Designing for virality: Choo-Choo Charles edition

Plus: Netflix's evaluation criteria & games, Steam Deck Verified, & lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

*pops up in your inbox* Hey there, it’s me, the nattering nabob of game discovery - and it’s a fresh new week here in Gamediscoveryland. Lots to talk about yet again, and our lead story looks at what happens - during and after - you have a ‘viral Internet moment’ with your game.

BTW, just wanted to say thanks to all the fresh newsletter subscribers in recent weeks, both free and paid. It’s really my dream job to write about these complex issues for an engaged global audience. And you, my friends, are that very audience. So let’s hit it.

[Thanks to new members of our GameDiscoverCo Plus paid subscription - only $12 a month if you sign up for a year, and includes an info-filled Discord, a data-exportable Steam Hype back-end for ranking/comparing unreleased games, two eBooks, & lots more - join them!]

Choo Choo Charles: what virality! What’s next?

So, it’s quite possible that many of you are aware of the creepy-ass Choo-Choo Charles, a newly announced ‘a spider-train is stalking you’ game from Two Star Games, which debuted its first trailer (above) on October 1st.

And the reaction was fascinating - both the official YouTube trailer (330,000 views!) and the official TikTok post (1.5 million views, 298,000 likes) have done crazy numbers, and the mentions, re-uploads, related YouTubes, follow-on TikToks (almost 11 million hashtag views!) and third-party news stories have radiated out from there.

Gratifying, Gavin Eisenbeisz from Two Star Games (which also released the black & white outsider art-y My Beautiful Paper Smile) has been extremely transparent with the surprising - to him - blow-up of his concept. And thus we have an interview with PC Gamer and also a super in-depth analysis from HowToMarketAGame.com’s Chris on the phenomenon so far.

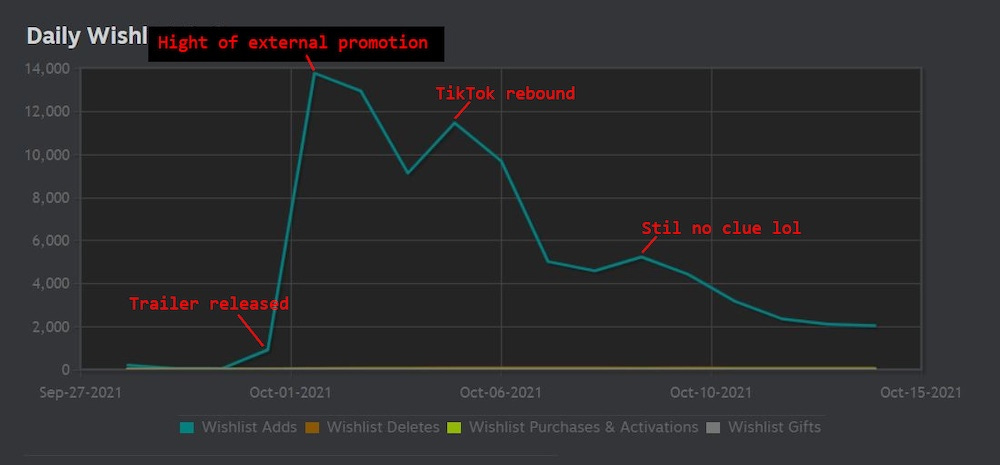

Gavin’s also a GameDiscoverCo Plus member, so we got to chat to him in our member Discord a little bit, and he shared some data. So first up, here’s his Steam daily wishlist totals for immediately after launch (with annotations from him). And they’re impressive, to say the least:

So as you can see, that tops out at amost 14,000 wishlists in one day. Even two weeks later, Choo-Choo Charles is still doing 2,000 wishlists per day, with 85,000 wishlists added in total for just that small two-week period.

Gavin also shared an annotated version of his Steam page visits/impressions (below). What’s particularly notable is how the green line in the top graph - the Steam Discovery queue referrals - amps up as a result of the surge of incoming traffic:

This is a great example of what Valve is often saying. The best way to get extra Steam-powered impressions for your game? ‘Just’ create external traffic which the Steam algorithm takes note of. See, it’s easy. *laughs*

One other thing I found interesting in Chris’ write-up was that he pulled external traffic to the Choo-Choo Charles Steam page by domain name, And it read as follows (selected highlights in descending order): Kotaku, 25k referrers; Reddit, 21.5k referrers; Facebook, 20k referrers; YouTube, 14.5k referrers; PC Gamer, 11k referrers; Eurogamer, 6.5k referrers; RockPaperShotgun, 2k referrers.

(This gives you a good idea of the ‘power’ of some of the outlets out there in this case. But remember that some traffic is indirect - see video on TikTok, search for game on Steam, etc. So this is really just trackable traffic.)

Anyhow, I think other outlets - as well as Gavin’s own Reddit r/gamedev post - have done a really good job getting into the specifics. So I wanted to focus on a couple of ‘next stage’ issues. Firstly, was the game intentionally designed to go this viral? And secondly, what may be the commercial results for the game when it comes out?

Virality: Thomas The Tank Engine horror ftw?

On the first point, when I saw the game’s trailer, I figured the dev’s thought process was: 'people like Thomas The Tank Engine-style horror memes, and various Resident Evil mods with Thomas (switching Mr. X with Thomas, see above!) are big, so why not make a whole standalone game like that?'

But when I spoke to Gavin, he said it wasn’t quite that simple: “I honestly didn't know Thomas the Tank Engine memes were so big when I came up with the idea for the game. I had seen the spider Thomas memes, and that’s where the spider aspect of the character design came from.”

He added: “But I mainly liked that there wasn’t an existing spoof on the Thomas character. Lots of horror games make childhood memories scary. But very few horror games do this with TV shows. That was why I liked this idea for a character so much.”

Nonetheless, this was definitely inspired by ‘creepypasta’-ish Internet horror trends, and Gavin agrees: “It was entirely designed for virality. I knew it would work well, but wasn't expecting it to blow up so soon” And what we’re seeing here is virality-related interest. Which is to say, people are interested in the game, but fascinated by the idea.

Hype vs. expectation: delivering what players expect

So, getting wishlists is good. But how do you capitalize on that? Choo-Choo Charles is a single-player horror game, which isn’t always a breakthrough subgenre. (Although I will say that the art style is competitive.And the gameplay concepts for the game, which has you both on foot and hopping into your own train to escape, seem strong and even a little innovative for the genre.)

But what do people expect now? The above slide is from a talk I’ve been doing in recent months. To sum up from my own notes: “Most of the time (90%+ of games), before it releases, you simply have a hype issue. Which is - people aren’t excited enough about your game. So you need to find ways to make them excited!

But as you get closer to release, and sometimes if you’ve done a great job of selling people, you run into a different problem: an expectation management problem. Is the game you’re releasing the same one that people are excited about? Trying to work out the difference between hype and reality (and/or trying to narrow the difference without turning people off) is incredibly important.”

Expectation management is still a better problem to solve for than 'nobody knows about my game', haha. And I asked Gavin whether he was worried about inflated player expections for Choo-Choo Charles. Here’s what he said: “I was a little bit [worried] at first, but I think the trailer communicates what the game is really well, so hopefully there won’t be a disconnect between what people are expecting from the game, and what they end up getting.”

“The main thing now is just putting in the extra time to make sure that the game is really fun, and well polished. I think as long as I allow myself the time to make sure everything is done well, everything will go pretty smoothly.”

I agree! The trailer shows a lot of real gameplay, and it feels to me like the game is somewhere close to the Hello Neighbor zone . Which is to say - it’s the game’s universe, merch, and YouTube fanbase which powers this particular corner of the ‘kidult horror’ world, much like Five Nights at Freddy’s and even Bendy and the Ink Machine.

This is doubly intriguing because maybe you’re accidentally creating merchandisable IP alongside your game? In any case, good luck to Gavin. It’s a spectacular start, and we’ll be watching the game’s Hype score and its 2022 launch with a lot of interest.

Game subs & measuring success: lessons from Netflix

We’re early on in the rise of video game subscriptions as a delivery method. And as Xbox has taken pains to point out, game subs like Game Pass aren’t identical to Netflix, where all you can do on the service is watch movies and TV that you’ve already paid for.

Nonetheless, I think ‘evaluation of content success’ is going to be a big topic for services like Xbox Game Pass and Apple Arcade in the future. So, defining success for video game subscription platform games is really important. Which is why it’s so interesting that select Netflix ‘success’ data has leaked to Bloomberg alongside the controversy over Dave Chappelle’s latest Netflix stand-up special.

The info comes via Lucas Shaw’s Screentime newsletter, which is free to subscribe to - though the web version tends to butt up against Bloomberg’s aggressive paywall. Summarizing how Netflix internally sees success for projects:

A primary metric is ‘adjusted view share’, which Netflix describes as its “primary measure of a title’s impact.” Interestingly, Shaw says: “We don’t know the formula(s) used to calculate AVS. Current and former employees say that new customers and people who don’t watch a lot are considered more valuable viewers. If those people watch a program, it suggests that show is a reason they remain customers.”

There’s also ‘efficiency score’, which “measures a show’s value over its cost.” Shaw explains of the Chappelle special, which cost $24.1 million: “It had an impact value of $19.4 million and an efficiency score of 0.8X. An efficiency score of 1x means that a show generated about as much viewership as it cost. Anything above 1x means a show was efficient. Anything below that means it was not.” Bo Burnham’s excellent Inside (above) scored 2.8x on effiency, though it only cost $3.8 million.

Then there’s South Korean viral smash Squid Game, which “has an adjusted view share of 353, compared to 12 for Chappelle and 10 for Burnham. It has an efficiency of 41.7X.” I guess viral hits will do that, given 132 million people have watched at least 2 minutes of Squid Game since it launched, and about 87 million people completed it (!). (This data is gold, precisely because it’s incredibly difficult to get if you’re outside of the company - others try to synthesize results for TV.)

Anyhow, why is this relevant? Because some of these criteria - predicted or actual - may influence you getting your game onto subscription services in the future. There’s so many things you could base success metrics for games on, too: download count, play count (can be quite different to download count!), total hours played, daily/weekly retention, etcetera.

Some of this is happening already. We already know that Google Stadia is explicitly using daily sessions played as its Stadia Pro payouts (which we are now hearing are very pleasant, btw! Yes, we were surprised too.) Apple Arcade also shifted a lot of its interest into high-retention games, after its first tranche of titles were a little too ‘one and done’. And you do get extra payouts from Apple Arcade based on daily players, though it’s not the majority of the game funding.

And then there’s extra monetization. As Microsoft’s Sarah Bond said: “When you subscribe to a channel that enables you to watch a video, like Netflix, that's kind of the end of the monetization cycle that you have with that piece of content. In gaming it's the opposite: there are items that you can buy in the game, there are extensions you can buy, there's a next franchise you can purchase, there are other genres that you can leap to.” (Perhaps this is partly why Game Pass doesn’t do session or download/based bonuses as a matter of course, reserving it for the top tranche of games?)

Which is all to say: I hope & presume that how sub platforms evaluate games isn’t going to solely favor high-retention games - or games that can afford to give the platform a good deal, because they’ll make money on IAP/upsell. (Luckily, I think the cost of indie titles allows for the appearance of a lot of smaller but interesting games?)

And we now know a little bit more about Netflix’s approach. It takes into account the ‘value’ of the viewer, and has multiple views of success - some based on the cost of the original media. I’m a fan of metrics (did you notice?) But let’s use the right ones to ensure the correct amount of content diversity in this exciting (?) new era… We don’t want to get to the ‘Computer Says No’ era of game sub A&R, after all.

The game discovery news round-up..

And so we reach the final part of this newsletter. The bit where I usher you to the darkened links basement and project information into your poor skulls until you cry ‘no, Sir! Enough! Lead me from this place! I need fresh air!’ Infotransfer starts… now:

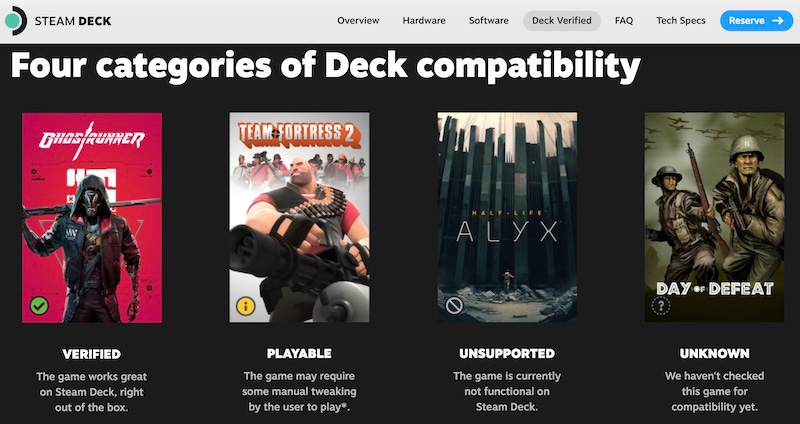

Fresh from the Valve ideas factory comes the ‘Verified on Steam Deck program’, a smart/logical extension of the ‘all Steam games will play on Steam Deck - but how well will they play?’ question. There’s an explanatory video for devs - that’s you - on the Steamworks YouTube channel, plus this RPS interview where it’s explained: “Valve is putting significant effort into this review program. We've hired an additional group of testers specifically for Steam Deck compatibility.”

Good PlayStation 5 news via Shu Yoshida’s Twitter feed - “[the] PS Store on PS5 now has a "New Game" strand on top page, making it super easy to find newly released games.” PS5 discovery still a work in progress - some interesting replies in here like: “I’d really most love to see pre-orders separated from actually available now, and DLCs grouped into a folder for the required game instead of spread out all over sale items like some desperate publisher bid for maximum coverage.” But it’s improving!

We all know we like Discord here, but liked this Vice piece, ‘Game Developers Say It Helps When Fans Realize They’re Human’, because that’s… a lot of the point! As Astroneer’s Joe Tirado says in the piece: “I was looking for any way to make sure that people understood, we are humans, we sometimes make mistakes, but we're trying our best to do the right thing.”

Since the last round-up, Nintendo’s Animal Crossing Direct revealed its Switch Online Expansion Pack subscription has N64 games, Genesis games, and.. an Animal Crossing expansion? (You can also get the Animal Crossing DLC standalone for $25.) This makes DLC-related game logic if you unsub messy, for one. And it also doesn’t smack of ‘Nintendo has a holistic, explainable plan for this whole subscription thing’. But hey, baby steps for the Big N?

If you make video games, you probably want feedback. Which is why this Derek Yu blog post, ‘Indie game dev: getting feedback’ is worth reading. As Derek says: “It’s a surprisingly tricky… topic, that not only touches on marketing… but also the complicated relationships between artist and audience, games and "fun", etc. Everyone brings their own unique experiences and expectations about games when they give feedback and it can often be contradictory. Who should you listen to?”

Just checking in on the Valve x crypto news you probably spotted already, Steam has banned games which are “built on blockchain technology that issue or allow exchange of cryptocurrencies or NFTs”, whereas Epic will “welcome games that use blockchain tech”, but, per Tim Sweeney, “we aren't touching NFTs”. Alrighty, then.

News from the generally predictable NPD U.S. hardware sales charts - PlayStation 5 outsold the Switch in September 2021, wowzers. (NPD’s Mat Piscatella sez: “November 2018 was the last month a platform other than Nintendo Switch led the market in unit sales (PlayStation 4).”) But with supply issues around both consoles and the Switch OLED debuting in October, real trends may be tricky to extrapolate.

More ‘TikTok is great’ propaganda - Among Us’ Victoria Tran is helping out unpacking game, uhh, Unpacking, and has a Twitter thread with associated Steam wishlist stats showing that “their toilet paper TikTok went viral (1.3 million views in a week)… Before [that], our highest vid count was 500k, and we teetered around 5k - 30k views for every vid… [that] video doubled our [TikTok] followers from 10k -> 20k.” Yo, s’impressive.

Microlinks: want to win the alphabet wars on the Switch eShop? Try calling your game ‘a’, or ‘AAA Clock’, I guess?; the Independent Games Festival has more than 400 entries this year; here’s a fun teardown of the Switch OLED, if you wanna see what’s inside.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]