Big get bigger: why Paradox is refocusing on its largest franchises

Also: all the Apple and Meta AR news you can shake a stick at & lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Goodness, is it another week already? And this one is pretty darn busy, with Apple keynotes starting things out, and ‘not-E3’ press conferences - here’s a schedule with local timezones, btw - kicking off on Thursday. So strap in, goblins.

This time out, our lead story involves us watching a three and a half hour long (!) Paradox presentation, so you don’t have to. Our new slogan? “GameDiscoverCo: we save you time, only to waste it again with meandering newsletter intro sections.” Score!

[PSA: get actionable info & talk to your peers via a GameDiscoverCo Plus paid subscription. This includes an exclusive Friday PC/console game trend analysis newsletter, a big Steam ‘Hype’ & performance chart back-end, eBooks, a member-only Discord & more.]

Inside Paradox’s growth & monetization strategy

We’re indebted to Game World Observer for writing up a recent Paradox Interactive investor ‘deep dive’ video, which is also available on YouTube, for those interested in watching the Cities: Skylines, Age Of Wonders & Crusader Kings publisher talk.

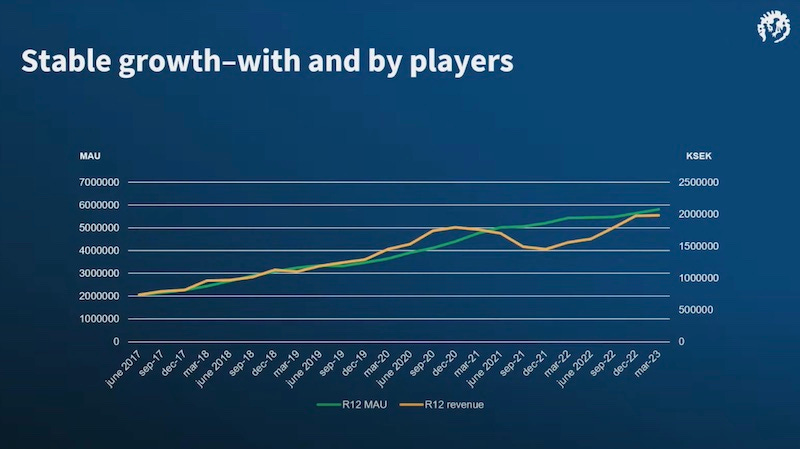

Paradox’s former and returning CEO Fredrik Wester led off the presentation, noting the PC strategy game-focused company has steadily grown MAU (monthly active users, in green), even as revenue (yellow) dipped - apparently due to lack of new releases - during the pandemic.

There are three pillars to Paradox’s strategy, per GWO: “Dig in: focusing on core brands and adding player value to already launched titles; Stock up: extend the existing franchises and producing new IPs by studios with a successful track record; Break out - finding promising games from [smaller] third-party teams in the market to help them grow.”

There’s a lot of depth in the multi-hour presentation. But just trying to surface some of the most interesting data points, based on a GameDiscoverCo watch:

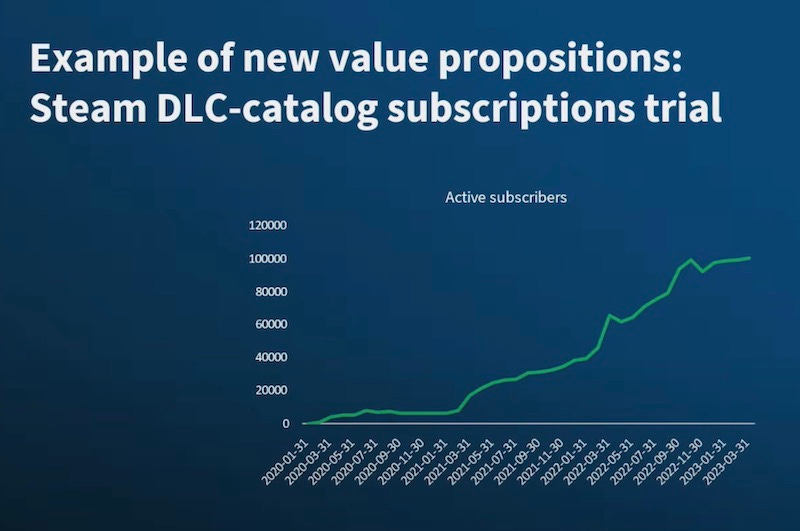

Paradox’s DLC subscription experimentation is going decently: Wester explains that “focusing on the games we already have live” and adding value is key. And “sometimes if you come late to a game”, the amount of DLC can be overwhelming, leading to this idea of ‘$5/month to get access to all DLC’, as tried on Crusader Kings 2 & other older titles.

The results so far for this experiment? Decent, but not gamechanging, with around 100,000 active subscribers a month across the entire Paradox catalog on Steam:

Paradox Arc is a different play on a third-party publisher: Wester said they’re spending $7-$9m per year on the newly launched Arc, and it’s an attempt to “find super-promising games in the market” from smaller developers, and make them “break out”. But there are some significant differences here.

Firstly, Wester says they will ‘cancel’ (unsure if this means shut down before or after launch, or just mothball/hand back control to dev?) 60-80% of the Paradox Arc titles they sign, only keeping the ones with super-strong momentum. And the deal breaker is “is player retention good?”, naturally. (Mechabellum is a promising new Arc title, btw.)

Secondly, we’ve heard from multiple parties that Paradox Arc contracts with third party devs can be generous $-wise, but include the option for Paradox to take over the IP of the game if it’s extremely successful. (That’s fairly rare elsewhere in third-party publishing right now.) So we’ll see what they end up signing over time!

Paradox considers itself to have a 71% ‘hit rate’: this interesting graph (above) has various levels of success, from Misses through Break-Even to Profitable, all the way to ‘Endless’, which is basically a mega-hit that keeps making good money for ever.

There’s some unsurprising things in here - Empire Of Sin, unfortunately, being a ‘Miss’, for example. And in recent times, looks like the Shadowrun Trilogy console/remaster roll-up is the ‘eh’ break-even investment for Paradox.

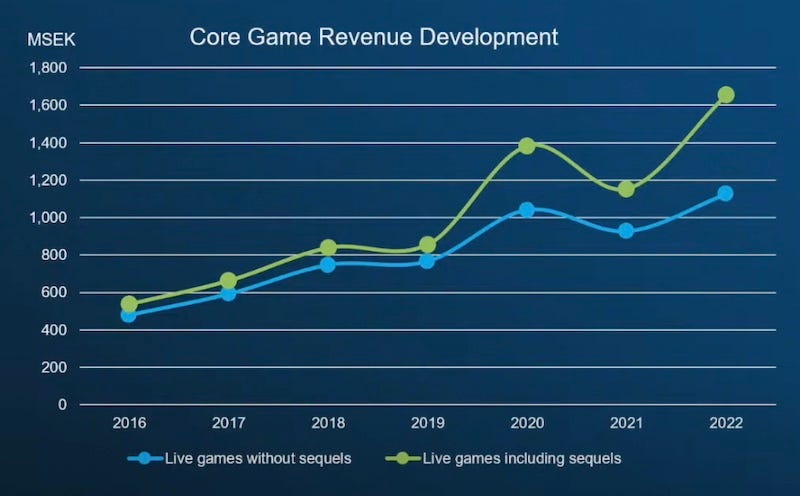

Core game revenue grows without sequels - but even better with? The crux of the presentation? Near the end of the ‘deep dive’, Paradox CFO Alexander Bricca talked about how the ‘perennial’ Paradox hits are those really fueling its growth.

As he noted, there are almost always five Paradox franchises atop the company’s top-grossing list for any given quarter: Stellaris, Cities: Skylines, Crusader Kings, Europa Universalis, and Hearts Of Iron. And from 2016 to 2022, only one of those franchises has got a ‘true’ sequel - Crusader Kings III. (Cities: Skylines is getting one soon.)

Nonetheless, from 2016 to 2022, Paradox’s four key ‘live games’ without sequels - the above, minus Crusader Kings - managed to have yearly revenue increase from $44 million (2016) to $103 million (2022). That’s 15% growth per year! Why is that?

In our view, lots of high quality DLC (and free updates), high player retention, and smart use of discounts, plus a high ‘barrier to entry’ for all these major Paradox franchise titles, due to their complexity and depth. (Not many people are even trying to make a Crusader Kings-a-like.)

And if you track all ‘core franchise’ live games with sequels - basically adding the Crusader Kings & Victoria franchises to the OG graph - you’ll see revenue growth from $50 million (2016) to $152 million (2022), thanks to layering new versions of the games on top of old. Pretty impressive - that’s 21% per year.

The whole point of showing all of this? Bricca explains this data - and the fact that fueling existing IP is “limited risk” - is why Paradox thinks it’s a “great idea to shift focus back to our existing titles.” (This pivot is some of the politics behind Wester’s return as CEO, we presume.)

We’ve written about why the power of DLC can boost your PC game’s success, but certain of these Paradox titles have really taken it to the next level. And let’s finish off with yet another graph (more graphs! more graphs!) on that subject.

In this great example from an big unspecified Paradox ‘live game’ franchise (above), you can see that when you stack up enough DLC over time, you can make significantly more money with it than the base game. (R12 is ‘rolling 12 month revenue’, btw.) In this case, it’s acting as an acceptable IAP alternative for paid PC games.

It’s not just revenue growth that really works. It’s the ability to scale profit without spending lotsa money on a risky new full game. Paradox’s CFO notes that in recent quarters, “there wasn’t one of our 5 core franchises that had less than 60% profitability.”

What did we learn? If you have a big game in a complex or undersupplied market with great retention, you can scale surprisingly well. And while the attraction of the new is palpable, you may need to stick to your knitting within that already-hit IP to prosper. (At least, if profitable, non-risky growth is your goal?)

AR: Meta & Apple, sitting in a tree, F I G H T I N G?

We’re writing this just as Apple rolls out its Vision Pro AR headset - a not-inconsiderable $3,500, debuting in early 2024, if you haven’t heard the news yet. And there will be plenty of op-eds about it emerging in the next few days, lol.

But what we found interesting was Meta getting ahead of this announcement by debuting info on the Quest 3 late last week, which’ll be $499 when it debuts in fall, and adds passthrough AR capabilities. (Quest 2 is getting a performance boost & just reduced in price to $299, too.)

It was particularly intriguing to see Meta CEO Mark Zuckerberg release an Instagram Reel last last week which showed him trying out the AR experiences currently being worked on for Quest 3. (This did feel like a mild ‘we have this too, Tim Apple!’ diss.)

Now, we’re a PC and console game discovery newsletter that peeks in on VR/AR sometimes. And there were many great-looking VR games announced alongside Quest 3 - Asgard’s Wrath 2, new 7th Guest and Bulletstorm VR games & more.

But it was interesting to see Apple’s take on this all, since it’s very different. There were games featured in the Vision Pro rollout, sure - but much more along the lines of ‘you can play Apple Arcade games using a projected TV screen’. (Nothing complex or big in AR or VR.)

And as I just said in the GameDiscoverCo Plus Discord - slightly informally, haha: “This is much more of an 'Apple OS overlay in AR' than whatever the heck Zuck is trying to cook up. The way i see this, Apple is basically 'we're not going to launch anything that couldn't effectively replace your phone or PC’”, hence the complexity & price.

So yeah, $3500 for Apple’s Vision Pro? A bit ridiculous, but this is the cheapest Apple can do that for right now, given it’s using 23 million pixels across two tiny displays. Right now, it’s a developer tool and high-end toy, while (poor) battery life and (not yet exciting but soon?) use cases are worked through by Apple & third parties.

Will ‘just replacing your screens’ be enough in the end for widespread adoption? Eventually, I wouldn’t bet against it. But by pitching the goggles as a ‘general spatial computing device’, Apple is making VisionOS an additional option augmenting its other OSes - for iPhones, Mac, Watch, and so on.

This is much more of a complementary pitch than the ‘moonshot’ of Meta’s Quest & Horizon Worlds, which is unaccompanied by other major hardware lines. And as for pure VR gaming, we think the writing is on the wall that it’s never going to be truly* mainstream. (*We think tens of millions of active players, not billions.)

In particular, Axios’ Stephen Totilo noted of the Quest 3 roll-out: “Today's Meta VR gaming showcase drew about 17,000 concurrent viewers on YouTube, far below the healthy six figures generated by traditional gaming showcases from the likes of Nintendo or Sony.”

So are Meta and Apple really F I G H T I N G for the same market share? Probably not, today or in the next few years. But they’re both converging on a 10 or 20-year vision around destinations you spend most of your time in. Meta thinks those are Horizon Worlds-ish metaverses. Apple thinks it’s ‘your augmented desktop’. And we know which we believe in more. (Spoiler: it’s the latter.)

The game discovery news round-up..

Let’s finish off today’s bumper newsletter by crawling around in the debris of ‘video game discovery news since the middle of last week’, straining it through a sieve:

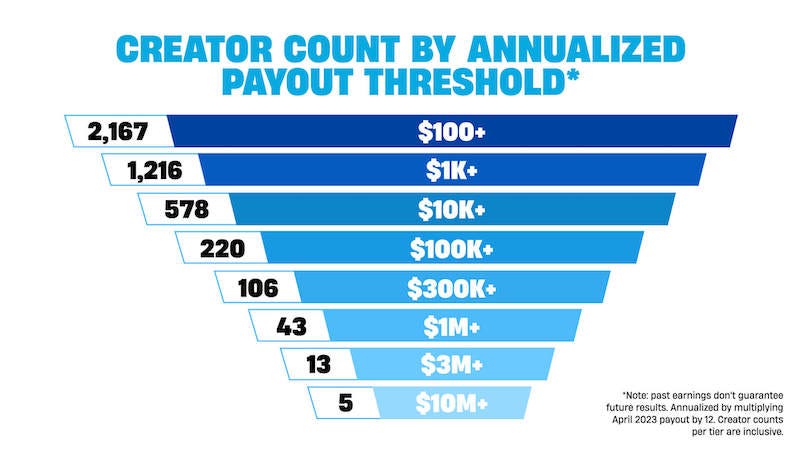

Epic got more specific about Fortnite Creator Program payouts, revealing the spread of third-party level creator payouts if April 2023’s totals were annualized (above!), and also “introducing an additional ‘time played’ metric to reward creators for the time players spend in their islands.” Oh, and Josh Ling linked the similar chart for Roblox to compare.

Valheim is running into issues where popular mods had tiers of items that could only be unlocked by directly paying the mod developers, hence a statement from the devs that: “We feel that charging money for a mod is against the creative and open spirit of modding itself.” (It’s tricky for them, because some third-party Valheim servers prompt for mod downloads. All a reason to take mod support official?)

Veteran game designer Daniel Cook had some thoughts on why it’s difficult to get big GaaS companies to share methodologies: “GaaS titles are businesses. With trade secrets. And competition, zero sum interactions with the market and temporary advantages / opportunities to exploit… Almost any other type of game company is not a business in the classical sense of being a ‘repeatable revenue generating engine.’”

A fascinating lens on SEO & TikTok via a new Victoria Tran piece: “In Hootsuite’s 2022 State of the Media report, they found that for the first time, an age group (16 to 24 year olds) were using social networks more than search engines to discover more about a brand - especially TikTok.” So yes - TikTok SEO matters like Google SEO does!

Are you in Europe and have seen a weird Steam ‘buy game’ layout listing the 30-day low for a game & its current price? That’s likely because of the European Union’s Omnibus Directive, which “requires retailers to quote the lowest price of their product in the last 30 days when announcing a sale or promotion.” It’s quite a specific use case, so may only appear after ‘big’ Steam sales, but FYI!

Roblox stuff: its 2023 creator roadmap has been summarized by BloxyNews; Patrick Klepek’s new ‘family x games’ newsletter on ‘The Surprises (and Dangers) of Finally Letting Your Kid Play Roblox’; you can now use the Roblox login via oAuth 2.0 to create login methods for (approved!) third-party tools & apps.

Some interesting research about what type of game genres benefit from short-form video showcasing: “Some game genres experienced more short-form video engagement than others - but the figures for horror games blew all other genres out of the water.” (It’s more fun to just see the jumpscares than hang around waiting for ‘em.)

The trend of AAA-looking Chinese F2P games debuting on PlayStation after mobile/PC versions continues, with Perfect World’s title Tower Of Fantasy debuting on PS4/PS5 this summer. Why? Well, GameDiscoverCo estimates Genshin Impact at 400,000 DAU and 2.1 million MAU on PlayStation right now. These hot #s are why Honkai Star Rail is also planning a PlayStation version.

A succinct explanation of what’s going on in mobile game discovery right now: “The shift to ‘hybridcasual’ may sound like a marketing ploy, but it’s a compelling and distinct thesis: acquire players at minimal CPIs using the hypercasual playbook, then retain and monetize them with proven meta models from Clash Royale, Coin Master, and others. The only challenge is that midcore is burning the other end of the candle.”

Microlinks: Microsoft President Brad Smith will meet with UK Chancellor Jeremy Hunt this week to talk about the CMA’s Activision Blizzard deal block; Supercell launched a ‘Creators Academy’ to help influencers streaming Supercell games improve their output; Samsung’s smart TV gaming hub has added Blacknut and Antstream to other apps like GeForce NOW & Luna.

Finally, we all know that rare virtual items sometimes sell for a lot. But did you know that the highest-end Counter-Strike Global Offensive weapon combos now sell for >$500k? Here’s a case in point, as explained by Dexerto a few weeks ago:

The explanation? “It features pattern number 661.. considered the best pattern for the skin, as it features the most ‘blue’ coloring… what takes this AK from a $150,000 skin to a $400,000 skin, are… four Katowice 2014 Titan Holo stickers on the weapon, each worth approximately $60,000 today.” The buyer? A high-end Chinese collector.

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]