How Paralives 'life sim'-ed it to 750k Steam wishlists

Also: that Epic Games Store 'year in review' & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to the newsletter, crew. We just got back from DICE in Las Vegas, where Danny O’Dwyer summed up the mood: “There's minimal investment coming from publishers… Many VCs have tightened belts too… Ever increasing cost of AAA development a real problem given little core-market expansion… ‘Survive ‘24’.”

So that’s.. not great. (Also see: this GI.Biz interview with investors on tightening pockets.) But to quote late techno pioneer Andy Weatherall - ‘Fail We May; Sail We Must’. So let’s splice the mainbrace & voyage off towards the game discovery horizon….

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, 7 detailed game discovery eBooks - & lots more.]

How Paralives hit 750,000 Steam wishlists already

We recently talked about Ted Gioia’s idea of “two warring groups” in culture - “Macro (i.e. mass media, legacy media) and Micro (i.e. influencers, creators, new media platforms).” This is most obvious, for example, in the ‘Netflix vs. YouTube creators’ split.

But we do think games have clear examples of those, too. And here’s a great ‘micro’ one - the in-development life sim Paralives, which reached out to GameDiscoverCo to reveal it just hit a whopping 750,000 Steam wishlists. (It’s also in the Top 50 of Steam’s ‘popular wishlists’ chart for unreleased games & has 123,000 Steam followers, an ultra low 6x ‘follower to wishlist’ multiple - much organic interest here.)

The ‘elephant in the room’ that Paralives is going up against, of course, is The Sims, Maxis & EA’s gigantic franchise that has sold nearly 200 million copies in the last 24 years. We’d call that the ‘macro’ king. So what’s up with this ‘micro’ challenger?

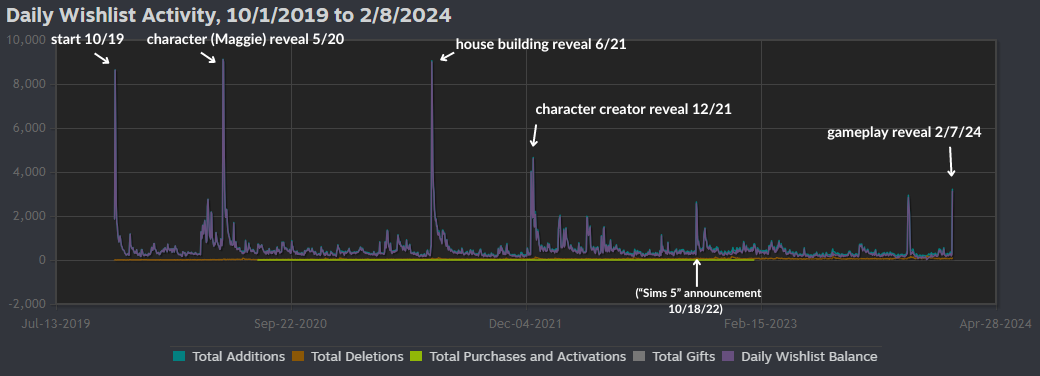

Above is the full history of Paralives in terms of daily Steam wishlist additions. The overall view? Organic daily interest is bubbling nicely, with spikes around the game’s own ‘marketing beat’ announcements - and even a knock-on effect from The Sims’ Project Rene announce in 2022.

How does Paralives rank compared to other unreleased ‘life sim’ tagged titles on Steam? Very well - it’s #1! Our GameDiscoverCo Plus subscribers can see the interactive data here, and we’ll screenshot it for everyone else:

It’s probably worth noting that many of these titles are not ‘pure’ The Sims-style life sims - but have elements like ‘witches & school’ (Witchbrook) and ‘farming / crafting’ (The Ranchers) in them. The closest comps are Paradox’s ambitious Life By You - which has been on Steam for way less time - and the PlayWay-adjacent (!) Alterlife.

So what are our takeaways from the game getting so much organic interest? We chatted to Paralives’ Gabrielle Boyer-Antoni, and discovered the following:

The Paralives team were transparent and early to promote: the game’s Steam page debuted “only a few months after the project was publicly announced and some GIFs had gone viral on social media”, and as the team expanded from 1 dev (Alex Masse) to 12, it’s been super transparent - see the giant ‘dev progress’ webpage,

Crowdfunding via Patreon has been a key growth driver: this type of recurring crowdfunding is rare, and not easily repeatable, but the game has 7,800 paid supporters giving it $38,000 per month to continue dev. (Since The Sims 4 has a lot of modders being supported by Patreon, that community seem used to it..)

The lack of The Sims competitors makes ‘hungry’ players and streamers: as Gabrielle noted, Maxis’ title has “barely ever had any competition, but has a huge fanbase”. She adds: “A lot of content creators with hundreds of thousands of followers only play The Sims and are eager to cover, and eventually play, another life simulation game.” So niche content - but big - influencers will cover your game, even pre-release.

What’s intriguing about Paralives is that it has crazy big goals, given it was started by a solo dev - and ‘still’ has only 12 people working on it. In some ways, it reminds us oddly of a miniaturized Star Citizen, in terms of the ‘we have big ambitions, help fund us to get there’ business approach.

But is it an issue that The Sims fans would see their ‘perfect game’ in Paralives & transfer all their complex feature requests onto it? Gabrielle noted, sagely: “Managing expectations is something we are very mindful of; we make sure to not over promise on features or content and aim to be as transparent as possible with our development.”

And it does seem like Paralives has done a good job of dealing with this so far, at least for the hardcore fan - Gabrielle adds: “We track popular suggestions, and often evaluate whether it aligns with our vision of the game or not.” Check out the public road map for Live Mode or for the character maker to get an idea of granularity.

With a 2025 Early Access release date confirmed for Paralives, she adds: “We are now at a stage of development where we have plans laid out for the whole [Early Access release]” - so “there are limits to what we can really consider developing.” Again, bonus marks for honesty here.

So: it’s difficult for a ‘micro’ game to compete against way more expensive ‘macro’ titles like The Sims, Life by You and even Krafton’s upcoming inZOI. And we do wonder want the more casual ‘life sim’ player will think of any of these games, which may not have the content or feature ‘moat’ created by The Sims.

But, given the success of even more graphically stripped-down mobile titles like BitLife - Life Simulator, it may be that players will be happy with trying alternate ‘takes’ on the genre - especially those that play up the ‘dollhouse’ vibes. And 750k (and counting!) Steam wishlists say that’s the case for Paralives! So good luck to ‘em…

[Side note: Why aren’t there more life sims? Maybe traditional game devs and publishers a) don’t want to make them or b) don’t understand them or how to market them, due to the lack of conventional gameplay? Or have been scared off by lack of comps. It’s a bit fascinating…]

Epic Game Store’s 2023 & its mobile aspirations!

So now, to discuss a major game platform’s announcements, and… no it’s not Xbox, you fools, we’ll be talking about their strategy shift in Wednesday’s newsletter. It’s Epic Games Store, which just released its public 2023 ‘year in review’.

There’s a lot of interesting data in here, and the December 2023 Fortnite ‘Big Bang’ event was perfectly timed to make ‘year on year’ comparisons look good. Specifically:

Epic Games Store (including Fortnite) hit 75 million MAU in December: this ‘monthly actives’ number was up 10% year on year, part of $950 million spent on EGS in 2023, up 16% on 2022’s $820 million. (And also up on 2021’s $840 million.)

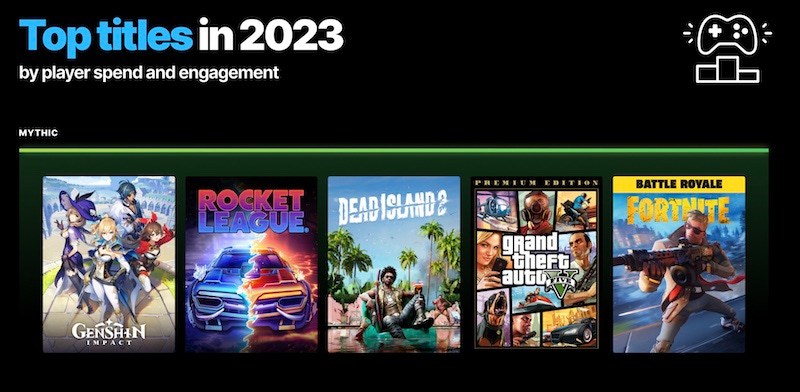

Third-party game spending on EGS was down 13% to $310 million: with Fortnite (the big contributor!) and Rocket League two of the platform’s five top games (see above, tier is randomly sorted), first party games are 67% of EGS’ revenue.

586 million free games were claimed on EGS in 2023: that’s 86 titles in total, and a median of 6.8 million copies ‘added to account’ per game. (A much smaller # of these are played, and most go on the backlog. But that’s a lot of clicking!)

It’s also worth perusing the Top 20 ‘games by player spend & engagement’ listed on the post’s infographic. We would roughly divide them into:

3 ‘first party-owned exclusive bangers’ (Fortnite, Rocket League, Fall Guys)

4 ‘Epic exclusive-ish on PC’ titles (Dead Island II, Alan Wake II - which is published by Epic too, Lord Of The Rings: Return To Moria, Assassin’s Creed: Mirage)

13 ‘AAA games as a service’ titles (Genshin Impact - which is not on Steam either, but is downloadable standalone, GTA V, Dead By Daylight, EA Sports FC.)

So, the Epic Games Store is hanging in there, certainly as a first-party PC game hub for Epic, and also as another place for big AAA GaaS titles to grab players - sometimes via giveaways - and then monetize them. (It has value there!)

What EGS is doing less well with is sellthrough for small/medium games (still low single digit %s compared to Steam.) And the ‘coming soon’ section of the Epic First Run program - where you get 100% dev revenue for 6 months for being EGS-exclusive on PC - is looking pretty anemic.

But there’s a couple of other notable wins for Epic. Firstly, Epic Online Services being both part of Fortnite and free to third-parties is really boosting the amount of people with an Epic account of any kind. (804 million in total, and 270 million+ on PC.)

And secondly, as was announced in the round-up: “We've received our Apple Developer Account and will start developing the Epic Games Store on iOS soon thanks to the new Digital Markets Act.” This is via European subsidiary Epic Games Sweden AB, which “will operate the mobile Epic Games Store and Fortnite in Europe.”

And Epic Games Store GM Steve Allison boosted this news on LinkedIn, noting: "The big news here however is the work we're doing to launch the first-ever multiplatform, games-focused store across PC/Mac and mobile, anchored by our players' Epic Accounts. It's been incredibly energizing to see the over-indexing interest and excitement from major mobile developers at D.I.C.E. this week!"

We have no way to know what role alternative app stores will play in mobile’s future in the West, versus off-platform monetization. But with Epic’s lawsuit against Apple and now the Digital Markets Act, Epic is keen to ‘do what it said it wanted to’, and launch lower-royalty third-party mobile stores. We await it with interest…

The game discovery & platform news round-up…

And finishing off for today, we have a surprisingly large amount of game discovery and platform news to inspect, as follows:

There’s reports out there - from VGC and also from Bloomberg - that “Nintendo has told publishers its next console will now launch in Q1 2025. According to the sources, third-party game companies were recently briefed on an internal delay in Nintendo’s next-gen launch timing, from late 2024 to early the following year.” Not a massive shock, since Nintendo likes to get its ducks in a row before launching, but nonethelesss…

There’s an excellent postmortem from News Tower on using Steam Next Fest here: “As a small publisher with a limited budget, we knew SNF offered the best visibility boost for News Tower… getting in the most played demo without a very strong game promise and/or community is tough, but we still made 22k wishlists during the SNF.”

The big winners at the DICE Awards last week? Spider-Man 2 (Action Game Of The Year, 6 awards) and Baldur’s Gate 3 (Game Of The Year, 5 awards), while also: “The Legend of Zelda: Tears of the Kingdom won Adventure Game of the Year, Alan Wake 2 took home the Art Direction prize, and Cocoon won the Independent Game award.”

Referenced in Friday’s Plus newsletter, we love Palworld CM Bucky’s response to ‘panic’ about its CCU going down: “There are so many amazing games out there to play; you don't need to feel guilty about hopping from game to game. If you are still playing Palworld, we love you. If you're no longer playing Palworld, we still love you, and we hope you'll come back for round 2 when you're ready.”

Apple things: Apple Arcade is adding Vision Pro-compatible ‘spatial gaming’ titles to the subscription, including Game Room & Super Fruit Ninja; however, some are returning the Vision Pro, since “the device is simply too heavy… the current lack of applications and video content doesn’t justify the price… the work features don’t make people more productive.” But look, it’s early, right?

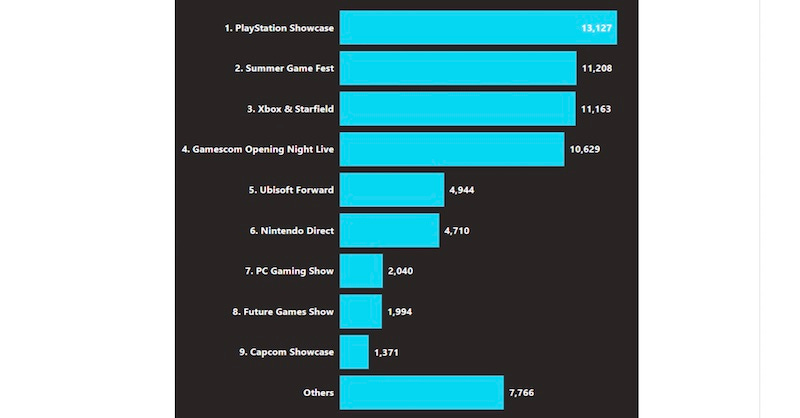

Evolve PR analyzed the top ‘summer of 2023’ game showcases, revealing: “PlayStation Showcase, Summer Game Fest, Xbox & Starfield, gamescom Opening Night Live, Ubisoft Forward, and Nintendo Direct generated the most articles and were responsible for 81.7% of total coverage.” (Also: “On YouTube, only 7 out of 37 showcases surpassed 100K in peak live viewership.”)

Supercell’s Ilkka Paananen has his v.readable ‘year in review’ for the mobile company, revealing: “Revenue of €1.7bn (down 4.2% compared to 2022)… EBITDA of €580m (down 8.2% compared to 2022)… Corporate taxes of €110m paid in Finland.” Lots of soul-searching over launching new games, but Brawl Stars “more than tripled its player base since last summer” - so maybe the solution is to revitalize old ones?

PSA: The European Union’s Digital Services Act has expanded to ‘all online intermediaries’, including PC/console game platforms, starting February 17th - well, all except those “employing fewer than 50 persons and with an annual turnover below €10 million.” This is for things like: “Flag illegal content.. provide users with access to a complaint mechanism to challenge content moderation decisions.”

We hear little about India and console games, so we appreciated this ‘state of 2023’ update from Rishi Alwani: “Multiple store owners across the country have stated that Call of Duty: Modern Warfare 3 India sales were 40% lower than last year’s instalment”, and the Top 3 titles in console retail were Spider-Man 2, Hogwarts Legacy, and Mortal Kombat 1.

Microlinks: how Disney’s deal with Epic is ‘reigniting Hollywood’s love affair with video games’; TikTok has a new study claiming the platform is the #1 way to discover mobile games for 18-24 year olds; Xbox’s February 2024 update includes “custom touch control layouts on more than a hundred games when using the Xbox app on iOS, Android, and Windows devices.”

Finally, did you know that Nintendo and HAL College teamed up in the ‘90s to make a super obscure - but cool - ‘students can make their own Super Nintendo game’ hardware & software combo called the Nintendo Game Processor? Here’s a new ‘explainer’:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

"The rising popularity of games like BitLife and the overwhelming response to Paralives on Steam wishlists suggest a growing appetite for diverse life simulation experiences. The scarcity of life sims in the gaming landscape raises intriguing questions about developer attitudes and market perceptions, adding an element of fascination to the genre's evolution."