How Over The Hill quickly offroaded to 200k Steam wishlists!

Also: a new survey on YouTubers and games, and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to a fresh week at GDCo. We think this one is a goodie for ‘PC / console discovery information enjoyers’. Which all of you are, otherwise you wouldn’t be here, right? (Oh, and thanks to Portside Game Assembly for sponsoring this newsletter.)

Before we start, deep history nerds, look: here’s a 1995 internal Microsoft memo, ‘Taking Fun Seriously II’, an early blueprint for Windows’ PC gaming ambitions: “By ensuring that the PC is also a LARGE market we ensure consistent title support from [third-party devs], which in turn assures the consumer that the PC will always have the coolest titles shipping on it, regardless of who’s selling the hot console that week..” 30 years later - check!

[SUPPORT US: upgrade your GameDiscoverCo access by subbing to GDCo Plus, inc. access to our second weekly newsletter, Discord, basic data & lots more. And companies, get even more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 50+ have.]

Game discovery news: Mecha Break goes big, yeh?

We’re starting with oodles of Os game discovery and platform news, and we won’t hear a word said against it. So let’s do it:

The chart is changing a lot now that Next Fest launched, but our ‘trending unreleased games’ Steam chart (as of Monday) saw third-person Gundam-esque multiplayer shooter Mecha Break (#1) shooting up the charts, due to a huge demo timed just before NF. It topped out at 317,000 CCU (!), mainly in China/Asia.

Otherwise: Monster Hunter Wilds (#2) and Split Fiction (#5) are rolling strongly into their official launches, while heavy vehicle reconstruction sim RoadCraft (#3), co-op multiplayer dungeon crawler Fellowship (#7), and newly revealed roguelike deckbuilder sequel Monster Train 2 (#10) all had Next Fest-adjacent boosts.

Over the weekend, Steam’s overall ‘on-platform concurrent users’ got very close to 40 million, topping out at 39.92m users - around 12.3m of those actively playing a game, “surpassing its previous top peak of 39.3m back in December 2024.”

European physical game ratings board PEGI has changed its rating for Balatro and Luck Be A Landlord to PEGI 12 (from PEGI 18), after high-profile complaints over its ‘any gambling elements = auto 18’ rulings. They cite “mitigating fantastical elements” for Balatro, which sounds like a ‘dog ate my homework’ excuse, but hey.

We know that Steam has created a mandatory ‘we used generative AI’ flag for devs - heck, Call Of Duty recently added it to their page. But in a sign of its divisiveness, indie devs are now adding a ‘no gen AI’ logo to the ‘awards’ section on their Steam pages - as a badge of honor, effctively.

StreamElements & Rainmaker.gg’s review of Jan. 2025 in Twitch streaming shows a post-holiday bump to 57m hours watched daily, with “Marvel Rivals disrupting the usual suspects by staying in the top 10 games for two consecutive months” and League of Legends streamer Caedrel hitting #1, with 9m hours watched.

The latest ID @ Xbox streaming showcase included a surprise Game Pass release for the ubiquitous Balatro, a confirmed GP deal for viral hit Buckshot Roulette, an upcoming appearance on the relatively underused Xbox Game Preview for the previously discussed by us co-op FPS Jump Ship, and more indie goodness.

Black Myth: Wukong’s co-creator Yang Qi recently revealed that around 30% of the game’s player base comes from outside of China - a decent number for a game sometimes stereotyped as ‘China-only’. (GDCo estimates have 26% of Steam owners and 46% of PS5 owners of Wukong outside of China - so it checks out.)

Circana’s Mat Piscatella has data on US game console & accessories sales since 1996, noting hardware’s “returned to a place more in-line with its 2010's performance, following the early [2020s] surge driven by stay-at-home activities and the launches of PS5/XBS. 2008 remains the best year on record for US video game hardware sales.”

Paradox boss Fredrik Wester made a post called ‘Beyond Hype: Building Enduring Games in a Boom-and-Bust Industry’, praising games like RimWorld, Euro Truck Sim & Terraria - and his company’s games - which “prioritize depth, replayability, and player agency.” He thinks it’s about “deep systems rather than spectacle.”

Midia Research is mashing the button marked ‘we think games are too long’ repeatedly, this time with some survey data which reveals: “Two-thirds of PC and console gamers spend <10 hours a week gaming, 36% of console gamers spend <5 hours a week gaming, and 40% of PC gamers spend <5 hours a week gaming.”

Finally: VGHF’s Phil Salvador spotted this Will Wright quote from 2010, with The Sims creator saying players looking to buy your game “are already playing this low-res version in their imagination of what the game is going to be like.” Yep - this is what we mean when we talk about ‘expectation management’ for anticipated games.

OUR SPONSOR: We’re on a boat!

On June 27, a very special conference will set sail in Hamburg, Germany: Portside Game Assembly brings together visionaries from the indie games scene in an unconventional setting on a ship to exchange on strategies, get inspiration, and make contacts that really matter.

Join studios like Evil Empire (Dead Cells), Stray Fawn (Dungeon Clawler), The Game Kitchen (Blasphemous), Toukana Interactive (Dorfromantik), Ghost Ship Games (Deep Rock Galactic), Landfall Games (Content Warning), and many more for a laser-focused talk program on how to navigate through industry challenges as a thriving indie studio, networking with like-minded people, and simply a good time.

Tickets for this extraordinary event are available for 189 € + fees & VAT, including an Opening Mixer, Networking Brunch, Conference Program - and of course a party. While there is a curated attendee list for the conference program (only studio leaders will board the ship), the networking brunch and party are open for all.

How Over The Hill offroaded to ~200k Steam WLs!

Those with fine memories may recall, at the end of our ‘blue ocean’ report from two weeks ago, that we said: “we actually have a great example of a ‘blue ocean’ follow-up game in next Tuesday’s newsletter. When I heard it was doing well, it made me go ‘oh, that’s such a good idea, but I never thought of the OG game as a ‘blue ocean’ originator’.”

Well, scheduling conflicts interceded, but Funselektor Labs’ & Strelka Games’ oldskool 3D co-op offroading game Over The Hill is the title we were referring to! And we’re featuring it now because, just a month after its January 23rd announce, it already hit 200,000 Steam wishlists. (In today’s market, this is very good.)

We were lucky enough to catch up with Funselektor founder Dune Casu and Strelka Games’ Pietro De Grandi to chat about the title, which has >10 full-time devs. It follows up Funselektor’s 2020 hit retro rally game Art Of Rally and the two studios’ cool collab on ‘70s motorsport management game Golden Lap last year.

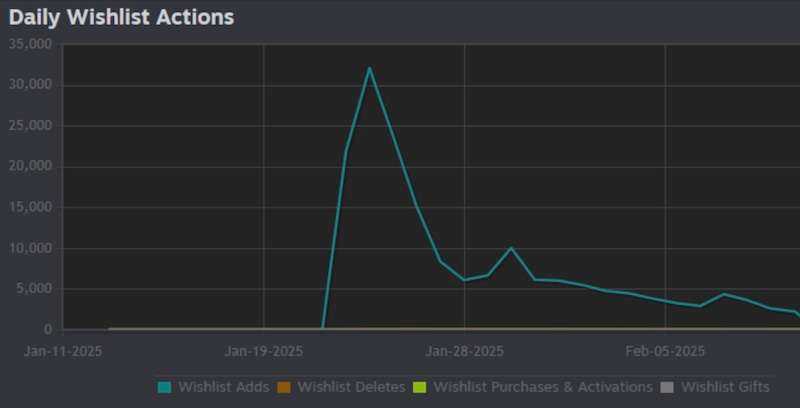

Before we get started, here’s the Steam back-end wishlist additions for the game. You can see it hit a one-day maximum of 30k wishlists added, and only very slowly ‘came back down to earth’ over time:

So sure, new game gets interest, congratulations all around, whoop di doo. But why? We tried to drill down on that, and came up with the following for Over The Hill, which is being fleshed out fully from a prototype that Dune made in 2023:

The ‘indie retro motorsports’ angle is relatively undertapped: Art Of Rally was a clever title, in that it used flat-shaded car art and a zoomed-out arcade-y approach to evoke nostalgia. And Over The Hill also pushes retro cleverly… (Funselektor’s first Steam title Absolute Drift played with a hot subgenre in a different way.)

If you’ve gained audience trust, they’ll follow you: Strelka’s Pietro was “a bit concerned about presenting a non-racing game as the next flagship title to a community built on racing experiences”, which is fair. But existing fans ended up buying in, because it’s still an interesting, fresh take on a driving game.

The SnowRunner/MudRunner ‘genre’ is absolutely.. a genre: Dune told us: “The game was inspired by offroad games like SnowRunner to make something mechanically engaging and less frustrating, but also inspired by the open-world freeroam gameplay in our previous games.”

There’s a lot of real-life ‘offroading’ media that got super popular: we noted a Steam forum commenter mention Matt’s Off Road Recovery, which is a YouTube channel we’ve watched featuring mini-documentaries about an offroad towing company. So this may be a market where people watch, and want to play games!

The lightbulb moment for GDCo is that this odd, relatively new subgenre - ‘offroading games where you move slowly through terrain and mud, rather than racing’ is a) an area that can be iterated and innovated on, and b) not just limited to Saber’s own efforts. You know, how great ideas become subgenres over time? It’s that…

The end result? Interest is scaling in Over The Hill because, as Pietro says, it got “a great response from players who enjoy a chill experience, a cozy, fun exploration game to share with friends without too much added stress.” Beyond *Runner, there’s even strong player interest overlap with not chiefly vehicle-led sandbox games, like Teardown.

So we rather suspect that Over The Hill has ended up being a ‘double whammy’ in terms of interest. It’s drawing in fans of Funselektor’s previous games, sure. But it also goes wider and brings in fans from sandbox-y vehicle games that sport more freeform and offroad facets.

It’s also notable that the motorsport management game the devs finished last year, Golden Lap, also an interesting subgenre, but didn’t scale majorly. (GDCo estimates it at ~10k copies sold.) Why? It looks like that’s just too hardcore a niche, whereas casual players may feel more emboldened to check out Over The Hill.

Finally, we asked our typical ‘are player expectations correct?’ question, and Pietro told us: “Expectations seem pretty in line with what the game actually is… There are a couple of minor things, though, like the camping mechanic. It’s designed to be a simple way to fast-forward time, but people seem to view it as a more central feature than we originally intended.”

Given titles like Pacific Drive are using the car as a ‘base’ for more exotic survival gameplay, we can see that being a minor issue. But in the end, we suspect people ‘get it’ - Over The Hill lets you drive retro offroad vehicles around the wilderness with your buddies! Which sounds like a video game escapist dream come true to us….

Survey: how gamers are using YouTube in 2025…

Finally, the smart folks at Big Games Machine, who did a game discoverability survey in 2024 that we really liked, are back with a new survey on how players use YouTubers to help pick which games to play.

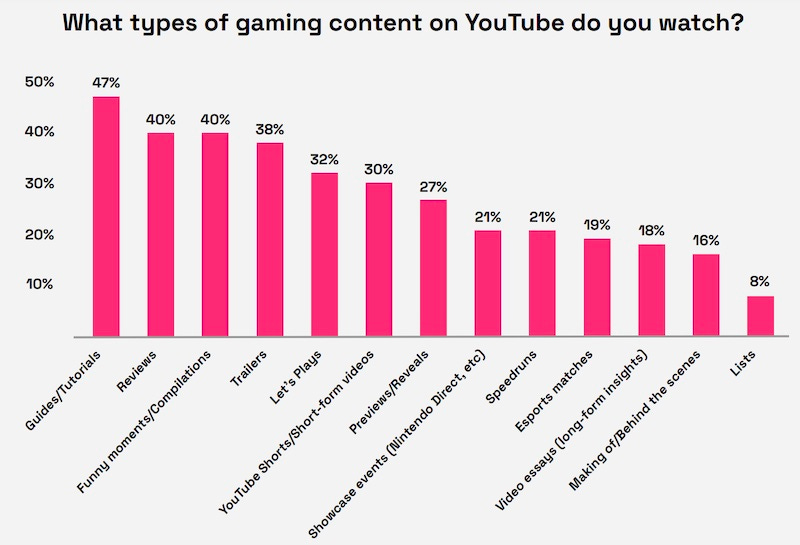

Last year’s survey showed that “YouTube has become the biggest discovery channel for gamers, with 64% of the 1000 gamers we surveyed using it”, and so this new survey looks at “key content types gamers watch the most [above]… and what makes gamers choose one content creator over another (SPOILER: subscriber count came lowest!)”

The surveyed players - 1,050 U.S. gamers, split 50/50 between men and women & watching YouTube for at least 30 minutes per week - saw 35% of respondents using phones as their primary gaming device, compared to 28% for PlayStation consoles, 17% for Xbox consoles, 13% for PC, 6% for Switch, and just 1% for Steam Deck.

Honestly, the ‘key insights’ section on the download page for the BGM survey is so good that we’re just going to yoink it intact, which we rarely do:

Content type: Guides and tutorials are the most popular (47%), followed by reviews and funny moments (40%). ‘Core viewers’ (those watching more than 2 hours per week) are twice as likely to engage with long-form content, like video essays. These responses highlight the importance of diversifying content to cater to varying levels of engagement.

Channel subscriber size: Mid-sized channels with 100k-1 million subscribers (39%) are the most popular, followed by micro-influencers (10k-100k) at 26%. Casual viewers are more likely to favour micro-influencers.

Genre and channel size: While medium-sized channels lead across all genres, larger channels (over 1 million subscribers) are more prevalent among those who favour action games compared to other genres.

Shifting streaming landscape: Gamers embrace a multi-platform approach to live stream viewing. While YouTube remains the clear leader amongst the respondents (79%), the significant audiences engaging with live content on both Twitch (43%) and TikTok (40%) underscore the need for a diversified live streaming strategy.

Great work, BGM! And that’s all the data we have for you today. We’ll be back in your inboxen on Friday, with more discovery news and a reaction to how huge Monster Hunter Wilds launched on Steam. (>500k CCU? A lot higher? Could be…)

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]