks about a super basic solitare-ish dice game, i say it's way too basic to be a game, he makes a prototype, it's super fun, we fund it.”

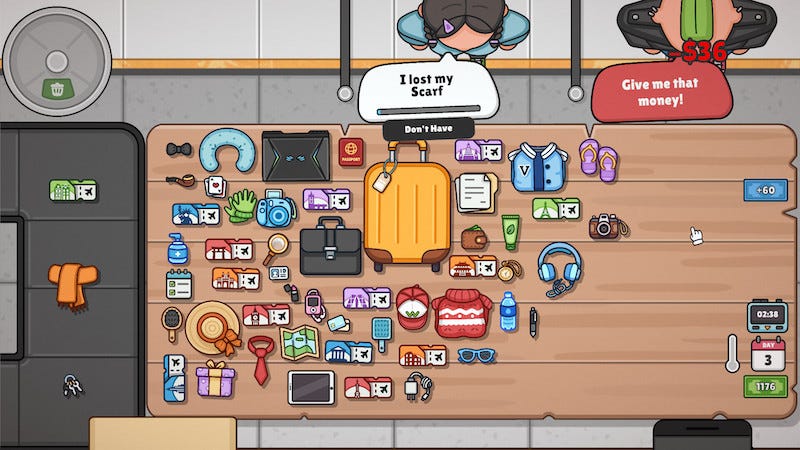

Lost But Found: “A university student intern makes the game in one of our internal game jams, turns out it's quite fun, we fund the project, thinking maybe it's gonna be a $1 game, scope increases slightly and it becomes our [biggest] hit so far.”

Witchy Business: “Hey, looks like casual games are a money maker (Lost But Found) let's try that formula again with an interesting theme: running a magic shop!”

Pairs and Perils: “We saw the game in Next Fest and it fits our library so [well] (a strategy game that you understand how to play at a glance) so we contacted the developer & helped him improve the game and do the marketing.”

Finally, we got some ‘straight out of the publisher’s master spreadsheet’ data on which Next Fests the games were in, how they did in them - Steam wishlist-wise - and how many wishlists they launched at:

You’ll notice that none of them did incredibly well for wishlists, but even more interestingly, here’s the Day 1, Day 7 and Day 30 revenues for each:

You can see that a couple really took off after launch, thanks presumably to a lot of social video virality - Lost But Found in particular has a ton of YouTube videos, and Day 30 revenue of 10x Day 1 $ is pretty good going. The price point really helps here.

Concluding: why are we enthused about Rogue Duck? Because it feels like it’s super well-aligned to what many people want from the market. It’s not $-scaled, sure. But that doesn’t mean it can’t be successful, and growing, just on its own bootstrappy terms. And that, in today’s market, is relatively rare.

[BONUS: Dora just did a YouTube video on whether you should get a publisher that looks like it has a lot of good analysis in it - check it out and see what you think.]

Most-streamed Jan. 2025 games: Tarkov jumps..

To end, we’re exclusively featuring data from livestream analytics platform Stream Hatchet - which also has a new 2024 live-streaming trends’ piece (free reg. req.) - by looking at Jan. 2025’s Top 100 games watched in big (non-China!) streaming platforms.

Anyhow, here’s the full ‘Top 100’ for Jan. 2025 (Google doc), annotated by GDCo. Quite a few % increases in the Top 10 due to a slow December, but here’s what we picked out:

Marvel Rivals is settling in near the top of the charts: the only title in the Top 10 (except a sports iteration!) released in the past few years, the hero shooter is at #4, up 44% to 94 million hours watched - very impressive.

Escape From Tarkov rode a ‘wipe’ to extra hours watched: games like Rust and Tarkov do ‘player progress wipes’ every few months to keep players on their toes & allow re-engagement. And Tarkov’s late Dec wipe led to +120% hours watched and 52m hours watched (#9) in Jan. Some ‘Twitch Drops’ campaigns also helped…

Dynasty Warriors Origins was the top new entry in January: despite not tracking China-based streaming services, the ARPG hit - also the top-grossing new title in January - hit #56 in these charts, with 4.7 million hours watched. (Not a giant win, but the best in a quieter month!)

Otherwise, we previously noted that F2P singleplayer ‘creepypasta’ horror standout Poppy Playtime had a CCU spike in January as it released its latest Chapter 4 DLC. Relatedly, it made #53 with 5.25m hours watched (up 28x on the previous month!)

The other new entry in these charts was Streamer Life Simulator 2 (#77, 3.35m hours watched), which is a competent, if weirdly genre mashed-up (it has driving in it!) title from the devs of the also viral, also oddly meme-y Internet Cafe Simulator 2. (Look, streamers like first-person games where you play roles…)

Finally, weird trending Russian game of the month is SchoolBoy Runaway (#83, 3 million hours watched), if you can deal with the stealth ‘run away from home’ sim, inc. corporal punishment. (It’s also created in a first-person ‘simulator’ style.)

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]

Oh I definitely wasn't expecting Rogue Duck to be featured! I've been following Dora and Rogue Duck for quite some time now, and as a fellow Turkish gaming enthusiast, I was very interested to see their growth ever since I came across their stuff. I find their way of communicating with players on social media very sincere, and I find their approach to the balance between fun and work very likeable. Hopefully they can ride the hype and get even bigger.

It was really interesting to see a deep dive into their games and revenues. Thank you for the insightful article!