How 'top-heavy' is the PC/console player-base in 2023?

Also: plenty of discovery and platform news, y'know...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back - to the email newsletter that never ends (…my friend?) We’re basically your inbox’s equivalent of the Riders On The Storm’s long fade-out, right? And this time out, we’re ‘breaking on through’ not into specific sales, but share of market.

Yes, people don’t have to be playing your game ‘right now’ for it have done well. (Our favorite example, the short & elegiac What Remains Of Edith Finch, had max CCU of just 300 for its first 5 years after release, but has sold nearly 1 million Steam copies.)

But PC/console games that retain players can keep monetizing. And share of attention - in the form of DAU or CCU - is often studied in isolation, but not in overall context of the entire player-base. Which is what today’s newsletter focuses on…

[PSA: a couple of weeks until ‘new user’ pricing of our GameDiscoverCo Plus subscription is going up! Subscribe now to get Steam pre/post-release data, weekly PC/console sales research, an exclusive Discord, detailed game discovery eBooks - with more coming soon - & lots more.]

How top-heavy is the current Steam player base?

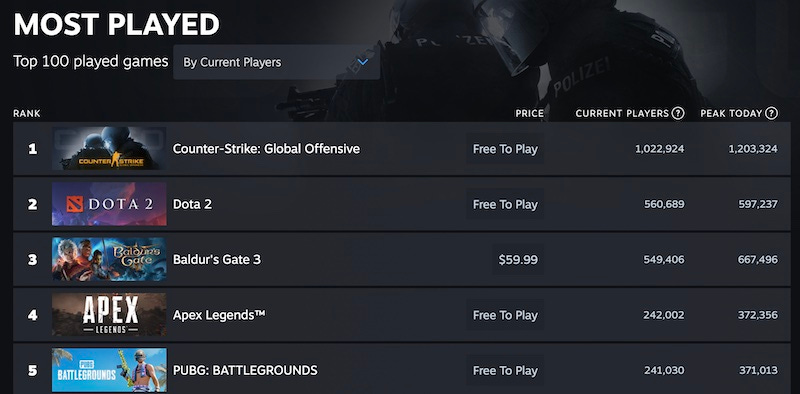

So you’re probably aware that Steam has a ‘most-played’ chart, with CCU (concurrent users) for all games running on Valve’s PC game platform. As seen above, Valve’s own games (CS:GO & DOTA 2) and Baldur’s Gate 3 are the Top 3 titles right now.

Since we can see CCU for all games on Steam, can we use this to more fully understand player market-share? What percentage of the Steam audience - there’s often 8 or 9 million people actively playing a game - are concentrated in the top titles?

Well, since we started tracking CCU recently, GameDiscoverCo crunched the data as of last Friday, and calculated the following split across a real-time CCU snapshot for the Top 1000 games:

Perhaps not too surprising, but the Top 10 games make up a whopping 48.4% of this CCU snapshot, and the Top 50 make up almost exactly 70%. Oh, and the Top 1,000 Steam games are 94.7% of this CCU snapshot of all Steam games.

(For the record, the Top 10 Steam games by CCU as we write this article are: CS: GO, DOTA 2, Baldur’s Gate 3, PUBG: Battlegrounds, Apex Legends, Grand Theft Auto V, Rust, Team Fortress 2, Naraka: Bladepoint, and War Thunder. And 70% of these are F2P.)

What do we get from this initial takeaway? That even on a fairly open PC game platform such as Steam, active players cluster in a few GaaS, largely multiplayer games. This isn’t a conspiracy - it just tends to naturally happen.

Mind you, you don’t need to have big sustained CCU, as a smaller game, to get return on your investment. Heck, there are publishers I know who gross millions of dollars a year with a combined ‘current portfolio CCU’ of less than 1,000. But player base helps!

How about Xbox & PlayStation player-base / DAU?

Wouldn’t it be great if we could see a similar data set on the Xbox ecosystem and PlayStation, too? You’ve heard us say before that consoles - especially PlayStation - ‘seem’ top-heavy too. Are they more top-heavy than this Steam snapshot?

Well, good news - thanks to some of GameDiscoverCo’s recent data analysis, we do have some estimates on DAU (daily active users, will be 5-10x or more higher than CCU) on these consoles. Here’s our estimate of Xbox’s Top 10 DAU as of last Friday:

It’s not surprising to see titles like Minecraft, Fortnite, Call Of Duty and FIFA topping this list. (Although perhaps the inclusion of Roblox (#5) and Rocket League (#7) might be slightly more unexpected, depending on your point of view.)

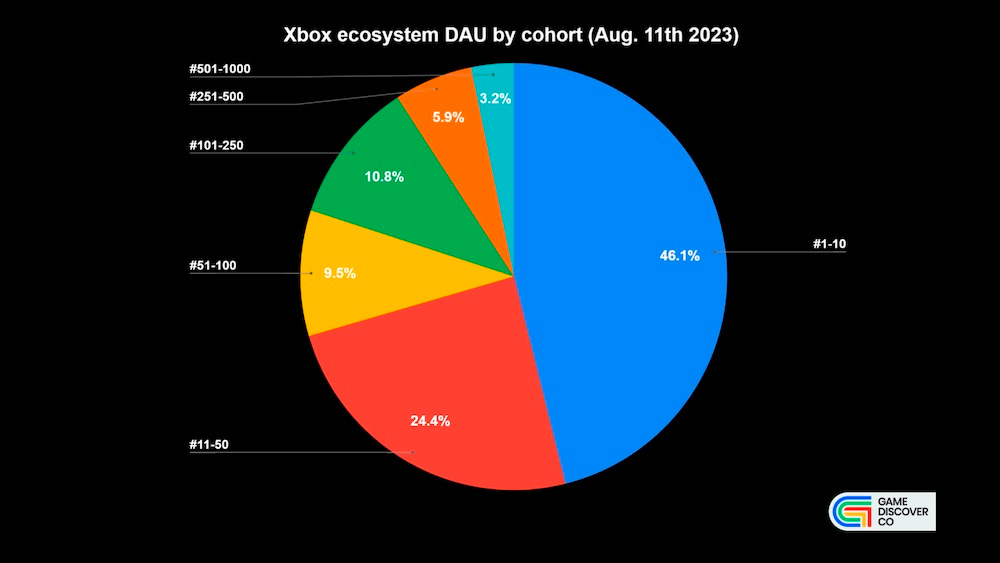

In any case, we also crunched the numbers across the Xbox ecosystem for the Top 1000 games by DAU, and got the following results. They’re very similar to Steam:

So you’re looking at the Top 10 games being 46.1% of all daily DAU, and the Top 50 around 70.5% - extremely adjacent to Steam’s 70%! We were wondering if Game Pass noticeably broadened the tail in terms of DAU. (We actually think it did, but you’ll have to wait until the PlayStation part of the data to find out how much!)

Side note: we’re calculating Top 1,000 games as high as 99% of all games’ DAU for Xbox & PlayStation, but we just realized that this is probably an artifact of the fidelity of our calculations for tiny games. So we suspect it’s more like 95%, much like Steam.

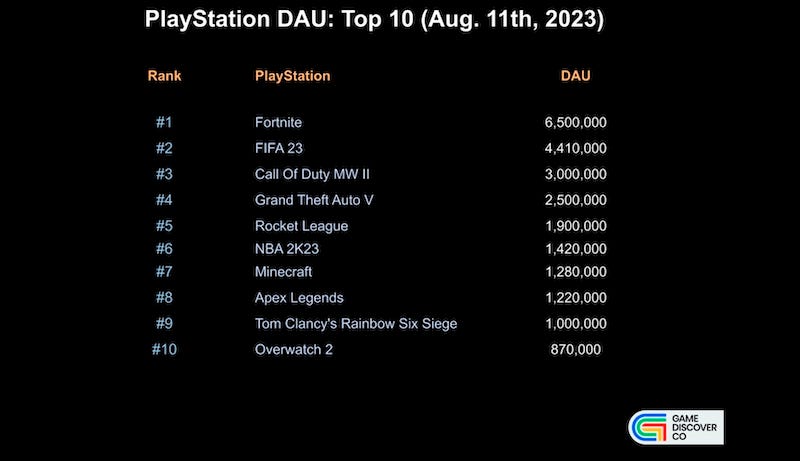

Finally, we took a look at PlayStation, for which we have the following estimates for top games by DAU, as of last Friday:

You’ll see that select PlayStation DAU leaders have higher multiples than Xbox, with Fortnite DAU at 3x - and FIFA higher still. But further down, the #10 game on PlayStation (Overwatch 2) is ~2x the DAU of the #10 title on Xbox (Apex Legends.)

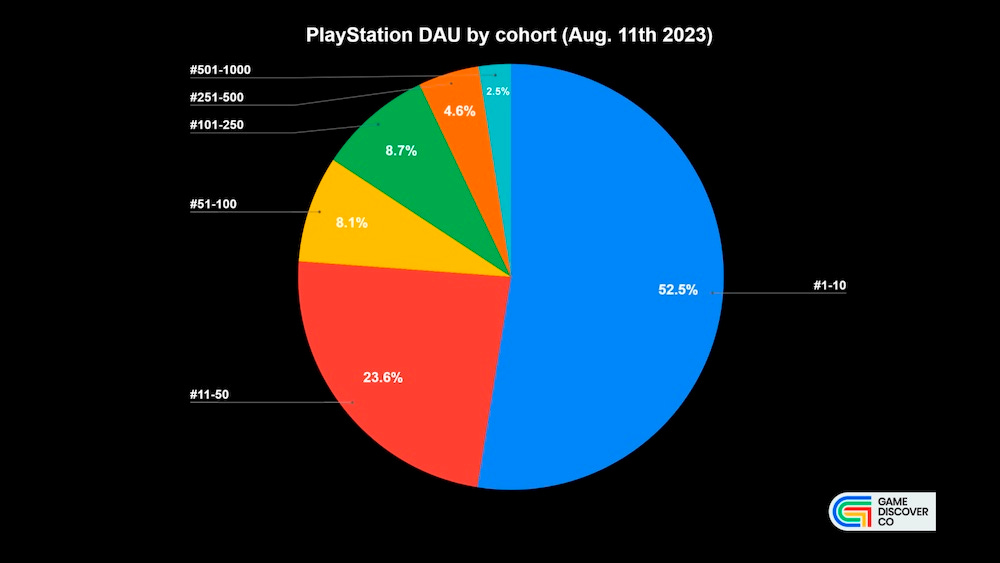

Separately of the relative popularity of the consoles, does this mean that PlayStation is more top-heavy as a platform from a DAU perspective? Well, yes, we think it does:

We see the Top 10 PlayStation games as 52.5% of all DAU on the platform, and the Top 50 as an even larger 76%. Admittedly, it’s not spectacularly different from Xbox and Steam. (And part of it may be the outsized popularity of Fortnite and FIFA!)

But nonetheless, it plays into our view that PlayStation is a slightly more hit-driven platform. Why? It tends to attract mainstream players who are interested in high-budget, good-looking AAA games. (Not that there’s anything wrong with that.)

And we think Xbox would have this slightly top-heavier DAU distribution too, without Game Pass, which ‘spreads out’ a bit of the DAU interest. (PlayStation Plus also diversifies DAU, we think, but the % of active PS players who have access to Game Catalog is significantly lower than % of Xbox players with Game Pass access?)

But ultimately, all of the above graphs tell us that PC and console games are hit-driven, right, at least at a high level? When you see the Top 50 games out of thousands - or tens of thousands - on a platform get 70-75% of the interest… that’s the headline?

[BTW, we would have loved to do something on Nintendo Switch. But the amount of data available to extrapolate from is miniscule. Still, we note that the most-downloaded U.S. Switch eShop games frequently include Fortnite, Fall Guys, and Rocket League - with Minecraft also regularly in the Top 20. So there’s going to be some ‘top DAU’ overlap with other platforms.]

The game discovery news round-up..

Finishing things out for this week, at least for our free newsletter crew, here’s all kinds of interesting info and links we dug up from ‘somewhere or other’:

Valve just announced minimum game price threshold changes on Steam, aligning other currencies with the $0.99 USD minimum previously announced. Devs should take a close look, since “games or DLC using older, lower pricing in some regions may be hidden from purchase in certain countries or unable to discount as deeply as previously.”

We’ve started covering Fortnite map CCU charts in Friday GameDiscoverCo Plus newsletters. But for a real-time view, FortMonitor just launched, and looks at CCUs for the top-third party Fortnite levels - still headed by recent break-out hit OnlyUp Fortnite! (31k CCU).

Xbox continues to improve its player management to reduce toxicity. The latest announce is an ‘enforcement strike system’ which “educates players about enforcement severity, cumulative effect of multiple enforcements, and the total impact on their standing.” There’s varying strike numbers for different infractions, too…

The Epic Games Store on PC recently re-added a ‘Deals Of The Week’ offer to its front page, with two games - Tchia & Pinball FX Indiana Jones - getting front-page editorial featuring for offering a bigger discounts. (Not sure how they select these!)

Over in TV/movie land, the big streaming services are raising prices aggressively to try to break even - here’s a TV showrunner take on the situation: “In their mad rush off the digital cliff, these companies transformed Hollywood from a high-wage, high-profit, hits-driven industry into a low-wage, low-profit, subscription-driven one. They also broke the basic bargain… that creative artists and independent producers will share in the financial success their work creates.” No direct lessons for games, but.. echoes?

The second set of Xbox Game Pass titles for August have been announced. As well as some interesting games, including The Texas Chain Saw Massacre and Sea Of Stars on Day 1, we note an opportunity to play Starfield “up to 5 days early” with a Premium Edition upgrade, specifically for Game Pass subscribers. Upsell!

Just expanding on that ‘Netflix cloud streaming Beta’ announce - Ars Technica thinks that: “Streamed games have not had an easy launch in their still-early days (RIP Stadia). But here, again, Netflix is not taking the traditional approach or targeting traditional game archetypes.” We agree that starting with an existing sub userbase for whom games are a ‘bonus’ at least gives you more… stability?

HowToMarketAGame attended the Q&A for the next Next Fest, and has a great summary. Particularly interesting to see Valve say (paraphrased): “We sometimes take away and change [Next Fest homepage chart] widgets during the festival if the widget no longer seems relevant.” (We still fully intend to Pepe Silvia about this.)

Epic just announced that it’s bringing its free Epic Online Services (EOS) service to Xbox, Switch, and PlayStation, explaining: “The crossplay overlay offers a ubiquitous way to authenticate players, streamline friend management, and provide game invite and joinability functionality.” A clever way to expand the Epic account user ecosystem, while giving devs some complex & free functionality?

We linked it before, but we’re re-linking it because we get a lot of requests: this list of PC/console ‘indie game publishers’ from Seyed Nasrollahi is very helpful. (Also similarly handy: a larger list of publishers is part of Liam Twose’s Global Games Industry Guide.) Ping us if you know of other handy lists…

Microlinks: a look at big Chinese B2C/B2B game event ChinaJoy, perennially under-covered in the West; why vTubers might be key influencers for your next game; this response about Dolby Atmos from PS5 system architect Mark Cerny makes us generally impressed re: underlying system architecture at Sony.

Finally, a wholesome story of the week? One of Hello Kitty creator Sanrio’s hundreds of listed mascot characters is an alligator called Big Challenges, created in 1978 and sadly never, ever utilized since. There’s been petitions to actually use him, y’know!

Well, as BrianLeeWow mentioned on Twitter/X, the new - and apparently very good - Apple Arcade-exclusive title Hello Kitty Island Adventure busted Big Challenges out as an in-game friend:

Given this is the same dev (Sunblink) that seems to have named their game after a joke game in a South Park episode, we shouldn’t be surprised to see a bit of subversive IP-resurrecting from this studio, huh? We love it…

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Great post, as usual!

A suggestion for a future topic: there is a lot of speculation that the below-average performers of the current summer movie season relate to streaming. People got used to seeing blockbuster movies soon appear on streaming, so anything that doesn't get audiences very excited basically gets far less traction. It's a theory, but an interesting one.

My question is: if Microsoft prioritises streaming-style models (Gamepass) over a potential blockbuster release such as Starfield, will it have the same effect on triple-A games? I personally think using Starfield to promote Gamepass is a terrible waste of such a property and could lead triple-A publishers down the same 'low profit' route that movie studios are now experiencing.