Analysis: multiplayer game discovery & the 'cold start problem'

Also: your game trailer, optimized & lots more discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

It’s definitely the middle bit of the week. And before we teeter down the slope to what is often called ‘the weekend’, let’s get started in fine style - by sending you a bunch more game discovery content to consume.

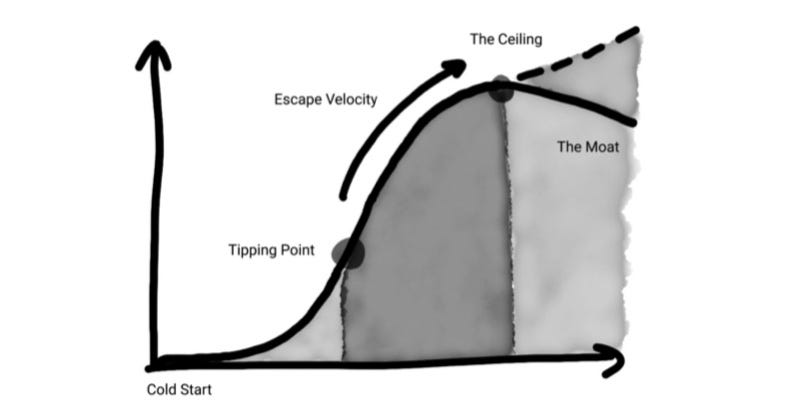

Today’s lead story deals with how people do - or sometimes don’t - get multiplayer PC/console games off the ground - with inspiration from a book detailing how tech companies reach ‘escape velocity’ for their businesses…

[Final warning: our 30% off access to our GameDiscoverCo Plus subscription - inc. a sales analysis weekly newsletter, Steam pre-release data back-end, Plus-exclusive Discord with lotsa handy info, and more ends tomorrow. So please hop on that if you’d like to support us!]

Multiplayer game discovery & the 'cold start problem'

We do sometimes read literature - beyond, you know, old copies of Nintendo Power. Which is how we came to check out Andrew Chen’s recent book ‘The Cold Start Problem: How to Start and Scale Network Effects’ and what it means for games.

Andrew is a partner at Andreessen Horowitz nowadays, but was embedded in Uber as it scaled its business in the mid-2010s. So, he has a great perspective to apply to one of the biggest issues for multiplayer games - how to reach ‘escape velocity’.

In case you didn’t work it out, the aforementioned ‘cold start’ is the idea that your (antiquated gas engine!) car has trouble getting going, if it’s very chilly in the morning. And Chen’s argument - as summarized well by Sachin Reiki - is that you need to build an ‘atomic network’ you can scale your business from.

The book explains (per Reiki), re: the atomic network: “For Zoom, it's simply two people that want to video call each other. For Slack, they found it took 3 users to have a stable network. But for Airbnb, it took hundreds of active listings in a given market for a stable network to arise.” What does this mean for multiplayer games? Here’s what we think:

Co-op games have a much smaller ‘atomic network’ than PvP ones: in titles like It Takes Two, you just need a buddy. That’s it. The entire game can scale in multiples of two, and often within friend groups. This leads to easier and more stable upscaling and downscaling.

The larger the player requirement, the bigger the ‘atomic network’: say you want to make a 10 vs. 10 PvP game. Fair enough. But now you’re beyond ‘people bring their friends’, and onto ‘you need enough players with good ping to be able to start new games quickly in your particular timezone’. That’s a large atomic network.

The higher the skill level, the harder it is to escape ‘cold start’: if you need players to be highly skilled in order for the game to be enjoyable, you are further increasing the minimum size of the atomic network. (Fortnite, though having large minimum player requirements, is very good at letting low-skill players co-exist and noodle alongside high skill players, due to the size of the maps.)

There’s been some hints that games understand this - Overwatch 2 reduced from 6v6 to 5v5 in part to help with player matching. But this helps explain why we’re advocating for more online co-op in everyone’s games, but not necessarily more ‘traditional’ vs. multiplayer - despite there being big market leaders in those spaces.

Ultimately, we think trad multiplayer launches have a high CCU tipping point. They’re way more difficult to reach and persist at than a lot of people think. We’ve done some client research in the past that the typical multiplayer PC/console game levels out at 6% of peak launch CCU. (And the best case is often only 10-20%!)

There are other reasons for this, too: the switching cost is high for both players, who have friend groups on existing games like Apex Legends or Fortnite - and for non-variety streamers, who have existing fans of a particular game they want to retain.

Concluding, I’m reminded of the case study of Proletariat and their game Spellbreak - actually an Andreessen Horowitz investment. They really did do a lot of things right and had a great game, but still couldn’t make their battle royale’s CCU stick over time, and got acqui-hired by Blizzard to work on World Of Warcraft. (An existing titan!)

Ultimately, it’s all good, as long as you understand the risk profiles of making different types of multiplayer game. And it turns out that the atomic network is a great tool to do that - thanks, Andrew!

The best ways to optimize your game trailer..

Yes, Valve recently changed its rules around Steam trailers, “to address some frustrations we've heard from players when trying to find gameplay videos or navigate to screenshots.” Steam did its part - mandating only 2 trailers up front on a Steam page, categorizable.

But now you have to do your part! And game trailer guru Derek Lieu has a great new blog about how to optimize your trailer to get maximum information & takeaway in minimum time. Here’s what we would highlight:

Maybe you’re thinking about ‘store page’ game trailers wrong: Derek points to problems “created by AAA game trailer editing style which riffs off decades of movie trailer editing”, including too many CG or animated elements up front, and logos and camera pans slowing the trailer start.

The size of the game & the venue it’s shown in affects trailer structure: as he says: “AAA game trailers don't worry about showing gameplay as soon as possible because they know all eyes are on them, and whenever one of their trailers release it's either a big venue or a big event with captive eyeballs.” A lot of AAA games’ Steam pages don’t actually use best practices - but still get away with it.

Besides gameplay, people want to understand ‘game feel’ & tone: what, are we saying you should just show a chunk of gameplay and that’s it? Largely, yes - albeit a skilfully edited one. But Derek says other elements you can show in video later, but not easily in screenshots include “‘game feel’ via animation, sound effects & visual effects… story/narrative, voice acting.. [and] mood & tone.”

When I’ve discussed this issue with devs, I do think that some balk at starting a trailer with game footage - as Derek did for the Noita release trailer (above). (Even though the average use case is ‘people want to get a good impression of your game, swiftly’.)

So perhaps as a compromise, you can create a special Steam/console game page edit of your trailer that has footage inserted at the front, if you want to preserve the sanctity of trad trailer creation, but still get the point across? Something’s gotta give..

GameDiscoverCo Pro? No more.. but we got next!

Some of you may be aware that we’ve been working on an enterprise grade PC/console game metrics solution, GameDiscoverCo Pro, for the last few months. Well, we got it up and running, got interest, demo-ed it very positively, and now... we’re canceling it?!

Why? As those who had demos can attest, the data (and interface!) were looking sweet. But we ran into a problem: as we showed it to large companies, they asked us about GDPR, CCPA & platform/user permissions on aggregated public player data in our estimates.

It’s a ‘gray area’, for sure. But it’s not an agreed/solved problem, and we didn’t think enough about this for a big enterprise-level SaaS product. (You live and learn.) And so we’re - sadly - not going forward with Pro. So, what’s next?

GameDiscoverCo Plus will reap big benefits from Pro work: We’ve done a lot of super-cool UI and UX work - including large-scale Steam tag, publisher & owner rankings & unique features like a ‘revenue predictor’ for unreleased games - which will arrive via our Plus sub later in 2023. We’ll tell you all when it’s here.

Some of the deeper-dive data may still surface via other means: While we’ve opted not to launch Pro, some of the data has reverted to our amazing data warehouse partner, GamingAnalytics.info. We’re hoping they may be able to offer a subset of the data in the future. (We’re also finding good ways to abstract data, so we may be able to feature it here or offer it to clients later.)

As part of this transition, our biz dev/outreach head, Jordan Taylor, will be leaving us a bit later this summer. He gets our highest recommendation: if you’re looking for a savvy scout, producer, biz dev person or PC/console publishing expert, hit him up. (He’s been so great to work with.)

The game discovery news round-up..

Finishing this out for the week in free newsletters, here’s the notable announcements about game platforms and discovery - for you all, right now:

While eschewing a streaming event in the June ‘not-E3’ period, Sony has moved their big PlayStation Showcase to May 24th, promising it will “run a bit over an hour”, with “several new creations from PlayStation Studios, as well as spellbinding games from our third-party partners and indie creators” across PS5 and PSVR2.

In ‘crossovers can mean big discovery wins’ news, we noticed that MOBA Smite - still doing great after all these years - hit the Top 5 in the U.S. by Steam revenue after launching a collab with the Vshojo virtual influencers (above). You too can now play as ‘pink eldritch cat’ Nyanners in the game. (Smart move.)

Zelda stuff? 10 million units sold of Legend of Zelda: Tears of the Kingdom in its first three days - with over 4 million sold in the Americas, the fastest-ever selling Nintendo game in that territory. And according to Gamesight, it was #2 to Pokemon Scarlet/Violet in ‘hours streamed on Twitch in first 72 hours of release’ for all Nintendo games.

Looking for a simple ‘social media content calendar’ to co-ordinate all your coverage? Evolve made one of those for you, with Steam festivals and events already included in there. Oh, and: “ICYMI, we’ve released a Contact-Database Template for all your outreach needs, and a Social Media Asset Guideline for 2023.”

Microlinks: in North America only for now, Amazon is experimenting with web game Prime perks, like premium mode unlocks in Waffle; here’s a big Steam data analysis on price, reviews, etc; the Ubisoft Store on PC is giving away indie game Lake with all purchases during its current sale.

Here’s a good case study of Tape To Tape, a roguelike ice hockey game we’ve discussed in GameDiscoverCo Plus newsletters, “basically Slay the Spire Meets NHL 94”, and how it grossed $600k in Week 1. How did it do so well? Read the study to find out, but Canadian streamer NorthernLion playing the heck out of it helped!

One surprise in the latest Xbox/PC Game Pass content announcements? Massive Chalice, a 2015 Double Fine-created ‘tactical strategy game’, finally got put into console & cloud on Game Pass! (Also in there? Cassette Beasts, Chicory, Planet Of Lana - and EA’s FIFA 23 for anyone with PC Game Pass or Ultimate.)

NPDCircana results for April U.S. game hardware & (select) software results are here, courtesy of Mat Piscatella, and they stand at $4.1 billion, as “a 6% decline in April spending on video game content [YoY] offset 7% growth in hardware.” Star Wars Jedi: Survivor and Dead Island 2 were the big AAA $ winners for the month, and PS5 “leads the 2023 hardware market year-to-date across both units and dollars.”The move of AAA titles from $60 to $70 hasn’t been quite as universal as everyone thought it would be - for example, Sega’s recent releases are still at $60. But even they are considering options here: ”Titles sold at $69.99 have appeared in the last year… we would like to review the prices of titles that we believe are commensurate with price increases, while also keeping an eye on market conditions.”

Microlinks: Humble raised more than $33 million for charity during 2022 - amazing work; Epic Games and digital fashion company CLO Virtual Fashion have purchased shares in each other; Horizon Worlds is rolling out members-only worlds in beta, for those private ‘hangs’.

Finally, a 36-person Powerwash Simulator eSports contest? Look, we’re just telling you that’s what happened, we don’t actually understand it:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]