Case study: muscling The Riftbreaker's DLC to success

Some great learnings for a popular DLC to an already-popular game.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, for another week of poking at data and disgorging it in your general direction. (Yes, myself & my colleagues really love doing this, and it doesn’t feel like eating frogs at all… which is awesome?)

Before we start, shout-out to Newgrounds & open-source Flash emulator Ruffle for getting ActionScript 3 games like Wonderputt running without Flash being required. Dead platforms, working again? It’s the dream…

[We need your support! Sign up to help us fund our work via a GameDiscoverCo Plus paid subscription! This includes Friday’s PC/console game trend analysis newsletter, a big Steam ‘Hype’ & performance chart back-end, eBooks, a member-only Discord & more.]

Deep dive: The Riftbreaker’s Metal Terror DLC

So, you may remember we ran a 2020 interview with Pawel Lekki of EXOR Studios on how The Riftbreaker managed to get 250,000 wishlists up to that point, thanks to a combination of great-looking tech, unique selling proposition, and dogged marketing.

After the game came out in October 2021, we noted to our Plus subscribers: “14,000 CCUs right now for the hack & slash/tower defense hybrid, and 92% Positive rating (855 reviews) bodes well for the medium term. Should sell hundreds of thousands of units over time.”

We thought it was time to return to The Riftbreaker, now that it’s been out for almost a year. And in soliciting data from Pawel, we concentrated on the fascinating subject of DLC, since EXOR released The Riftbreaker: Metal Terror in July as a $10 add-on to the $30 game.

Firstly, we’d like to confirm that our ‘hundreds of thousands of units’ estimate at launch was correct. Pawel tells us The Riftbreaker had sold 383,000 copies on Steam at the point Metal Terror launched, and nearly 500,000 units across all platforms. (The game is also available on Xbox/PC Game Pass, where many more have played it.)

But onto Metal Terror, which is a large expansion for the original game, and launched alongside a big free content update for all owners of the game - a smart move. Pawel says “with full voiceovers and additional game endings, Metal Terror added roughly 20-30% new gameplay content compared to the base version of the game.” So… a decent size!

What’s interesting - and fairly rare - is that Metal Terror’s DLC itself got a very good amount of Steam wishlists from its May announce to July release. Look for yourself:

Pawel notes that the DLC had a ‘100 wishlist a day’ baseline, and reached almost 16,000 wishlists by the day before launch. The announcement day and related Steam post was the biggest boost - at nearly 2,000 wishlists.

But as you can see, other announcements - even including a delay when the team realized they “underestimated the number of changes that the expansion introduced into the base game”, actually led to increased interest. Pawel says: “The timing for that release window was a lot less favorable due to the Steam Summer Sale running at the beginning of July, but we felt that maintaining quality was more important.”

When the DLC came out in July, it launched with a Midweek Madness promotion from Steam and a 30% discount for the base game, meaning that interest spiked. And the DLC alone made it to #9 in the global ‘all SKUs’ Steam list on the day of release!

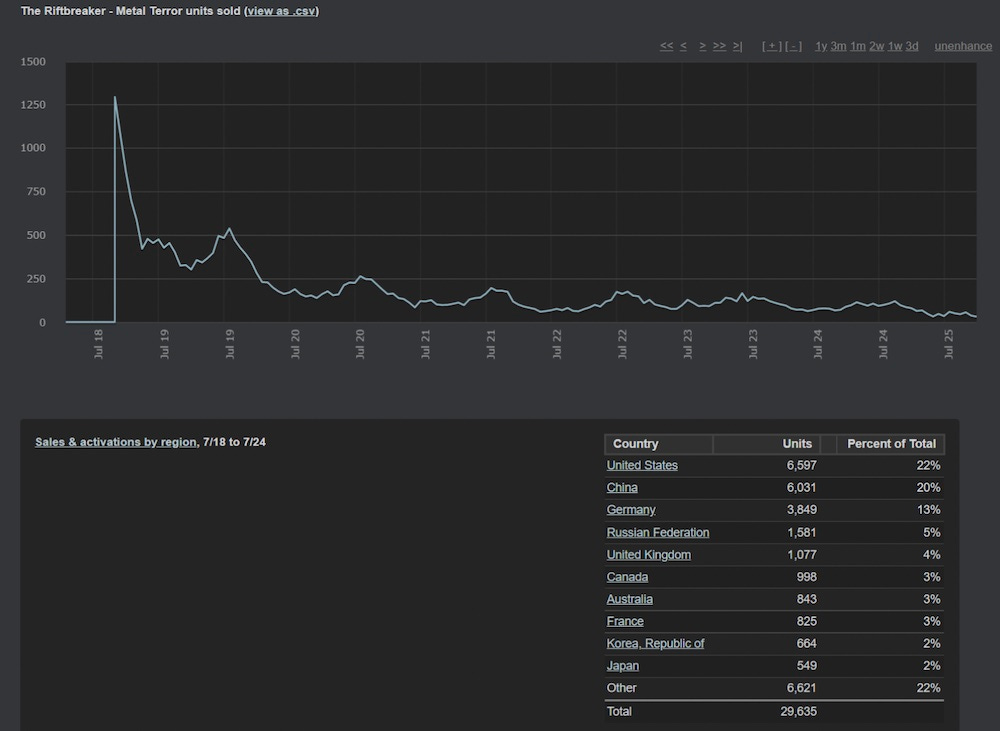

So, the Week 1 results for Metal Terror (above) were very strong - with almost 30,000 units sold. And The Riftbreaker: Metal Terror DLC has now sold more than 50,000 units, LTD. Some takeaways we spotted from the DLC launch:

Getting people to wishlist DLC on Steam can be difficult. But when they do, conversion rates are off-the-charts good! Pawel notes: “The statistic that surprised us the most is the 7-day conversion rate for the initial batch of [DLC launch] notifications. The base game’s 7-day conversion rate for initial wishlist notifications was 18.6%, while the DLC landed at 43.2% 7-day conversion rate.” Looks like DLC wishlists are truly a ‘reminder to buy’.

How about who bought the DLC vs. the base game? “When we compared our regional sales for the DLC against base game sales, the top 10 remained the same… [but] China’s sales percentage dropped from 29% to 21%. The pricing of the DLC was relatively the same as for all the other countries (base game $30/¥90 - DLC $10/¥30).”

It’s not a massive difference, but why was that? Pawel added: “We’ve noticed that the majority of negative reviews for the DLC were written in Chinese, and a portion of them claimed that they expected all additional content to be free. or that it was overpriced.” So there’s perhaps some cultural differences at play here.

Did the DLC exceed expectations? Yes: “I expected ~5% of total base game sales within the first month, which would be about 20,000 units, and I expected the DLC to show its full potential during sale events. The results that we achieved were higher than expected. The Metal Terror DLC sold 41,145 units within the first month, compared to 23,024 sales of the base game within the same time period.”

We’ve been seeing this overperformance recently with DLC on successful GaaS & continuously updated titles - e.g. the Total War: Warhammer III DLC. And The Riftbreaker has maintained its base game community adeptly. It’s had “more than 15 free updates that included new content additions, seasonal events, quality-of-life improvements, balancing changes, and various fixes.”

Thus, instead of DLC as simply a long-term yield improvement for new buyers, which we talked about in our July ‘paid DLC’ newsletter, it can become a real strengthening point for the whole ‘discovery story’ of the game - and you can make good $ from existing players, too.

On that subject, Pawel concluded: “I was very surprised about the ‘long tail’ effect, if we can talk about that at this point. Our ‘baseline’ revenue for The Riftbreaker increased by ~2x in comparison to baseline revenue before the launch of the DLC, and our concurrent user numbers are also visibly higher, post-update.” Excellent news all round.

Sales distribution of the game biz vs… books?

When we talk about this, well, very crowded/tight market for PC & console video games, it might a good idea to look into other industries, and… see how the sales distribution for creative titles works out there. Right?

Luckily, NPD BookScan’s Kristen McLean did exactly that for major publisher books in the U.S., via the comments of an analysis piece on the Penguin Random House x Simon & Schuster antitrust trial. (Look, antitrust consolidation drama in other industries, too!)

Obviously, this data doesn’t penetrate the eBook space, since Amazon owns and covets much of that data (boo). But from the 45,571 unique physically distributed books in 10 major book publishers’ frontlists (which means newly published, btw):

0.4% or 163 books sold 100,000 copies or more

0.7% or 320 books sold between 50,000-99,999 copies

2.2% or 1,015 books sold between 20,000-49,999 copies

3.4% or 1,572 books sold between 10,000-19,999 copies

5.5% or 2,518 books sold between 5,000-9,999 copies

21.6% or 9,863 books sold between 1,000-4,999 copies

51.4% or 23,419 sold between 12-999 copies

14.7% or 6,701 books sold under 12 copies

Some of these books might have been big sellers online - or poor sellers, haha - but that gives you a really good idea of the sales distribution curve, right? Only 6.7% of new books from the big publishers sold >10k units physically in the U.S….

Now, when we compare to games, VGInsights probably has some of the best estimated data on this - in this case for the first half of 2022 for all Steam games:

You can see the same general banding in effect as books - looks like only 4% of games grossed >$200k in their first few weeks/months on sale. And as VGI notes, “80% of the games released [in H1 2022] have made less than $5,000 in gross revenue” so far.

So - it’s a busy market, and only a smaller fraction of games (or books!) break through? Sure, that’s a facile message. But it’s definitely interesting to see that the shape of the curve is roughly the same here. (Even if visualized in different ways.)

The game discovery news round-up..

So let’s finish off today with a look at some of the burning game discovery platform and news we’re seeing out there. Let’s have a hack at it, y’all:

Some great context for how Switch-centric the Japanese console market has become, following a 3.45 million unit debut week (!!) for Splatoon 3? The above chart, which shows hardware (left) and retail software (right) sales from 2011 to 2022 for the country. (Wow, Nintendo’s console is dominant.)

We didn’t cover this drama last week, but yes, PlayStation’s CEO Jim Ryan did say: “Microsoft has only offered for Call of Duty to remain on PlayStation for three years after the current agreement between Activision and Sony ends… their proposal was inadequate on many levels and failed to take account of the impact on our gamers.” More antitrust maneuvering will ensure, of course…

Logitech is teasing its September 21st Logi Play event, which should include an official announce of its collaboration with Tencent on its Logitech G Switch-like handheld, for which images have already leaked. (It also has Google Play store access and Chrome/YouTube apps, “alongside Xbox, Nvidia, and Steam icons” - will be interesting to see how it’s pitched, cloud gaming-wise.)

This is a year or two old, but Chucklefish (Starbound/Eastward) made a pretend pitch deck for Wargroove, as part of a ‘how to pitch us’ page, and we just happened upon it and found it very helpful. (Other PC/console indie-ish pitch decks available here and here.)

Just Netflix things: so Netflix and Ubisoft are collaborating with Netflix-exclusive (timed? permanent?) Valiant Hearts, Mighty Quest & Assassin’s Creed titles, we also note Alto Adventure’s dev Snowman launched Lucky Luna on iOS/Android with Netflix login. Here’s all the Netflix titles on Android so far, btw, if you just want to poke around.

Microlinks: “the future of Fortnite is in the hands of its players” via Creative Mode; the Oct. 11th Meta Connect 2022 virtual event promises more about the Quest Pro, if you didn’t find one in your hotel room; the Game Maker’s Sketchbook competition is open until Oct. 17th, for artists looking for peer recognition.

Sure, Disney+ isn’t a ‘game platform’, but there’s an AR-enabled short film that makes a waterfall come out of your TV, plus CEO Bob Chapek saying of Disney+ that “we have.. an opportunity to turn what was a movie-service platform to an experiential platform and give them the ability to ride Haunted Mansion from a virtual standpoint.” (And also the D23 games showcase, though that’s not on Disney+. Yet? We see interactive convergence, long-term…)

How is ‘physical software related to video games?’ selling in the UK? The ERA’s latest data reveals Switch boxed games down 12% in 2022 so far to UKP 89 million, with PS4/PS5 games at UKP 80 million, and Xbox (Series & One) games at just UKP 18 million. (We did say that Xbox is slower in Europe, and it appears to have less collectors.) Vinyl music, tho? Up 12% to UKP 81 million!

Roblox is a big game/metaverse platform, and now it’s planning to “add age guidelines to its games and significantly expand its advertising business as it works to court an older demographic, expand its revenue streams, and still support the needs of its millions of young players.” Into The Metaverse also broke things down handily.

We now picture Matej Lancaric as the James Dean-esque young rebel of the F2P mobile game discovery space. If you can decode the acronyms*, we highly recommend you read things like ‘11 tips for killer user acquisition ops - Q3 version’ - and its precedessor - cos they’re the real deal. (*There are a LOT!)

Microlinks, Pt. 2: Sony’s new PS5 has been totally redesigned inside, is lighter and uses less power; Steam Deck repair centers are now online - though you can also use iFixit parts and do it yourself; Sony UK anti-competition lawsuit claimant's Reddit Ask Me Anything backfired.

Finally, we love French animator Kekeflipnote, and we love this 1993 interview with the Kirby team where the devs - Satoru Iwata, Shigeru Miyamoto & Masahiro Sakurai included - try to sketch Kirby. So when Keke decided to animate the results? Bliss:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]