How your Steam launch players relate to Week 1 sales!

Also: the most-watched games of April & lots of game discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we start the week, apparently with less (but not zero!) U.S/China physical tariffs, it’s time to return to the cozy world of ‘opening emails and looking at numbers’, courtesy of GameDiscoverCo’s signature ‘we throw a lot of figures at you’ approach to game discovery analysis. (You like it, you really do.)

Before we start? Many British & French schoolkids probably studied the Bayeux Tapestry, a giant embroidery which “depicts the events leading up to the Norman Conquest of England in 1066.” Well, to celebrate the Doom: The Dark Ages launch, they’ve made a ‘Slayeux Tapestry’, viewable in Leeds at a museum. Mm, embroidered carnage…

[FOR YOUR INFORMATION: signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, data & lots more. And companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 55+ have.]

Discovery news: Europa Universalis hits the radar!

Let’s take a look at a - slightly quieter, actually - weekend and early week so far in the world of game platforms & discovery:

Looking at GDCo's countdown of 'trending' unreleased Steam games by 7-day new follower velocity, from May 5th-12th, debuting #1 with a bullet is Paradox’s grand strategy standout Europa Universalis V. (EU IV shipped 12 years ago!) Also hot: Dune: Awakening (#2) ARC Raiders (#3), Doom: The Dark Ages (#4).

Elsewhere, 'Papers, Please but with zombie detection' breakout Quarantine Zone: The Last Check (#5) continues to trend, even ahead of a May 22nd full demo. And neat to see the long-awaited, linear cinematic action-adventure Mafia: The Old Country getting a pre-order (at a $50 price point) and a chart placing at #7.

Prepping for an iOS App Store return for Fortnite (possibly?), Epic went Rewards big: “When you make a purchase in Fortnite, Rocket League, and Fall Guys using Epic’s payment system globally on PC, iOS, Android, and the web, you’ll get 20% back in Epic Rewards.” This is spendable on Fortnite & EGS, and permanent….

Garry’s Mod & Rust creator Garry Newman is ‘a character’, which is why his ‘getting into the game industry’ advice is directionally interesting, and also mentions a Play Fund for s&box, “paid to creators based on minutes played, like Fortnite.” (The test fund is only paying $1.5k/month to the top creator, but watch for full launch.)

Valve has officially announced a new compatibility rating system for third party SteamOS devices, starting with the portable Lenovo Legion Go S, and they explain: “If your title already has a Steam Deck Compatibility rating, an automated process will use that data to give it a SteamOS Compatibility rating.”

Dune: Awakening got big ‘I paid for this already & can’t try it’ player pushback on its Beta weekend, so opened it to all Steam pre-orders of the game - which kinda created an ‘Advanced Advanced Access’ situation, haha. (The ability to do this was a manual privileges edit by Steam, and also created a big pre-order spike.)

The Horizon-ing of the Meta Quest continues, with the $8/month ‘Quest+’ games subscription now rebranded to Horizon+, following the store rebrand (to Horizon Store), and lots of Horizon Worlds content being liberally sprinkled betwixt the standalone games.

Unity’s got poor press from DayZ creator Dean Hall (in a lengthy Reddit post) about an incorrect request/threat from them “you currently have users using Unity Personal licenses when they should [in your] Unity Pro subscription.” Enforcing license use can rarely be done in a non-heavy handed way, but still, it’s not a good look.

On Roblox trends: we got sent a big list of Roblox game trackers, and picked out RoTrends from SuperBiz as one of the cleanest/easiest to check out. Anyone else got a favorite/preferred? (We want to cover this space more, but there’s a lack of B2B trend coverage, with a few exceptions.)

Konvoy went right ahead and tried to make some estimates for Grand Theft Auto VI’s launch revenue. They’re suggesting it will cost $80 & IAP, break even on its $2 billion investment in way less than 30 days, and gross $7.6 billion within the first 60 days of launch (including pre-orders.) We just know it’s a big number!

Finally, here’s a take on too many Clair Obscur ‘why it succeeded’ op-eds from Raphael van Lierop: “Enjoy the magic when it happens. Do not destroy it with all your callous and self-aggrandizing analysis... Do not taint it with your feeble attempts to glean its inner workings. They are not for you to know. Let art be art.” We’ll… get our coat?

How Steam launch players relate to Week 1 sales!

Unlike many other platforms, Valve’s Steam store on PC has had a history of transparency with the number of CCU (concurrent players) for each game on its platform. Which, we tend to believe, is a good thing for the market.

But where? Well, not only is there an official chart of the top games by CCU, but each community page for the game has the number of in-game players at the top. (And if you want to see it easily on the web version of Steam, the SteamDB Chrome plug-in injects it as a custom insert on each Steam game’s store page!)

In recent years, we at GameDiscoverCo have been using launch CCU as a yardstick for how a game might perform in its first week on Steam, while other estimation algorithms are still accruing information. Our general, informal view had been:

You could ‘expect’ a reasonably performing game to have sold 20x its peak Day 1 CCU by the end of the first week.

Games that were heavily pre-ordered by fans frontloaded Week 1 sales to as low as 8-12x Day 1 CCU.

These numbers could change quite a bit if the title went viral with influencers during launch week, or if it was particularly replayable (more overlapping players = bigger CCU!)

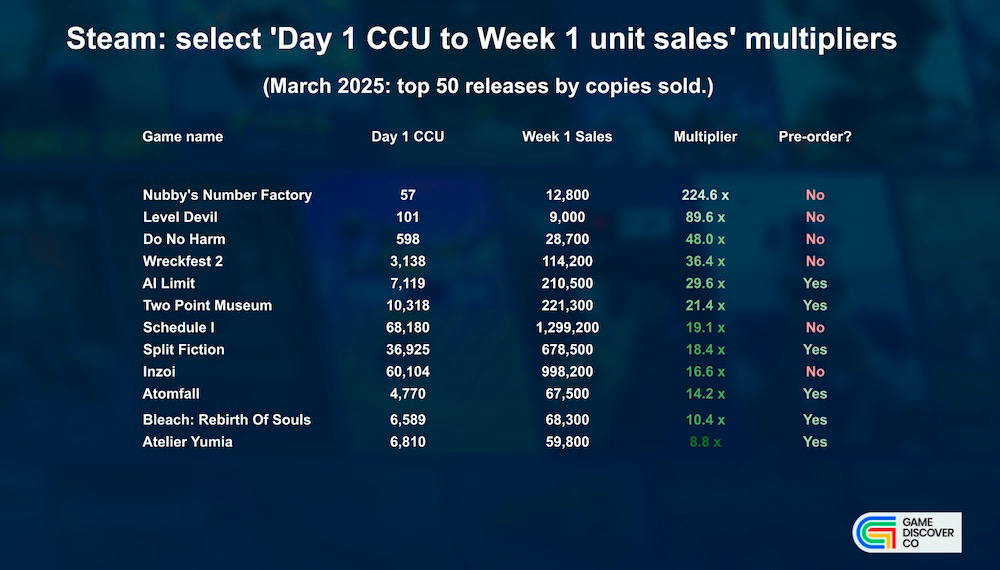

But of course, we can test this supposition using GameDiscoverCo data. So here’s a spreadsheet of the Top 50 Steam debuts in March 2025 (Google Drive doc) where we compared GDCo’s sales estimates to Day 1 (and all-time high) CCU. To start with, here’s some notable games released in March with ‘Day 1 CCU to W1 sales’ multipliers:

So far, so good - there’s quite a range of results, which can be roughly subdivided into:

High performers through post-launch virality: Nubby’s Number Factory (224x), Level Devil (90x), Do No Harm (48x)

Good quality games that launched strong and kept a decent multiplier: AI Limit (30x), Two Point Museum (21x), Schedule I (19x).

Pre-ordered, more expensive titles that skewed ‘early adopter’-ish: Atomfall (14x), Bleach: Rebirth Of Souls (10x), Atelier Yumia (9x).

We’re not saying a high or low multiplier is ‘good’ or ‘bad’ here, necessarily. Higher multipliers probably imply better post-launch virality. But if a game starts strongly out of the gate - as Schedule I did - it can get to amazing numbers without an outlying Day 1 CCU to Week 1 sales number.

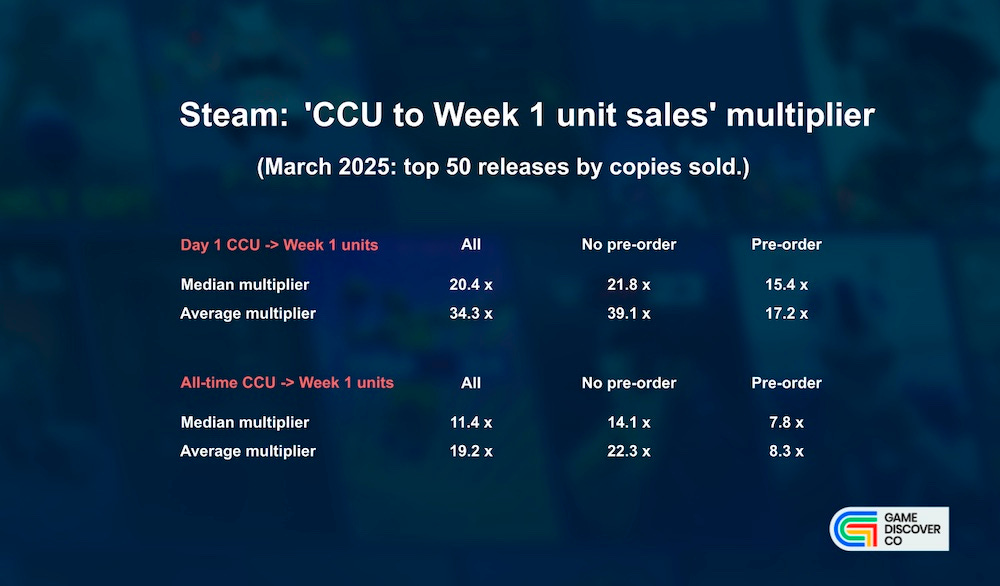

So that’s a selection of the top titles. But if we take the Top 50 March 2025 Steam releases by copies sold - which will skew things a bit in favor of successful games - what median and average multipliers do we see?

So, good news! Looks like our anecdotal ‘Week 1 sales are 20x Day 1 CCU’ multiplier for a game without pre-orders on Steam was pretty much on the money, with a median multiplier of 21.8x. (The average multiplier is higher, due to outliers.)

For pre-orderable games, it’s not quite as low as we thought, and it turns out you ‘still’ get to a median of 15.4x, at least for the games in March 2025’s selection. Which makes the blended total 20.4x.

The conclusion? If your game has 1,000 Steam CCU on Day 1, you can very roughly ‘expect’ 20k sales in Week 1. But a big reminder: this can regularly be 50% or more different, both up (for viral/longplayed games) and down (for heavily pre-ordered fan-first games.) So it’s just a guide - don’t take it as gospel….

We also mapped ‘all-time high’ CCU vs. W1 sales, since many games increase CCU in the days after launch. It’s an 11.4x median multiplier for ‘all-time CCU to Week 1 sales’, a 14.1x multiplier for ‘no preorder’, and a 7.8x multiplier for pre-ordered games.

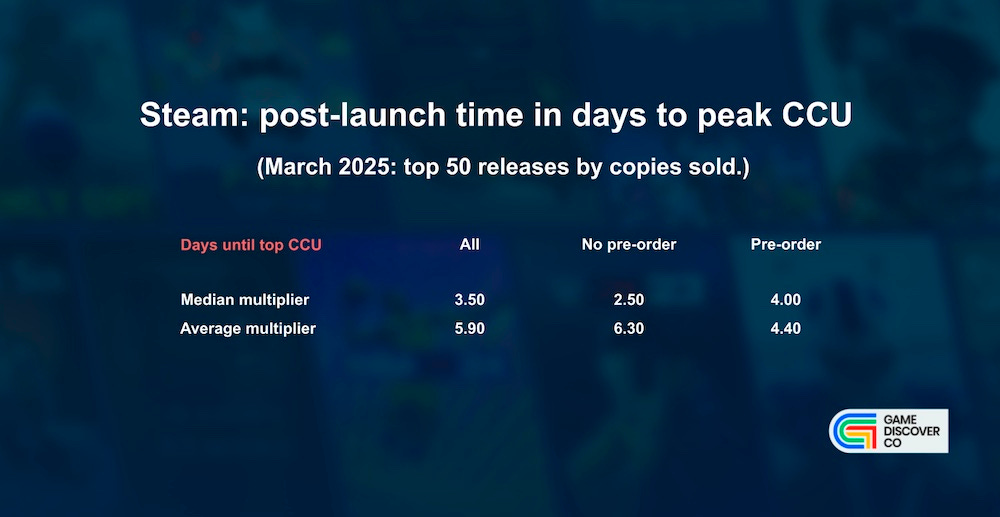

Doing this allowed us to take a look at how soon most games peak in CCU after launch. The full list for March 2025 is in the linked document, but look here:

Basically, Top 50-grossing games without pre-orders peak at a median of 2.5 days after launch. We think, again, this is partly a factor of the Top 50 being more successful, since many games we see have their Day 1 CCU as their highest. But it wouldn’t be much lower for all games - likely closer to 2 days.

Oh, and pre-ordered games take 4 days to reach their peak CCU - perhaps partly because they’re longer, meatier titles and so the replayability will nudge the CCU upwards as more people jump on? The median for all is 3.5 days, with most games peaking within the first week - with only a small handful of exceptions like Nubby’s Number Factory, Drive Beyond Horizons, etc….

So there we go - real data to back up our suppositions. Now when you’re looking at real-time CCU ranks for new games on GameDiscoverCo’s Pro/Plus back-end, you’ll have some mental model to tie it into, right? Right…

April ‘25 in streaming: Warzone gets it right, surges

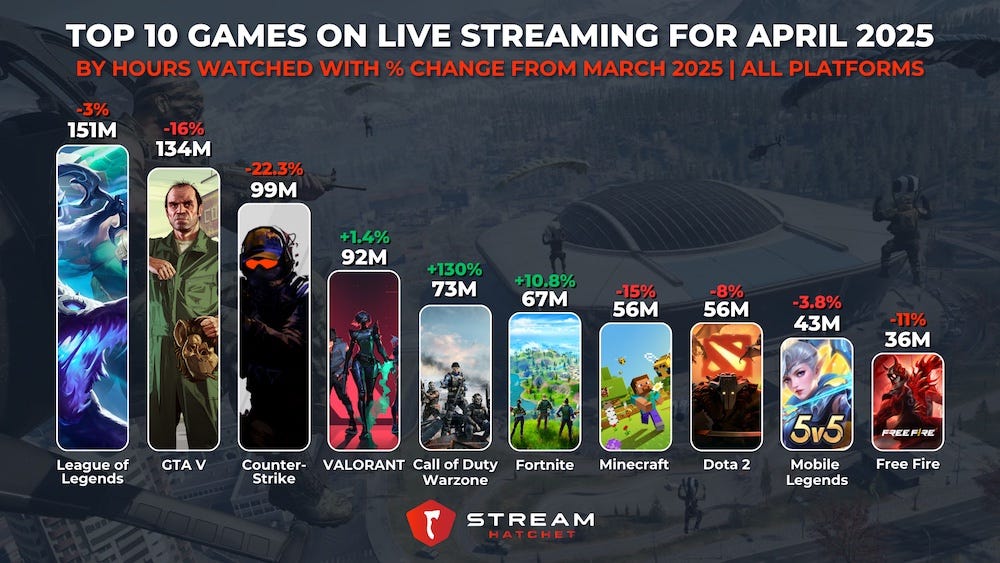

Finally, we’re zooming to examine from livestream analytics platform Stream Hatchet. They gave us the Top 100 games in terms of total hours watched via big (non-China!) streaming platforms like Twitch & myriad other smaller platforms.

We def. think this helps us understand the popularity of specific ‘evergreen’ - and new - titles in the PC/console games market. So - here’s the full ‘Top 100’ for April 2025 (Google doc), as annotated by GDCo. And here’s what we saw:

The Top 10 games for April? Unsurprisingly pedestrian & evergreen: just calling out a lot of the usual suspects - League Of Legends, GTA V, Counter-Strike, Valorant, Fortnite, Minecraft and Dota 2 - atop the charts. (It doesn’t matter if they didn’t ship anything giant or new, they still all crested 50m hours watched!)

Call Of Duty Warzone surged, due to a favorite returning: the Verdansk map launch provided a reset for CoD: Warzone players. And it sounds like the revitalized ‘battle royale’ formula was a big hit with players, also sending hours watched up an impressive 130% to 73 million (#5) for April, even beating Fortnite.

New entries? The Oblivion Remaster leads a busy month: people loved Bethesda’s remastered fantasy world, as it hit #17 (22.5m hours), but also notable was Clair Obscur: Expedition 33 (#33, 14m), Blue Prince (#37, 9.2m), RuneScape: Dragonwilds (#72, 3.5m) & Into the Dead: Our Darkest Days (#75, 3.4m.)

A couple of titles charted purely due to Beta coverage - Bungie’s extraction shooter Marathon at #46 (5.9m hours), and Sloclap’s PvP soccer game Rematch at #79 (3.15m hours.) Oh, and physics-y slasher Half Sword’s updated demo boosted it to #55 (5.2m hours) - more on that next week…

Finally, also notable in the ‘Diablo-esque’ games space, Path Of Exile 2 (#16, 25.1m hours) surged 6.2x due to the Dawn Of The Hunt update, and Last Epoch (#38, 9.2m hours) hit 1.0 in style with a 22x increase in interest. (Diablo IV isn’t in the Top 100.)

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]