How Abiotic Factor rode a hot Steam 1.0 release to 1.4m sold...

Also: a look at publisher wants from a survey, and lots of game discovery & platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we saunter into September, time to admit that we got successfully baited by Abiotic Factor co-creator Geoff ‘Zag’ Keene into running a second newsletter about his team’s expansively humorous survival crafter. (He claims he was just ‘asking questions’ about why we don’t feature 1.0 versions in our ‘new on Steam’ charts. Pshaw!)

Before we start, can you imagine the most ‘this is 2025 and I want to go home!’ video game headline ever? Is it ‘a blockchain-using Stumble Guys-style mobile party game has a collab with Roblox smash To Steal A Brainrot’? If you dizzy-ed, douze points to you…

[WANT TO SUPPORT US? Companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 80+ have. And signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, basic data & more. ]

Game discovery news: Everwind, YAPYAP trend…

Kicking off, let’s take a look at the top video game platform & discovery news over the last few days:

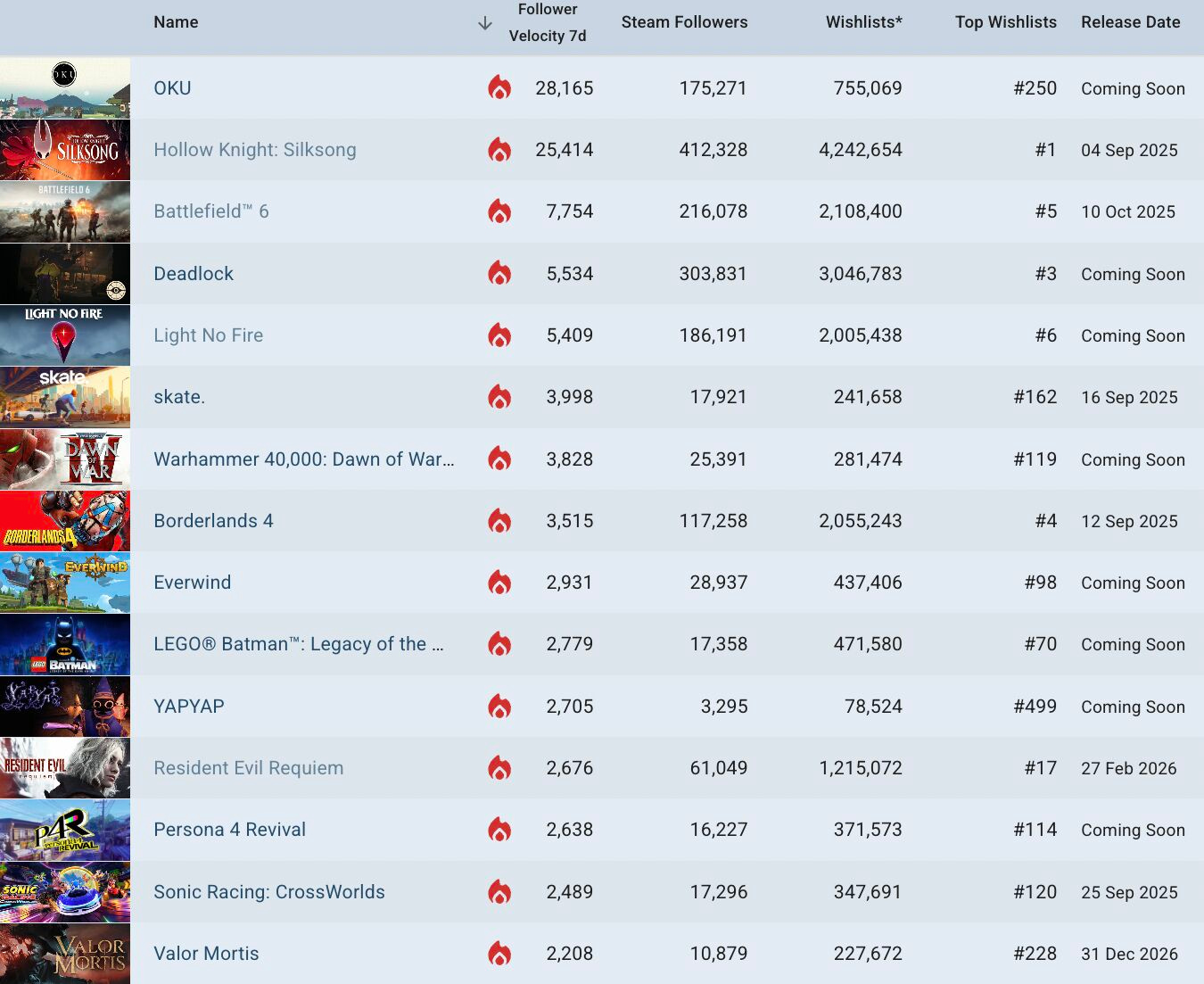

Looking at GDCo's analysis of 'trending' unreleased Steam games by 7-day new follower velocity (above) - ignoring the incented OKU (#1), Hollow Knight: Silksong (#2) is surging ahead of its much-vaunted release later this week. And Battlefield 6 (#3) continues to rack up both followers and pre-orders.

Elsewhere, Valve's third-person MOBA Beta Deadlock (#4) got new heroes & map, and Light No Fire (#5) added interest due to a No Man's Sky update w/LNF's tech. New-ish? Minecraft-block-y survival-er Everwind (#9) had a viral gameplay trailer, and goofy physics-led co-op 'wizards x dungeon' title YAPYAP (#11) also trended.

There are new reports that Steam isn’t allowing mature-themed games to launch in Early Access when content can change, with Valve saying “please resubmit when your app is ready to launch without Early Access.” (This is presumably due to previously discussed payment provider-related reasons.)

A new ‘Gen Alpha at the Movies’ report asked U.S. under-13s about their favorite IP, and per Kidscreen: “Roblox, Minecraft and Fortnite are the top social franchises… with classic favorites like Pokémon, Spider-Man, Avengers, Super Mario and LEGO” also making the Top 10. (Lots of games in there…)

A good note from this HTMAG analysis of Parcel Simulator, which we’ve also covered: “There’s this one weird trick where every other indie game developer is too scared to launch during a Steam Sale so the popular upcoming and new and trending charts are frozen solid for weeks.” So if you can get on them at the right time…

One ‘amusing’ follow-up comment from UA expert Matej Lancaric after we were surprised by a $2,000 spend in a month on mobile title Kingshot - actually: “Spend depth in Kingshot is in [the] tens of thousands.” (We don’t have the ‘vision’ to grok how much money the top players spend on mobile, apparently!)

Over on the r/gamedev Subreddit, somebody analyzed every Steam game released on July 30th to see how they did a month later, and of the 40 (!) released, 18 had no traction, 11 had a bit of visibility, 7 sold hundreds (?), and four titles “seem to have sold well” - though maybe only single-digit thousands so far?

Uwu Biz & IndieBI’s Callum Underwood is helping out cannon shooter PVKK, and posted a great annotated pic of its wishlists over time, saying that an IGN gameplay reveal “performed a lot better than I expected”, and “the main learning is obvious - Steam events/sales dominate [WL additions], but…consistent beats” are vital.

Popping in to peruse the Meta Quest VR game charts ($), the recent-ish hit by new ratings is F2P Buckshot Roulette-ish party game Devil’s Roulette. But it barely makes the Top 10, which is dominated by GOLF+, VR shooter Vail, Gorilla Tag, Horizon Worlds & more. (Almost all of these are F2P, and all have IAP.)

Hooded Horse’s Tim Bender pushes back on the idea that “Steam's latest change to review display 'removes social proof' and will hurt sales”, busting out real data from games like 9 Kings & Manor Lords to show that, for ‘All Reviews => German Reviews’ titles, “German sales did not generally slip… instead we see random variation.”

Microlinks: why today’s game consoles are historically overpriced; a look at the range of Twitch viewership loss after ‘viewbotting’ got cracked down on; a micro-indie tried a bunch of paid ads for his Steam game, with some interesting results (Reddit good?)

How Abiotic Factor rode its Steam 1.0 to 1.4m sold!

You may recall that back in August 2024, we covered Abiotic Factor, the ‘co-op x Half-Life-adjacent look x exploration x crafting’ title from developer Deep Field Games and publisher Playstack (Balatro, Mortal Shell). Well, it’s just over a year later, and the 1.0 and console versions just hit. So it’s a great time to look at performance and lessons.

The 1.0 release has been a v.useful $ boost on Steam, bringing total Abiotic Factor sales to >1.4 million copies (per Playstack). And PS+ and Xbox Game Pass launch deals added revenue, too. (Playstack’s parent company reported H1 profit up 125% to $9m, citing “in particular… the full launch of Abiotic Factor… in July 2025.”)

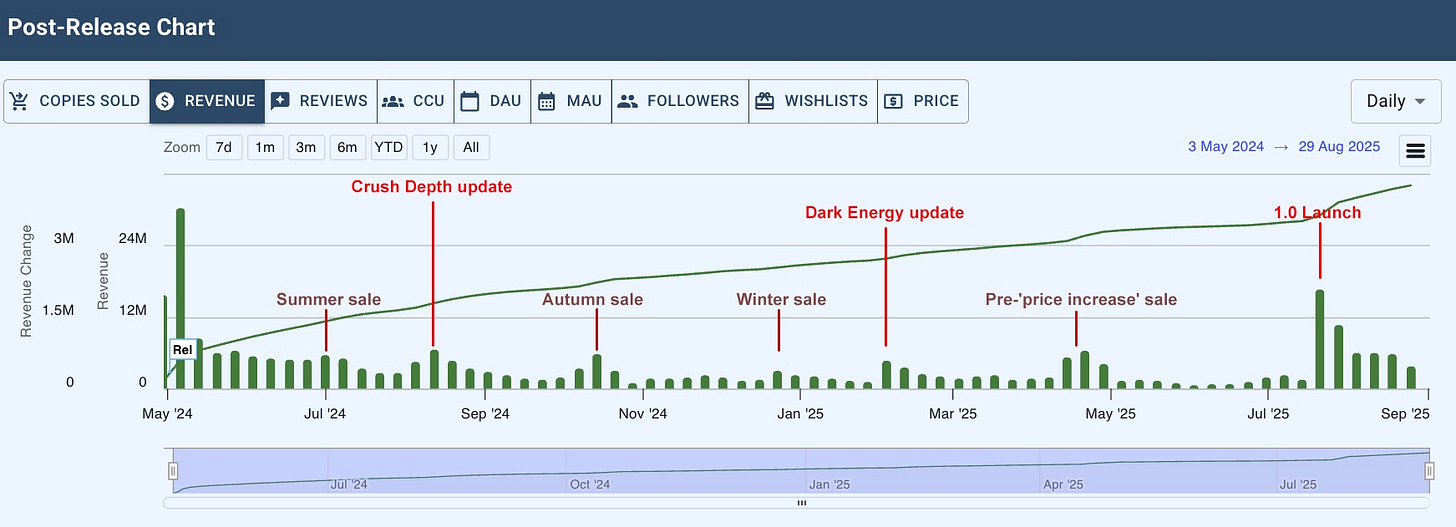

As the game’s Steam sales evolved from 600k from May-Aug. 2024 to 1.4m by the end of Aug. 2025 - with an all-time high Steam CCU of 29,000 at 1.0 launch - it’d be great to view the ‘long tail’ effect & how discounts and updates help. So here’s a GDCo-estimated revenue chart, using our GameDiscoverCo Pro data:

A big takeaway: growing sales is a continuous, laborious process. There’s no one ‘winning’ sale, but compounding these discount $ spikes & update interest spikes over time is what matters! We talked to Playstack’s lead marketing manager Shawn Cotter & Deep Field’s design director Geoff ‘Zag’ Keene, and here’s key points:

Raising prices before 1.0 helped Steam revenue outpace units: per Shawn: “The Early Access release sold just under 250k units in the first month [but] just under 50% of that with the 1.0 release on Steam.” But they did raise the price from $25 to $35 prior to 1.0 launch, given so many new in-game features, which helped bridge the $ gap.

Incenting players to buy before the price increase = smart: the team created a pre-price increase ‘push to buy’, via exclusive Early Access cosmetics and a Supporter’s Pack DLC that was free to EA players but paid at 1.0, to good effect. (Shawn says the supporter DLC “has performed surprisingly well post launch”, also.)

Planned PC/console crossplay helped virality at 1.0: GDCo is estimating another 1m+ Abiotic Factor players across console platforms - largely in Game Pass/PS+ tiers. And Shawn thinks the cross-play helped virality: “the word-of-mouth of friends convincing friends to play it with them [crossplatform] likely accelerated sales beyond what we would have seen from a premium only launch.”

The subject of when to release is also a fraught one (see recent Hollow Knight: Silksong existential panic.) Shawn says: “1.0 timing was a complicated web… it had to be ready on all platforms, in a window that was agreeable with platform holders, and was generally free from competitors doing things during that same window. (We only dodged Grounded 2 by a week, but couldn’t escape the void that was Killing Floor 3 and Wildgate!).”

One of the secrets to Abiotic Factor’s success is its gameplay. It’s an (independently invented!) built-out take on some of the sloppier goofy co-op hits of late, with way more depth, and it’s had a highly active Early Access period, updates-wise.

This top-rated Steam player review explains more: “I don't think i've ever seen a game that blends genres that well. As so many pointed out, it's Half Life 1 aesthetics meets Subnautica survival mechanics and the SCP universe. It's immersive, highly customisable and highly addictive. Just one more supply run, one more base to build, one more minute (hour ?) exploring this giant interconnected facility you find yourself stranded in.”

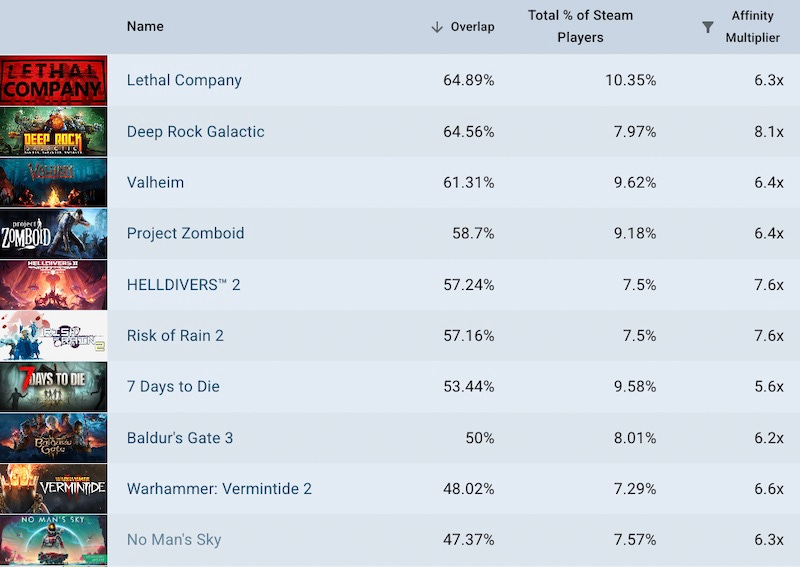

For more context on player influences & overlap, here’s some GameDiscoverCo Pro data showing the % of Abiotic Factor players who own a certain game on Steam, and how much more likely they are to do so than the average player (‘Affinity Multiplier’):

So what did the devs do to further enhance the game’s discoverability during Early Access? Zag tells us it was a chunky, well-signposted approach: “During EA, we opted for large, impactful updates, instead of something like weekly or monthly updates. We decided early on - due to the game’s story structure - that our best bet would be to divide it into “chapters”… and we put in a few community updates or holiday-themed content in between.

Each major update added (roughly) 2 more sectors to the whole experience, ending with an NPC giving a very in-world explainer that you’ve reached the end of the current content. It worked out quite well, and really left our scientists hungry for more.”

Themed updates have better hook for streamers, too, we think. OK, there’s a lot more great info, and we’re running short on space. But let’s end with some final insights:

More Chinese outreach = a key piece of the 1.0 puzzle: Shawn noted “localized store assets & logos, localized trailers, and working with a regional partner that helped promote and drive engagement on platforms such as Bilibili.” (GDCo estimates ~20% of Abiotic Factor’s players are Chinese.)

There’s always new influencers to discover your game: Zag spotted brand-new, sometimes influential streamers waiting until 1.0 to play Abiotic Factor, including Shroud, joking that until now, maybe they were “being cautious of the ‘cursed runes’ (as our Art Director calls it) – Early Access, survival & open world.”

Steam store bundles with similar games helped a lot: Shawn says: “Not only does this help with cross-store visibility, but even we were surprised with how lucrative bundle options can be. One of our more successful bundles has moved over 80,000 units with only a modest 10% [extra] discount.” He adds that timing them to one of the games having a major content update is key, traffic-wise…

What are game publishers looking for in 2025?

So, we’ve been talking to the organizers of Paris Game Biz, an upcoming event in late Oct. that’s planning high quality, in-person matching for publishers to meet devs. Why? Well, they came bearing data from a survey of 25+ PC/console publishers - everyone from 505 Games and Dotemu/Focus to Kepler, Paradox, and beyond.

The idea of the event is that devs pre-qualify by paying a small sum up front, and get access to data on the budget ranges of publishers and other survey info. Any reasonably promising pitch would then get approved to attend the full biz event.

It’s an interesting idea. And as Dotemu’s Cyrille Imbert, who’s involved in the event with French game org Capital Games, tells us: “The pandemic forced many companies to conduct business remotely, and now most of us operate that way. This makes B2B events harder to promote, as a strong incentive is needed for people, especially buyers, to attend physically. Consequently, we've seen fewer buyers and ‘leading’ studios, and a proportionally higher number of service providers at our B2B events in Paris.” Hence this new approach.

And while this piece may also - in effect - be a promotion for the event, we were interested in the publisher survey results, which we’re permitted to print selected parts of. Specifically:

City-builders, survival games, roguelites & co-op top the ‘most wanted’: the above graphic shows some of the top publisher-desired genres. We’re not surprised to see city builder (72% of all publishers), survival games (72%), roguelike/lites (69%), co-op games (69%) and horror titles (66%) top the subgenre-specific rankings.

There’s plenty of interest in newbie devs, and a paucity of higher-end opps: per the survey: “76% of buyers are open to working with studios that have no prior track record… [and] only 28% of buyers are looking to work with medium-sized or larger studios (25+ [full-time workers]).”

We’re also seeing a clear split in publisher funding ranges: we can’t print the exact numbers, but publisher budgets are roughly carved in two: a) those that don't have a minimum project cost to fund (the majority of funders); b) those that won't look at a title below a minimum funding range, often of at least 1 million Euros (a significant minority, and those targeting ‘AA and above’ experiences).

We asked Dotemu/The Arcade Crew CEO Imbert about this trend - lower upfront dev budgets from a number of the leading players in the space - and his impressions are interesting:

“With increasing competition in both PC and console markets, buyers seem to be prioritizing de-risking individual projects by focusing on lower investments. This trend is also driven by the rise of million sellers, particularly on Steam, which achieved success with relatively small budgets and surprised everyone. I believe this is a result of three combined factors:

Increased Accessibility for Small Teams: It's becoming easier for small teams to develop games, notably with the growing popularity of UE5 in the indie space.

Shift in Player Preferences: A significant segment of players now prioritize fun, depth, accessibility, and replayability over elaborate graphics, intricate storylines, and high production values.

Intensified Competition for High-Production Value Games: The market for III to AAA titles is increasingly competitive. With so many excellent games being released, ensuring multi-million dollar projects gain enough visibility has become a major challenge.”

That’s pretty much how we see it, too. And we’ve heard from multiple people about downward $ pressure (more bets, each with less upfront cost) from a number of funders. Nonetheless, publisher game pipeline is needed, and bets are being made. So keeping your eye out at all times is an awesome idea…

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]