How user reviews affect your game's Month 1 sales

Also: GDC Vault recommendations & lots of news

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, and thanks for all the great feedback on Monday’s newsletter re: top countries by Steam bandwidth. We got some Qs about whether VPN usage skewed any of the results - y’know, ‘Steam regional tricks’ to get cheaper-priced games.

It’s possible - especially for cheaper-priced countries like Russia and (well, before Steam’s USD shift) Turkey. But those are also ‘large in population’ game-playing nations. So yes, we still believe the majority of that traffic is real and local.

[HEY YOU: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to our Steam data back-end for unreleased & released games & weekly PC/console sales research, Discord access, eight detailed game discovery eBooks - & lots more.]

How reviews (and EA!) affects Steam conversion

After we published our signature survey on ‘wishlists to sales’ on Steam the other week, we got questions around conversions by review score, conversions by genre, and more. And unfortunately, we had to say ‘not enough data’. (Or we didn’t survey for it.)

But luckily, our awesome data partners* at Gamalytic stepped in. We had 100 survey results, but they’ve got ‘all the data points’, reverse engineered from public Steam data - and put out a giant blog on Steam conversions. (*We’ve licensed their algorithms & data, and Gamalytic’s owner Strale is also helping to improve GameDiscoverCo Plus nowadays!)

In this case, they sampled “around 700 [Steam] games released after September 2023 with at least 5,000 wishlists, and at least 500 copies sold within the first month.” So it’s pretty recent estimates. And here’s some of the headline results:

The overall picture? Wishlist conversions vary wildly…

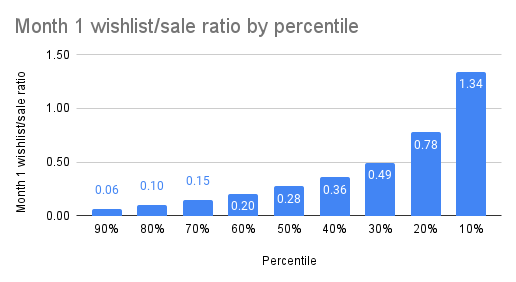

This isn’t a change from the GameDiscoverCo survey data, but it’s really good to see this grouped by ‘percentile of games’. In this case, the worst - 90th percentile - has 0.06x conversion (100,000 wishlists, 6,000 sales in Month 1.) And the best - 10th percentile - has 1.34x conversion (100,000 wishlists, 134,000 sales in Month 1.)

As Strale says: “We have median Month 1 sales as 27% of launch wishlists and median Week 1 sales at 22% (23% and 17% respectively if we don't.. filter out games that sold <500 copies within m1.) This aligns with GameDiscoverCo data btw, where they had W1 at around 20%.”

Better Steam user reviews? Better wishlist to sales numbers!

So yes, higher-rated games do the best compared wishlists, as a median. You’ll see a particular jump in the Overwhelmingly Positive category (95%+ - well, if you’ve got >500 Reviews!) at a whopping 0.51x wishlist balance as Month 1 unit sales.

And looks like it’s the Mixed reviews stage (<70%) where you see significant conversion dropoffs. Why? Mostly Positive and above - after a month - indicates the game is essentially ‘safe’ for people to buy, and quality isn’t affecting conversion.

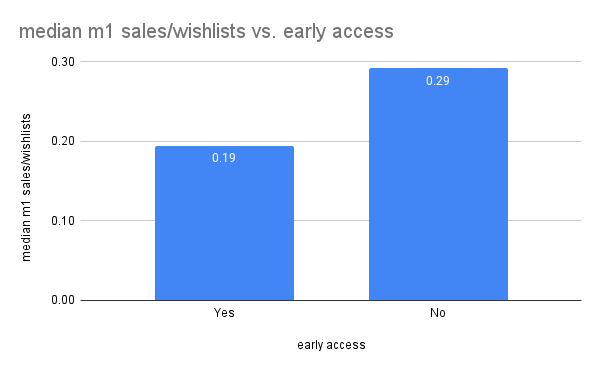

Initial sales in Month 1 are somewhat lower for Early Access games

This also isn’t a shock - because they have a full release to mount a ‘comeback’. But: “Early Access games convert worse than their full release counterparts. Early Access games have median Month 1 sales as around 20% of their launch wishlists, while full release games have their median at around 30% of their launch wishlists.”

We don’t think this data creates any key reason to do - or not to do - Early Access, though. It’s just context into the median performance you can look towards, if you do.

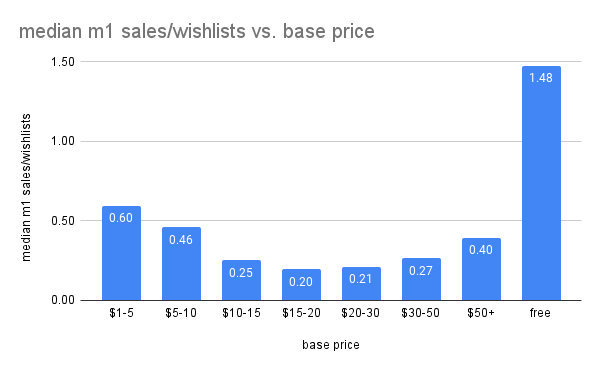

‘Base price’ maps to sales positively both on the low and high ends..

Trying to explain the trend: a lot of smaller <$10 games get less wishlists overall, and more spontaneous organic buying because they’re cheaper. So you get a high ‘launch wishlists to Month 1 sales’ rate.

Then, when you get to the $15-$30 range, that’s where the majority of the pro or semi-pro games come in, and you get more towards ‘normal’ success rates. (Or slightly below average?) And $50+ gets higher success rates, because there’s less of those games. And maybe viral wishlisting happens less with ‘trad’ AAA sometimes?

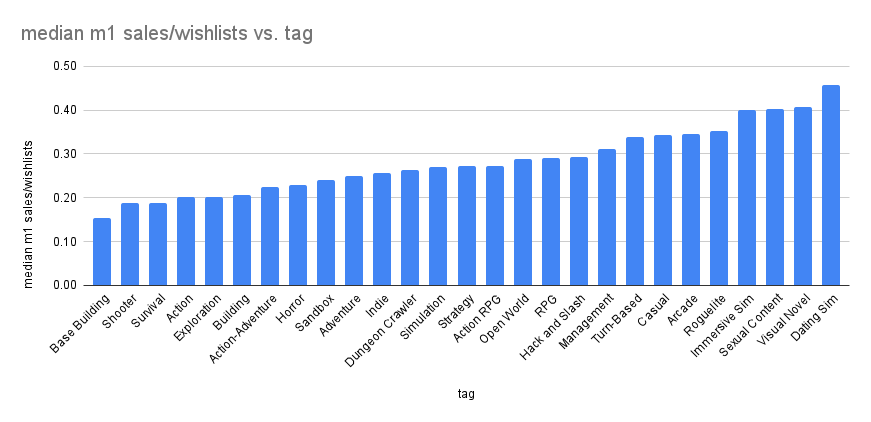

Tag conversions - a little ‘all over the place’, but interesting…

It’s possible we need even more data to refine this. But there’s some unsurprising trends here, with ‘niche’ tags like visual novels (and, uh, sexy games) topping the ‘launch wishlists compared to month 1 sales’ ratios.

The important note here is - the top-converting tags aren’t the ones that get the most wishlists. They just do well compared to the wishlists they do get. (Visual novels is a super-crowded market that we wouldn’t recommend most commercial devs entering.)

Still interesting, though, huh? And please read the full Gamalytic blog post for quite a bit more data besides on success vs. wishlists on Steam, everyone’s favorite subject.

GDC Vault: best of 2024’s game discovery talks?

Some of you may know that in a previous life, I helped to run Game Developers Conference for almost 15 years. And as one of the people who helped keep GDC Vault up and running, I always like to look post-show at the ‘free for all’ talks, every year.

So: I believe the current GDC team always makes all talks free 2 years after they first debut - GDC 2022 (and before) is 100% free in Vault now. And second, the GDC YouTube channel - which now has 65 million views - also posts free talks regularly.

Anyhow, you’ll find a bunch of brand-new GDC 2024 talks - particularly from the Independent Games Summit - now free on the GDC Vault website. And we wanted to point out some highlights:

In some very handy microlectures, Son M., Jennifer Scheidereit and Kenny Sun presented ‘Pitching from the Indie Dev Perspective’ - lots of practical advice on pitch decks, relationships with publisher in this difficult market, and more.

Tomas Sala talked on ‘Releasing an ‘Evolving Demo’: A Postmortem for Bulwark: Falconeer Chronicles’, explaining “why the evolving demo worked great for his latest game, but why it might not be the best option for every game or even for every phase of development.”

HowToMarketAGame’s Chris Zukowski presented ‘The Steam Secrets Nobody Tells You.. Until Now’, a typically direct talk from him on how devs can get “the most possible visibility for their game” on Valve’s phantasmagorical platform.

We dig game trailer supremo Derek Lieu, and ‘Make the Trailer Before the Game: A ‘Marketing First’ Way to Prototype’ suggests: “Thinking about what a trailer for your game will look like when you're at the prototyping phase can be an effective lens.” Also: Derek & Dana Trebella presented ‘It's About Time(lines): Marketing Your Game from Finish to Start’, which explains this worksheet in detail.

Finally, ‘Cult of the Twitch: How 'Cult of the Lamb' Used Twitch Integration to Reach a Massive Audience’ has Harrison Gibbins and Thomas Tuts explaining “an in-depth look at how the integration was designed and developed, the hurdles that were faced as well as a… look at how well Cult of the Lamb performed on Twitch.”

And two bonus talks - Valve’s Kaci Aitchison Boyle did a talk for the student-focused Game Career Seminar (above) called ‘Developing Your Audience While Developing Your Game’, and John Cooney followed up his epic Flash Games Postmortem from GDC 2017 with a Pt.2 talk re: what happened next & lessons for modern devs.

The game platform & discovery news round-up..

Finishing up the free newsletters for this week - we’ll look at Gray Zone Warfare’s surprise Steam debut for our Plus subscribers in Friday’s newsletter - but let’s see what we can find right here, right now:

The latest ‘trad media publication’ charts from ICO’s Footprints.gg (above) show Stellar Blade as the clear leader, thanks to a strong PS5-exclusive debut. It’s followed by Fallout 4’s revitalization, thanks to the TV show and a new patch (and also some controversy!), the hot Manor Lords, and new JRPG Sand Land.

If you’re used to putting GIFs and MP4s on your Steam game page and work with the Meta Quest, there’s good news: “The Meta store now allows you to add GIFs and MP4s (before it was text only). works on web, in-app and in-headset. Super cool to highlight gameplay clips of your game!”

The Circana U.S. ‘game hardware, physical & most digital’ results for March 2024 are here, and “gained 4% in March 2024 [YoY], reaching $4.9B. Mobile content spending grew 15%, offseting a 32% drop in [console] hardware.” Dragon’s Dogma 2 and Helldivers 2 are doing great, and Mat Piscatella adds: “[Hardware] down more than expected, but not shockingly so. Really could have used new [Nintendo hardware] this year… Trend of surprising mass market hits continues.”

Xbox things: the ‘not-E3’ Xbox Games Showcase “followed by [REDACTED] Direct” is confirmed for Sunday, June 9th at 10am PT - there’s general agreement that the latter is a Call Of Duty showcase, btw. And the latest games coming to Xbox Game Pass include Little Kitty Big City, Tomb Raider: Definitive Edition & more.

Microlinks: Steam store pages now display a banner when a member of your Steam Family already owns the game; Japan’s retailers are cracking down on duty-free resales of consoles (uhoh, China!); the Q1 2024 video game investment market seems complex but interesting, according to InvestGame data.

Some interesting data from Ampere Analysis re: the console AAA marketplace, showing the domination of a) live services games from big publishers b) older titles in the PlayStation and Xbox ecosystem: “The games portfolios of [EA, Epic, Activision Blizzard, Take-Two, Microsoft, Ubisoft & Sony] represent 55% of MAUs” across those platforms.

2x Roblox things: 2D video ads within the platform are now available to any advertiser on the platform, a “scalable opportunity for brands to connect with Gen Z”; Walmart’s Roblox e-commerce experience launched, with “users inside… Walmart Discovered able to have real-life items shipped directly to their doorsteps.”

We’re just a ‘mobile-adjacent’ newsletter, but found stats from this Metacore interview very interesting: - "Merge Mansion has over 50m downloads and the game’s lifetime revenue is already close to 400m Euros", as "the Finnish firm reports its 2023 earnings: €162m in revenue and operating losses of €5.6m." That paid UA ain’t cheap!

Some really interesting research from Gamesight here on “the reasons behind viewer drop-offs when streamers switch titles”. They identify the biggest drop-offs are when RTS or MMORPG streamers who ‘main’ a specific title change to playing another game - the lowest are for streamers of puzzlers and first-person shooters.

Xbox is keen to sign titles for Game Pass that grow subscribers - whether more PC-centric titles, or ‘emerging market’ portfolio, we think. So makes sense that in the new ID&Xbox Digital Showcase, Chinese publisher Gamera Games “announced that their lineup of indie games [including Volcano Princess, Depersonalization & more]… will be available with Xbox [or PC] Game Pass.”

More microlinks: PlayStation Plus’ monthly ‘essential’ games for May are EA Sports FC 24, Ghostrunner 2, Tunic and Destiny 2: Lightfall; an interesting story on the average screen time playing games every day, per country - the U.S. is #3 with 8%; U.S. arcade chain Dave & Busters is to allow customers to bet on arcade games, weirdly.

Finally, must-watch YouTube video of the week is ‘classic PC adventure game speedrunning’ channel (!) OneShortEye deconstructing how Sierra’s original King’s Quest now has ‘complete the game’ speedruns in less than… a minute? Really? Yes:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]