Deep dive: inside Strange Horticulture's delightful Steam success

Cozy puzzle detective games for the win.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the working week, folks. And I’m also grinning and waving to all of you attending GDC this week in San Francisco - sounds like it’s going to be a busy one. In the meantime, we’ll be keeping you well-stocked for newsletters.

Oh, random ‘music while working’ mix suggestion to start your week? This early jungle mix from LDLN on NTS, inspired by the exhibit Sweet Harmony: Radio, Rave & Waltham Forest, 1989-1994, is great if you dig proto-UK drum and bass. (If you want something more downtempo, may I recommend Mixmaster Morris’ Mixcloud?)

[FYI: we’re still doing a 30% off the first year of GameDiscoverCo Plus deal for the next 30 paid subs. You get data-rich exclusive newsletters (what’s really selling and why?), custom Steam/console charts to rank and data-export, two eBooks, a member-only Discord & more.]

Strange Horticulture - behind its Steam success?

We’ve recently been talking to Erik Schreuder, CEO of indie publisher Iceberg Interactive - and we’re delighted to share insights and outcomes from the late January 2022 release of the Bad Viking-developed ‘occult puzzle game’ Strange Horticulture on Steam/PC, which has racked up almost 1,700 Overwhelmingly Positive Steam reviews since then.

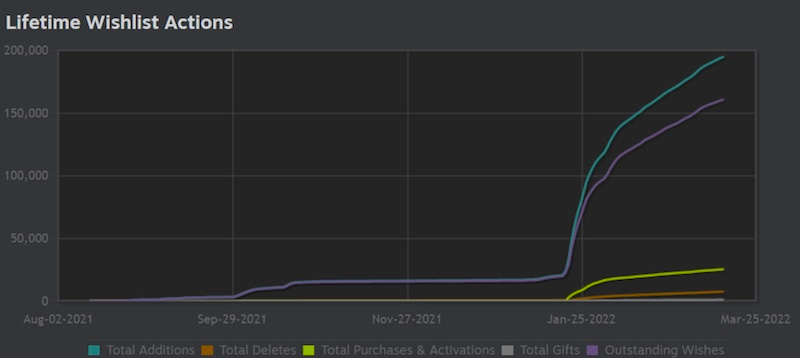

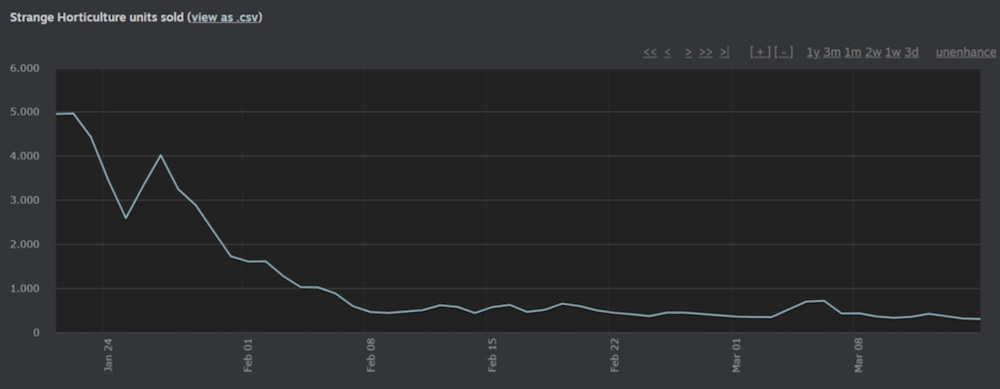

The game was sitting at around 20,000 Steam wishlists at launch. But what’s been really impressive is its first-week results (about 5x as good as median, according to our Plus data), and its long term sales. It’s now the 18th best performing new January 2022 title by total Steam reviews to date - which is great for such a small title.

The game was made by a two brothers based in the UK, whom GameDeveloper.com got to discuss the creation of the game just after its debut, btw. (They’ve been making Flash games like Bad Eggs Online for almost a decade before creating this, so have a lot of experience shipping titles!)

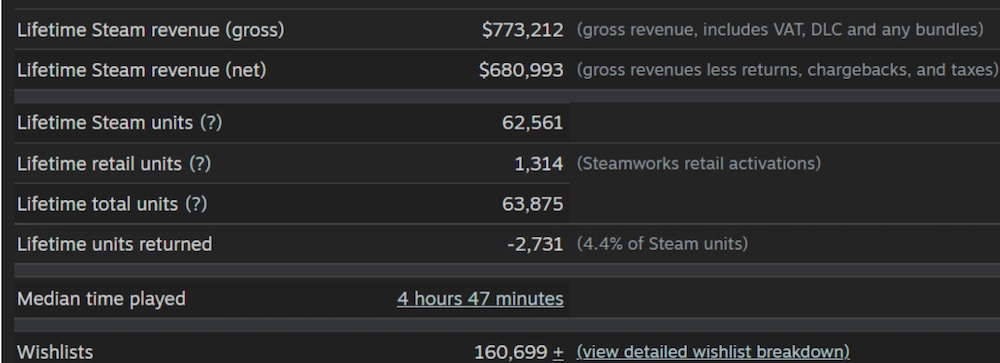

Anyhow, Erik from Iceberg was kind enough to share both lifetime Steam revenue to date (below), as well as talk pre-release wins & lots more in the below Q&A. Let’s go:

Q: When you signed this title, what things specifically appealed to you about it? Why did you think it might do well on Steam?

Erik: Strange Horticulture had a really great demo. The art is adorable, the characters are charming and the mystery is really intriguing. It’s also an oddly relaxing game that captures the vibes of tabletop classic like Sherlock Holmes: Consulting Detective, a real rainy-day experience with a wonderful pace, we just loved it.

In commercial terms, the game gave us a bit of a Potion Craft vibe, which is a great market to tap into, as well as elements of other favorites of the team, such as Papers Please. We felt it was destined to be a success - in fact, we can't remember a time when the entire team was so in agreement about a title.

Q: How do you feel about the Next Fest inclusion for the game, and Next Fest in general for your games? Was that a major reason why the game picked up interest - the demo?

Honestly, we’re a bit mixed now about Next Fest. When Steam started to run these events in 2020 they were fantastic. We saw a lot of engagement across all our participating titles - store visits, wishlists, and follower. In some cases, this was well beyond the other digital events we did during the pandemic.

However, we’re finding each event is worse than the last across these metrics - likely due to both too many games participating, and less excitement from audiences to really get engaged. October traditionally and this February in particular were busy periods, with more exciting AAA releases to soak up the limited attention.

Strange Horticulture was an outlier though, and did perform well during the October ‘21 Next Fest. But that was more thanks to the external traffic generated by a very positive Rock Paper Shotgun feature than through the event itself.

That said, we can credit the demo (which we premiered at Gamescom) for catching the eye of RPS originally. This opened the door for us to send them a bigger preview build with an embargo timed for Next Fest. So the demo was critical - but we could debate if Next Fest in particular is a reason for our success.

Q: Is there anything specific about the community management or marketing for this game that you think helped?

On the surface we think Strange Horticulture is a wonderfully “hooky” game. It has superficial qualities that aren’t played out and generic, but are still quite universal and have a strong audience appeal. Books, cats, plants, old maps - they gave us a lot to work with in our marketing to stand apart, and to help target our messaging at different and diverse communities.

We wanted to reach folks on Reddit, but had our doubts about development-focused subreddits like r/indiedev and the like. Sure, a pretty gif of the map unfurling might have performed well, but it wasn't exactly the audience we were trying to reach.

Instead, we focused on subreddits like r/MapPorn, r/ImaginaryMaps, r/IndoorGarden, and r/Houseplants (above). We wanted to make sure our posts reached people who would 'get' the beauty of Strange Horticulture, rather than throwing stuff at every proverbial wall and seeing what sticks.

A big factor in this, though, was authenticity. Bad Viking’s Rob, who was the one posting on Reddit, genuinely enjoyed using the site, and would also post random pictures of his plants and terrarium. It helps when you can show you're a part of a community, rather than using it for self-promotion.

After launch, we continue to monitor mentions of the game through F5bot, occasionally popping into threads. The game is even mentioned on D&D subreddits, urging DMs to pick it up and use its puzzles and plants in their own games.

Q: Directly after release, the game seems to have done very well vs. expectations. We have its first week 'Hype to Reality' score as about 5x as good as a normal game. Were there things directly after release that you can point to?

Following her preview in October, Alice Bell from Rock Paper Shotgun recommended the game in a full review at launch. After that we started to get love from many more press outlets - helped in part by being able to send review keys out more than a month ahead of launch, which isn’t very typical.

The game was released in January, and before the December holiday, we sent out keys to press and gave them a longer time to review the game than we normally do. We were lucky that the developers were completely ready in time to allow us to do so, and that the game was relaxing and cozy to play over a holiday.

As a publisher, we’ve never had a true Game of the Year contender, and that’s what this is. It’s still one of the best reviewed PC games of 2022 so far, even after an especially fruitful Q1 for quality releases. It’s also important that the actual players agreed with the press, quickly voting the game into Outstandingly Positive on Steam, which has perpetuated our visibility and sales there for much longer than usual.

Launching on a Friday also served us very well. It can be a double-edged sword - the downside, of course, being that your first couple days after launch are stressful as any bugs need to be addressed quickly.

On the other hand, the larger Friday crowd on Steam can potentially boost initial sales enough to keep a game in the New & Trending section on the front page, which turned into a positive algorithm feedback loop that worked very well for Strange Horticulture. Of course, the more games that do this, the less often it will work!

Q: The game seems to have good long-term 'word of mouth' support. Why do you think that is?

Strange Horticulture is so cozy. It’s relaxing, but has an intense buildup and a feeling that something dark is just around the corner. The puzzles are not necessarily difficult, though every time they feel rewarding to complete. There is no time pressure and failure just makes you want to go back and try again. Solving a mystery or objective gets more rewarding as the story branches deeper, and the player is introduced to new personalities, locations and plants.

The game has a very strong theme, and that helps people identify friends and family members who would enjoy it. Everyone knows someone who would enjoy running an occult plant shop, whether they are into Harry Potter and other whimsical fantasy media, or are just big fans of plants.

You won't believe the sheer amount of people with "cat dad" or "plant mom" in their Twitter bios, tagging other plant and cat parents because they were 100% convinced they'd love Strange Horticulture too!

We got a bit lucky as well with a current trend that seems to be just ramping up, in cozy witchy games. Strange Horticulture (as well as Potion Craft and Songs of Glimmerwick, for example) was perfectly positioned to appeal to fans of this content. And right now, as we’re all recovering from 2+ years of the COVID pandemic and other global stressors, a bit of magical cozy escapism is just what we all need.

[Thanks to Erik and the Bad Viking crew for letting us chat. We think the game’s doing so great - and it’ll easily sell 250,000-500,000+ units over time - because it’s incredibly well made, feels high-value, and as they say, has the right vibe and genre for the right time. Congrats.]

Dispatches from GameDiscoveryLand.. c. 2009?

Looking back into the deep, dark history of digital console/mobile and PC game sales, we found an interesting artifact. Can you believe that some idiot was trying to estimate these sales all the way back in 2009? And it was… me. (*muted applause*)

Somebody pointed out that a couple of my old GDC presentations were still available over on Slideshare. And so I made this GDC 2009 presentation, ‘Independent Games Sales & Stats 101’, available in slide form via Google Drive.

This is interesting and fun because heck, it was early times for digital console and mobile games. Xbox Live Arcade - as it was called then - was fairly new, and even iPhone had only launched in June 2007. Some takeaways from the slides:

Oh, the lack of digital games! There were only 60 downloadable games total (?!) on PlayStation 3 in early 2009 & very few were not via first-party or big publishers. And just 196 Xbox Live Arcade games overall, all of which had compulsory free demos (remember that?)

We even have leaderboard-derived XBLA sales estimates for 2009, which are fascinating in hindsight: “R-Type Dimensions = 40,000 units, Castle Crashers = 553,000 units, Braid = 278,000 units, Penny Arcade Adventures Vol. 2 = 17,000 units, Space Giraffe = 24,000 units, N+ = 229,000 units.” This was with ‘only’ 28 million Xbox 360s sold at the time, btw - but a relative lack of XBLA releases.

As for the iPhone, this was before F2P took over, of course. On the high end, the stats were pretty good: “iShoot was #1 in the App Store on January 11th 2009 with 17,000 downloads at $2.99 each - in one day - [which was] $35,700 to the developer.” But the open platform made success trickier: “Of 25+ daily games, speaking to iPhone indie developers and looking online, I estimate only 1-2 sell more than v.low hundreds of copies.”

So there you go. Oh, and this was even early for Steam itself. This is why it’s listed as a ‘core’ PC game portal alongside things like Direct2Drive (!), and direct selling PC games via your own website was still discussed first in the slides. Ah, halcyon days…

(There’s also a wider GDC China 2009 slide set of mine, for ‘Independent Games In The West - Market Trends’ that I also ported to GDrive - the source of the above image.)

The game discovery news round-up..

Time to go through the notable game platform and discovery news since the last time we caught up, eh? And one thing that we particularly wanted to highlight to kick off was Epic’s very generous pledge to donate all Fortnite proceeds from March 20th to April 3rd to Ukraine relief. Wow.

Look, it’s already $36 million after just one day - so who knows how high it will go? The Epic/Fortnite team absolutely did not have to be so generous, but they did - and I hope we all take note and think about how we can do better too. Onward:

Leading the ‘we love charts with numbers’ news for this week is Ars Technica’s Kyle Orland trying to rank Elden Ring’s launch against other major games (above). There’s multiple charts in there - we just extracted the longer-term one. Also: “As far as FromSoftware's recent catalog is concerned, Elden Ring is already in a class by itself… [it] has outsold each individual game in the Demon's/Dark Souls series, as well as… spiritual successors Bloodborne and Sekiro: Shadows Die Twice.”

The subject of ‘are publishers responsible for making sure the developers they’ve signed have a healthy workplace environment?’ came up loud and clear twice late last week - both in this video discussing Mountains, Fullbright and Funomena, and this article on Moon Studios. (The primary responsibility is the dev studio itself. But thinking about checks and balances at a funder level is also good.)

VGInsights tried some high-level number crunching in asking what we can learn from higher-grossing games on Steam. Not sure I agree with all of these, because there’s so much data to wade through here. But some like ‘top developers pick the right genres’ and ‘successful developers specialize’ are things we can wholeheartedly agree with.

In Steam Deck and Xbox news, two of the most functional platform dev teams combined “to bring support for Xbox Cloud Gaming (Beta) with Xbox Game Pass Ultimate through Microsoft Edge Beta for the Steam Deck.” Good stuff, and Ars Technica tested it out, noting: “both Stadia and Xbox Cloud Gaming performed admirably via a wireless 5GHz Wi-Fi signal in terms of both image quality and button-tap latency.”

Publisher/funder notes: funder (and NOT publisher) Kowloon Nights is still funding new games, and hit $150m in lifetime revenue on the back of Sifu’s success; Humble Games actually bought the Monaco IP and is funding a sequel, showing the continued publisher move to boost company value via owned IP.

Some interesting Game Pass data - the /ID@Xbox Game Showcase via Twitch had some great-looking titles last week, with a fairly large percent also coming to Game Pass. There were both multi-title Game Pass deal showcases (Fellow Traveller) and surprise ‘it’s out and it’s on Game Pass right now!’ (Tunic) reveals in there. Seems like Game Pass content marketing is getting more sophisticated.

Ubisoft made a cloud announcement, but it’s not cloud streaming for players. It’s Ubisoft Scalar, which is “a new foundational technology that enables Ubisoft titles to utilize the power of the cloud to ensure that developers aren’t limited by time or hardware.” Only for internal Ubisoft studios, but promises “more players in a single shared world”, as “the processing power for a game isn’t tied to a single machine, but a decentralized computation system.”

As game subscription services continue to grow, they will use metrics - sometimes changing metrics - to decide what games to commission and fund. The mid-2020 Apple Arcade pivot is a great example of this. Which is why I read this post-cancellation interview with the Netflix ‘Baby-Sitters Club’ TV producer with interest: “When you only have your numbers in a vacuum and you don’t know the numbers of anything else, you don’t know what you’re trying to hit.” Different media and model, but lots of interesting questions raised.

Finally, we Tweeted this at the weekend, but below is a slightly updated version. It’s our GameDiscoverCo Plus-exclusive monthly Steam chart, showing the best-performing new games of March 2022 on Steam - time-adjusted for total reviews in Week 1. Gives you a good idea of trends and performance:

Three minor caveats/details, btw. 1. F2P games are excluded. 2. Any game with a red * hasn’t finished its first week yet, so will rise in the rankings further. 3. The ‘Hype Score to First Week Ratio’ figure is based on pre-release Hype (followers, wishlist ranking, etc), with an approximate median of 0.15 for medium/larger games. Data!

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]