How Cloverpit added 100k Steam wishlists.. in a week!

Also: some handy XR research, and a bunch of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Another sun-dappled day at GDCo HQ. And while we listen to Elizabeth Fraser trill delightfully through Blue Bell Knoll, we should probably knuckle down and alert you to another trending unreleased Steam game - and how it got trend-y….

Before that: SNK’s cartridge-based Neo Geo arcade (& expensive home!) system from the ‘90s (y’know, Metal Slug?) wasn’t so hot at 3D. Well, a new hobbyist demo-scene Neo Geo ‘demo’, Vaporous - coded by an old Amiga demo-scene buddy of mine - shows you can do polygons (via lots of sprite tricks?) on it anyhow. Mm, very cubist…

[YOU KNOW WE GOT SOUL: signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, data & lots more. And companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 55+ have.]

Discovery news: Subnautica 2 raises periscope..

Let’s start by taking a gander at the top game discovery & platform news since last last week. And yes, there’s some things to look at:

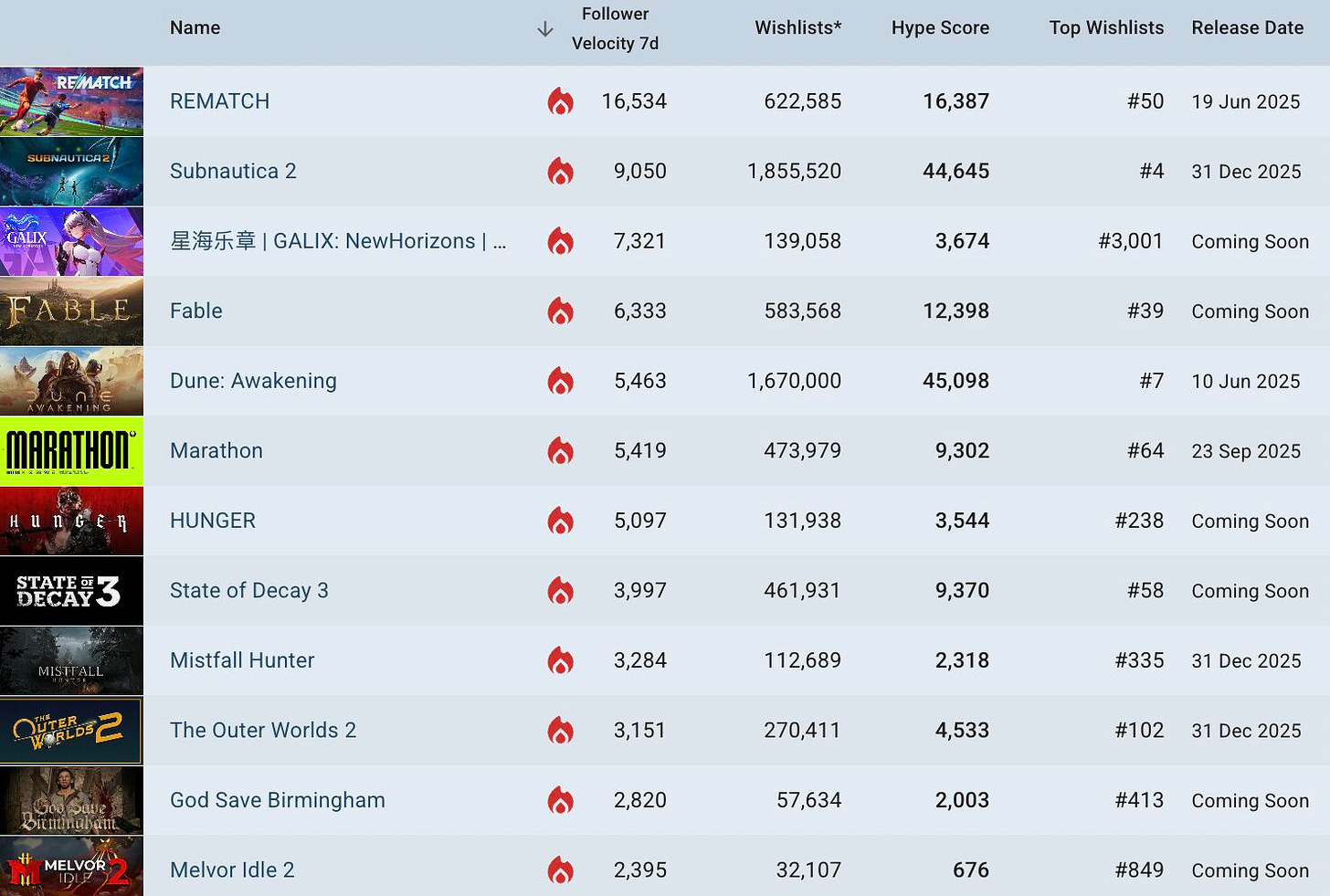

Checking out GameDiscoverCo's countdown of 'trending' unreleased Steam games from April 21st to 28th, Soccer PvP standout Rematch is #1 yet again, and Subnautica 2 is up to #2, thanks to a 'Road To Early Access' Vlog. Fable (#4) & State Of Decay 3 (#8) were boosted thanks to an Xbox Publisher Sale takeover on Steam.

Asia-centric anime-ish ARPG Galix: New Horizons (#3) bumped up, as trailers for PvPvE Napoleonic extraction RPG Hunger (#7) and for gritty medieval zombie jam God Save Birmingham (#11) boosted interest. (There's a lot of dirt & grime encrusted in these games, haha.) Idle sequel Melvor Idle 2 (#12) is a new entry too.

A survey of Japanese players trying to pre-order a Switch 2 has found that the vast majority of them (97.1%) want the cheaper Japan-exclusive region-locked model. (That’s the folks pre-ordering on the Nintendo Store who have 50 hours of playtime logged, though - presumably not many China-exporting scalpers there!)

Via the GDCo Plus Discord, Patrick Seibert spotted that when uploading ‘vanilla’ Steam capsule assets, you now need to select a checkbox: “I confirm that this capsule contains no additional text aside from the game’s logo.” (FYI: artwork over-rides are what you use to market DLC & new game features in the capsule art.)

In ‘nation-state woes’ news, pro-Ukraine World Of Tanks creator Wargaming split out its Russia biz after Ukraine was invaded, but is running into the Russia gov, with “reports that the country's prosecutor general wants to seize the shares held by Lesta owner Malik Khatazhaev, as well as those of Wargaming owner Viktor Kislyi.”

Remedy’s co-op ‘Control universe’ shooter FBC: Firebreak is taking the ‘launch into console subscription services’ approach - on June 17th, it will “launch day one on PC Game Pass and Game Pass Ultimate [and] onto the PlayStation Plus Game Catalog… for all Extra and Premium members.” There’s also a deluxe version & cosmetics.

Circana’s Mat Piscatella notes that “Indiana Jones and the Great Circle was the best-selling video game in the US during week ending April 19th, following its PS5 launch.” (GDCo estimates 50k units on U.S. PS5 so far, which is decent, not giant?) It wasn’t in the Top 15 most-played, though - Piscatella murmurs: “The big live service games are sucking the air out of the market.”

Bigger devs, take note the South Korean government is mandating ‘a domestic representative’ for legal compliance, for “foreign-based companies that recorded 1 trillion won ($700,000) in total annual sales [in South Korea] the previous year.” (This seems fairly mobile/loot box centric, part of a domestic crackdown, but YMMV.)

Looks like the Humble Choice bundles (of Steam game keys) are increasing in price in Europe and Canada - up ~30%, from €9.99 to €12.99 (EUR) and

$14.99 CAD to $17.99 CAD (Canada) - while bundling in IGN Plus membership from its parent company. (Unclear if a worldwide change, and we’ll see if subs like it.)We’ll have more about Clair Obscur in Friday’s newsletter, but Palworld’s community manager John ‘Bucky’ Buckley opines: “Expedition 33 is the latest game to get unwillingly dragged through gaming Twitter as people debate the viability of Game Pass. I feel like I’ve just a little more knowledge on the topic than most - so I’ll just say yes, yes it is very worth having your game on Game Pass.” And he should know, folks!

Offpath’s Tim Elliott is tracking the quickest Roblox games to 500k CCU (!), and in at #2 is new incremental/farming sim Grow A Garden, which took just 31 days to get there. (That’s even quicker than fishing game Fisch (48 days), which we’ve mentioned recently. Roblox speed-scaling can be wild...)

A pithy video game VC view from F4 Fund’s David Kaye: “The ‘vertical slice seed round’ is dead. Series A games VCs are basically out of the business of funding partial prototypes and vertical slices without any customer validation. [Either] 1) Ship a game on your seed round… [or] 2) Find a publisher or strategic investor.”

Video game-adjacent tariff news: Hasbro discloses a $300m max tariff risk in 2025, mainly toys, while Wizards Of The Coast “has a tariff exposure of less than $10 million”; Playasia doesn’t expect the Trump admin’s ‘de minimis’ exemption U.S. rule changes on Chinese-made goods to apply to its “video game-related orders”.

How Cloverpit added 100k wishlists… in a week!

So, we were talking to the folks at agency/publisher Future Friends (The Cabin Factory, Summerhouse) about their latest “demonic lovechild of Balatro and Buckshot Roulette” title Cloverpit, developed by micro-indie Panik Arcade (Yellow Taxi Goes Vroom), and discovered its ‘Triple I showcase reveal x demo drop’ has gone… v.good!

For context on Cloverpit, its ‘capsule description’ is illuminating: “Cloverpit locks you in a rusty cell with a slot machine and an ATM, in which players must pay off their debt or fall to ruin – literally. Manipulate the slot machine to earn extra coins. Turn the odds in your favor with various prizes and charms that trigger big big combos, snowballing into a dazzling lucky run. Bend the rules, break the game, and pay off your debts!”

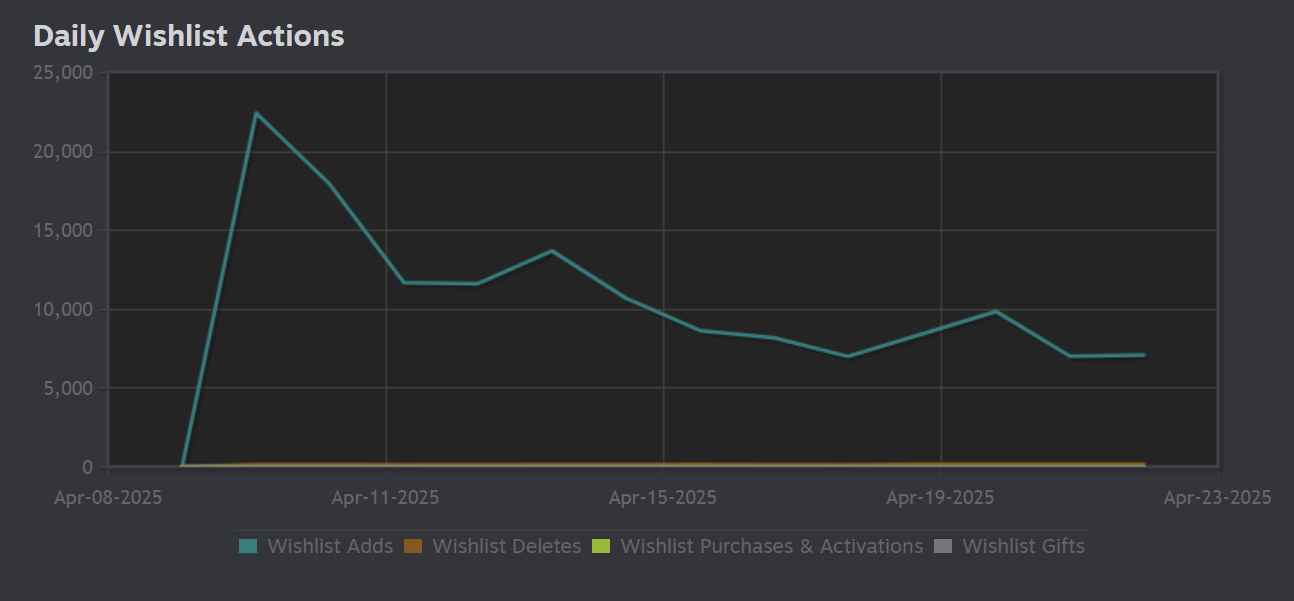

And the result? Specifically, according to Future Friends’ Thomas Reisenegger, who is leading publishing on this game with FF’s Laura Topakian, Cloverpit’s already scaled to nearly 150k Steam wishlists and >200k demo activations. Here’s the wishlist chart as of the middle of last week - it’s attractively chunky:

Some additional stats around this game’s breakout demo success, which has been - as you would expect - led by a lot of organic influencer and social video coverage:

Cloverpit had 100k wishlists and demo plays in just the first seven days post-’proper’ unveil. (There was previously only a ‘teaser’ Steam page up.)

PC demo concurrents for this single-player title peaked at 3,200 on April 26th, and have been largely >1,000 (at most times of day!) for the past two weeks.

Median playtime of the Cloverpit demo is 1 hour and 5 minutes, with an average of 2 hours 2 minutes and 7% playing for >5 hours.

For demo activations, China is 35% of the total, followed by the U.S. at 21%, Germany at 5%, then the UK, Canada, France, and Japan at 3%.

Wishlists are led by the U.S. with 31%, however. It’s part of a trend GDCo has seen, where China seems to under-wishlist compared to demo & sales numbers.

Tactically, Future Friends played the reveal right. In particular, timing a live demo to Clover Pit’s ‘reveal’ helped skyrocket interest. ‘Here’s a game announce, you can try it now’ - without the demo being aggressively gated - is great marketing.

There were some smart storefront wins from FF, too - Thomas adds: “Triple I Initiative’s Steam feature was massive and only contained a handful of demos - so we got a lot more eyes on it than we would have [at] Next Fest.” So intelligent timing clearly helped.

But look, a lot of this is simply the game itself, which mashes together a number of trends very cleverly, and is incredibly well designed for social virality. For us, there’s a few things that work particularly well:

the ‘gritty’ PlayStation 1-styled textures and low poly 3D art places Cloverpit squarely in the Buckshot Roulette-ish ‘PS1 horror’ aesthetic.

the ‘X mechanic but it’s an upgrade-able roguelite’ idea is very meme-y, and a slot machine (a la Luck Be A Landlord) is a great, grokkable randomized start point.

having a cramped, navigable first-person 3D space where you can move between different machines - with a trapdoor to plummet through if you lose - is clever.

Sometimes we wonder - or perhaps worry - that people will read notes on games like this and think - ‘hm, trashy game, looks bad, encourages gambling, not art?’ To which we’d say - games that balance player emotions cleverly like this are not that easy to make?

In fact, when we talked to Panik Arcade’s Matteo and Lorenzo about how they designed Cloverpit, they highlighted “the whole balance between luck and strategy, preserving both emotions like anticipation and control” that’s built into the game. You could win a jackpot, or you could plummet to your death, and it’s not 100% random.

There’s strategy in there, beyond the “mindless act of pulling a lever”, since you can “alter your odds in a significant way” by picking complex modifiers and powerups. And there’s some entertaining ‘pay back Tom Nook’-style debt management, since if you spend all your money on the slots, you’ll be down the trapdoor before you know it!

The roguelite game balance is also tricky, as the Panik Arcade folks explained to us: “It's a delicate dance between feeling luck, but also being able to alter your odds in a significant way. Too much luck and it doesn't make sense to call it a roguelite with a strategy. Too much outcome-consistency from items, and it doesn't make sense to have a slot machine.”

So we see the game as a focused but smart roguelite with Saw movie-ish vibes, and it’s not designed to extract too much of your income, or thousands of hours of your time. It’s a clever emotional rollercoaster which allows influencers to ‘perform’ that rollercoaster ride for their fanbase - which is a big, big key to its social virality.

And obviously, we’ll see how Cloverpit does on release. But with the Balatro-ish round-based structure married to lots of item and powerup possibilities, and the devilish vibes already honed, we’re expecting this to be at least a medium-sized hit!

The state of XR: crowded, evergreen, and gorilla-y?

We’ve previously featured Cassia Curran’s research on the XR games market, and the XR biz specialist at the Curran Games Agency has just put out a 2025 XR software market report ($). Which is great, since there’s relatively little analysis on the space out there right now.

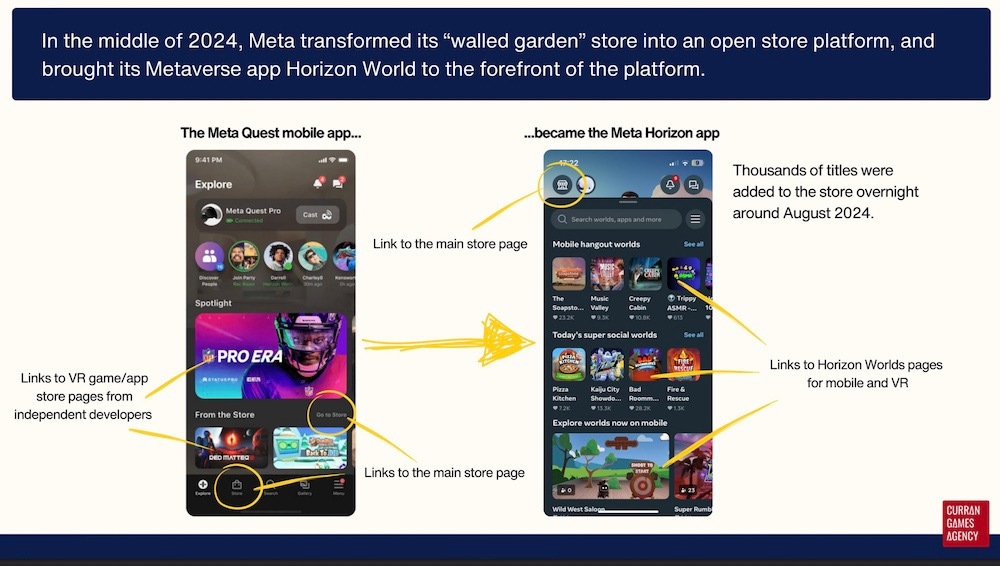

While the report has great insights on the much smaller Steam and PSVR2 markets, it’s really the Meta Quest space that’s most interesting. And there’s been some big changes there, with Meta’s virtual world app Horizon Worlds becoming a storefront anchor (above), as the less vetted ‘App Lab’ games got folded into the overall store.

There’s been negative coverage around this reducing sales - as well as pushback from Meta, which claims that the younger demographic playing on Quest 3S is skewing ‘mid-core rather than core’, meaning more F2P and multiplayer game interest.

Whatever the case, it’s great to see some detailed data - based largely on Quest store rating counts - for how games performed in 2024. And here’s what Cassia spotted:

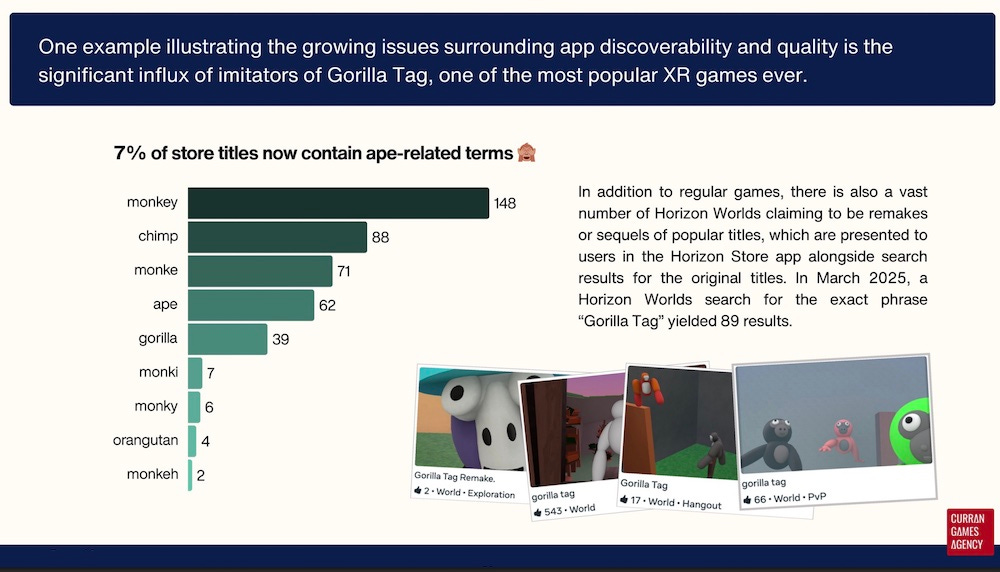

Half of the most-rated titles on Quest are now F2P, including the Top 3: and five of these games were released in 2024, including Yeeps: Hide and Seek and Animal Company, which are very much taking the Gorilla Tag torch and running with it. (Yes, Gorilla Tag is #1!)

Most of the titles in the Horizon Store today aren’t commercially viable: 30% of the 6,180 games on the Horizon (formerly Quest) Store have 0-1 player ratings, and 81% have less than 50 ratings. (However “86% [of the <50 ratings titles] originated directly from App Lab, or were added in late 2024 once the store submission rules were relaxed.”)

Revenue in the store for premium games is exceedingly top-heavy: according to their estimates, 58% of premium app revenue in 2024 originated from just 25 titles, representing 0.4% of the overall catalog. (Those games included evergreens like Beat Saber, GOLF+, Bonelab, Blade & Sorcery: Nomad & Ghosts Of Tabor.)

So we’re seeing a busy store - even more so now that App Lab titles are rolled in, and F2P games are getting more popular with a somewhat younger demographic. It’s not impossible to break through, but the ‘evergreen effect’ is similar to other platforms.

Finally, one fun graph Cassia provided (below) looks at Gorilla Tag-style games with similar naming. (And don’t forget there’s lots of Gorilla Tag-ish ‘fast follows’ like Yeeps and Animal Company that don’t even use monkey - or monkeh, lol - in their title.)

You can read more about the state of the market in Cassia’s full report ($), which we found pretty handy if you’re trying to navigate the space. See ya Friday… toodles!

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]

I've never heard of Cloverpit - time to give the demo a try!