How Crow Country spooked its way to 50k sold

Also: the latest PlayStation strategy data, and lots of platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Another unique week in games is upon us, crew. And as a whole bunch of interesting events start appearing on the horizon (Summer Game Fest & friends, another Steam Next Fest & more!), GameDiscoverCo is strapping in to cover them all for you.

Before we get going: it’s difficult to grok how difficult making games was in ‘the old days’ with less versatile toolsets. (David Lightbown has interviewed classic game tools creators like John Romero & Tim Sweeney, leading to a GDC talk on takeaways.)

And the same issue is true for music, where today’s software enables things unheard of 30 years ago. So check out this great new video (from The Flashbulb) analyzing how Aphex Twin harnessed early ‘90s music synth software to create pioneering sounds.

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data site for unreleased & released games, weekly PC/console sales research, Discord access, eight detailed game discovery eBooks - & lots more.]

How Crow Country spooked its way to 50k sales..

You may - especially if you’re a retro horror fan - have spotted SFB Games’ Crow Country, a $20 paean to classic ‘90s survival horror titles of the PlayStation 1 and 2 era, painstakingly assembled by brothers Adam and Tom Vian.

(The Vians have had a fascinating history in games, btw. Originally known as Super Flash Bros. in their ‘00s teens, they made adorable co-op puzzler Snipperclips for Nintendo as a Switch launch title in 2017, and beguiling Knives Out-style mystery Tangle Tower as an Apple Arcade - and subsequently PC/console - title in 2019-2021.)

While also prepping Tangle Tower sequel The Mermaid Mask, Adam worked on Crow Country as a personal project since 2020, as he started to learn Unity visual scripting and, per Tom, “ended up trying to make the 'smallest possible survival horror’” game.

Adam told us the game was inspired by Resident Evil 1 “for the moment-to-moment gameplay” & exploration, the OG Silent Hill for “some of the darker story tones, the grungier aesthetic and the gloomy atmosphere”, and Final Fantasy VII “for the aesthetic of simple blocky character models laid over a more detailed environments.”

Yes, the game genuinely reads as being steeped in ‘90s and ‘00s horror-adjacent console classics - and that’s a lot of the charm. (Adam also referenced Parasite Eve 1 and 2, as well as Clock Tower 3, Haunting Ground, and Rule of Rose to us.)

In many ways, this was a passion project that morphed into a commercial game: “All in all, it was 3 years of just Adam very part time on it, then ~6 months of us both 50/50 with our other project, then ~3 months of us both full time to get it across the line and shipped.”

But the results are impressive - Tom Vian tells us Crow Country just hit 50,000 sales across Steam (64% of sales), PlayStation 5 (28% of sales), and Xbox Series (8% of sales.) And it’s in the Top 30 selling games on Steam by ‘debuts in May 2024’.

That’s an interesting SKU split, with PlayStation doing better than we’d expect compared to ‘the average indie’. That’s partly due to the game’s inspirations, but also ‘cos SFB Games announced the game and dropped a PS5 (& Steam!) demo same day.

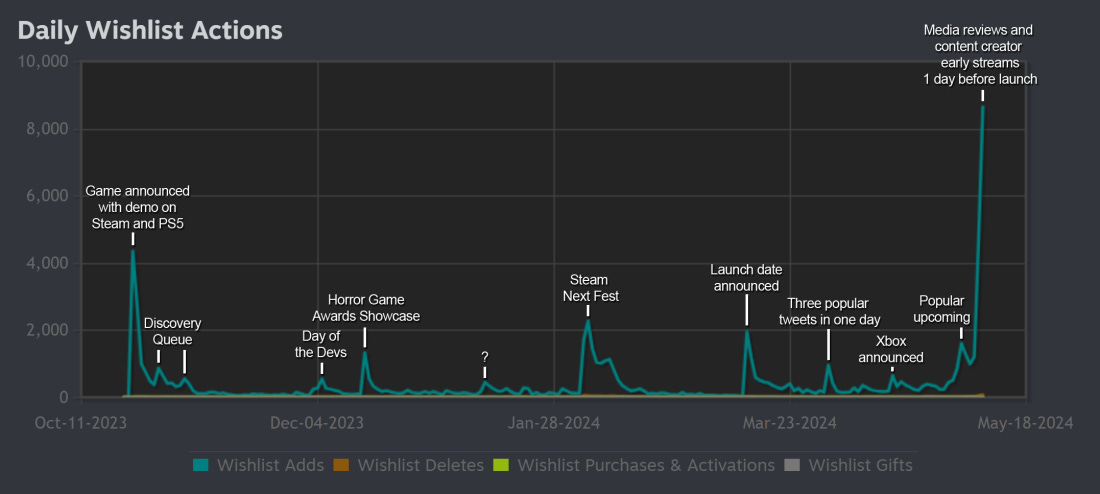

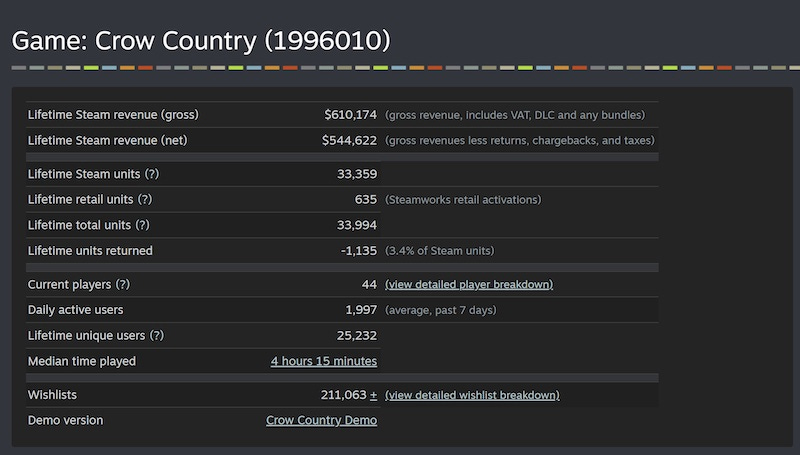

So let’s look at annotated Steam wishlists over time for the game (above) - which had around 80,000 wishlists at launch, but totted up 24,000 units on Steam in Week 1. (That’s a 0.3x ratio, almost double the median of games with >10k wishlists at launch. And it’s now at 210,000 Steam wishlist balance, providing lots of discount upsell leads )

A few thoughts we had there: firstly, dropping your game announce with an immediately available demo is a great idea, even if it’s often not possible. And second, a variety of showcases - and the general ‘hotness’ of horror as a subgenre - seemed to have helped provide multiple inflection points for Crow Country.

Looking at the game itself and recent Steam stats, you can see it’s not the biggest title in active players- it topped out at 830 CCU at launch, and sees about 2,000 DAU recently - but it’s not really that type of game. (It’s a great, niche, one-off adventure!)

We can see that total returns, at 3.4% of all copies sold, are extremely low - no doubt helped by its Overwhelming Positive (98%!) Steam reviews, as well as a clear ‘if you like this aesthetic, you’ll love the game’ vibe. (Which we’re not convinced is easy to make…)

And this type of non-reproducable vibes should keep the game’s sales scaling to multiples of the 50k. (Similarly, Tom told us that Tangle Tower had a “bizarrely good [long] tail” - that’s another Overwhelmingly Positive banger from the SFB Games crew.)

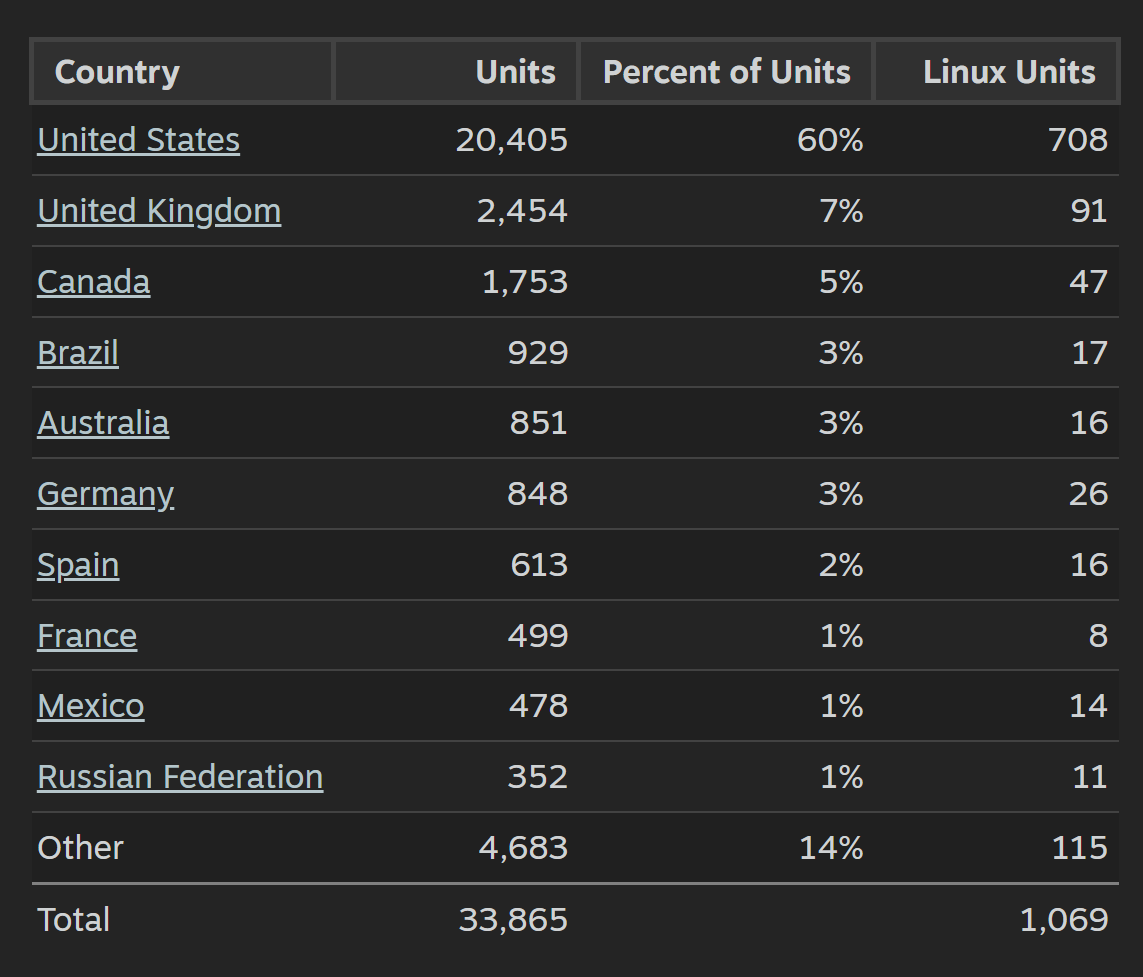

Crow Country also lacks a Chinese translation currently, which a) may help the refund percentage b) partly explains the U.S.-centricity of Steam’s LTD interest by country:

So far, so good. But before we move on, some notes from Tom Vian on marketing - and Adam on design - that help illuminate the game’s success:

Horror streamers were key, but the game even had some cozy overlap (!): Tom says, working with marketing partners Neonhive: “We found from the demo release the year before, and from Next Fest, that the game had a wider appeal too, even reaching into the cosy game sphere.” I mean, it is kinda a ‘chibi horror’ take, right? Engadget agrees…

Paid content creators avoided spoilers, with a full reveal at launch: Tom explains: “We had a small handful of paid content creators who were able to do early videos and streams without too much spoiler content… Then we sent out keys to hundreds of creators about 2 hours before the game went live, with free rein to show any part of the game they could reach.” (Which definitely worked.)

The game’s interesting/unique camera view is very specifically designed: we asked Adam about the PoV, which is inspired by the “shoebox dioramas” of small interiors in Final Fantasy VII: “it has the effect of keeping you in the dark about what enemies or traps may be lurking ahead of you. But it also - I hope - encourages the player to look at the environment around them, including what's on the floor.”

So what’s the takeaway here? Well, it’s another example of the democratization of the game biz that a project that started as a solo dev tools-learning exercise in 2020 has become a standout game release in 2024. (Without lots of extra resource!)

And while Crow Country is in a niche - the ‘devoted survival horror slash ‘90s PlayStation nostalgist’ space - it’s clearly one that a) is happy to buy games and enthusiastic about supporting devs and b) scales to hundreds of thousands of units over time. Not bad.

How Sony plans to grow PlayStation as a business

We mentioned it last Wednesday, but Sony’s Business Segment meeting about the PlayStation division has brought us lots of fun slides (.PDF link) and analysis opportunities about the state of the brand.

Here’s some of the key takeaways we had about the state of the biz that the new co-CEOs are coming into:

PlayStation 4 is still 50% of active consoles - but only 37% of gameplay hours: we’ve recently discussed the surprising (?) degree towards which PS4s are still actively used for Fortnite & more. Here’s more confirmation (above): 49 million of the 56 million PS5s are used monthly, but also 49 million of the 117 million PS4s.

Lifetime-to-date PS5 software spend is up by 26%, led by IAP & DLC: the slides revealed that in the first 4 years of the PS4’s lifecycle, players spent $580, whereas PS5 players have spent $730 thus far. In particular: PS5 ‘add-on content’ spend is up 176% compared to PS4, but ‘full game’ content is down 12%. That’s GaaS for ya!

PlayStation Plus’ tiers are getting people to gradually move up the value chain: we don’t know whether it’s upgrades or ‘some people dropping off, new people signing up’ - numbers haven’t been growing much. But PS+’s non-Essential tiers increased from 30% of total subscribers (FY22) to 35% (FY23) - good yield increases.

In a complicated post-COVID market these results seem… fine? It’s good to see PS5 software spend up 26% compared to PS4, but if you look at inflation, $580 in 2016 in the U.S. is the equivalent of $736 now. (So spend is roughly keeping up with inflation.)

Also, in making points about the durability of PlayStation’s ‘platform cut’ revenue, the slides revealed that the Top 10 ‘major franchise’ titles on PS4/PS5 - including EA FC, Fortnite, Apex Legends, Call Of Duty, NBA 2K, Madden, MLB The Show, Genshin Impact, Destiny & GTA - made up 51% of PlayStation Store revenue in FY2023. Wow.

Otherwise, this corporate presentation rattled through PlayStation’s recent sales highlights - confirming Helldivers 2 at 12 million units sold across PC & PS5, and Spider-Man 2 at 11 million on PS5 alone.

The firm also teased a mix of titles divided between ‘tentpole PS5-first single-player’ (Wolverine, Death Stranding 2) and ‘cross-platform PS5/PC GaaS’ (Concord, Marathon). This led to some interesting comments from SIE co-CEO Hermen Hulst on strategy:

“We have a dual approach here… we are releasing our live service titles simultaneously [on PS5 and PC]… [but] with our single player narrative driven titles… we take a more strategic approach.”

So that’s why we’re not seeing Spider-Man 2 come straight to PC. Sony wants PC players to try Spider-Man on platforms like Steam, and then be interested in “playing sequels... on the PlayStation platform”, as Hulst says. Huh. But is this realistic?

We’ve seen some people scoff at the idea - unclear if it works at macro scale. But at the micro enthusiast level, looking at The Verge’s comments section, there’s anecdotal player comments that it sometimes work: “I have three friends on PC who have done just what they’re describing, so perhaps the strategy is effective.”

Still, it’s the strategy that PlayStation should probably take, given its need to keep driving PlayStation hardware sales too. And honestly, the biggest issue PlayStation management has is a lack of blockbuster near-term first-party games. (No, Astro Bot is not one, even if we love it too.)

Was this exacerbated by too much time & money spent by previous leaders on chasing live service megahits, at the exclusion of commissioning single-player tentpoles? (We’ll find out over the next 2-3 years.)

The game platform & discovery news round-up…

As the world turns, let’s get down and analyze some of the platform and discovery news consuming us, this fine Monday:

April 2024’s Circana U.S. game hardware/select software chart overview is here, and it’s unpleasant on console in particular. Why? Console game hardware spending - led by PS5 - is down 43% (!) YoY, and console game spend was off 24%. Mat Piscatella adds: “[Hardware] declines this year are steeper than I'd expected.”

Ahead of June 2024’s Steam Next Fest, there’s playable demos launching early you can see in the ‘all demos by top CCU’ SteamDB charts. Looks like Meme Mayhem has been doing particularly well, as is Aska (which debuted its demo in the Open World Survival Craft Fest), Drill Core & Tiny Glade.

Here’s a data-backed opinion piece re: older gamers as a growth opportunity for AAA publishers: “74% of the 55+ group said playing solo against the computer was their favourite gameplay type… publishers should continue making premium, single-player-focused games to appeal not only to older players but also all players.”

PlayStation’s latest State Of Play showcase (video) continued Sony’s PS5 => PC plans with God Of War: Ragnarok’s PC version, had Astro Bot (above) and Concord lead the first-party reveals, and also had notable Chinese-developed games all over it - previously a bit of a rarity for console platforms.

You can keep up with all the trailers from the upcoming ‘not E3’ summer showcases via Games Recap 2024, which also has a ‘countdown’ list for all the show times. B2C show IGN Live has also revealed its schedule, with “more than 30 playable games on over 100 gaming stations” and various public appearances.

Looks like the cheaper version of the Meta Quest 3 is called the Quest 3S, according to some leaks on Meta’s store pages. As UploadVR reminds us, this upcoming hardware revision “is likely to include older lens technology to cut cost while still resembling the Quest 3.”

After mulling a shift into ‘comms platform for all’, Discord is doubling down on games: “we’ve recognized the need to narrow our focus from broadly being a community-centric chat app to being a place that helps people deepen their friendships around games and shared interests.” Quests & the Embedded App SDK are part of that!

Fortnite is changing the payout for its UGC-created UEFN islands “to increase the weighting of player acquisition metrics to reward creators who are bringing new players into Fortnite and are reengaging lapsed players.” So it’s more about “the importance of introducing new players to the Fortnite ecosystem”, starting July 1st.

As rumored, PlayStation VR2 players can access games on PCs with a $60 adapter, “including fan favorites like Half-Life: Alyx, Fallout 4 VR, and War Thunder”, starting Aug. 7th. Also: “Some key features, like HDR, headset feedback, eye tracking, adaptive triggers, and haptic feedback (other than rumble), are not available when playing on PC.”

The list of Apple Design Award noms for 2024 includes a bunch of games: Death Stranding, Honkai Star Rail, Little Nightmares, Lies of P are some of the ‘AAA-ish’ ones, but What The Car?, NYT Games, and Hello Kitty: Island Adventures are also vying for the ‘Delight & Fun’ award.

Finally, of course we all ‘love’ a good moral panic, something that video games have sometimes been the subject of. So looking across other media, we dug this recently unearthed Canadian anti-comics pamphlet from 1954, as a Fredric Wertham-sparked panic roiled North America.

Yes, comic books ‘glorify crime’, present ‘a distorted, unhealthy & immoral concept of sex & marriage’, and even… have creepy stuff in them (below)! What on earth would the authors of this pamphlet have thought of Crow Country? We do wonder:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Love this newsletter so much <3 you're always on the pulse so unsurprised to hear you talk about Crow Country - but stoked you are all the same.

Amazing how media scares all seem to blur across the generations.