How does streamer popularity & Steam wishlists relate?

We take a look with Stream Hatchet. Also: the latest Roblox hits & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

And we’re back, folks, thanks for playing along at home. Your Daily Double for today is - how much does streamer support create PC and console hits? Your answer… coming right up after the news.

Before we start, you might know Spirit City: Lofi Sessions is a ‘gamified focus tool’ hit on Steam. But did you know how the OG Lofi Girl YouTube stream “became a chill beats empire”? (How hot is this space? Like yoiks, ‘Lo-Fi Scooby-Doo’ album hot…)

[NEED BEST-IN-CLASS PC/CONSOLE DATA? Companies, get ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 80+ have. And everyone, signing up to GameDiscoverCo Plus gets more newsletter, Discord access, basic data & more.]

Game discovery news: Danganronpa 2x2-s charts

Kicking off the week with a host of notable discovery and platform news, we’ve got the following:

Looking at GDCo’s chart of ‘trending’ unreleased Steam game followers chart (Sept. 8th to 15th), and skipping the ‘Bongo Cat incented’ OKU, soccer management sim Football Manager 26 is #2 again. (It’s always popular, and not just in the UK, which was 'only' 12% of the Steam owners for FM24.)

Elsewhere, an 8,000 CCU demo version for JRPG creature collector Digimon Story Time Stranger (#3) has folks excited for the Oct. 2nd release. And this week's releases Skate. (#4) and Dying Light: The Beast (#6) perform. Brand new? Danganropa 2x2 (#7) is a content-added remake of the murderous visual novel.

Update to ‘gaming YouTubers & lower page views’ story: YouTube says it’s definitely not Restricted Mode (but is vague about what it actually is), and this investigation indicates it’s a desktop-only view decrease starting early August (possibly linked to ad-blocked video views or viewbot restrictions?)

Want a better way to work out the effect of your Steam discounts? Well, Valve has stepped up with a new discount history option in Steamworks, “split out to align with the time frame for each of the past discounts you've run.” So you see the name of the sale, the number of units, the revenue, and the price. It’s human-readable!

Is there a silver lining for needing to get your gleaming PS5 Pro title working on the marginally more potato-y Xbox Series S? Well, “Battlefield 6’s technical lead says that optimizing the shooter for Microsoft’s entry-level Xbox Series S console ‘made the whole game more stable’”, since optimizing memory usage was key. So there.

A dev’s ‘Steam ruined our launch’ post on Reddit reveals that Valve says there were “a very small number of game releases (less than 100 since 2015) where wishlist email notifications for the launch of a game were not sent.” (Perhaps some hyperbole from the OP, but Steam has notified games & is giving a Daily Deal as a make-good.)

Our latest This Week In Videogames column (TwIV sub req.) is about whether in-person events are still good for game discovery. We like B2C shows for engaging with fans and co-ordinating streaming showcases with physical demos, but our ‘isn’t working’ list includes: “Physical events can be super, duper expensive… some of the biggest influencers don’t have time to visit.. ROI on an in-person event can be subpar.”

Mobile trends: a new Moloco report (summary) sez “the top 5% of players generate 48% of total IAP revenue. The top 10% account for 64%, and the top 25% for 77%.” And here’s some great specifics on how “mobile game-makers are directing players outside of Apple’s walled garden much more aggressively”, skipping that 30% cut.

On the roguelite $20 Donkey Kong Bananza DLC that just surprise-shipped, Game File’s Stephen Totilo had a smart comment: “The shock there is the timing. Bananza, which cost $70, only came out two months ago. Nintendo usually waits longer to charge for more.” (That’s pretty early even for traditional AAA DLC, actually…)

The ever-spicy Joakim Achren LinkedIn-ed about “the gaming VC gold rush” being over: “here's what really killed [it]: Unpredictability. In B2B SaaS, you solve a quantifiable problem. Show traction. Scale predictably. In games? You might burn $5M and 2 years only to discover nobody wants to play.”

Digital Foundry took a close look at some Unreal Engine 5 launch-ish games for Switch 2, from Fortnite through Split Fiction to Cronos: The New Dawn. A summary on ResetEra notes: “Split Fiction: Visually looks similar to [Xbox] Series S”, and Fortnite and Cronos don’t use Lumen but still look decent (& swift) overall.

Microlinks: the Nintendo Today iOS/Android app has added special features unlocked by inaudible sounds at in-person events (!); VR hit Walkabout Mini Golf debuted some impressive stats - 23m hours played, 2b+ putts; Russia’s Internet censorship ministry (partly?) blocked Itch.io.

How does streamer hype & Steam wishlists relate?

Our lead story today is summarizing an excellent Stream Hatchet blog post from Mark Rowland & friends, as the streaming tracker firm (which looks at live-streams from all non-China sources, led by Twitch) used access to GameDiscoverCo’s Pro API to grab historical wishlist balance estimates for recent Steam hits.

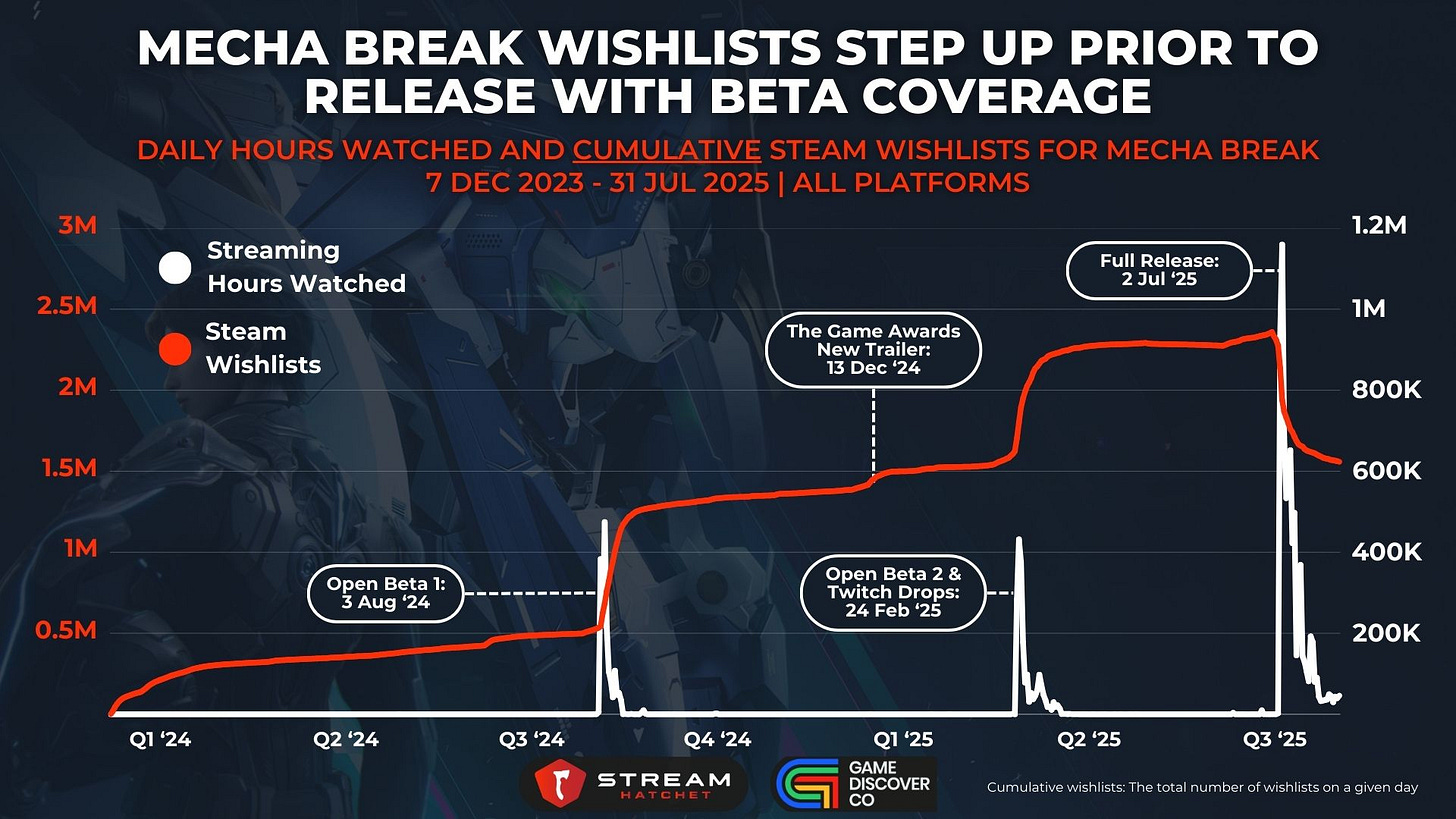

The super-cool thing about this? You can see pre-release ‘streaming hours watched’ correlated with wishlist increases. And some games - like F2P anime shooter Mecha Break (above) saw massive wishlist increases tied to their 2 Open Betas, which came with a great deal of prominent streamers showing the game to their audiences.

We’d expect a graph to look like this with a game that’s overwhelmingly multiplayer and online-focused. (BTW, it doesn’t look like Mecha Break has retained players, since it’s maxing out at 5k CCU on Steam. But it did launch with 132k CCU, so I think we can say this Beta approach, as also utilized by Battlefield 6, is the right one here.)

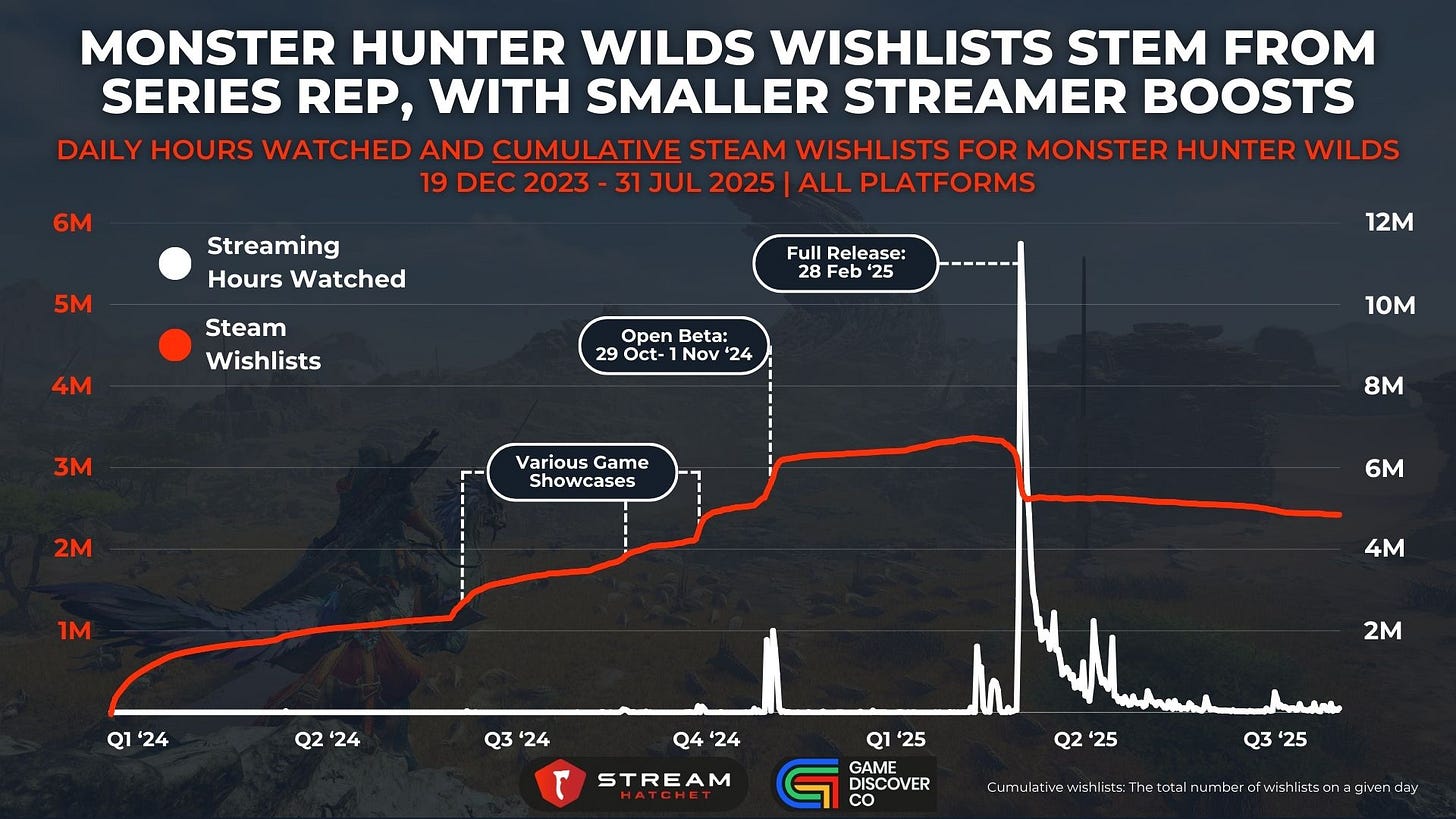

Looking at Monster Hunter Wilds, you can see, as Mark says: “a legacy AAA series that wasn’t concerned so much with generating awareness as it was with proving itself to be culturally relevant.” There’s a lot of interest anyhow, and the two Open Betas and streamer plays are dwarfed* by the main launch spike in hours watched.

(*Although just noting, if we compare directly between games: the first Open Beta-watching spike for MH: Wilds is actually 4-5x the size of each of the two Mecha Break ones. It just doesn’t look like that because the launch interest is so ridiculously big - ugh, graph scale.)

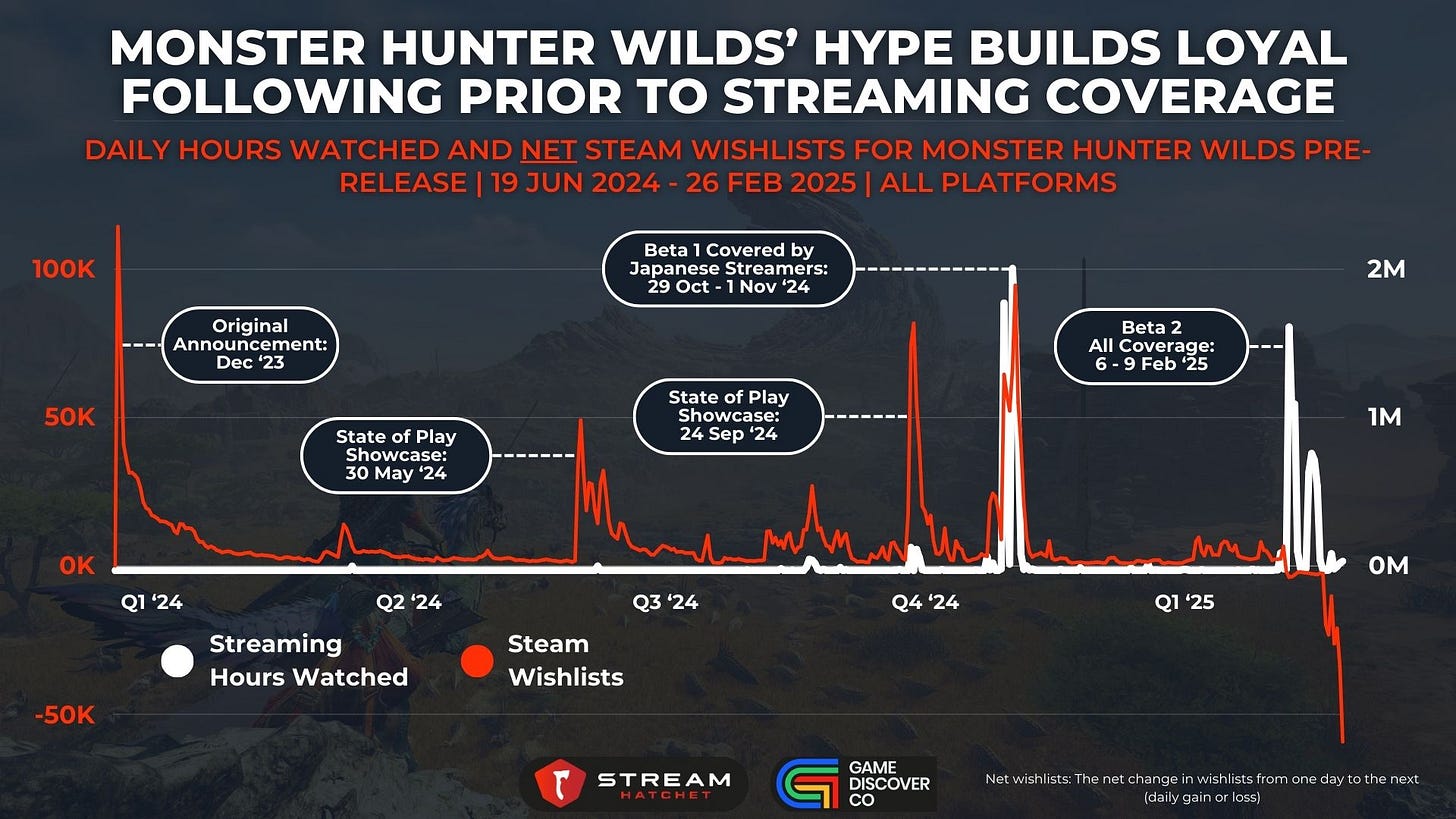

This zoomed-in look at Monster Hunter Wilds’ non-cumulative wishlists over time, annotated handily by Mark, shows the strength of the original announcement - and the game’s inclusion in two PlayStation State Of Play showcases (and resulting residual interest, some of it from Steam’s Discovery Queue.)

None of that comes with much conventional/measurable streaming upside, in terms of multiple streamers playing games for many hours. (Although it clearly had reach, and the wishlists spikes reflect that!) But getting a playable version out there - as Capcom did in November 2024 - definitely spiked wishlist interest even higher.

(As for why you can’t see a wishlist spike around the time of the second Beta close to release - it’s ‘cos the game was pre-orderable, so wishlist increases were being offset by purchases! Everything makes sense if you stare at it for long enough…)

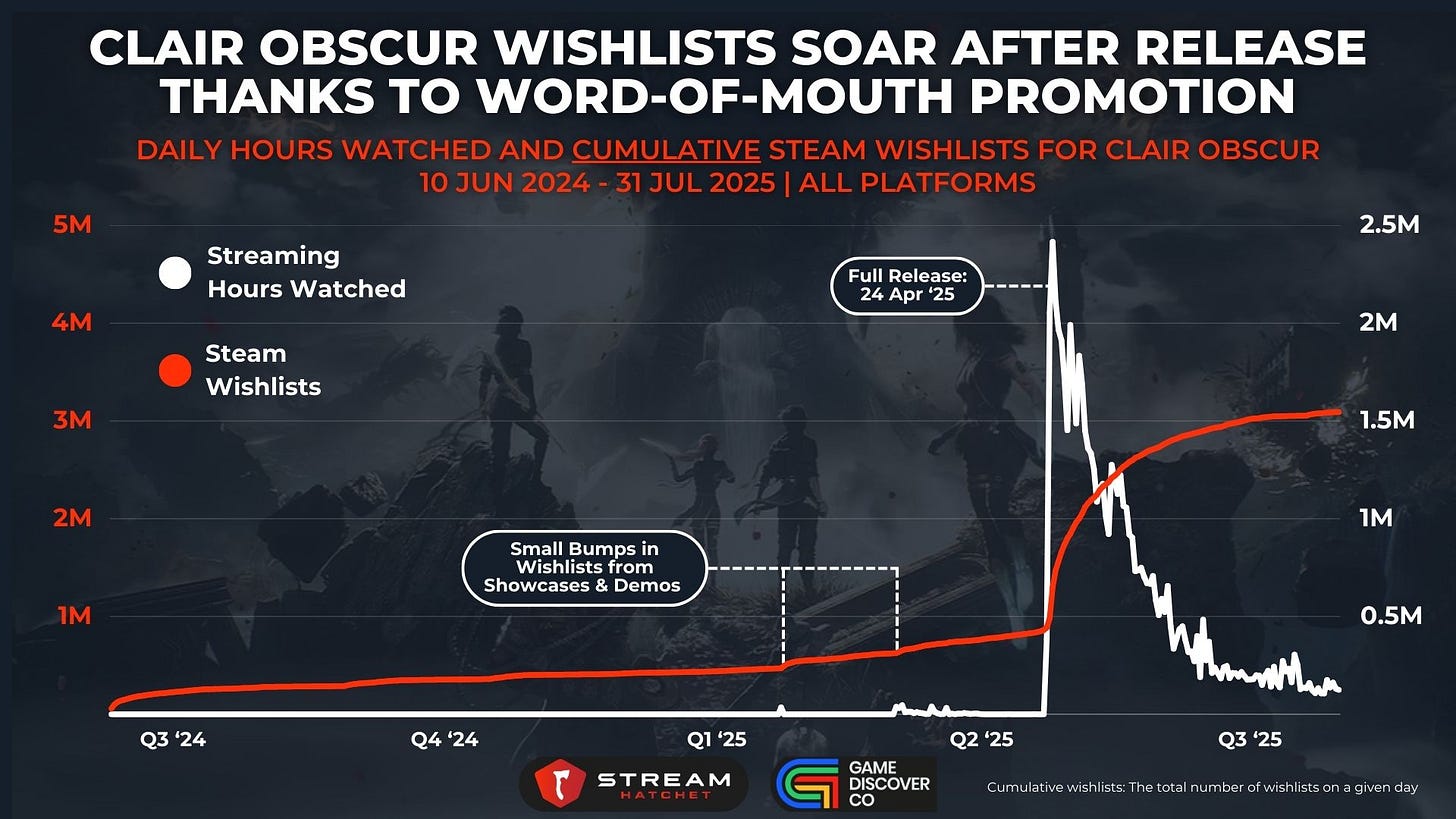

Finally, we can look at Clair Obscur: Expedition 33 which - reminder - was not that ‘obscure’ on release, haha, since it had between 750k and 1m wishlists at launch, but blew up (in a good way!) majorly. (We have its ‘wishlists/Week 1’ sales multiplier at 0.66x, which is 6 times as good as we expected - that’s a big overperform…)

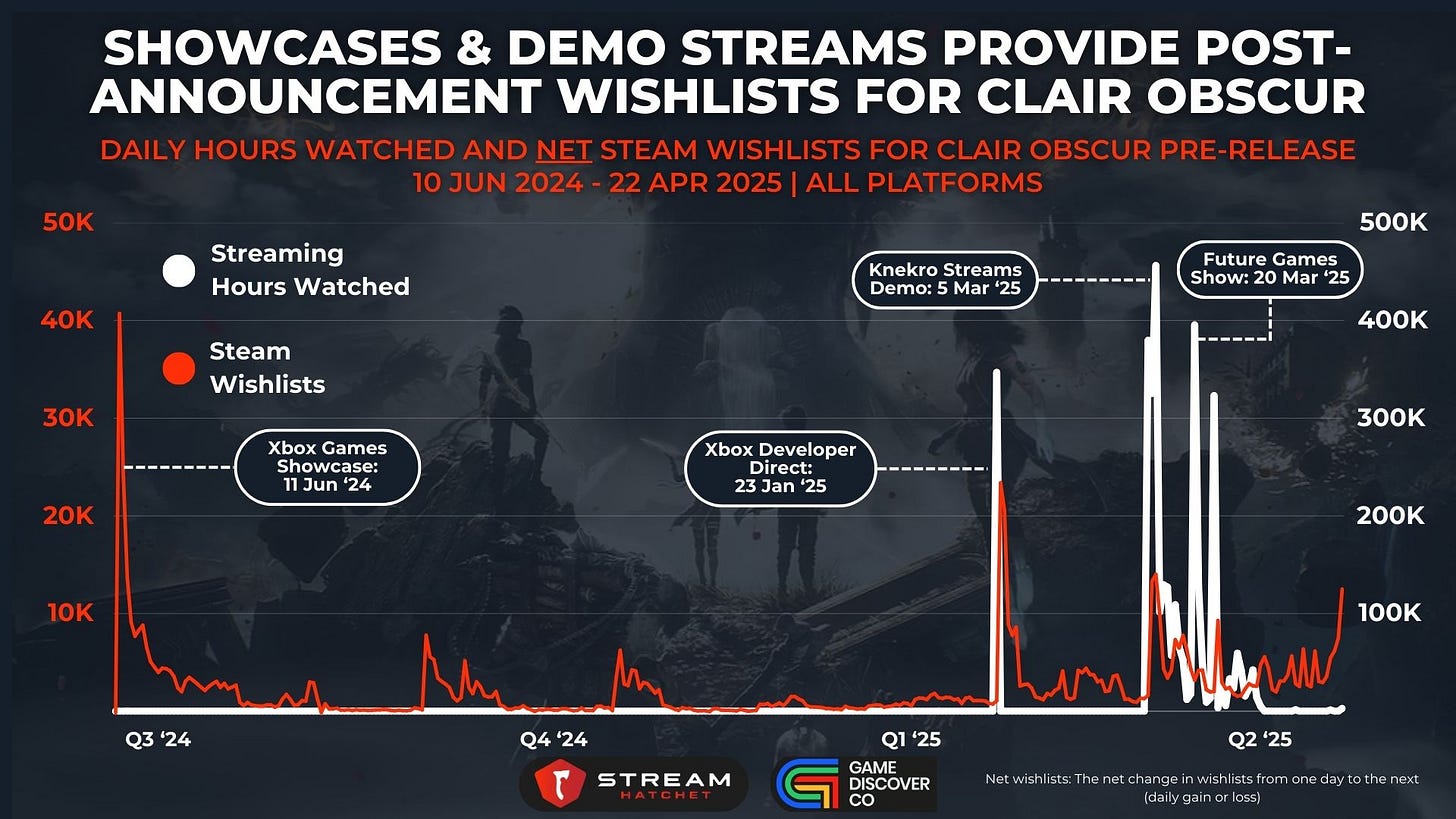

Bu it didn’t have a wide-distro pre-release demo for streamers (and probably correctly so - JRPGs are not the easiest to release demos for?) So there were only a select number of streamers and other showcases you could see Clair Obscur in before release. That’s reflected in this detailed graph from Mark:

So far, so good - and Clair Obscur really was a viral success on launch, so the graph reflects that to some great extent.

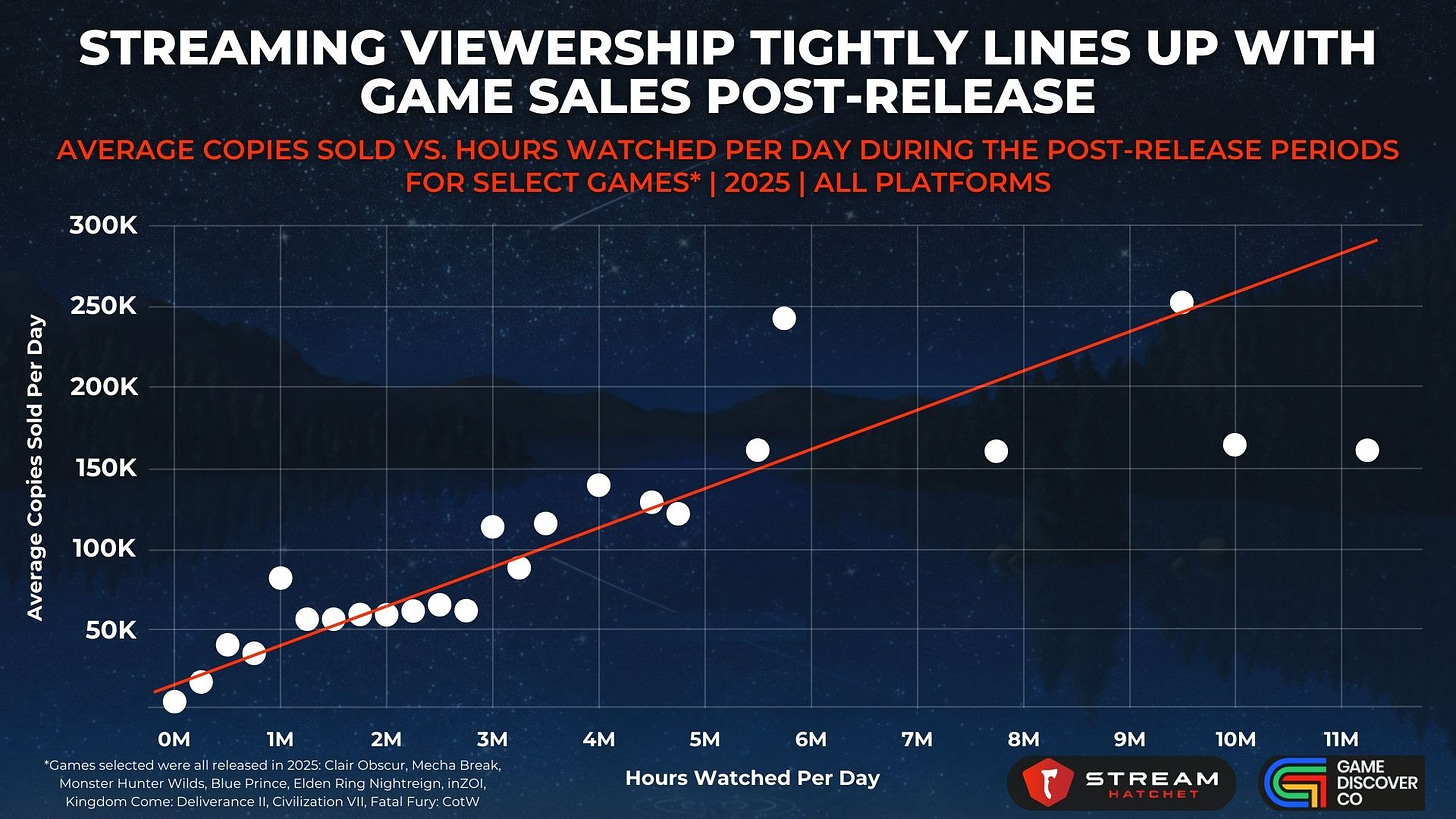

Finally, as a coup de grace, the Stream Hatchet team took prominent 2025 Steam releases: the above titles, but also Blue Prince, Elden Right Nightreign, inZOI, Kingdom Come: Deliverance II, Civilization VII and Fatal Fury: CotW. They then mapped ‘hours streamed per day’ to sales in the immediate post-release, and got this:

Of course, we get into the old chestnut of correlation vs. causation. But you can definitely see ‘copies sold per day’ and ‘hours watched per day’ correlate here, across multiple post-launch days per game.

And Mark added: “For every 41 hours watched post-release, 1 copy of the game is sold on average.” Which is a fun stat to roll out at parties, right? Anyhow, read the full Stream Hatchet blog, support ‘em, and thank ‘em for doing the heavy lift on research…

Roblox in August: gardens, brainrot steal the show

Spending a little time away from announcing a fundraise to identify & scale Roblox games, the Creator Games/Exchange folks have once again crunched the numbers & worked out the top Roblox games of August 2025 - both by $ and minutes played.

Here’s the full Top 20 (Google Drive link), including release date, change vs. last month, CCU, visits, session length and revenue ranking. But it’s worth some brief analysis:

Grow A Garden and Steal A Brainrot won’t be denied atop the charts: farming, pets, and goofin’ around sim Grow A Garden had a huge 2.19m average CCU (#1), and meme-nicking bonanza Steal A Brainrot - which also hit >500k CCU on Fortnite at the weekend - was a strong #2 yet again.

99 Nights In The Forest is making a strong revenue run: it was already much-played, and averages 1.58m CCU this month, but the grind-y survival/action game - check out the new volcano level -made a dash up the ‘Top Earning’ charts from #9 to #3.

The two surging games in August are anime to their core: looking across the Top 15, the extremely Bleach-inspired PvP open-world RPG Type://Soul bumped up to #9. (It’s got heavier monetization on lower volume.) And tower defense title Anime Vanguards (#11) is also monetizing well, on average CCU of 66k.

You can see that there’s quite a lot of stasis in the top charts. The rest of the Top 10 best-monetizing has a lot of usual suspects, from Blox Fruits and Brookhaven to Dress To Impress. But the CCU and player base is huge here - gotta keep an eye on it!

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]