Discovering your game's regional appeal, pre-launch?

We've got some data suggestions for youuuu!

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to the surprisingly busy midsummer of games! What’s happening? Well, Steam Deck is still reverberating (I made some comments as part of a GI.biz piece on it), and the main Game Developers Conference is virtually happening (Chris Zukowski and Gamasutra are writing up sessions if you’re not attending.)

And we also have a truly mammoth amount of discovery news to get to in this latest GameDiscoverCo round-up, so, uhh, let’s get to it.

[PSA: if you appreciate all our work, sign up for GameDiscoverCo Plus now - only $12-ish/month if you get a year, includes tag browsing/rankings for all unreleased Steam games, our Game Discovery Toolkit eBook, private Discord access, & more - here’s all the details!]

Which regions might your game be popular in?

This first newsletter section actually stems from a query in the GameDiscoverCo Plus-exclusive member Discord. Somebody was wondering the best way to see the regional breakdown of their Steam wishlists before launch.

This proved surprisingly difficult to track down for me. And it reminded me that regional interest for your game(s) is important to survey, and not everybody has a good handle on it. (Steam is a very global marketplace, especially if you’re used to consoles or historical PC reach.)

Firstly, the best explanation I found of how to see your Steam wishlists by region - VERY hidden, btw - is via this Patreon post from Jake Birkett of Grey Alien Games, who kindly gave me permission to reprint it here. (Sign up to his Patreon for more!) Here we go:

“I found out recently from a helpful Steam rep that you can view Steam wishlists by region, and thought this was pretty interesting and potentially useful. It's not very obvious how to view that data, though. Here's how you can see it:

1) Go to the ‘Sales & Activation Reports’ system on Steam.

2) Click on Regions at the top.

3) If you have more than one game, you need to add your appID to the URL like this: https://partner.steampowered.com/region/?appID=nnnnnn

3.5) [NOTE FROM SIMON: you can also go to a specific ‘App details’ page, e.g. https://partner.steampowered.com/app/details/nnnnnn/ where nnnnnn is appID, and clicking on the ‘Regional sales report’ link on the right tab.]

4) Enter a date range of "all history".

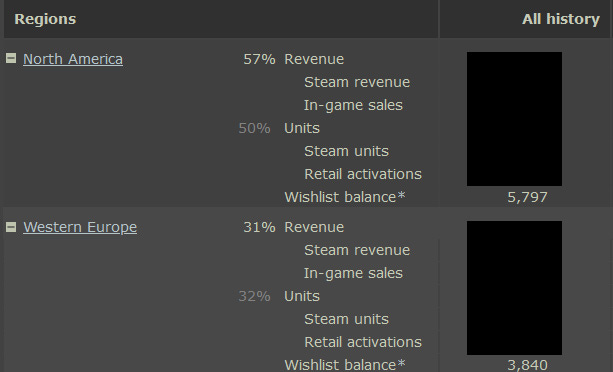

You will see 3 sections on this page: World, Regions, Countries. You can click on any of the + buttons to expand the data and see "Wishlist balance" at the bottom. See the image below for an example.”

So that’s that! And pre-release, it obviously shows 0 for revenue and units, but you can still see wishlists by hitting ‘+’. So if you didn’t know that.. now you do.

It’s also worth pointing out that Google Analytics is heavily used to look at which countries your Steam page traffic is coming from. There’s a whole page Valve made about this, and we think every Steam game should use this.

Thanks to the GameDiscoverCo Plus Discord (again!), Jordan Taylor from Hitcents provided this example from “neon synthwave virtualscape FPS” Get To The Orange Door:

So those are the two obvious indicators of pre-release regional interest. Another is Steam demo/prologue downloads by region, incidentally. That’s all broken down in the Steam back-end. It’s worth remembering that your free demo may sometimes have a different userbase than people who want to pay $20 for the full version, though.

(Some regions like Thailand and Vietnam sometimes download demos like crazy, but may be more economically suited to free games with small microtransactions than a one-off, more expensive title.)

As for what you do with the above information, appropriate localization is one big thing. Promising you will localize to a country or translating the store page increases interest from that country, mind you, so it’s a little chicken and egg-like. We talked about localization extensively in a recent free GameDiscoverCo newsletter.

In addition, local marketing/marketing to streamers in those countries is also worth tailoring to the regions who are most interested. China in particular benefits from local marketing, and you may be able to target foreign-language streamers fine if you can identify them yourselves. (Just remember that the regional pricing can be very different in some of these locales, and factor that into your allocation of effort!)

Stadia & Stadia Pro’s future - a follow-up.

Following our newsletter last week about Google Stadia and its shift in how it pays developers for Stadia Pro - its subscription service - I discovered we had slightly inaccurate information about it, and it colored our write-up. (Apologies.)

Specifically, Google announced that “any title included in Stadia Pro -- which gives subscribers access to a library of games for a monthly fee -- a share of the money generated by the service.” I then compared it to other services like Apple Arcade and Xbox Game Pass, which are majority upfront $, but with some back end $ - because that was how we thought Google was bridging the gap.

Not so. Although there are some exceptions (hence the confusion), a dev source confirmed to us that for the vast majority of devs, Stadia Pro is switching to be much closer to the Google Play Pass-style Android premium game monetization. That is to say - no money up front and sole compensation being “70% of all [Pro subscription] monthly revenue.. split between partners based upon how many ‘session days’ players have spent on their games.”

What’s more, we’re told some of those with upcoming Pro deals had their guaranteed up-front $ for being a Stadia Pro title switched to be ‘variable revenue based on Pro split’, even though they had lump sums written in their original contracts. The contracts were legally amendable, so this was technically allowed, but… that’s no bueno?

Time will tell if devs come out with more $ in the end, of course. But it seems unlikely, especially for those games only designed to be played through just once. And whether spending more (as I initially thought) or less (as I think now) money, Stadia’s trajectory doesn’t look brilliant or very dev-friendly.

The game discovery news round-up..

We’ve got a few things to breeze through here, so let’s get to it. Oh, before we do, wanted to shout-out this great mini-article from The Verge about how Disney+’s Loki “built a different reality” with retro hardware. It’s not 100% about video games, but it references this Eurogamer piece about using CRT monitor to play modern games. So… close enough, right?

Firstly, the next Steam Next Fest (!) is confirmed to start on October 1st, and is open to games who can get a demo up and running by then, and intend to be released between October 7th, 2021 and May 1st, 2022. Given our current views, Next Fest can be a useful marketing bump that should go alongside other beta/demo opportunities for your unreleased Steam game - so go read more and apply!

A few things going on about games in Netflix-land: firstly, ex-Oculus/EA exec Mike Verdu got hired as VP of game development, and secondly, Netflix publicly announced that they really love games now: “‘The success of this initiative is about great games, fundamentally,’ Netflix chief operating officer and chief product officer Greg Peters said.. ‘We think we can deliver more entertainment value through [games].’” They will be delivered in a mobile-centric way (cloud streamed? in-app? Bandersnatch-style interactive choices?) and this feels incredibly early, but we’ll see!

Microlinks, pt.1: Cozy Grove’s use of the ‘notice’ game page warning on Steam is intriguing - can you put any text in that box?; why Apple killing IDFA isn’t going to kill F2P mobile games; how Rockstar uses subscription services & storefront deals to maintain momentum - see my ‘GaaS on subscription’ article for the general strategy.

Pivoting to Roblox for a second, although it’s ‘absolutely not a game’ for Epic/Apple lawsuit reasons, and the App Store rules just got rewritten to cite Robloxian non-developer authors as ‘creators’, the company is also introducing a game fund, with $500,000+ available per team. “This program is designed to support developers who are eager to push the boundaries of what Roblox experiences can deliver”, apparently. Worth looking at?

Some minor Steam drama here, with some dev complaints over the fact you can make your game name as long as you like (!) and put a zillion keywords in it. Games like Ranch Simulator already do this, and it may help in some places in Steam’s search results. It’s kinda spammy, but guess you can try it if you feel SEO horny, baby? (But be aware that Google plan to limit maximum game name length cos people were overdoing it on Android, haha!)

Microlinks Pt.2: apparently the Itch.io store app should work on Steam Deck, and has a Wine interpetation layer for Windows=>Linux for the games; this 10-step ‘how to market your game’ plan from Mr. C. Zukowski is wondrous in scope; a gigantic ‘here comes the metaverse’ primer from the ever-turned-on Matthew Ball.

Thus far, blockchain & games has been a bit of a nothing-burger. But that’s until Axie Infinity’s massive ascent in recent weeks, and the Not Boring newsletter has a great rundown of what’s going on. Lots of people are supplementing their income or even working full-time (!) by ‘gold farming’ (well, the modern equivalent) in Axie Infinity. And they’re renting in-game pets - which you need to generate in-game currency - from others. It’s tied in with Ethereum, it’s deeply odd, slightly disturbing, and you should keep an eye on it - if for no other reason that ‘play to earn’ is a great discovery method!

Microlinks Pt. 3: a gigantic ‘how China censors the video game world’ piece at The Guardian is worth perusing, given market size; just shouting out Microsoft for this super well-considered Xbox family settings upgrade for monitoring your kids’ spending; somebody who has a game on both Steam China & regular Steam reveals that 1% of his Summer Sale units were on Steam China. (Still think being on Steam China is great as ‘Steam in China disappears’ insurance, though.)

Finally, we don’t cover hypercasual mobile games here much, but Cabel Sasser from Panic (Untitled Goose Game, Playdate handheld) highlighted this briefly top-charting title on the App Store, and… wow:

If you check out footage from the game itself, it’s a primordial soup of mini-games and weird morally bankrupt drama. For example: taking selfies of yourself while your boyfriend is in the shower, or fighting your love rival by slapping each other with fish.

What’s also interesting is that there’s not NOTHING to be learned from games like this, for premium PC/console devs. For example, I notice the same dev as Affairs 3D has a popular Deep Clean Inc. game, and boy, that Powerwash Simulator title on Steam has similar gameplay - not through copying, just through happenstance - and is now a big hit.

But yes, some ad-festooned hypercasual mobile games understand hook spectacularly well and perhaps should be studied. Just, like… try to balance morality and respect for your audience with the fact you have to get people interested and still make money. That’s allll.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to an exclusive eBook, extra weekly newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides.]