How Discounty rang up 100k sales in a week!

A good result across Steam & Switch. Also: why power laws matter.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, it’s time to get acquainted with another coupla thousand words of game discovery and platform analysis, folks. (With zero ‘hot takes’ on E*ectro*ic A*ts, since that megadeal is fascinating but neither platform or discovery-centric, phew.)

Before we start, did you hear about the person who got assigned Nintendo’s game counselor hotline phone # (20+ years ago, after it moved to a 800 number)? The phone company refused to change his #, so he asked for “a credit card from any [kid] caller… I told them to go into mommy’s purse and pull one out.” (It got changed for free after that.)

[INTERESTED IN PC/CONSOLE GAME DATA? Companies, get ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 80+ orgs have. And everyone, signing up to GameDiscoverCo Plus gets more newsletter, Discord access, basic data & more.]

Game discovery news: Forza Horizon 6, TGS win…

OK, so let’s get ready, steady, go for a little game platform & discovery goodness to start out the week:

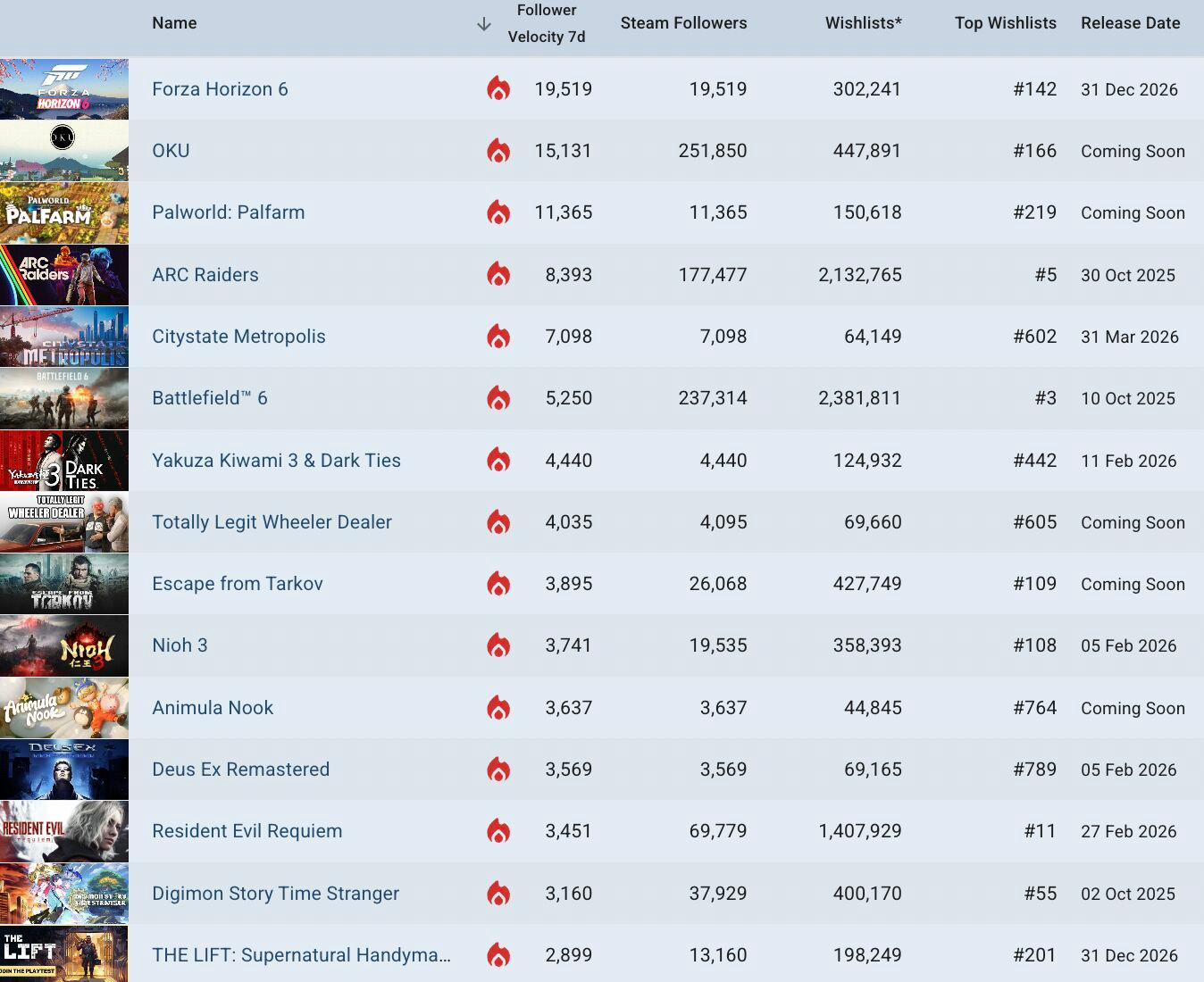

Checking GDCo’s ‘7-day trending’ unreleased Steam game follower chart (Sept. 22nd to 29th), Microsoft’s Japan-set racing franchise sequel Forza Horizon 6 hit #1 with a bullet as it got officially unveiled at Tokyo Game Show. Also new at #3 - Palworld: Palfarm - a cozy farming spinoff of the hit survival monster-collector.

Extraction shooter ARC Raiders hit #4 thanks to pre-orders opening, followed by new entries Citystate Metropolis (#5, Sim City-style procgen citybuilder), Yakuza Kiwami 3 & Dark Ties (#7, ‘remake + new expansion’), Totally Legit Wheeler Dealer (#8, ‘dodgy car dealer’ sim), and Animula Nook (#11, super-cozy ‘tiny world’ life sim.)

We’re seeing some more comments on Switch 2 physical cartridges and loading speed, this time from FFVII Remake director Naoki Hamaguchi, who chose to use a Game-Key Card for physical because cart loading speed vs. SSD was “going to be inferior, it just has to be, that’s the way the media works, physically.”

Eagle-eyed folks may have noticed the Steam Autumn Sale has changed its layout a bit vs. Summer and before. There’s now one big ‘main bank’ of discounts that rotate regularly, instead of two, with a higher-profile ‘Top Sellers’ section further down. (And notably, Popular New Releases is now in a tab, not on the front page.)

Bloomberg’s Jason Schreier is talking ‘too many games’, suggesting: “I’m not sure there’s any solution to this problem. Returning to the era of gatekeepers would be a regression, and the increased democratization of game development has led to more creative and interesting products all around.” (More fan discussion via ResetEra.)

UGC news: with GTA RP (roleplaying) being such a big part of Grand Theft Auto V’s success, it’s notable to see a) nopixel collab-ing with Rockstar to bring its GTA RP flavor ‘to the Rockstar Game Launcher and other PC platforms’, and b) big influencer Caylus doing a RP video series in association with NoPixel & YouTube.

Government stuff: Brazil is banning video game loot boxes aimed at players under 18 as part of a wider law “for the protection of children and adolescents in digital environments”; Australia’s potential under-16 social media ban might include platforms like Discord, Roblox, Steam, and Twitch, who will self-assess risk.

It’s impossible to tell if your game will ‘pop’ hard enough to port to mobile. But if it’s a hit, iOS/Google Play spawns a load of direct or indirect ripoffs, such as the CloverPit pirate version near-topping the iOS paid charts: “this version of CloverPit is not made by us, we don’t get a cent and it’s barely playable, please don’t buy it!!”

Ampere Analysis did some megacrunching of public player accounts across Steam, Xbox, and PlayStation, and worked out: “In August [2025], Xbox gamers played an average of 5.7 different titles, whereas Steam gamers played an average of 4.5, and PlayStation gamers played an average of just 3.7.” The reason? Game Pass, innit…

Steam devs switching in malware to existing games is very tricky for Valve to find, and the latest is truly unfortunate: “A cancer patient lost $32,000 in crypto after installing a Steam game… containing malware that drained one of his crypto wallets.” (The game was called BlockBlasters, and a crypto whale made him whole again.)

Microlinks: the ROG Xbox Ally PC handheld is up for pre-order now, costing $600 (base version) and $1,000 (Ally X) in the U.S.; Valve is bringing its wireless PC VR streaming software, Steam Link, to five more PICO/HTC headsets; how a micro-indie got 3k Steam wishlists in his first month.

How Discounty rang up 100k sales in a week!

In today’s market, if you can sell 50-100k copies of your premium PC/console game quickly, it’s good for two reasons. Firstly, you’re beating the odds. And second, with a well-received game with smart updates & discounts, you’re going to sell 4-8x (or more!) units of that title during the ‘long tail’ period. (Albeit at reduced per-unit costs.)

So when we heard that satirical cozy supermarket sim Discounty sold 100,000 units across all platforms (Steam, Switch, Xbox, PlayStation) in its first week, we reached out to publisher PQube to chat about how they - and 5-person Danish dev Crinkle Cut Games, who’ve been making the title since Nov. 2021 - managed to do so well.

Let’s lay out the ‘flavor’ of Discounty, via its Steam capsule description: “Manage your own discount supermarket! Get caught up in small-town drama, organise and plan your shop’s layout, and strike lucrative trade deals as you expand your secretive aunt’s business empire. Selling more frozen fries will surely heal this broken community...right?”

So what made the game ‘pop’, despite the iffy SEO on the game’s name (Google is consistently telling me I typo-ed the word ‘discount’ when I search for it, haha)? We talked to PQube’s Andy Pearson & Paschalis Gkortsilas, and here’s what we saw:

The ‘headline’ is ‘great-looking 2D supermarket management sim’: I think we shouldn’t underestimate the fact that a) Supermarket Simulator’s giant success has shown sky-high interest in this theme, and b) making a ‘Moonlighter x Stardew Valley’ shop management game with winning 2D art is a great angle of attack.

The game performed by far the best on Steam & Switch: we shouldn’t be surprised by this, being a 2D pixel art cozy sim. Switch eShop is about 2/3rd of Steam in terms of units - almost 1:1 if you include the physical Switch release, too. (PS & Xbox are minor - ~5% of the total each, according to GDCo data.)

But Discounty’s satirical, and has big narrative elements: as this Steam player review notes, many expected “a far less story driven game that focused on store management and expansion.”, but the game is “a story about a small town mystery, with a side of running a discount grocery store.” Def. a player expectation issue…

A brief discovery aside: something that’s helping on the Switch eShop is Nintendo’s June 2025 change to ‘3-day revenue’ charts for top games - from 14-day copies sold. PQube noted “the snowball effect of getting into the eShop charts: once you manage to appear… the added visibility leads to more sales, which in turn pushes you even higher..”

We asked PQube about this visibility shift, which benefited them & other recent Switch hits like Tiny Bookshop. They agree it’s “far more representative of what’s popular at the time”, and gets rid of the previous ‘90% off to go high up the charts by units’ hacks.

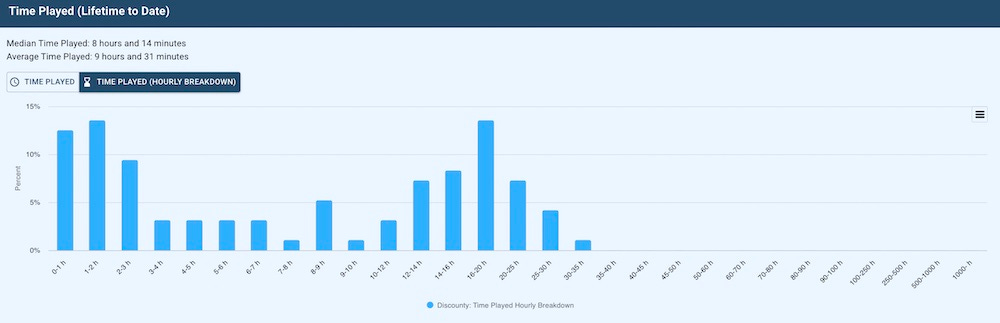

Anyhow, back to the most interesting thing about this game: that it’s a narrative satire of a discount shop sim which has some intentionally obnoxious characters, but also uses ‘sticky’ shop sim mechanics to keep players moving forward. As a result, according to GDCo’s estimates, Discounty has a great median time played of >8 hours:

We talked to PQube about this mismatch in player expectations, and how relatively tricky it is to market. We did spot that the top of the game’s Steam page says - in bold: “Discounty is a narrative-driven management sim offering a 15-20 hour single-player campaign.” (Making it clear it has a finite end, at least for now…)

PQube noted: “What… proved challenging in the marketing campaign was striking the right balance between highlighting the RPG/story elements and the store-management aspect…Ultimately, this is a store-management sim with a brilliant story - rather than a brilliant story that happens to include a store-management sim.”

Ultimately, we think this is a good example of getting the theme and art direction right. This gives you some leeway to convince players that what you’re giving them is good, if a bit unexpected. (And PQube says that many of the game’s upcoming updates “will be focused on expanding endgame content and replayability.”)

Finally, there’s a lot of practical, good-quality marketing that PQube & the dev team did to raise the game’s profile and we shouldn’t ignore. These include a June demo, paid ads, press & influencer embargo lifting 6 days before release, and more.

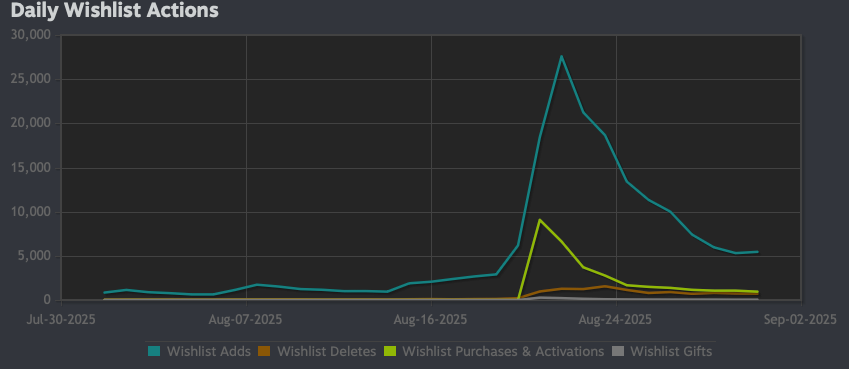

This snapshot of the game’s Steam wishlist actions in the few days before launch shows swelling wishlists, after the embargo lifted and a feature in the Future Games Show at Gamescom streaming showcase hit:

As a result, Discounty has ~300,000 cumulative Steam wishlists LTD, and the game’s Steam players by country are: USA – 39%, China – 9%, Germany – 8%, UK – 7%, Canada – 5%, France – 3%, Australia – 3%, Brazil – 2%, Spain – 2%, South Korea – 2%. (What we’d expect for a title like this that isn’t incredibly Asian-friendly.) Good stuff!

Why popularity ‘power laws’ matter in media…

We’ve mentioned media strategy exec Doug Shapiro before, since we’re a big fan of his Mediator newsletter, which is currently excerpting chapters from his upcoming MIT Press book, Infinite Content. While he’s not a video game native, a lot of his data and insight works just as well across visual (TV/movies!), audio and playable media.

Doug recently excerpted a chapter of his book ($) which dealt with the concept of ‘the platform and the power law’ . And we all know about ‘network effects’ at the platform level, which leads to a winner-takes-all type situation. (Hey, look at Steam.)

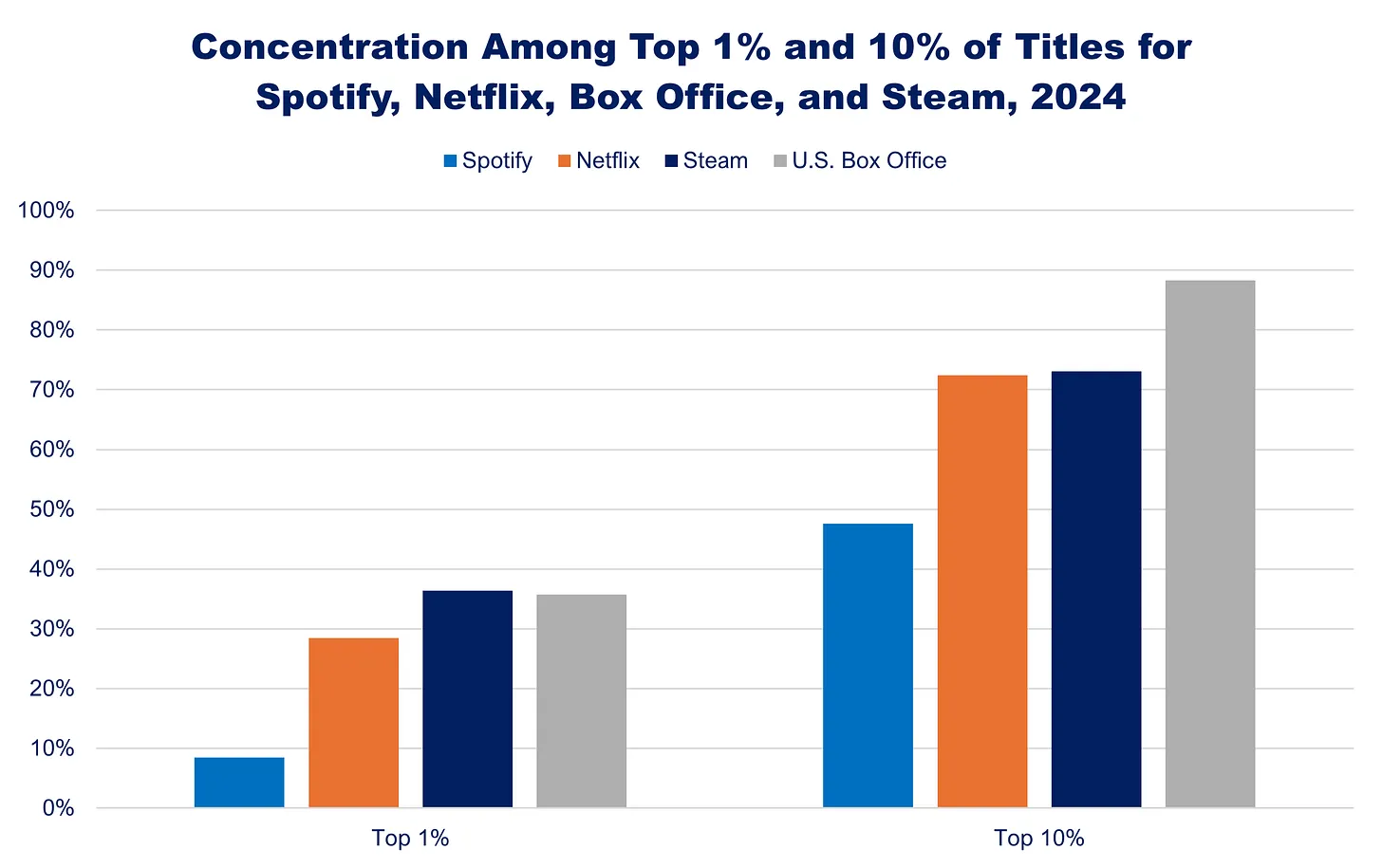

But on the content level, per Doug, we should examine ‘power laws’. He describes them as follows: ”On networks [that are platforms], hits are self-perpetuating because people interpret popularity as a signal of quality (information cascade) and/or social currency (reputational cascade). This results in power law-like popularity distributions: a small number of outsized hits (in the “head”), a skinny “middle,” and a vast number of misses (in the “tail”).”

The graph above shows that across all audiovisual media - Spotify, Netflix, the U.S. film box office, and Steam - the top 1% of titles (except songs) capture about 30% of the attention, and the top 10% capture 50%-80% of the attention. (For Steam, he used the Top 1,000 titles and Steam CCU, btw, which is a representative cross-section.)

And boy, we’ve been talking a lot about the hit-driven market on PC and console. For example, in GameDiscoverCo’s analysis of new paid Steam releases in 2025 so far, we see 11 games grossing >$100m, 58 at >$10m, but only about 235 grossing >$1m, and just 880 grossing >$100k, out of 3,250 with >10k copies sold - and 14,700 in total.

That dropoff definitely feels like the ‘skinny middle’ at play - especially given that a lot of the 235 titles grossing >$1m on Steam (let’s say 50%+?) are from existing franchises or from already-hit developers (the ‘spiritual sequel’) in some way. Not a lot of room there.

Anyhow, two more paragraphs that struck us from this book excerpt - and you should totally sign up to get Doug’s work-in-progress chapters & other analysis, if you’re a media wonk:

“Although it seems contradictory, the internet both fragments and concentrates attention. While the reasons for the former are intuitive, the reason for the latter are less so. As described before, the most salient thing about networks is that they are subject to positive feedback loops. Since consumers increasingly discover and consume content through information networks, their decisions are increasingly influenced by other people’s decisions. These feedback loops amplify the popularity of a small number of choices, or what we call hits.

The net result of these opposing forces — fragmentation and concentration — is that media consumption, and culture more broadly, is persistently, and in some cases increasingly, observing power-law like distributions. That means that few TV shows, movies, songs, books, video games, journal articles, newsletters, short form videos and tweets will be wildly popular, while the vast (vast, vast, vast…) majority will be hardly consumed at all.”

This is very much what we’re seeing in today’s game market, with visual social media (YouTube, Twitch, TikTok, etc) - aided by plain old word-of-mouth - giving massive reach boosts to the most viral, power-law friendly ideas. And we’ll be looking at this more in Friday’s newsletter, about wishlist conversion medians & outliers! Toodles…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]