Making a successful video game Kickstarter in 2024

A great example! Also: Next Fest algo notes & lots more...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to the GameDiscoverCo newsletter, folks. It’s February, and there’s a lot to talk about in the world of PC and console video game discovery, so let’s get on and ‘find all the answers’*. (*Fine, scribble about them vaguely and floridly.)

The funniest ‘happening’ since the last newsletter? That’d be the Dwarf Fortress & Deep Rock Galactic devs “making a fuss about the lack of the dwarf tag on Steam”, and Valve then adding ‘elf’ but not ‘dwarf’, before claiming puckishly they hit the ‘wrong button’ & adding dwarf as a tag after all. See - game discovery is fun!

[HEADS UP: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, 7 detailed game discovery eBooks - & lots more.]

How Trash Goblin won at Kickstarter: can you, too?

While we’re not claiming that crowdfunding site Kickstarter is a major funding source for most video games, a quick peruse of its ‘video games’ category shows ‘cozy farming game’ Tales of Seikyu at $250k raised from 4,400 backers, and Blizzard-y RTS Stormgate just finished funding at $2.4 million from 28,000+ backers.

These numbers pale in comparison to the board game category. When we last looked at video game Kickstarters, video games raised around $24 million USD in 2021, compared to a whopping $272 million USD for tabletop games. But it’s still useful for certain sizes and notorieties of studio!

So we were pleased to see the folks at Spilt Milk Studios, who already gave us their pitch deck for their “wholesome & cosy shopkeeping game where you uncover & clean trinkets, then upcycle them” Trash Goblin, recently share a super-comprehensive Reddit post about their Kickstarter campaign for the game.

Trash Goblin’s Kickstarter ended a few days ago, and raised 95,000 UKP ($119,000 USD) from over 2,200 backers, at an average of about $54 per backer. The campaign and related demo also helped almost triple Steam wishlists (annotated additions!) during the KS.

But what can we learn from this relative success? Here’s what we took from the Reddit post, in particular:

Launching Kickstarters with a demo? A great idea: This used to be fairly rare, but for Trash Goblin, “the demo presents as a piece of a game that seems much more finished than it is”, given the full title is in pre-production. This helped a lot - especially adding campaign reach via YouTuber/Twitch infleuncers.

Have a really strong backer update plan: the team “posted 15 updates over the 30 days it's been running” up to the Reddit post, which is borderline overachieve-y, if you ask us. But the better-planned the updates, the more trust there is for new possible backers!

‘Paid promote’ is handy, as is cross-promote with other Kickstarters: although the much-vaunted ‘focused paid Facebook advertising’ for Kickstarters went ‘just OK’ - “we have to date paid a little less than the amount we earned from them”, the Spilt Milk crew noted that free ‘you promote us, we’ll promote you’ cross-promo with other relevant Kickstarters such as Tavern Talk “landed us nearly 6% of the total funds so far - for very little effort indeed.”

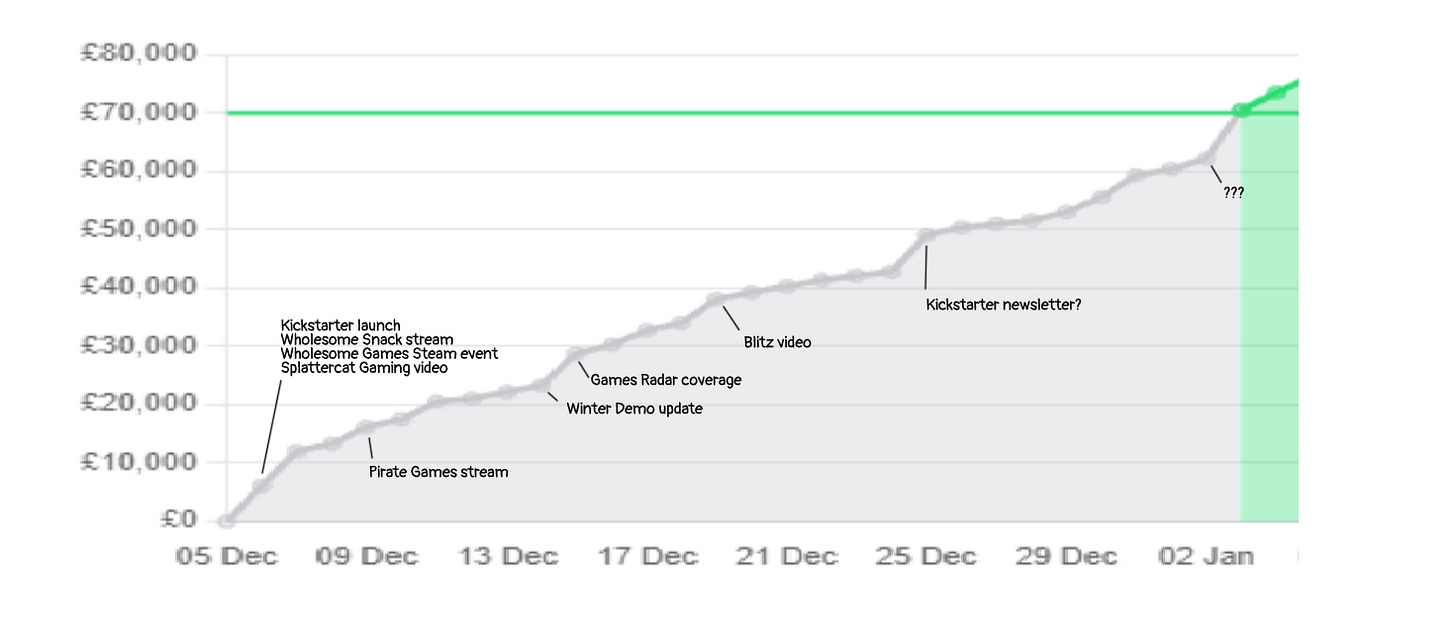

Here’s an annotated Kickstarter backer chart (by UKP) for Trash Goblin until a few days before ending, clearly showing where the game’s interest surged. It actually finished quite a bit higher than this estimate thanks to the end 48 hours ‘FOMO’:

One thing we’ve definitely noticed about Trash Goblin’s Kickstarter is that it really had to ‘draw people in’ over time - as a less well-known IP. And so it was a much more gradual route to goal, more so than we’ve seen for many crowdfunding efforts.

As a contrast, if you look at Stormgate’s Kickstarter results, a game that already had a fanbase and was, to some extent, locking in pre-orders and physical versions via the service? It hit $1.5 million - about 63% of its final total - 10 days in.

On the other hand, Trash Goblin was only just over 20,000 UKP (about 21% of its final total) after 10 days. We haven’t seen any normalized graphs of progression to final goal on Kickstarter. But we think demo updates & continued streamer coverage of Trash Goblin made it a ‘hard-fought win’ to goal, impossible without a playable version.

Anyhow, there’s a bunch of other great takeaways in the full Reddit post, so go check it out. And thanks to the Spilt Milk team for being so transparent…

Steam Next Fest and the meaning of ‘trending’?

Well, by the time you read this, Steam’s February 2024 Next Fest will have been up and running for a couple of hours. We’ll be running full results of the top demos/CCU next Monday (12th!) - and are looking forwards to playing lots of great demos! But we we wanted to cover something specific in the meantime…

Firstly, this PC demo showcase is becoming increasingly popular. And everyone wants to be on the ‘front page’ at launch, which has led to a lot of pre-show maneuvering (launching your demo a few days before the event, pre-seeding influencers, etc!)

We recently got alerted that - we believe - some of the algorithms have changed in the last couple of Next Fests. Specifically, there used to be a ‘Popular Upcoming’ category, but it got removed towards the end of the June 2023 Next Fest.

So, we now have the ‘Trending Upcoming’ category instead (slightly different name), which was either the second or first tab - and is currently the first tab - for the last two Next Fests. (The other two categories, ‘Most Wishlisted Upcoming Games’ in the Fest & ‘Daily Active Demo Players’, have stayed the same for a while now.)

What changed, and should games shift tactics as a result?

But what shifted? If you check out the December 2023 Next Fest Q&A video, Valve’s Ria Hu answered a question about the removal of the ‘Popular Upcoming’ category in a recent Next Fest. Specifically, she said: “We’re always trying to ensure that the games we’re showing to customers in any sorted category are a good representation of Next Fest, and aren’t duplicative of the other tabs we have available…

We explicitly don’t disclose what the algorithm is looking at…. Any changes that we make are because we’ve received customer feedback on the topic, or we’re just trying to ensure that we’re giving games an even amount of visibility where possible.”

So what shifted? It’s our impression that the now-retired ‘Popular Upcoming’ category was becoming too static - and in some cases too overlapped with ‘Most Wishlisted’ - because it rewarded constantly good performance over 7-14 days. (There was some predictability of Next Fest prelaunch to ensure highest chart position - and possibly some extra ways people found to ‘game’ the charts.)

The newer ‘Trending Upcoming’ - which is described as “sorted by trending or recent wishlist counts” seems to be going for a higher turnover of games, tied to both high volume but also shorter-term (1-2 day?) spikes of interest. We think the idea is to:

show more games in that prominent ‘front page’ position

allow titles to organically bubble to the surface when new videos or articles are published on them

discourage ‘buying’ your way onto those charts with a co-ordinated push.

Overall, we don’t think this should necessarily change your tactics. You may still want to launch your demo significantly ahead of Next Fest, to get streamer attention and player interest, before all the other demos come out and crowd the space. (You can lock in demo players and wishlists that way.) Or get more real-time with it…

And we could be wrong on algorithm. As Valve says, they didn’t say how it used to work, and they won’t say how it works now. Could be entirely Magic 8-Ball based. (Or randomized with lava lamps.) But we think there’s no clear ‘launch on X day’ remit any more. So - mix it up, stage your roll-out in increments, and see what works best…

The game discovery news round-up…

Finishing things off, here’s a look at the game platform and discovery things - and also the ‘not games but game-relevant’ tidbits - that make a difference to all of you:

There’s unconfirmed reports that Bethesda games like Indiana Jones may also hit PlayStation, adding to other former exclusive titles (like Hi-Fi Rush) that may be going console multi-platform. Is Xbox’s strategy - especially on hardware exclusives, but in general - changing? Phil Spencer promises to tell the baying Xbox fanboys - and us - next week in a ‘business update’. We’ll be there!

If you want a general idea of what (U.S.) adults ever use for social media & online video, the latest Pew Research study is here, revealing YouTube (83%) and Facebook (68%) are the usage behemoths, but Instagram (47%) and TikTok (33%) are on the way up. (The youngest adults are way more likely to use Instagram, Snapchat, and TikTik, though.)

Although Steam put measures in place to help prevent Steam game dev account ‘hijacks’, it’s not safe out there - at least one Epic Games Store game was compromised & replaced with a trojan recently. (PSA: the person asking you to click a link on Discord might be a friend whose account was also stolen.)

PlayStation’s State Of Play showcase has a trailer round-up here, and was notable for PlayStation console-first exclusives including Hideo Kojima’s reliably baffling Death Stranding 2: On The Beach, Team Ninja’s slashy Rise Of The Ronin, and the good-looking Stellar Blade. (We presume some of these will come to PC later?)

‘Big brain’ media type Doug Shapiro has a piece on ‘fragmentation’ and creative media, stating: “systematically declining barriers at each step of the content development process… have led to a near-infinite amount of content; and the very introduction of that content is changing consumers’ definition of quality.” (He’s more of a TV/movies guy, but weaves games in there, and the trends are similar.)

Apple things: the Vision Pro launch PR hyped both spatial games via Apple Arcade & “games from the Mac App Store and apps like Steam using Mac Virtual Display”; its services biz - a giant bucket including the App Store & Apple Arcade - grew 11% YoY to $23.1 billion in Q1; it revealed that its EU business - getting disrupted with alt.app stores - is only about 7% of its global app store revenue.

A new ‘state of the game biz’ survey (free download w/email) says that “65% of studios actively work on and 30% plan to release regular update cadences for their games, highlighting the industry's shift towards a live service era.” (It’s also the source of the “95% of studios are either working on or intend to release a live services title” quote that got some players riled - but this is part of a higher-end game dev ‘filter bubble’.)

If someone is (or claims to be) a Steam curator and asks you for lots of free Steam keys for your game via email, they are planning to resell them on a third-party key site? Indubitably true, but further proven by this game dev, who bought & tracked down a specific key to a specific curator. Woops.

Meta news: the latest Reality Labs divisional results show the Quest & friends “crossed over $1 billion in revenue for the first time, but also had its biggest quarter in terms of costs at $5.72 billion”. (But Meta tripled its profit YoY, so can fund this burn, baby!) Oh, and Quest 3 is now the third most-used VR headset on Steam.

Reader, we lol-ed when we read this piece on how Steam’s refund policy can harm short games when it was a) based on a viral Tweet about one individual case, and b) the dev who posted the outlier Tweet adds that “all his games have a refund rate of less than 5%”. (We’ve debunked this short game refund ‘issue’ before.)

Finally, from the same YouTube tinkerer who brought us the cursed Nintendo PlayStation a few weeks back, we have… powering a Game Boy using lemons? Yes sir:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

You forgot to add https://www.magic-8ball.net/