How Songs Of Conquest chose the right inspiration & sold 500k!

Also: top PlayStation and Xbox games by DAU in 2024.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to another week of closely inspecting spreadsheets for fun - which we apparently love doing at GameDiscoverCo. (Hey, it beats other forms of self-abuse.) And let’s get going - we have links & a big double-header for today’s newsletter.

First - PC game devs, just amplifying this ‘call for games’ from Brandon Sheffield (Necrosoft Games): “I am starting [an Itch.io-hosted] charity bundle to benefit victims of the Southern California wildfires.” He’s looking for paid games hosted on Itch to add to the bundle. Submissions are open until Sat. 18th, with the bundle launching next week.

[PLZ READ: we’d appreciate support for GameDiscoverCo by subscribing to GDCo Plus. You get basic access to our ‘core’ GDCo Plus Steam data back-end, full access to our second weekly newsletter, access to our peer Discord, eight game discovery eBooks & lots more.]

Game discovery news: the Bustling World looms!

Starting off with our regular round-up of ‘game discovery news you should probably know’, we’ve got a number of neat factoids for you, starting with:

Our weekly look at the ‘trending’ unreleased Steam games by follower increase has Civ VII and Kingdom Come: Deliverance II at #1 and #2 (no surprise!) But The Bustling World (#6) might be new to some - it’s an open-world RPG set in ancient China which is a) isometric and b) visually gorgeous. (~50% Asian wishlists!)

Also notable: PlayStation's The Last Of Us Part II Remastered (#5) confirmed an April PC release date - and 'mandatory PSN release country restrictions', ouch. And Sledding Game (#9) is a chill co-op sledding title that has good buzz on TikTok.

Latest unconfirmed reports on Switch 2? Maybe Jan. 16th is the date for the official reveal, when “a reveal trailer planned by Nintendo will focus on the Switch 2 hardware, with a software showcase coming later in late February or early March.”

Polygon notes that the Consumer Financial Protection Bureau, “a United States government agency charged with protecting consumers from unfair and deceptive practices from.. financial institutions, proposed a new measure that would protect Roblox users from scams and hacks.” (It’d apply to all user-to-user virtual marketplaces.)

The Academy Of Interactive Arts & Sciences has revealed its 28th annual D.I.C.E. Awards nominees: six noms each for Astro Bot, Helldivers 2, and Indiana Jones and the Great Circle, then Balatro and Senua’s Saga: Hellblade II with five noms. (Game Of The Year noms are for the first four of these, plus Black Myth: Wukong.)

Continuing his grand tour of Steam data, Will McCahill confirms you should respond to negative reviews: “If a review gets a developer response, it is twice as likely to get updated (26% vs 13%)… if a previously negative review is updated by a player after a developer has responded, it's 55% more positive.” So that’s a ~12% positivity lift.

Want to grok the top-grossing mobile games of 2024? Mobilegamer.biz and Appmagic have your back - looks like Honor Of Kings, Monopoly Go, Royal Match, Roblox, PUBG Mobile, Last War: Survival and Candy Crush Saga all grossed >$1 billion in 2024 (after platform cut, ignoring webshop & misc other $.)

This announcement from PowerWash Sim dev FuturLab - that their VR team were “working on a platform which costs us more than it makes”, so will be redeployed to other projects - is another indication that the installed base of VR (and perhaps long tail slowdowns?) can create trouble supporting dedicated teams, long-term.

This PC World video interview with Valve’s Pierre-Loup Griffais from CES has him weighing in on whether new SteamOS devices - like the Lenovo Legion Go S might be ‘competitors’ for Steam Deck: “I don’t think we see them as competitors… it’s a lot of different complementary offerings.” And a platform expansion win for Steam.

‘Games as platforms’ news: as in-world music game Fortnite Festival adds Hatsune Miku for Festival Season 7, an expensive-looking trailer teases local multiplayer for the Harmonix-developed experience. (Trying to bring back Rock Band 4 vibes, huh?) Looks like CCU is popping back up towards 50k as Epic tries to reboot this.

Veteran UK dev Paul Kilduff-Taylor posted a piece on ‘42 essential game dev tips’, which subverts the listicle format nicely by, uh, actually being thoughtful. Notable entries to argue about? “No genre is ever dead or oversaturated… A publisher without a defined advantage is just expensive money.”

Esoteric microlinks: the best CES 2025 round-up you’ll ever read, by ex-Microsoftie Steven Sinofsky; board game crowdfunder Gamefound surged past Kickstarter in 2024 in that category, with $85m in crowdfunding & $71m in late pledges; Skibidi Toilet is taking over toy aisles, whether we like it or not.

Songs Of Conquest: 500k, why inspiration counts!

So firstly, how many of you have been paying attention to Songs Of Conquest? Magnus Alm of Lavapotion was kind enough to chat to us about his studio’s game, which launched on PC in May 2022, and revealed 500,000 units sold in May 2024.

Although it’s been around for a while - and the 500k announcement was a few months back - we wanted to zoom in and analyze it now. Why? We think the game has some clear lessons for devs, in terms of inspiration, depth, and success in today’s PC biz.

To start with, here’s back-end Steam data for Songs Of Conquest as of November 2024, largely ‘as expected’:

So yeah, big numbers, everyone’s a winner, whatever, right? But we can ascribe the success of Songs Of Conquest (video review) to a few key things, and it starts with this:

Understanding of deep subgenre (Heroes Of Might & Magic!) history: the big selling point of SoC is that it takes inspiration from Jon Van Caneghem & now Ubisoft’s ‘turn-based strategy with overworld map’ Might & Magic spinoff series. The last of these was released in 2011 - and there were fans who wanted similar titles.

Having found an under-served niche, getting the dev angle right: Magnus told us - “All of the Lavapotion founders were huge fans of [1999’s] HoMM 3… We wanted to create something that paid homage to these types of games.” But he also noted: “Building upon a known game concept can be a dual-edged sword.”

Building its own twist & additional depth on the subgenre: Lavapotion defined their extension of the HoMM vibe as ‘classic adventure strategy’ - essentially its own subgenre. But it’s difficult to escape inspirations, since, as Magnus says: “Players will judge you based on previous experiences and often expect things that you haven’t promised. Solely because they ‘just expect it’ from that type of game.”

How can we tell that this “niche is starting to make a resurgence”, as Lavapotion puts it? Well, there’s a new Heroes Of Might & Magic game in development with Unfrozen and Ubisoft, due out in Q2 2025, and there are also other games like 2022’s Hero’s Hour which are HoMM-like but with some extra twists that have also done well.

So there’s a simple story underlying this - ‘dev spots niche based on an old game they like, makes games a bit like it, everybody else agrees with them, it sells like hotcakes’. Easy! But I think that would be writing off a lot of the hard work in the actual implementation. In particular:

Lavapotion had “been working on the game for around five years when we launched into EA.” So that’s a lot of prep for a full-featured Early Access starting point.

During the Early Access period, the SoC team and publisher Coffee Stain “updated the game almost monthly until 1.0.” Their Steam news frequency impresses.

The team did a LOT with a small, agile team: the core team was only 8 people when the game launched into EA, and 4 people when dev started. Songs Of Conquest does not look - to us - remotely ‘indie’. But the team size is.

Magnus also drew us a quick chart of daily wishlist spikes and associated them with particular events between game announce (2021) & now. We appreciate this view because it shows how much post-launch Steam featuring drives interest:

The future? The goal for Songs Of Conquest “is to become an evergreen title, that can live for a very long time, with free updates and DLC as part of the strategy”, per Magnus. The game has been growing revenue year-over-year since release, with discounting & new content a key reason. (There’s still a lot of people who haven’t tried it!)

But there’s probably a bigger meta-question here: how can you tell if the game you want to make a spiritual sequel to is the kind that’ll sell 500k? And when we ask this, we think of a game you almost certainly don’t know, Forza Polpo.

For those who don’t know, Forza Polpo is a wonderfully done spiritual sequel to ‘90s PlayStation first-person rabbit jumping game Jumping Flash. We estimate Forza Polpo has sold <1,000 copies on Steam. even though we think it’s as well executed as spiritual sequel as Songs Of Conquest. (Seriously.)

So understanding market positioning and ‘holes’ in the market is huge. We know core PC gamers are more likely to pay for deep strategy games. And it’s likely that ‘90s players of Jumping Flash aren’t the same people currently playing games on Steam in 2025. So that’s an obvious starting point for SoC doing better.

But ‘right place, right time, eager consumers & lack of competition’ has never been more important for PC sales success. And it’s worth deep, multifaceted strategic analysis with people who really understand game subgenres & PC and console game history.

PlayStation and Xbox games in 2024: top DAUs?

In most sane worlds, this might be our lead story. But because top-performing PlayStation and Xbox games are increasingly ‘similar games in a similar order’, we’ve noticed that leading with console data actually decreases our newsletter open rates (!)

Nonetheless, for companies who are targeting high-DAU (daily active user) returns in this space, it’s really interesting to see GDCo’s data on this. So here it is! Above - we added up DAUs for every day in 2024 on PlayStation. Some notes on trends, here:

Fortnite (#1) is the big winner, with Rocket League (#6) a surprising evergreen: everyone talks about Fortnite - and they should! But it’s interesting to see the also Epic-owned Rocket League still charting. (Its soccer adjacency gives it a lot of casual players, though we’re betting its monetization doesn’t match Fortnite’s.)

Rainbow Six Siege (#9) leads the non-Call Of Duty shooter rankings: there’s not a massive step down from Ubisoft’s title to slightly more cartoon-y games like Apex Legends (#11) and Overwatch 2 (#13). But Rainbow Six keeping DAUs high after its 2020 console launch is good, considering Ubi’s other woes.

Unexpected entries? eFootball (#14) and Genshin Impact (#17): Konami’s F2P eFootball soccer franchise - formerly Pro Evo Soccer - had an iffy console launch in 2021, but has improved a lot since then. And F2P gacha standout Genshin Impact (#17) has >25% Asian players here, but good Western support, too.

Here’s a different view to end (above): top games by average DAU for the days they were available. So if a game was only on sale for 3 or 6 months, we’d take that into account. The main new entry? Marvel Rivals at #8 - we’ll see if it can keep it up!

Otherwise, we did see further increases for EA Sports FC 25 (up from #7 to #4), and for NBA 2K25 (from #19 to #9), as well as multiple other yearly sports games too. Makes sense!

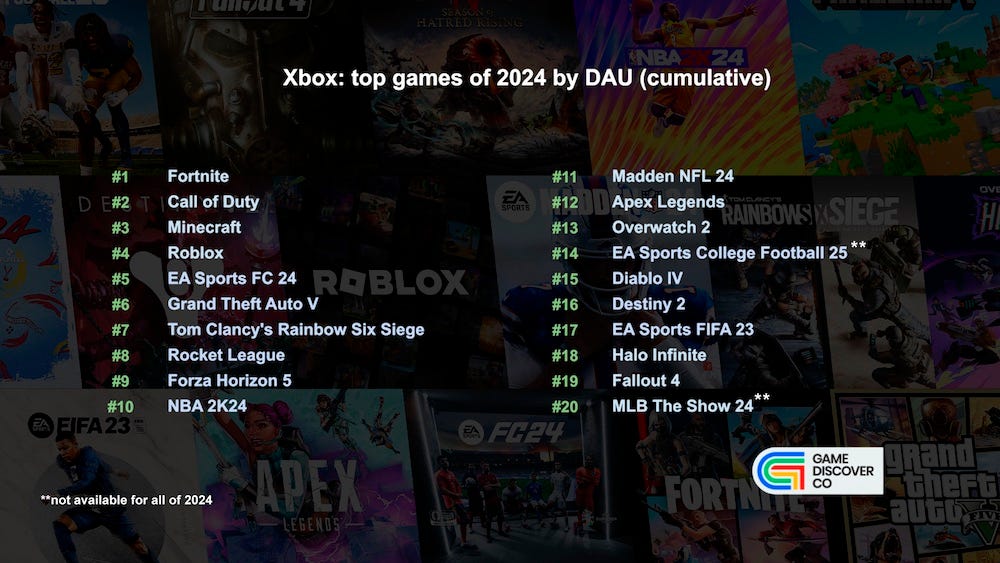

Next, how about DAUs on Xbox? We have that data too - and here’s the overall chart:

Nothing too surprising in here - if all in a slightly different order, further down. Most of the top titles are reassuringly similar to PlayStation, but here’s some differences:

Forza Horizon 5 (#9) and Halo Infinite (#18) are Xbox console exclusives: a lot of DAU action on Xbox is buoyed by Game Pass inclusion or F2P. And both of these titles are also part of Game Pass, of course.

Ease of access to Activision Blizzard brands (via Game Pass) helps DAU: you’ll see this in the form of Call Of Duty (at #2, one spot higher than PlayStation), Diablo IV (#15, and not in the top 20 on PS!), and even Fallout 4 (#19.)

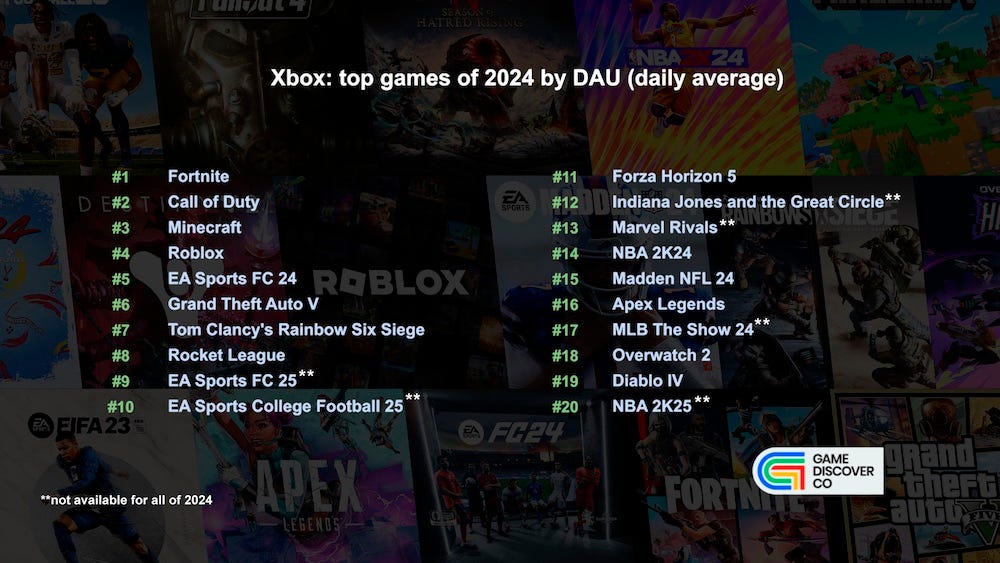

You’ll note that EA Sports FC 25 didn’t quite make it into the Top 20 on Xbox, due to it launching so close to end of year, with less Betas than the PlayStation version. But if we do our ‘by average DAU from # of days on sale’ view, it does turn up:

Besides the annual sports game surge - with EA FC 25 rocketing all the way to #8 - we can also see Indiana Jones & The Great Circle (#12, Game Pass!) and Marvel Rivals (#13, F2P) making it into the charts, thanks to this new view.

Debuting with <a month to go in 2024 is a good way to get onto this particular chart, Indiana Jones. It won’t have the DAU staying power of a Marvel Rivals - which is #5 in GDCo’s current daily Xbox DAU chart, compared to Indy at #14. But this ‘just looking at 2024 by average day on the market’ view brings it out slightly on top…

Finally: Crazy Taxi gets a ‘live band’ makeover…

To finish off today, you might know the Awesome Games Done Quick speedrunning charity festival just finished, and the GDQ YouTube channel has all the runs available on-demand, including an Elden Ring speedrun on a saxophone, if that’s your bag, baby.

And we’d seen earlier versions of this speedrun, but Sega’s arcade standout Crazy Taxi got a version with all the punk-y in-game songs replaced with a live band. And it’s glorious. (Particularly when the speedrunner completes a level & they have to stop-start songs in real-time.) Such fun - happy Tuesday:

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]