Deep dive: Devolver's indie publisher biz, poked at

With info handily provided by the company itself...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

A joyous Wednesday to you all, crew. It’s a busy one, given it’s one of the last full weeks before businesses start slowing down for the holidays. (We’ll continue a full set of newsletters until the end of next week, and then largely shut down until 2022, btw.)

Today’s newsletter leads off with analysis of some data that’s been out there in the wild for a few weeks, but we haven’t seen reported in significant depth, besides this mention. So we thought - we’re in charge here, why not go deeper on Devolver?

[PSA: membership of our GameDiscoverCo Plus paid subscription costs only $12 a month if you sign up for a year. It includes an exclusive weekly Plus newsletter, an info-filled Discord, a data-exportable Steam Hype back-end, two high-quality eBooks, & lots more - hop aboard!]

Devolver’s public listing takes us under the hood!

Many of you are probably aware that Inscryption, Death’s Door and Loop Hero publisher Devolver floated on AIM, the ‘alternative investment market’ for the London Stock Exchange, about a month ago. This valued the company at $950 million (!), and was generally well-received.

We talked about the game company ‘stock bubble’ about a year ago in certain markets such as the UK’s AIM, Sweden, and Poland, and it still seems fairly strong. Although maybe the honeymoon is over somewhat, with Frontier taking a stock price dive on recent poorer results, and EG7’s shares also on the way down recently.

But there’s still opportunities for strong firms like Devolver. And in order to list in the UK, Devolver had to produce a gigantic 186-page document [.PDF link] for regulatory and investor reasons, laying out its strategy in painstaking detail.

We’re not necessarily going to go deep on the raw finances. But there’s some amazing behind the scenes data in here. And we’re going to pick up the things you may care about most from a discovery point of view. As follows:

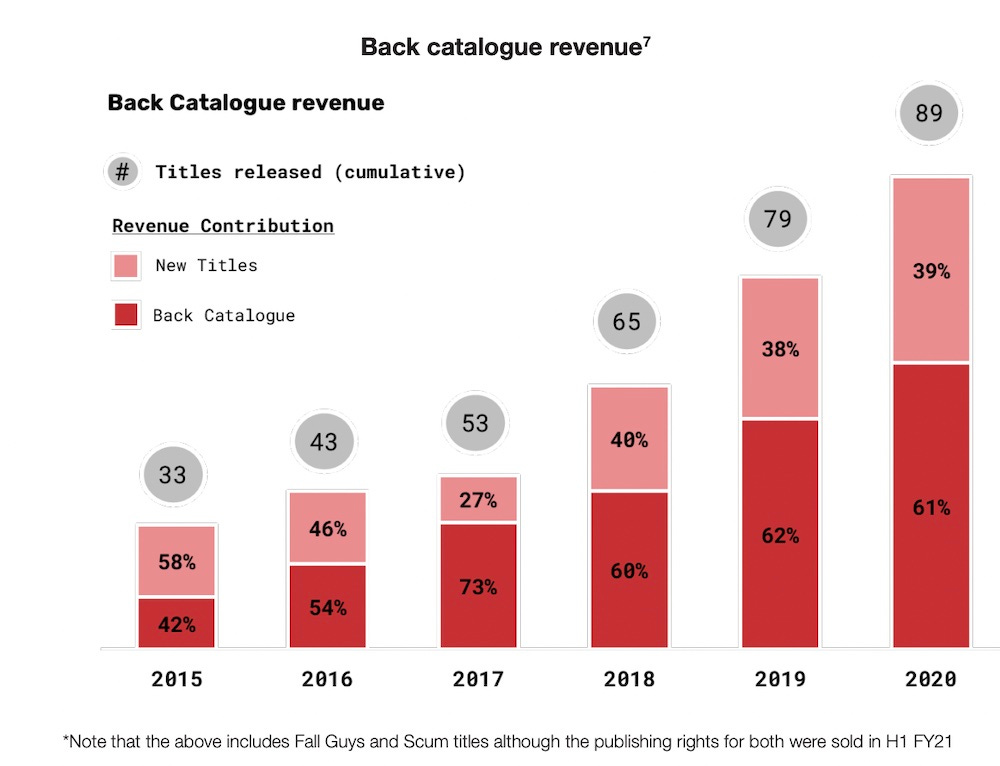

Back catalog is a big deal for Devolver

In recent years, at least 60% of Devolver’s revenue has been from games released in previous years, even though they don’t push IAP particularly hard in their games. So a lot of this is catalog sales, discounts, new DLC that sells the main game..

(The exception for Devolver was Fall Guys, which blew up gigantic in the late 2020/early 2021 time frame, before Mediatonic sold to Epic in March 2021. Devolver sold the publishing rights to Epic at the same time for “a confidential cash sum”. I see ‘other income’ in 2021 as $115 million, and I think that relates to the sale of both the Fall Guys and Scum IPs.)

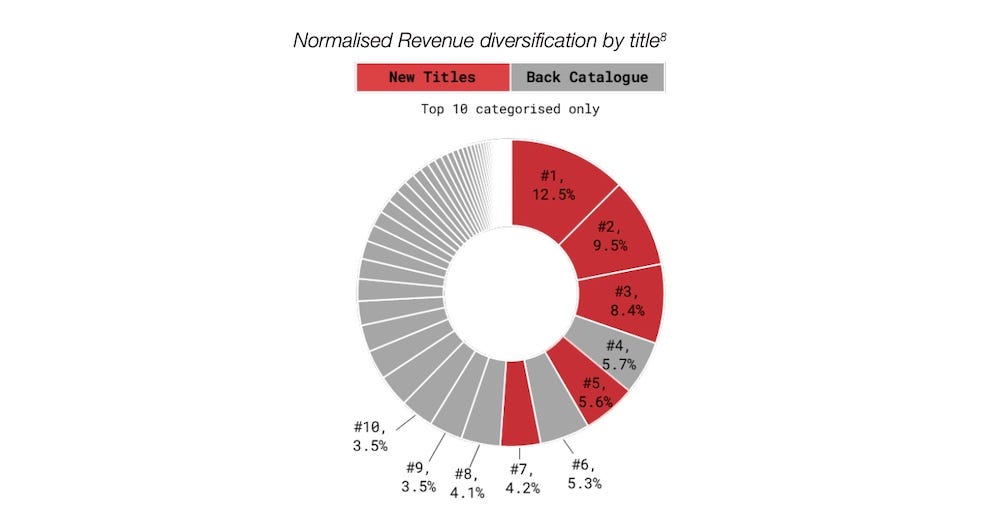

Revenue diversification per game - it’s pretty diverse!

Devolver also showed how diversified they’ve managed to get their portfolio over time: “In the twelve-month period ended 31 December 2020, normalised sales* from the top 5 performing titles contributed approximately 41.3% to total revenue, with the remaining titles in the portfolio contributing approximately 58.7%.”

So with $71 million in revenue for that year, you can see that the top game grossed about $8.9 million, the second title around $6.7 million, the third one $5.95 million, and so on. It certainly is fairly spread out compared to publishers who are powered by two or three games.

(*One weird thing - Fall Guys blew up SO big that it was skewing all the graphs. So Devolver invented a ‘normalised’ financial setup for 2020, which is basically ‘what if Fall Guys just did our expected budget numbers?’ That removed $140 million (!) in revenue from 2020. So that’s why you don’t see Fall Guys taking up 80 or 90% of the above chart.)

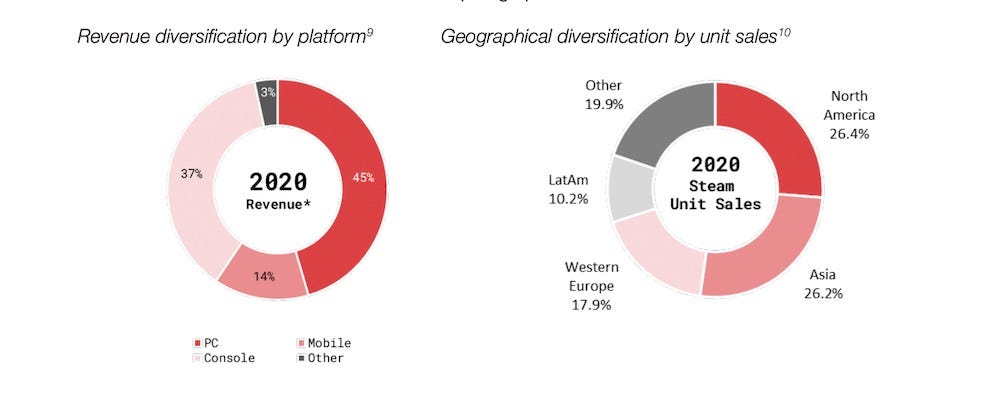

Platform & geographical diversity: Fall Guys-optimized?

There’s also some interesting info on ‘normalised’ budget platform spread - with 45.5% of revenue from PC, 37.2% from console, 14.0% from mobile and 3.3% other in the twelve-month period ended 31st December 2020. Devolver says: “In contrast, the year ended 31st December 2018 saw 65.4% from PC, 29.1% from console and 5.4%. from mobile.” I do wonder how much of 2020’s shift is still Fall Guys-related, even at ‘expected’ budget… But clearly, console split is improving somewhat.

The company also provided their geographical split on the often ‘very global’ Steam above, which is interesting and largely shows the global strength of Steam.

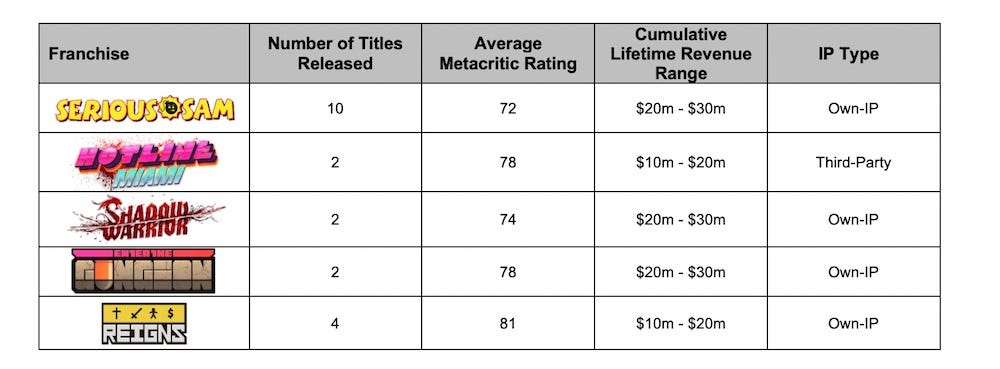

A swift switch to owned-IP is paying off?

Historically, I don’t think that Devolver was keen on owning its developers. But suddenly, top developers are in a lot of demand. And as a publisher in 2021, if you don’t buy your top devs you’ve worked with repeatedly, somebody else may. (Flying Wild Hog, who is a Devolver partner repeatedly on the Shadow Warrior games & other titles, recently got bought by Embracer/Koch, as one example.)

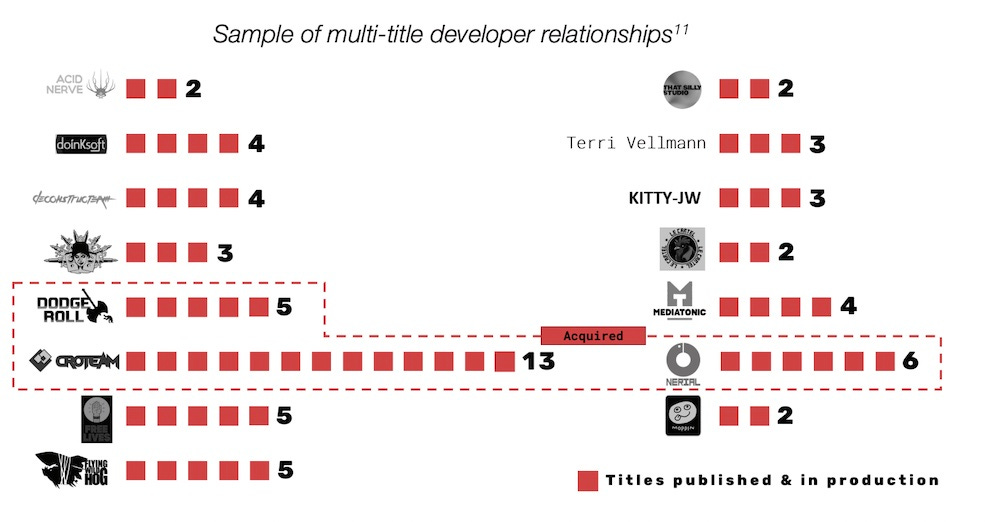

And luckily, the excess profit generated by Fall Guys - $70 million in 2020 alone - allowed the company to buy Croteam (Serious Sam), Nerial (Reigns), Firefly Studios (Stronghold) and Dodge Roll (Enter The Gungeon) - as well as publisher Good Shepherd. Which leads to the above figure, showing the company’s multi-title franchises, and which can be classed ‘own IP’*.

An interesting stat here, btw: “Each franchise provides long-term revenue generation beyond the first two years post-release. For example, Enter the Gungeon, which was released in May 2016, generated 70% of its total cumulative revenue from 2018 to 2020.” Impressivo.

And Devolver has been a particularly human company in the past, so I did appreciate this section: “The Directors believe that Devolver has unique multi-title long-term relationships with developers, who return to Devolver for title after title. For many, Devolver has published all of their games. Importantly, Devolver does not demand IP or sequel rights.”

It’s funny to see the above ‘does not demand IP’ statement, since Devolver may actually need to buy its top developers and IP/franchises just to keep working with them. Otherwise, others may buy them.

But to be fair, acquiring devs & their IP together is intended to be a mutually beneficial thing - especially given the high prices that these publicly floated publishers like Devolver can pay. (As opposed to the brutal ‘we own your IP’ work for hire deals of the past.) So I see what they are saying on IP - and I appreciate it.

Finally, this statement from the intro to the giant .PDF - the most interesting parts are from Pages 26 to 42, btw - obviously struck a chord, since we run, uhh, GameDiscoverCo:

“Developers need help to be discovered as title release volume is increasing, driven by the lower barriers of entry to development which digital distribution provides. The number of titles released on Steam annually has grown from 285 in 2009 to 9,692 in 2020. The growing number of developers releasing titles across a broader set of platforms makes it increasingly difficult for studios to differentiate their games to distributors and gamers.” Nuff said.

Steam Next Fest: more data on how it works?

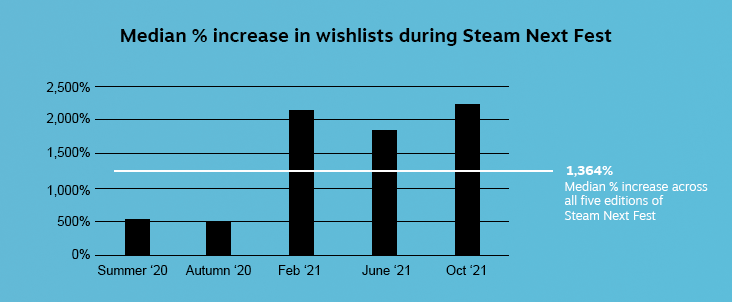

Not sure if you spotted, but Valve put out a new Steam Next Fest-related stats post last week, and it’s got some impressive stats. The above graph explains it pretty well. But just summarizing the main points that the Steam team was keen to get across:

More people wishlist if your game is in Next Fest: “Among 2020 and 2021 Next Fest participants, the median game saw daily wishlist additions jump 1,364% during the fest, compared to the two weeks leading up to the event.”

Wishlists continued after the event: “The rate of wishlisting remained elevated for the majority of games even after Next Fest ended, with the median game seeing a 26% increase in daily wishlist additions in the three weeks following Next Fest compared with the two weeks prior to the event.”

Wishlists made during the Fest still converted: “The median released game saw an increase of 500% in "converting wishlists" made during Next Fest compared to converting wishlist additions made in the two weeks leading to Next Fest.”

So here’s what I take away from this. Firstly, Next Fests are an important part of your arsenal, because they increase your base Steam wishlist rate radically. And - guess what - a chunk of those folks will convert to sales?

But what a Next Fest isn’t going to do is shift your game from a nothingburger to a must-play title. (Or at least, that’s not very common!) And it won’t necessarily boost the high-level launch conversion percentage of your title. People either want to pay $20 for it in the end, or they don’t.

But.. doesn’t mean you shouldn’t try this old-fashioned ‘promotional opportunity’. And the pre-release feedback you can get on your game’s quality and longevity can help you shape a more winning title, long-term.

Finally, it’s intriguing to see the 2021 Fests performing sharply better, Valve notes: “we changed the participation rules to limit developers to only one fest per year. This might mean that developers wait longer to participate, and only do so when they have a more polished game to present that converts better.” I also wonder if recent Next Fests are discussed more by streamers, media sites, etc, so have higher public interest because of that?

The game discovery news round-up..

And we come to the end of the newsletter, it’s time to look further afield, and poke around at the bigger stories in the game platform and discovery space. Of which there are, once more, quite a lot:

One follow-up from Monday’s discussion of PlayStation Plus’ imminent expansion? A couple of people pointed out that Sony has bought out anime streaming service Crunchyroll, and Eurogamer rumored back in August: “there are also plans to potentially offer Crunchyroll as part of a more expensive premium PlayStation Plus offering.” Could this be part of the package eventually, too?

What’s really going to happen with physical game events in 2022? The Game Conference Guide newsletter tries to work it out, and they believe we may see: “…stronger regional focus, important for discoverability and [an] attractive proposition for scouts and business developers flocking into uncharted events and less-travelled countries.” With GDC definitely a large international nexus, but not quite at previous-year highs.

Over on the Plus newsletter, we’ve been tracking the surprise-ish Steam success of Myth Of Empires, a Chinese-made Ark: Survival Evolved-type sandbox game (28,000 CCU right now!) Well, turns out it’s literally based on (allegedly) stolen source code from Ark, and Valve has delisted it from Steam as a result. Didn’t see that one coming.

We intended to devote a newsletter to the subculture of Steam Trading Card farming & badge crafting, but haven’t quite managed it yet. But this Ars Technica piece on why 400,000 simultaneous Steam accounts started ‘playing’ Capcom Arcade Stadium the other week starts down the path of explaining what’s going on. Weird/interesting stuff!

As Kotaku notes: “A new challenger enters the handheld console market. The chip manufacturer Qualcomm partnered with gaming hardware company Razer to produce the Snapdragon G3x [pic, above], a streamer-friendly console that can play games across PC, mobile, consoles, and the cloud.” But it’s more like a ‘developer kit’ for Qualcomm to entice manufacturers in, rather than a full product announce. So we’ll see who can provide better styling (hopefully!) and features over time?

Yes, Ubisoft is adding NFT item drops to Ghost Recon Breakpoint - using ‘proof of stake’, so not as energy-destructive as normal crypto/NFTs. And yes, a lot of people are not happy about the whole thing, with claims that “the blockchain adds nothing to this experiment in "unique" cosmetic DLC.” I guess we’re probably in the ‘Forget it, Jake, it’s Chinatown’ mode with things like this nowadays? (The market will decide what’s working, over time.)

Here’s an interesting eShop change: “At the bottom of the Discover section of the [Nintendo eShop], you can now view games Trending By Play Time [listing] the games ‘with the longest average play time over the past two weeks’.” This is a slightly weird metric to expose, and “the list is dominated by JRPGs, with Disgaea 6: Defiance of Destiny at the top” and the new Pokemon games also a long way up there. Huh.

Microlinks: Google Stadia is now available directly on select LG WebOS Smart TVs; Xbox has a ‘Winter Game Fest’ with in-progress demos timed to The Game Awards; late-breaking news is that Apple gets a last-minute delay in complying with App Store changes, after appealing the Epic ruling.

Finally, I was volunteering over at the Video Game History Foundation HQ the other day, packaging up ‘Mystery Box’ vintage game magazines to send out. I ran into this copy of PC Gamer magazine from 1996 - and some things never change, eh?

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]