Are Steam game prices dropping - and should you care?

Some data & thoughts... also: lots of news & Steam's debuts for the week.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

As we’re chunkin’ into the weekend here (reminder, no GDCo newsletters next week unless giant news, cos U.S. Thanksgiving!), time to take a look at hard data. Which is: are people paying less for new PC games? And if so, what should we do about it?

Before we start, the new deep-dive site Design Room has an excellent interview with Toshio Iwai, the artist behind “two of Nintendo’s attempts at making experimental music games -- one a canceled Super Famicom game based on musical insects, and the other a Nintendo DS cult-favorite based on electronic plankton.” Mm, Electroplankton…

[GOT INSIGHT NEEDS? Companies, get much more ‘Steam deep dive’ & console data SaaS access org-wide via GameDiscoverCo Pro, as 80+ have. And signing up to GDCo Plus gets (like Pro!) the rest of this newsletter and Discord access, plus ‘just’ basic data & more.]

Game discovery news: ARC Raiders x Black Ops 7?

Before we get there, here’s a chunk of game platform & discovery news, delivered in traditional style:

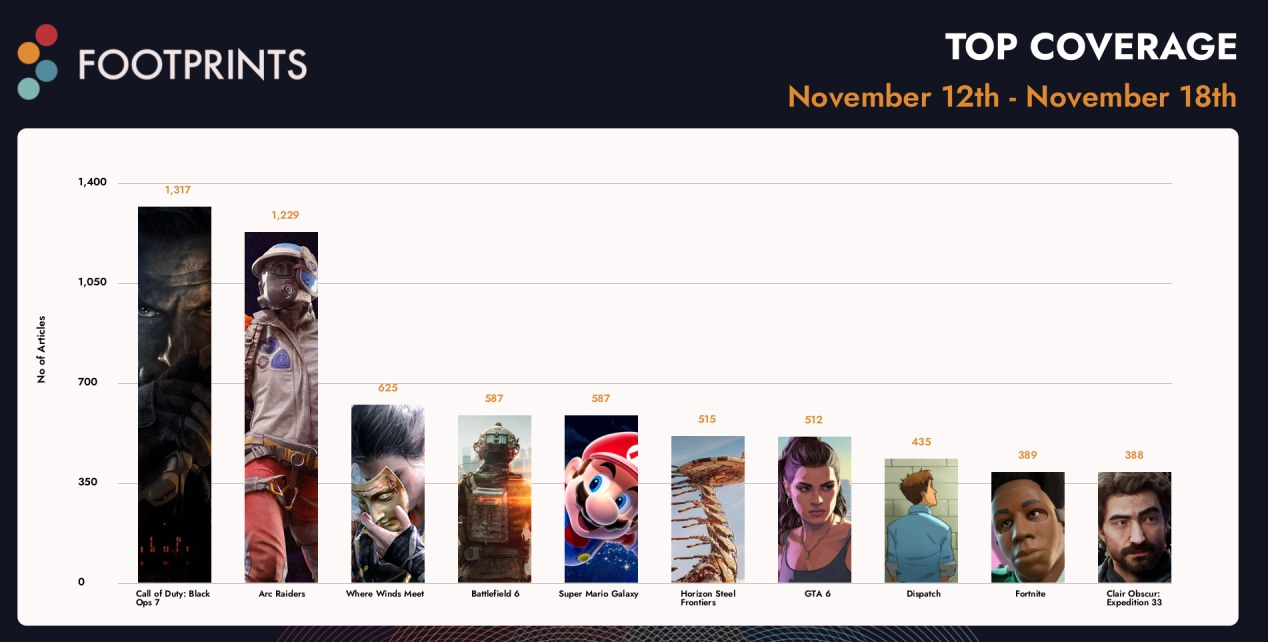

The latest Footprints.gg ‘trad media’ charts (from ICO) has Call Of Duty: Black Ops 7 (which had a mediocre CCU surge on Steam release) duking it out with Arc Raiders (which is still going great!) They’re followed by Wuxia F2P standout Where Winds Meet, the still-buzzin’ Battlefield 6, and more…

Surprise platform announce of the week is the Unity x Epic hookup, where “Unity developers will be able to bring their games to Fortnite and Unity’s enhanced commerce platform will come to Unreal Engine.” The Verge has more, with Epic’s Tim Sweeney preaching a metaverse-like open setup - tho practical specifics are still cryptic?

An indication of how non-Steam Deck PC game handhelds are selling? Asus has some revenue numbers for the ROG Ally line - “between $96 million and $160 million USD this current fiscal quarter, and approximately $130m and $160 million per quarter going ahead.” So that’s, what, ~200k units per quarter, give or take 50k?

Niko Partners looked at the ‘top Chinese shooters’ in October by streaming viewers - an interesting alt view. And Delta Force - a huge hit on mobile/PC in China, less so in the West - is way out in front with ~350m viewers, followed by Riot’s Valorant (84m), Counter-Strike 2 (76m), Cross Fire (40m) & Overwatch 2 (26m).

Roadside Research’s Mike Coeck tried to show the effect of a PC Gamer article on the game’s wishlists, concluding: “Press is amazing for legitimacy, branding, and long-term visibility. But when it comes to raw numbers, virality, especially from streamers, absolutely dwarfs it.” (We see maybe 100-200 more wishlists lurking there…)

Xbox things: their Xbox Partner Preview debuted Armatus & Vampire Crawlers - and Hitman’s ‘Eminem vs. Slim Shady’ DLC (wow!); Xbox’s new Culture Of Play report has 68% saying “gaming is more emotionally fulfilling than their other hobbies”; more Game Pass additions include the Fortnite Crew sub, Moonlighter 2 & more.

Engine giant Unity made a bunch of announcements at its annual Unite conf, including a platform toolkit which “simplifies multi-platform deployment with a single workflow”, and a Unity Core Standards initiative so you can see if “you can trust a particular package” from the Asset Store or elsewhere.

The entertaining Jonas Tyroller has been making videos about his ‘Steam review guesser’ plugin - look at a random Steam game page, multiple-choice pick the # of reviews the game actually has! (The Chrome plugin source is here, and somebody made a standalone website version if you want to try it quickly…)

Stream Hatchet has analysis of Twitch chat sentiment, pre and post-release, focusing on four games: “Black Myth: Wukong: High pre-release opinion, high post-release praise; STALKER 2: High pre-release, low[er] post-release… Hogwarts Legacy: Low pre-release, high post-release… Clair Obscur: unknown pre-release, high post-release.”

HowToMarketAGame has an excellent walkthrough of the (Vampire) Survivors-like subgenre lifecycle, suggesting many game trends go through 4 phases: the proto(typical) game, the genre-defining hit, the second wave variants, and the end of the conjunction - when bigger studios get on board. (Find ones in Phase 3!)

Roblox has officially rolled out its facial recognition age checks to access in-game chat, and it’ll be mandatory for most countries in January. Even more fascinating: “After users complete the age check process, we will inform them of their assigned age group… Users will be able to chat with those in… similar age groups, as appropriate.”

Oct. 2025’s Circana U.S. game hardware & select software results are out, and Batlefield 6 had “the highest single month tracked full game dollar sales total of any video game in three years” - though total game spending was only up 1%. And Switch 2 sold 328k units, 3% ahead of PS4 at the same time in its cycle, as Xbox Series sales dipped 37%, and even PlayStation 5 was down 22%.

The ESA has put out its traditional holiday season ‘kids want games for Xmas’ survey, with 58% of those surveyed asking for games, “close behind money and gift cards (69%) and clothes/accessories (63%).” And coincidentally, “58% of kids say they want to play more video games with their parents” - so get Mario Kartin’, old folks…

Microlinks, Pt. 1: Xbox has unlocked its game publishing documentation to all devs; Epic Games Store now allows game gifting to people on your friends list; ICYMI, Steam Frame will play Android-based VR games (like those shipped on Meta Quest), and Valve is happy to make them buyable on Steam.

Are Steam prices dropping - and should you care?

The question of how to price your game on Steam is… complex. There’s certainly been a lot of inflation during and post-COVID. (So - higher prices fair?) But the dawn of a new era of cheaper (but often very replayable!) indie titles in the roguelike, Survivors-like and crewlike x friendslop genres has meant some players are paying less.

And there are radically different approaches out there! Hit sandbox crafter/colony sim Necesse, which we profiled on Tuesday, started out at $10 and has never been more than $15. But survival game The Last Caretaker, which’ll be the subject of a post-Thanksgiving profile from us, charged $35 in Early Access and is doing just great.

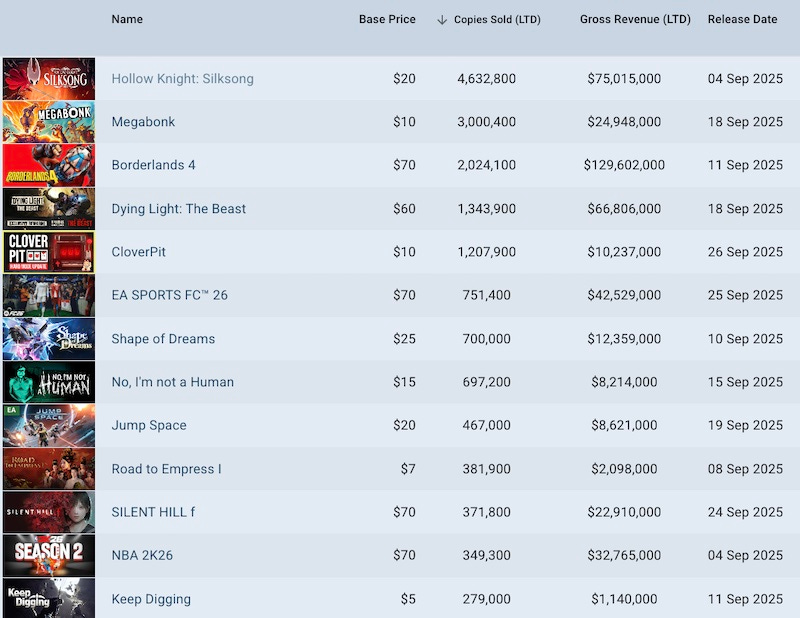

Still, it’s confusing, not least because cheaper titles are not always shorter or less enjoyable for players. Necesse & another recent hit CloverPit both have median playtimes of ~6 hours and averages >10 hours. So, as a starting point, here’s GDCo Pro data on the top games released in September 2025 on Steam by LTD copies sold:

What are you noticing - admittedly with anecdotal skew, since it’s just one month? Well, we spot a lot of $60-$70 games (Borderlands 4, Dying Light: The Beast), a chunk of $5-$10 titles (Megabonk, CloverPit, Keep Digging) and some $15-$20 games (No, I’m Not A Human, Silksong, Jump Space), with relatively little priced at $25-$55 as default.

This ties in to our impressions that it’s difficult in the middle of the market right now, and this goes for pricing, as well as game budgets. But could we, perhaps, go beyond the anecdotal?

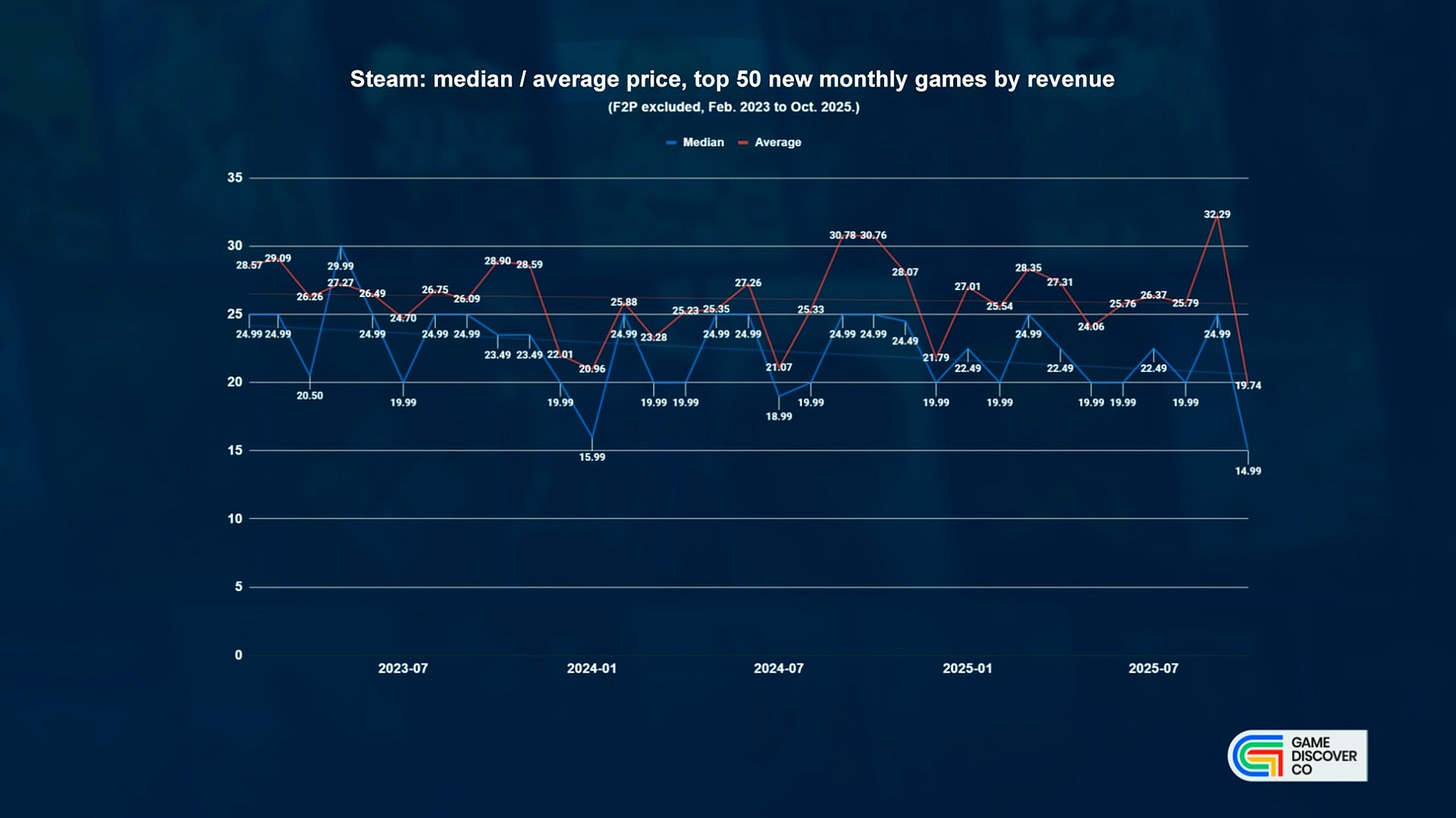

We certainly could, and here’s GameDiscoverCo-exclusive data - we looked at the first month of sales for the Top 50 new non-F2P Steam games (by copies sold!) released each month since Feb. 2023. And we plotted their median and average prices. Here’s what we got:

OK, that’s, uhh, a little intense. The median is as low as <$10 and as high as >$20, depending on fluctuations in release schedule. But we think we can detect a bit of a downward trend. Let’s isolate just a ‘line of best fit’ for that noisy data:

According to our semi-scientific (shh!) pixel-based measurements:

The average Top 50 Steam game price starts at $21.80 (Feb. 2023) and ends at $21.41 (Oct. 2025), down only 2%! (We wager that the high-priced games got a little pricier, and the lower prices titles got a bit cheaper, and it netted out.)

But the median game price starts at $19.50 (Feb. 2023) and ends at $15.64 (Oct. 2025), which is a 20% drop. This means that there’s been a notable increase in cheaper titles - when looking at sheer #s of units - over the last 2.5 years.

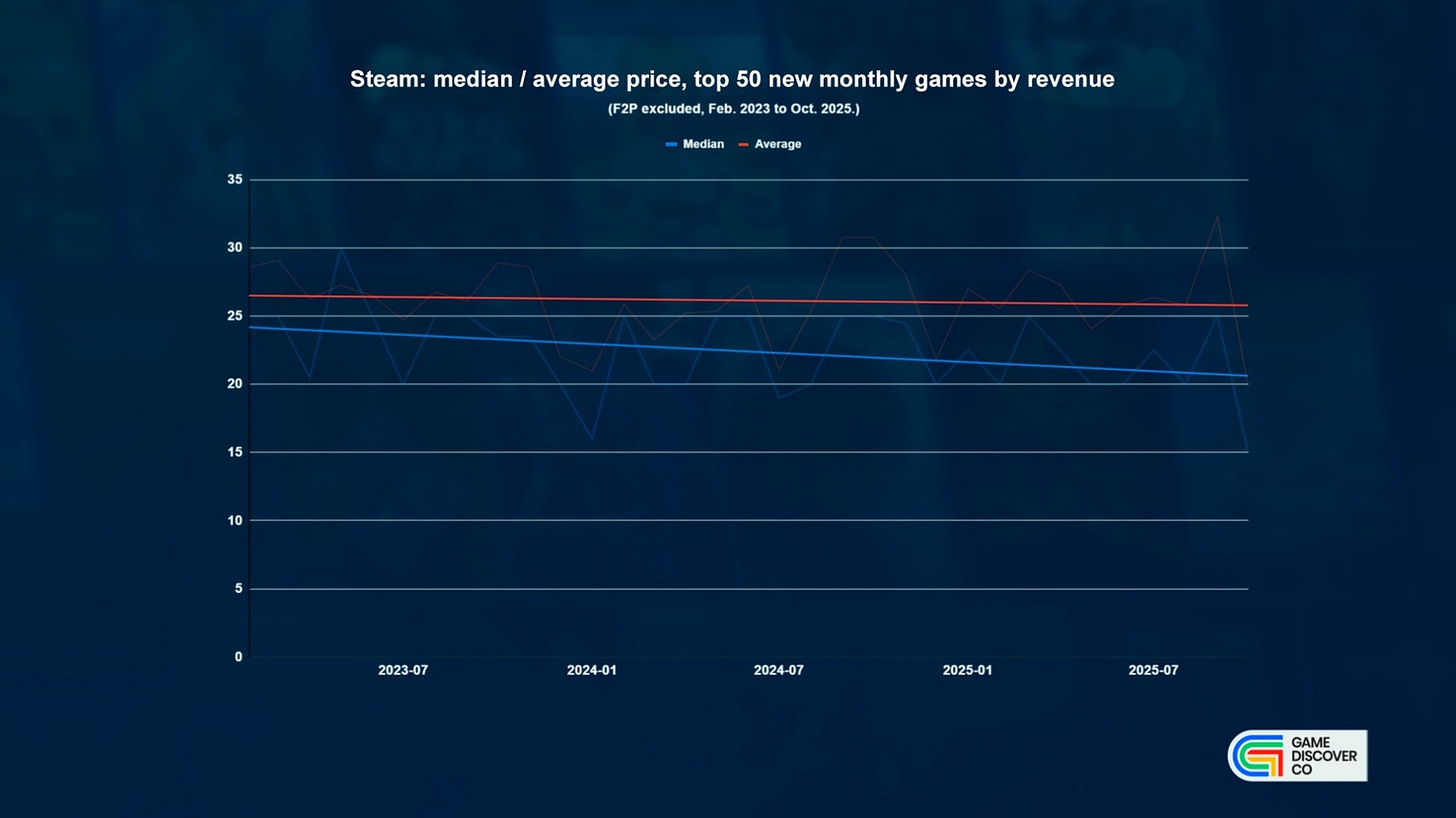

But wait, you might say - don’t we care more about revenue than units? Well sure, it’s another way to look at it, and we can sort the Top 50 monthly chart by revenue, rather than units. This will advantage more expensive games. And here’s the results:

That’s a little chaotic again, with medians ranging from $16 to $30, but general unreadableness abounding. So let’s fast forward and once again highlight the ‘line of best fit’ (below):

In the end, we get similar results for average/median game price by revenue as by ‘copies sold’, but just adding $3-$5 to the totals:

The average Steam Top 50 (by launch revenue) game price starts at $26.20 (Feb. 2023) and ends at $25.76 (Oct. 2025), down 2%.

The median game price starts at $23.70 (Feb. 2023) and ends at $20.35 (Oct. 2025), down 14% (a tad less than the ‘copies sold’ result!)

So what are we saying here? Well, we do think it’s trickier to win, in the space between games that cost <=$20 and those that cost $60-$70. We can find hit games priced in between in spades - for example, Dispatch ($30) and PowerWash Sim 2 ($25) in October, Titan Quest II ($35) in August, Grounded 2 ($30) in July. (All of those except one were a ‘known quantity’, IP and gameplay-wise.)

But we think if you have a new IP you’re making from scratch, isn’t a deep strategy game, and isn’t from a pedigreed team, charging >$25 is getting trickier, as players compare value to the $10-$15 indie titles that have brought them a ton of fun and playtime. Or to the $60-$70 megafranchise titles. (There’s plenty of genre exceptions, tho - for example survival crafters, which can be $25-$40 if deep enough.)

And when did this change really kick into higher gear? We took a look at median price for the Top 50 monthly games (by copies sold) all the way back to 2020. And it really does look like late 2023 was when medians started to shift down:

A stand-out month is March 2024, for example, with Content Warning, Rusty’s Retirement, and Buckshot Roulette all in the Top 10 LTD sellers and all <$10. (Some of these titles are more basic, sure - but in a pretty engaging kind of way.)

And to add to the metadiscussion: let’s not forget that players are paying less money for old games all the time, thanks to record catalog sales and 50-90% off deals for almost all old games. Many cheap old games are new to most players - so don’t ignore that.

We think this is also where some of the price pressure on new games is coming from. (And: indie creators finding ways to make new games inexpensively, esp. with system-based innovations aiding replayability!) It’s not a disaster - but you need to think carefully about both pricing and scope to make things work in 2025.